Summary:

- The management style adopted by Andy Jassy at Amazon is a feature, not a bug, in our view. We believe his approach will benefit long-term investors.

- The quarter just printed was strong, and we think Amazon stock has a meaningful near-term upside.

- We rate AMZN stock at Hold.

4kodiak/iStock Unreleased via Getty Images

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note’s date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Machine Learning

You can read all about Amazon’s Q3 all over the Internet right now. AWS this, retail that, advertising the other. I won’t bother re-hashing all that. I have a very simple observation to make about Amazon, and it is this:

Andy Jassy is a much better CEO than you think he is.

The general chatter about AMZN is that the stock is poorly managed from a capital markets perspective (no dividends or buybacks) that the company isn’t maximizing its growth opportunities, oh – also that the company is losing share in compute to Microsoft or Oracle or some other cloud provider du jour. Rocks are then lobbed at Jassy because, well, clearly he doesn’t understand retail and so forth, and yet Amazon is the biggest retailer, so, what is this guy even doing, and why hasn’t the stock made a new all-time high yet?

This is what I think: Jassy was hand-picked by Bezos to run Amazon going forward because, lacking the founder-paternalism that would run through even Bezos’ cool, calm veins, he would do what was necessary to maximize the potential of the stock. It’s not a bug that the current CEO of the world’s biggest retailer used to run the non-retail side of the business – it’s a feature. If Jassy doesn’t understand retail, then, from an AMZN shareholder’s perspective, good. Because retail isn’t where the money is here. Retail is where the business came from. Compute is where the money is here. Ads are where the money is here. Machine work is where the money is here. And Jassy knows all about running the machine for big profits. The biggest recent clue is the drive to restructure with the lowest possible restructuring expenses (by requiring managers to work 5 days/week in the office).

You can see this management focus in AMZN’s financial profile, which is good and getting better.

Amazon – Financial Fundamentals

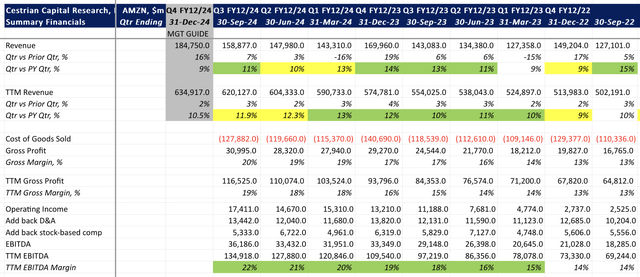

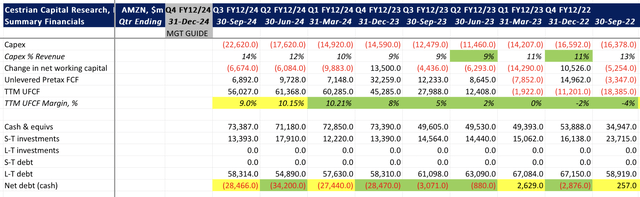

This quarter, revenue growth accelerated, EBITDA margins ticked up and cashflow margins only dropped a touch despite a painful capex bill (one which will persist I think, whilst the AI arms race continues).

AMZN Financials I (Company SEC Filings, YCharts, Cestrian Analysis) AMZN Financials II (Company SEC Filings, YCharts, Cestrian Analysis)

From a fundamentals perspective, my own expectation is that AMZN becomes more like ORCL and less like Kroger’s every day. And I think this is a good thing because compute services companies are a lot more cash generative than are retailers, whilst also growing a lot faster and being more predictable.

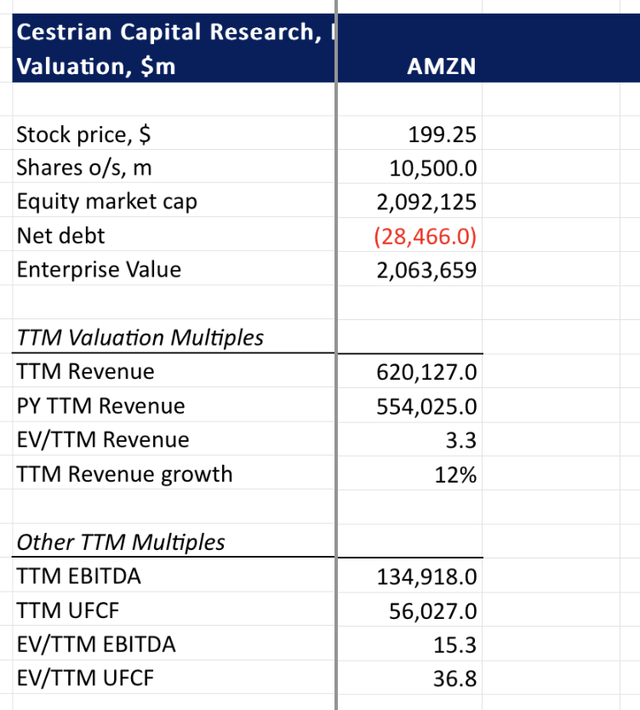

Amazon Stock Valuation Analysis

AMZN stock is inexpensive on fundamental multiples in my view. Yes, 36x TTM unlevered pretax free cashflow looks expensive for the growth rate, but that’s because you’re paying a mixed multiple – cheap for the compute business and expensive for the retail. As time goes by, I would expect AMZN’s cashflow multiple to fall, all other things being equal because the cash generation of the compute services business will continue to eclipse that of the retail side.

AMZN Valuation Analysis (Company SEC Filings, YCharts, Cestrian Analysis)

AMZN Stock Price Target And Rating

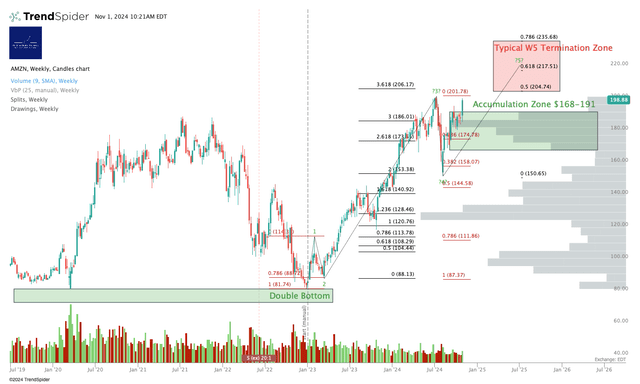

This is a tricky one. How far can the stock go? I think this is primarily a question of supply, meaning, does Bezos start supplying stock into the market by selling at around the $200/share mark. If yes, there will likely be a cap on the price for now. If no, I think the stock can make it to at least $217, maybe $235, before any kind of meaningful selloff. (These price targets arise solely from our chart analysis).

Here’s how we see the chart – you can come up with a more aggressive version, for sure, but this is our measured take on it. You can open a full-page version of the chart, here.

AMZN Stock Chart (TrendSpider, Cestrian Analysis)

Rather than bore everyone reading this with chart logic, I am happy to discuss this in the comments section! But in short – if you take the double-bottom low struck in January 2023 as the start of this bull cycle in AMZN, then it looks like the stock is in a Wave 5 up in the Elliot Wave / Fibonacci model. Such Wave 5s tend to complete in the red box zone highlighted – “tend” doesn’t mean “will”, of course. So I think the stock may encounter some resistance there, even if ultimately it pushes higher.

We rate Amazon at Hold, meaning Hold not Sell, but the risk-averse investor may consider taking profits here in the $200 zip code (because Bezos) or perhaps in that $217-235 range. The very long-term investor will likely ignore all this chart hoopla and hold, and the entire history of Amazon stock says that may very well be a good idea if your timeline is long enough, and you can wear the volatility.

Cestrian Capital Research, Inc – 1 November 2024.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours.

Business relationship disclosure: See disclaimer text at the top of this article. Cestrian Capital Research, Inc is a TrendSpider affiliate partner.

Cestrian Capital Research, Inc staff personal accounts hold no direct position in AMZN but have beneficial long exposure to the stock via S&P500 and Nasdaq ETFs.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Join Our Investor Community.

Our Growth Investor Pro service is one of the most highly-respected and most popular services on all of Seeking Alpha. And right now you can take a one-month trial for just $99 before deciding if you want to take an annual subscription. You can learn all about it here including the wall of 5-star reviews we’ve received in bear and bull markets alike.