Summary:

- AMZN has had a great reversal in sentiments after the painful FQ2’24 sell off, thanks to its robust performance metrics in FQ3’24.

- The management has continued to outperform expectations across the board, as observed in the growing top/ bottom-lines and healthier balance sheet.

- If anything, AMZN’s highly strategic Prime membership remains a core differentiator, allowing them to increasingly offer attractive deals while growing its loyal base.

- This is on top of its accelerating advertising growth opportunities in the US and globally, with market analysts expecting further market share gains at the expense of its competitors.

- Combined with AMZN’s market leading global leadership in the ecommerce and cloud market, the stock remains a cheaply valued MAG7 stock indeed.

DNY59

AMZN Remains Attractively Valued As A High Growth Mag7 Stock

We previously covered Amazon.com, Inc. (NASDAQ:AMZN) (NEOE:AMZN:CA) in August 2024, discussing its extremely cheap valuations as the company remained highly profitable, thanks to its growing advertising opportunities, profitable international segment, and robust AWS performance metrics.

Thanks to the stock’s oversold status then, we had believed that the drastic pullback had offered extremely attractive entry points for opportunistic investors whom were looking to dollar cost average.

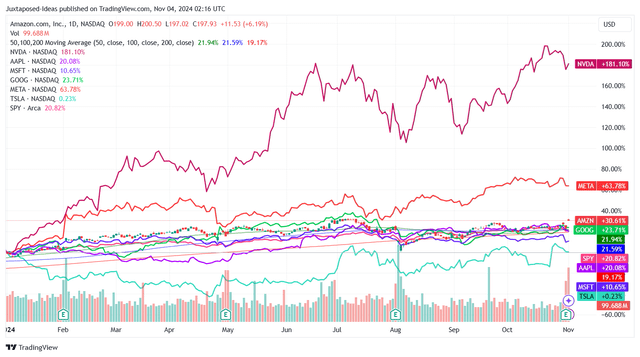

AMZN YTD Stock Price

Trading View

Since then, AMZN has had a robust +17.7% performance, compared to the wider market at +7%, partly attributed to the robust bullish recovery after the August 2024 sell off, as market trends continue to point to the durability of generative AI demand.

The other part of the tailwinds are attributed to the +6.1% one-day jump after the giant’s double beat FQ3’24 earnings call, with the net sales of $158.9M (+7.3% QoQ/ +11% YoY), EBIT margins of 10.9% (+1 points QoQ/ +3.1 YoY/ +7.5 from FQ3’22 levels of 3.4%), and adj EPS of $1.43 (+13.4% QoQ/ +52.1% YoY) well exceeding expectations.

This is on top of the eye-wateringly rich Free Cash Flow generation of $47.7B over the last twelve months (+122.8% sequentially) and margins of 7.6% (+3.8 points sequentially), which naturally contributed to AMZN’s increasingly healthy balance sheet with a net cash position of $33.16B (-3% QoQ/ +980.1% YoY).

Much of these outperformance are naturally attributed to two key drivers:

- the top-line driver being the North American sales at $95.5B (+6.1% QoQ/ +8.6% YoY) with operating margins of 5.9% (+0.3 points QoQ/ +1.1 YoY), and

- the bottom-line driver being the AWS segment at $27.5B (+4.5% QoQ/ +19% YoY) and 37.8% (+2.5 points QoQ/ +7.5 YoY), respectively.

AMZN’s numbers are impressive indeed, despite the rising inflationary pressure and the elevated interest rate environment, as numerous retailers highlight that “consumer pocketbooks are still stretched.”

This is on top of its top player position in the US e-commerce market, with a leading share of 37.6% as of 2023, as market analysts also expect a promising US market size growth from $1.22T in 2024 to $1.88T in 2029, expanding at a CAGR of +8.99%.

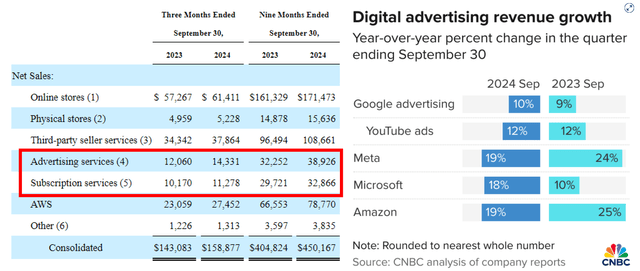

AMZN’s Performance Metrics

AMZN

If anything, readers must not forget AMZN’s core subscription service, Amazon Prime, which has contributed to the growing subscription services sales of $11.27B (+3.7% QoQ/ +10.8% YoY), as “Year-over-year paid membership growth accelerated in Q3 from both the US and globally, helped by our tenth annual Prime Day event in mid-July.”

This is on top of the improved monetization of its Prime membership (and ad-supported Prime Video) ecosystem with Advertising services sales of $14.33B (+12.2% QoQ/ +18.8% YoY), both of which are typically bottom-line accretive – naturally explaining the giant’s growing profit margins thus far.

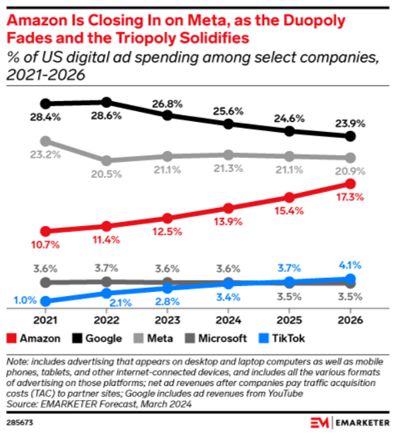

AMZN’s Projected Growth Through Advertising

eMarketer

AMZN’s growing prowess in the global advertising market can not be ignored indeed, with it commanding 8.8% share, compared to Google (GOOG) at 27.7% and Meta (META) at 22.8%.

An accelerating growth has also been observed in the US market, with AMZN expected to command 13.9% in 2024 and projected to grow to 17.3% by 2026, compared to GOOG’s decline at 25.6%/ 23.9% and META at 21.3%/ 20.9%, respectively.

With market analysts already projecting the expansion of the global advertising market from $1.07T in 2024 to $1.23T in 2026, expanding at a CAGR of +7.2%, one cannot deny AMZN’s immense opportunity for further market share/ top-line growth indeed.

At the same time, AMZN AWS’ outperformance is also observed in the richer profit margins, with the historical margin compression headwinds well behind us, along with the sustained growth in the cloud segment’s multi-year remaining performance obligation to $164B (+4.7% QoQ/ +23.3% YoY).

This is on top of AWS’ robust Q3’24 cloud market share of 31% (-1 points QoQ/ inline YoY), compared to Microsoft’s (MSFT) Intelligent Cloud at 20% (-3 points QoQ/ -5 YoY) and Google Cloud at 11% (-2 points QoQ/ +1 YoY).

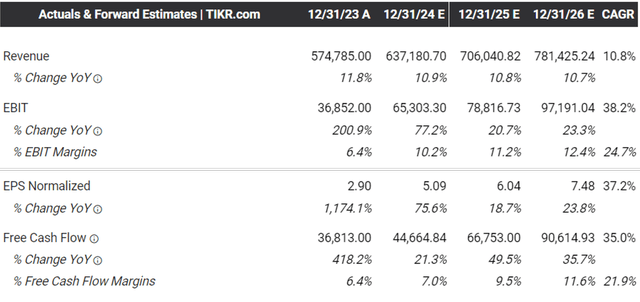

The Consensus Forward Estimates

Tikr Terminal

These developments may also be why the consensus have continued to offer promising forward estimates, with AMZN expected to generate robust top-line growth along with accelerating profit margin/ bottom-line expansions through FY2026, putting the painful FY2022/ FY2023 years well behind us.

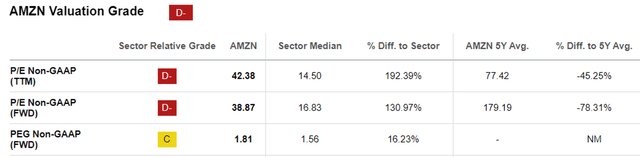

AMZN Valuations

Seeking Alpha

This is also why we believe that AMZN is not overly expensive at FWD P/E non-GAAP valuations of 38.87x, compared to the 1Y mean of 38.52x, 5Y mean of 179.19x, and 10Y mean of 242.23x, albeit elevated compared to the sector median of 16.83x.

This is attributed to the relatively cheap FWD PEG non-GAAP ratio of 1.46x, compared to its 1Y mean of 0.50x, 5Y mean of 7.59x, 10Y mean of 4.16x, and the sector median of 1.56x.

Even if we take AMZN’s Magnificent 7 position into consideration, its attractive valuations can not be denied indeed, as compared to Apple (AAPL) at FWD PEG non-GAAP ratio of 3.04x, GOOG at 1.30x, META at 1.20x, MSFT at 2.40x, Nvidia (NVDA) at 1.34x, and Tesla (TSLA) at 6.81x – with it offering interested investors with an excellent margin of safety.

So, Is AMZN Stock A Buy, Sell, or Hold?

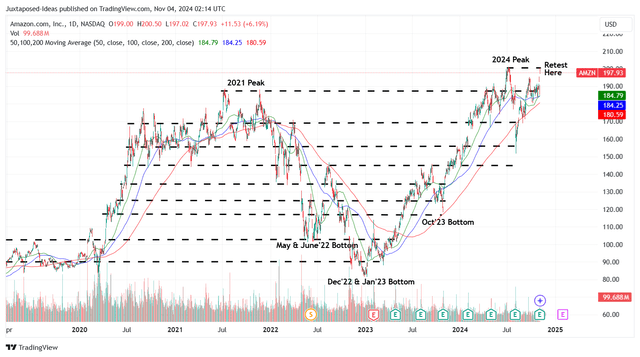

AMZN 5Y Stock Price

Trading View

For now, AMZN has had an extremely robust recovery of +22.9% since the worst of the August 2024 correction, with the stock currently retesting the 2024 peaks of $200s while running away from its 50/ 100/ 200 day moving averages.

For context, we had offered a fair value estimate of $161.00 in our last article, based on the LTM adj EPS of $4.18 ending FQ2’24 and the 1Y P/E mean of 38.52x.

Based on the LTM adj EPS of $4.67 ending FQ3’24, it is apparent that AMZN has ran away from our updated fair value estimates of $179.90.

Despite so, based on the consensus raised FY2026 adj EPS estimates from $7.43 to $7.48, there remains an excellent upside potential of +45.5% to our updated long-term price target from $286 to $288.10.

As a result of the market leading position in both e-commerce/ cloud and its robust capital appreciation prospects, as discussed above, we are maintaining our Buy rating for the AMZN stock.

Given that the recent rally, we urge interested investors to observe its movement for a little longer, since it remains to be seen if the stock may be able to break out of the all-time peaks of $200s.

Assuming otherwise, we may see AMZN return part of its recent gains and retrace to its previous support levels of $180s, with it implying a -9% downside from current levels.

While we remain optimistic about its long-term prospects, we believe that patient investors may be able to get an improved margin of safety upon that pullback. Patience for now.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.