Summary:

- AMZN is the largest e-commerce and cloud computing provider in the United States.

- BABA is the largest e-commerce and cloud computing provider in China.

- Both companies have experienced significant decreases in their market valuation during the previous year.

- Given the potential for growth opportunities, solid track record and attractive valuation for both companies, they present an attractive long-term investment opportunity.

gorodenkoff

In this article I will provide a look into Amazon (NASDAQ:AMZN) from the United States and Alibaba (NYSE:BABA) from China from a purely fundamental perspective. BABA and AMZN are two of the largest e-commerce companies in the world and the biggest cloud computing providers in their respective domestic markets. I believe both companies are undervalued and present a long-term investment opportunity, based on fundamentals.

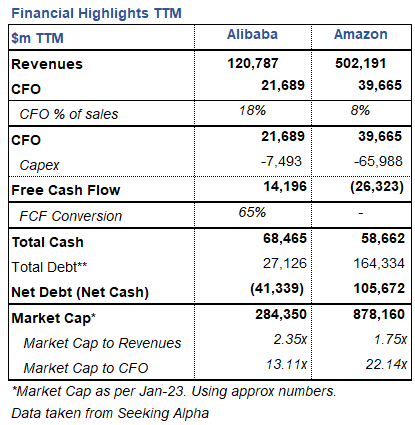

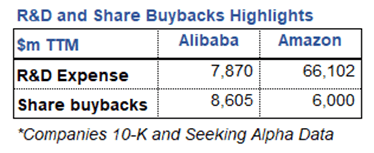

Please find below a comparison of the companies´ financial metrics during the trailing twelve months:

Amazon & Alibaba Financial Highlights (Seeking Alpha)

As presented in my previous article about Meta Platforms (META) and Tencent (OTCPK:TCEHY) as well as in the article about Baidu (BIDU) and Alphabet (GOOG) (GOOGL), I also take a look at R&D spend and share buybacks. It is important to look how much BABA and AMZN are investing in innovation and their platforms as well as how much they are spending to repurchase their common stock and decrease the number shares of outstanding in the open market. Important to note here that both companies have seen their value significantly decrease during 2022.

R&D and Share Buybacks highlights (Seeking Alpha)

Examining AMZN and BABA Fundamentals and Growth Potential

AMZN

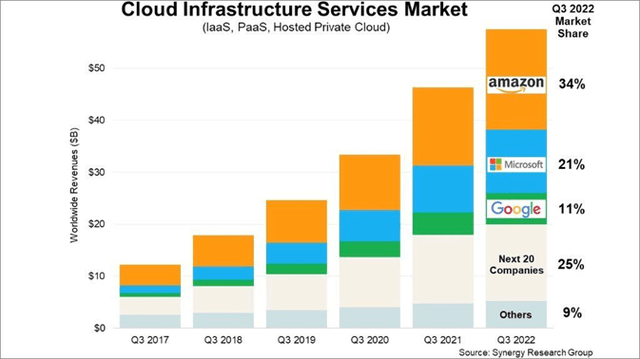

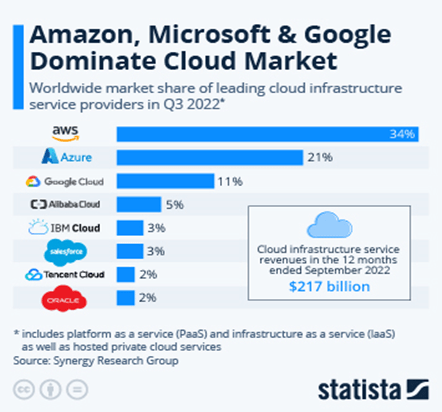

As we all know AMZN is the biggest e-commerce company in the United States and the leading cloud computing player in the world. The company has seen a drop in its market valuation since it had its eyes set at $2 trillion, the drop has been significant and is now trading at a market valuation of $878 billion. AMZN is able to generate a strong cash flow from operations at $40 billion which during the last twelve months the company had to spend purchasing property and equipment which has now ballooned to $66 billion during the last twelve months. AMZN has always invested its resources to reap benefits at a later stage, we can just take a look at its AWS business, which has over 30% market share in the global cloud market. This market has now surpassed the $200 billion mark during 2022.

Cloud Market (Synergy Research Group)

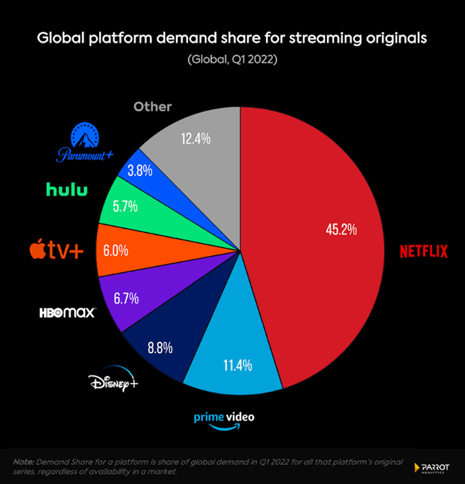

Another example of AMZN investment strategy is its R&D spend which is substantially higher than most tech companies. AMZN spent a whopping $66 billion in R&D expenses during the last twelve months. It is because of this investment mindset of the management that AMZN has a dominant position in the e-commerce, cloud computing, and video streaming markets. AMZN is now making strong investments and looking to become a dominant player in other market such as the on-demand streaming services market which is forecasted to reach the $330 billion mark by 2030.

Global Platform Demand Share (Parrot)

Fundamentally, AMZN has very strong financials with massive TTM revenues of $502 billion, a total cash position of $59 billion, and a robust cash flow from operations. AMZN does have substantial debt but let´s not forget that this is mainly because of operating leases. Based on the current valuation of $878 billion and the company’s strong market position in e-commerce, cloud computing, and video streaming, it is likely that we will see the company’s valuation return to its 2021 levels. The cloud computing market is projected to reach $1.2 trillion by 2027, and the on-demand streaming services market is expected to grow to $330 billion by 2030. With a dominant presence in these markets and in e-commerce, the company is well-positioned to experience significant revenue and profit growth. Overall, AMZN has proven it can diversify away from its main revenue segment, which has allowed the company to find profitable opportunities. We can expect management will keep looking for and finding opportunities which will set the company for long term value creation.

BABA

BABA has suffered a steep decline in its market valuation during the last two years, with headwinds coming from all directions. Chinese Regulators have punished the company through fines, blocked IPO, etc. These events have impacted investor sentiment and has made investors wary about the prospects of the company. However, investors should note that companies from the USA also suffer and have suffered scrutiny from the U.S. or European regulators. Let´s not forget about Microsoft´s (MSFT) fine in 2004 by EU regulators or more recently META´s fine by EU regulators for approx. $400 million.

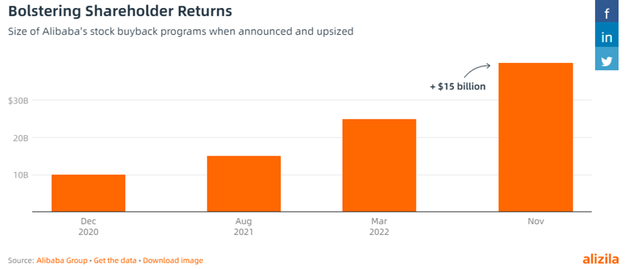

Anyways looking at BABA financials, we can clearly see that regardless of the headwinds the company has been able to generate solid results. With TTM revenues north of $120 billion and free cash flow of $14.2 billion, BABA has enough fire power to pursue growth opportunities or share buybacks. Management made it clear it is pursuing share buybacks with the announcement that the company would raise its share buyback program from $25bn to $40bn.

BABA Share Buybacks Increases (Alizila)

BABA is able to pursue this program thanks to its strong balance sheet which is bolstered by its cash position of $68 billion and net cash position (cash – debt) of $41 billion. With the current market capitalization, management could redeem at least close to 10% of its shares outstanding. Looking at BABA cash flow to price being close to 13 times it presents an attractive opportunity as the company still has the potential to keep growing. For example in the cloud industry which is set to grow in China alone to $84 billion by 2027 and globally to $1.2 trillion by 2027. Let´s not forget that BABA is the largest cloud player in China and top 5 in the world, which positions the company to take advantage of this opportunity.

As a leading player in the e-commerce and cloud computing markets in China, and with a market valuation below $300 billion, BABA presents an attractive long-term investment opportunity. The company has significant room to grow in these markets, and its strong cash flow from operations allows for aggressive repurchasing of its common stock, which will enhance earnings per share. In the long term, we can expect to see an increase in earnings and a decrease in share count, resulting in significant appreciation of earnings per share.

Global Cloud Market (Synergy Research Group)

Risks

Regulatory risks: As mentioned above, these companies are subject to several regulations in their domestic markets as well as abroad. As it has been seen throughout the years, fines by regulating entities are not a rare occasion. Some examples to point out are the fines delivered to BABA and TCHEY in China or to META and MSFT in the USA and Europe. Increased regulatory scrutiny will certainly impact these companies at some point and this could have negative consequences for their financial performance.

Geopolitical risks: It is no secret that both AMZN and BABA face geopolitical risks, the changing world order is impacting all companies in the world. Due to the massive size of these companies’ political instability, trade disputes, and other impactful events could hinder their operations and financial performance.

Conclusion

AMZN and BABA are both large influential companies in the tech industry. AMZN is the leading e-commerce company and cloud computing player in the United States, while BABA holds the same leading position in China. However, BABA has faced a number of headwinds in recent quarters, including fines and regulatory issues in China and this has led to a substantial decline in its market valuation. Overall, both AMZN and BABA have very strong fundamentals and the potential for future growth in markets which are set to increase in value significantly during the next years.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.