Summary:

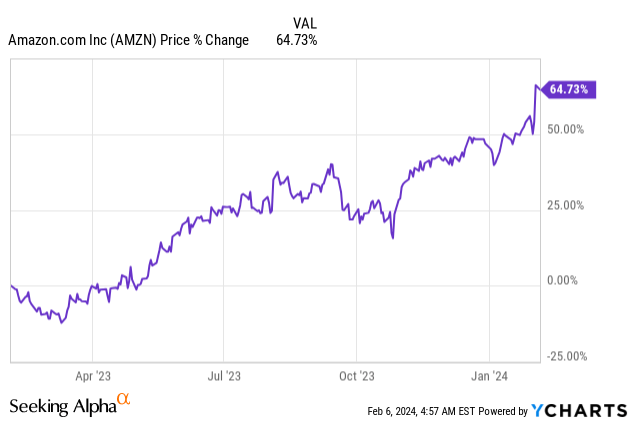

- Amazon’s shares reached a new 1-year high after strong Q4 results and an upbeat outlook for Q1 revenue growth.

- Strong results were driven by a powerful rebound in the e-commerce segment. A number of factors support continual growth here.

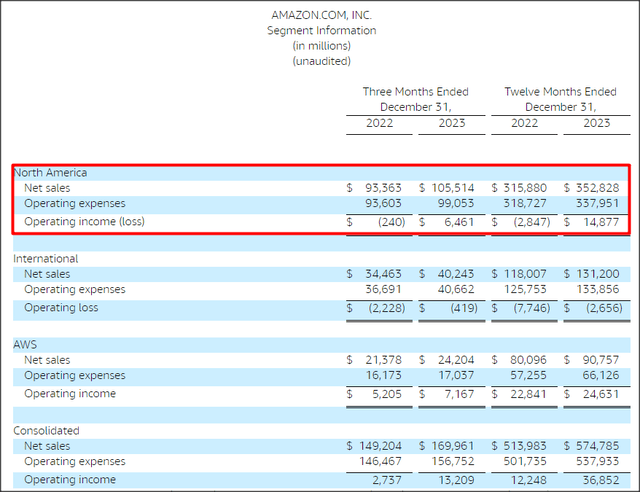

- Amazon’s e-commerce segment generated almost as much operating income as the super-profitable AWS segment.

- Shares are not cheap, but could revalue higher on continual operating income momentum.

Daria Nipot

Shares of Amazon (NASDAQ:AMZN) hit a new 1-year high on Friday after the e-Commerce firm presented an upbeat outlook for first-quarter top line growth and beat estimates for EPS and revenue by a big margin. Amazon is currently riding a wave of strong e-Commerce spending which obviously benefits the firm’s core business. As a result, Amazon is seeing massive earnings and operating income growth, which is a top reason to buy shares, despite Amazon reaching new highs. There is also a narrative shift taking place: real operating income growth is now coming from e-Commerce, not Amazon Web Services. While shares of Amazon are not cheap, the U.S. economy puts up a strong score card right now and I believe Amazon has potential to grow its earnings in FY 2024!

Previous rating

My previous rating on Amazon (October 2023) was buy due to what I saw were favorable adoption trends for Amazon Web Services as well as gathering momentum in the vital e-Commerce business post-pandemic. These trends continued to play out in both Amazon’s third and fourth-quarter and the e-Commerce company has been able to crush estimates for Q4’23 by a large margin. The e-Commerce market outlook is also very favorable and I believe investors have reason to expect stronger operating growth from e-Commerce than from Amazon Web Services.

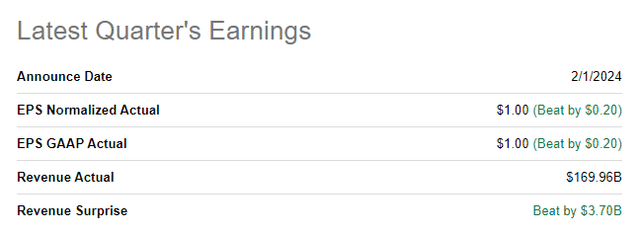

Amazon beats estimates easily

Amazon smashed market expectations for its earnings and revenues with the latter beating consensus estimates by $3.7B. Earnings, on an adjusted basis, came in at $1.00 per-share, $0.20 per-share ahead of the consensus.

Seeking Alpha

A major narrative shift is taking place

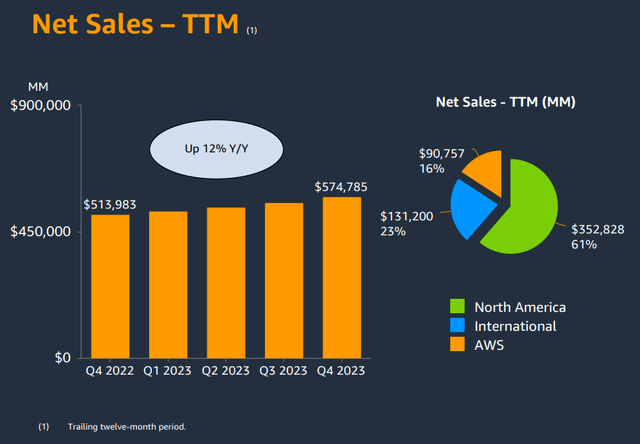

Shares of Amazon soared 8% on Friday and hit the highest price since December 2021 on strong Q4 results, especially in e-Commerce. Amazon’s net revenues increased 12% year over year and reached their highest level ever at $574.8B. These results were boosted by a strong revenue performance concerning the Black Friday-Cyber Monday period during which Amazon sold more than 1B items on the Amazon platform. Amazon’s fourth-quarter revenue hit $170.0B, showing a year over year increase of 14%.

Amazon

The market has justified valuation gains in the past chiefly with strong expected top line and operating income growth in Amazon Web Services, but this may not be the case in FY 2024 and I believe we are dealing with a narrative shift here which is that operating income growth in e-Commerce especially could drive a continual revaluation of Amazon’s shares.

While Amazon is seeing solid growth in Amazon Web Services — revenues increased 13% year over year to $24.2B — e-Commerce is where Amazon is seeing a lot of its operating income momentum going on. Amazon’s e-Commerce revenues in North America also soared 13% Y/Y to $105.5B, but the segment’s operating income surged from $(240)M last year to a massive $6.5B… reflecting a $6.7B swing in operating income within the last year. The international e-Commerce segment still struggled, however, and had $419M in operating losses.

Amazon Web Services’ operating income was $7.2B and it added about $2.0B in operating income incrementally compared to Q4’22. In other words, Amazon’s e-Commerce operations added $3.40 in operating income for every dollar in AWS operating income.

Amazon Web Services is a major source of growth, however, and the segment’s operating income is now growing 2.9X faster than its revenues. While Amazon Web Services’ top line growth saw a 1 PP acceleration relative to Q3’23, the much faster operating income growth is currently taking place in e-Commerce which is where valuation gains could come from in FY 2024.

Amazon

I believe this momentum in e-Commerce has staying power in FY 2024 for four specific reasons:

- The U.S. economy grew at a blistering pace of 3.3% annualized in Q4’23

- Employers created 353k new jobs in December

- Inflation growth is slowing: it increased slightly in December, but is overall down to 3.4%, causing relief for consumer spending

- e-Commerce sales are expected to continue to grow rapidly.

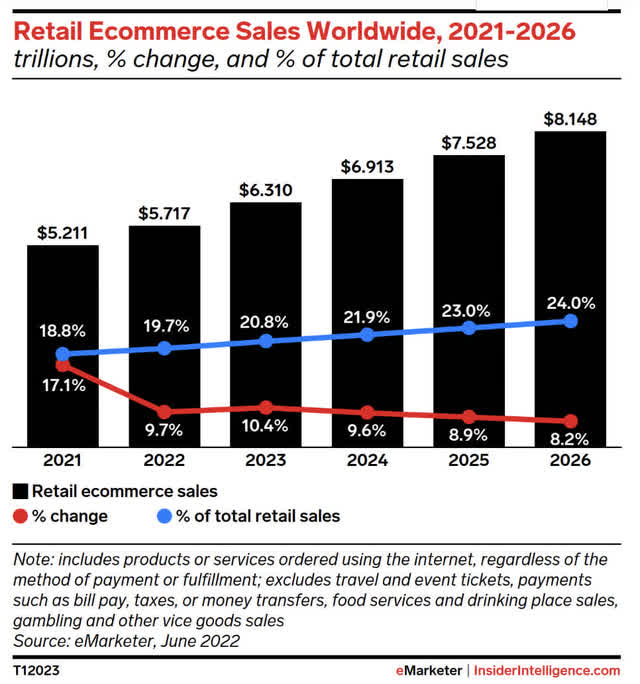

As to the last point, eMarketer predicts that e-Commerce is going to capture a larger share of (growing) sales volumes going forward which should benefit large online retailers like Amazon more than any other company. The share of e-Commerce sales of total retail sales is expected to grow by about 3.5 PP year over year while retail e-Commerce sales are expected to grow at an average annual rate of 9%.

eMarketer

Impressive guidance for Q1’24

Amazon expects its revenue momentum to carry over into FY 2024 as well. The e-Commerce firm projects between $138.0B and $143.5B in net revenues for the first-quarter, implying up to 13% Y/Y top line growth. This growth is supported by a rapidly growing U.S. economy, labor market strength and slowing inflation growth.

Amazon’s valuation

Amazon’s shares have revalued 65% higher in the last year so shares are a lot higher valued based off of P/E than they were at the same time last year. But there is a very good reason for this: Amazon’s operating income increased by a factor of 4.8X during this time and the four pillars I mentioned above should allow further valuation gains for Amazon in 2024.

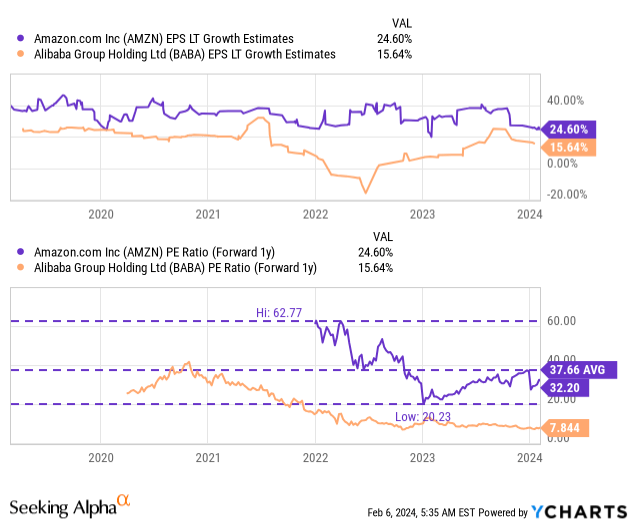

Amazon is widely profitable, so a P/E ratio can be used to value the rapidly growing e-Commerce company and I compare Amazon against Alibaba (BABA) due to the similarity in the business model. Amazon is priced at a P/E ratio of 32.2X and therefore much higher than Alibaba which is trading at a large discount due to real and perceived issues with investing in China. I personally like Alibaba given its business reorganization, low P/E ratio and massive capital return potential.

Amazon is projected to grow 4.5X faster than Alibaba next year and the long term EPS growth estimates are also in favor of Amazon (25% vs. 16%). This discrepancy in growth is due to Amazon owning the biggest cloud service provider in the world with a market share of ~30% and the U.S. economy is in a cyclical upswing which can’t be said about China’s economy.

From a valuation point of view, assigning a 35X P/E could make sense for Amazon since the firm is seeing such a powerful uptrend in its operating income, but this is only my personal opinion. The 3-year average P/E ratio for Amazon was 38X which is even higher than my “fair value P/E” ratio of 35X. Given a 35X earnings multiplier, Amazon may have a fair value around $185 while a 38X P/E ratio would translate to a fair value closer to $200.

Risks with Amazon

Amazon’s strong outlook for the first-quarter suggests that Amazon will continue to see material earnings/operating income growth. In a slowing economy, however, the story may be a bit different, especially since I mentioned economic support as a catalyst for e-Commerce related revenue and operating income growth in this article. Slowing e-Commerce operating income and top line momentum would be reasons for me to re-evaluate my stance on the e-Commerce company (I am monitoring these two metrics going forward).

Final thoughts

A narrative shift is taking place: it is no longer, in my opinion, about top line growth in Amazon’s much-celebrated Cloud business that could drive valuation gains for the company, but rather a surge in e-Commerce related operating income. Amazon has already seen a major recovery in profitability in e-Commerce North America in Q4’23, with operating income soaring to $6.5B in Q4’23: this means that Amazon’s North America e-Commerce operations generated just $700M less in operating income than the super profitable Amazon Web Services segment and it may even overtake it in the short term. Therefore, e-Commerce may replace Amazon Web Services as an operating income driver in FY 2024. Amazon is no bargain here, obviously, with a P/E ratio of 32X, but with the prospects of continual earnings and operating income growth, we may see a continuation of Amazon’s stock rally in 2024!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN, BABA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.