Summary:

- Amazon’s undisputed leadership in e-commerce and cloud computing, combined with its currently attractive valuation, makes it a must-have for every investor.

- Amazon’s digital advertising business is emerging as a potential superstar, following in the footsteps of AWS.

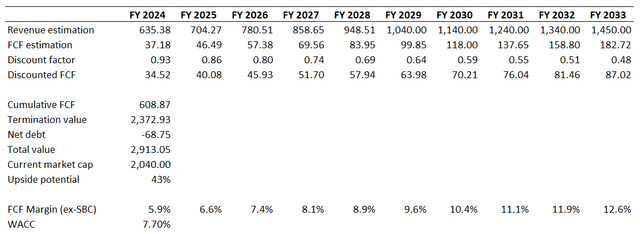

- Amazon’s valuation is compelling with a 43% upside potential, supported by a DCF model indicating a fair value close to $3 trillion.

Daria Nipot

Investment thesis

My previous bullish thesis about Amazon’ stock (NASDAQ:AMZN) aged well since the stock appreciated by 4.6% over the last three months.

Amazon remains every investor’s must-have in my opinion. This conviction is based on Amazon’s unparalleled leadership in two thriving industries: e-commerce and cloud. With its 32% market share in cloud and massive R&D spending, AMZN is poised to be the major winner of this industry that is expected to be worth $2 trillion by 2030. Amazon also builds new revenue streams, and digital advertising is the one that has massive potential. This revenue stream demonstrates staggering revenue growth despite its already large scale. The valuation is compelling at the moment with a 43% upside potential. All in all, I reiterate a “Strong Buy” rating for AMZN.

Recent developments

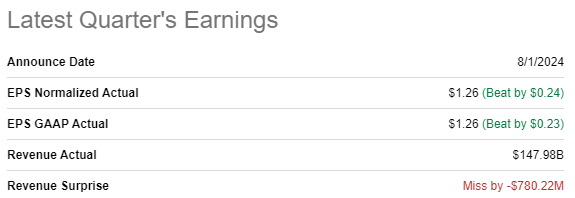

The company shared its latest quarterly earnings on August 1 when Amazon surpassed EPS estimates, but there was a tiny [less than a billion is insignificant compared to a $148 billion Q2 revenue] negative revenue surprise. Revenue grew by 10.2% on a YoY basis. The adjusted EPS expanded from $0.65 to $1.26.

Seeking Alpha

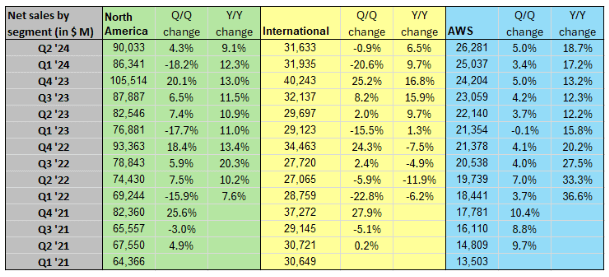

E-commerce business demonstrated strength both in North America and Internationally. The Cloud business also demonstrated accelerated momentum with a 19% AWS revenue growth. In Q1 2024 AWS’s revenue growth was two percentage lower. A rapidly evolving revenue stream of digital advertising also demonstrated strength with a 19.5% YoY growth and 8.0% QoQ increase.

Seeking Alpha

Operating leverage is one of the major sources of strength for a business, in my opinion. Amazon is doing well from this perspective as the operating margin expanded in Q2 from 5.7% to 9.9% on a YoY basis.

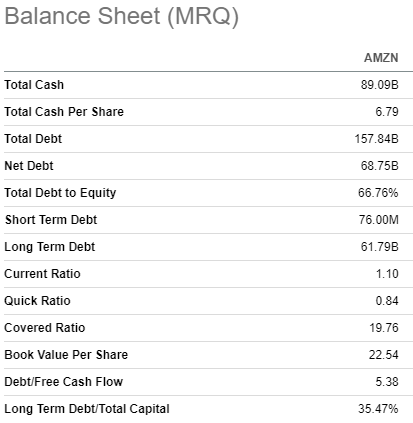

With such a robust improvement in profitability, Amazon generated $11.3 billion in free cash flow. The Q2 free cash flow was $2 billion higher YoY, making a solid contribution to the company’s financial position. AMZN finished Q2 2024 with an ample $89 billion cash position. Total debt is insignificant compared to a $2 trillion market cap.

Seeking Alpha

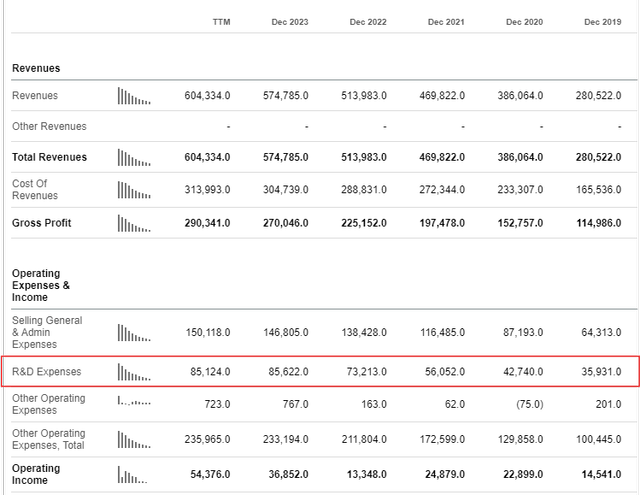

I think that Amazon’s fortress balance sheet is a vital source of strength. The company has been aggressively investing in growth and innovation since its inception, both organically and inorganically [M&A]. According to Amazon’s income statement, the company’s TTM R&D spending was $85 billion. Considering Amazon’s healthy financial position, I expect the company to continue investing substantial amounts in growth and innovation.

It is also crucial that Amazon spends much more compared to its main rivals in the cloud business. Microsoft’s (MSFT) TTM R&D spending is around $30 billion, and Google’s (GOOGL) (GOOG) is slightly above $45 billion. Unfortunately, I do not have a breakdown of how much of Amazon’s total $85 billion R&D budget was allocated to AWS. On the other hand, we all know that MSFT and GOOGL are also not only cloud companies. Therefore, I assume that AWS’s R&D spending in absolute terms is well ahead of major rivals.

This R&D factor is crucial and should not be underestimated. According to the recent report from Goldman Sachs, cloud revenues are expected to hit $2 trillion by 2030. This represents a 22% CAGR between 2024 and 2030. With a leading 32% market share and highly likely by far the largest R&D budget to develop its competitive edge, Amazon is poised to become the major cloud winner.

Amazon’s recent wins in cloud and AI are definitely worth mentioning. An AI start-up, Anthropic, which is backed by Amazon, is on track to generate $1 billion in revenue in FY2024. Anthropic also aims to raise money at a $40 billion valuation, which also speaks volumes about its vast potential. Apart from the financial successes of Anthropic, they also partnered with Amazon to enhance the capabilities of its Alexa voice assistant.

I wish to highlight some recent positive developments related to AWS’s Bedrock. Amazon’s application of Llama 3.2 models from Meta to Amazon Bedrock is a testament to the management’s commitment to strengthening its AI capabilities. This strategic move demonstrates the company’s competitiveness in the high potential AI market with a growing customer base looking for solutions to challenging problems such as image reasoning, multilingual requirements and efficiency in AI workloads. Offering of such models via Amazon Bedrock not only enhances Amazon’s market footprint in AI and cloud services but also provides opportunities for future growth and fortifying its moat.

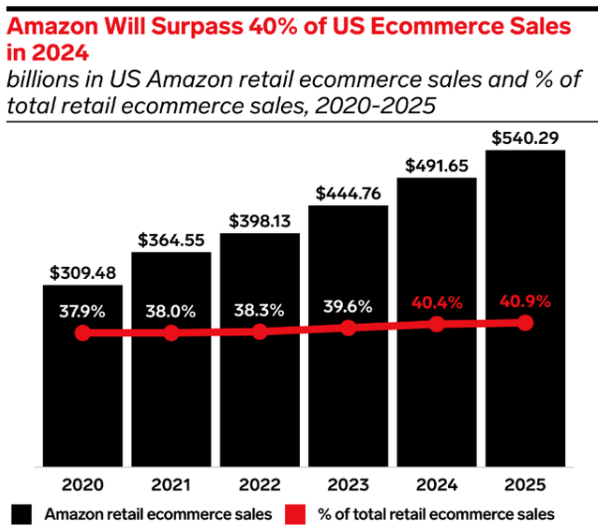

EMarketer

From the perspective of Amazon’s e-commerce business, I do not have to say much to prove my bullishness. Amazon’s e-commerce ecosystem and scale are just unmatched and are almost impossible to be ever replicated. According to EMarketer, Amazon’s U.S. e-commerce market share is expected to continue expanding in 2024-2025 and will go above 40%.

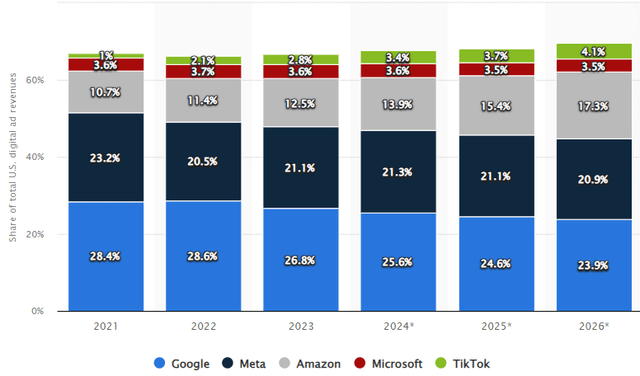

Last but not least, it is crucial that Amazon’s unmatched positioning in e-commerce and its cutting-edge technologies also help in driving a new revenue stream with vast potential. As I mentioned before, the digital advertising stream delivered a 20% YoY revenue growth despite already being a large business with the Q2 revenue of almost $13 billion. Let me bring some context here to understand how big Amazon’s digital advertising business is. The largest CRM company in the world, Salesforce (CRM), generated a $9.3 billion revenue in Q2. The below bar suggest that the company’s digital advertising business has vast potential. According to Statista, Amazon’s market share in the digital advertising industry is expected to achieve a formidable 17.3% by 2026.

To sum up, Amazon continues demonstrating strength across all its businesses. AWS is likely to remain Amazon’s primary growth driver in the foreseeable future, and I like the management’s commitment to innovate, which will help to protect its throne in the industry. I would also not underestimate Amazon’s success in digital advertising, which is already a multi-billion business but still demonstrates a staggering 20% revenue growth.

Valuation update

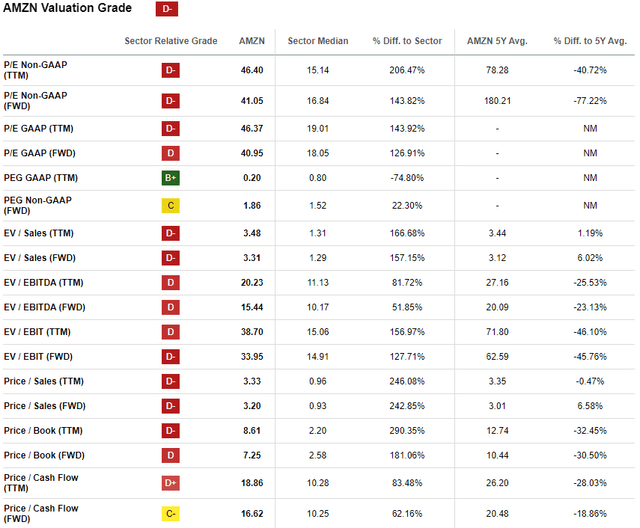

The stock rallied by 47% over the last 12 months, outperforming the broader U.S. market. YTD performance is also solid and notably ahead of the S&P 500 with a 27% share price increase. AMZN’s current valuation ratios are lower than historical averages across the board, which means undervaluation. I am not comparing to the sector median because Amazon is an absolutely unique company dominating in e-commerce and cloud.

The next step is always a DCF model for growth stocks. I incorporate a 7.7% WACC for AMZN, recommended by valueinvesting.io. Estimates of Wall Street analysts forecast a 9.6% revenue CAGR for the next decade, which looks quite fair given Amazon’s massive investments in growth and innovation.

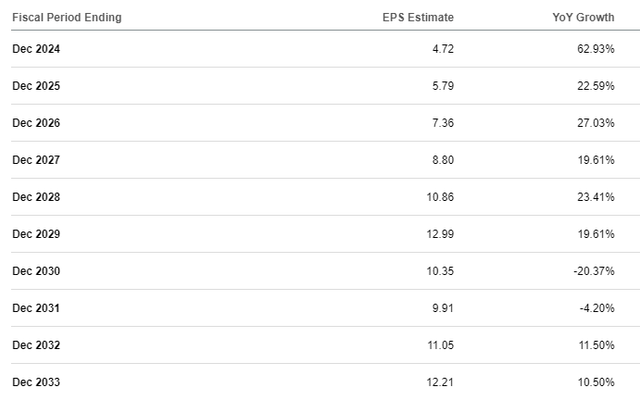

The TTM levered FCF margin ex-SBC improved once again, and my base-year assumption is now 5.9%. I reiterate my assumption that AMZN will be able to drive a 75 basis points yearly expansion of the FCF margin. My optimism around the FCF margin is supported by long-term consensus EPS estimates presented in the above table.

According to my DCF simulation, the business’s fair value is close to $3 trillion. This is significantly higher compared to the current market cap. The valuation looks compelling with a 43% upside potential.

Risks update

My valuation is dependent on projections for long-term revenue growth and an extension of free cash flow margins. There are plenty of reasons for optimism about Amazon’s growth prospects. It’s clearly dominant in its core cloud infrastructure and e-commerce infrastructure offerings. It’s also very well-positioned strategically and is well-placed to continue growing from a position of strength. But beyond the powerful market positioning, I have faith in Amazon’s long-term growth potential based on its strong historical track record. The fact that Amazon’s shares have grown strongly over the past decade doesn’t mean they will continue to do so over the next decade. And even though the company’s current operational strength might be more powerful than ever before, there are some important risks that could dramatically impact that growth potential.

Amazon’s position is unassailable in e-commerce but, in cloud, the competition risks are much larger. Amazon competes with Microsoft and Google in the cloud. In the cloud, Amazon competes with Microsoft and Google. Microsoft has dominated the PC software space untouched for three decades. Google’s monopolistic free cash-flow machine from dominance in digital advertising can fund the kind of AI research and acquisitions required to disrupt almost any legacy technology space. Oversight from the antitrust agencies could have also constrained Amazon’s growth due to its sheer size.

As its international e-commerce business expands, foreign exchange risk is likely to increase as well. One of the largest constraints on the profitability of the company’s international operations will be the strength of the US dollar.

Bottom line

To conclude, AMZN is still a “Strong Buy”. I think that the company’s undisputed leadership in e-commerce in cloud and e-commerce makes it a stock every investor should have. Moreover, AMZN’s valuation is very attractive at the moment.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.