Summary:

- Amazon has been performing above expectations and its growth story appears intact.

- The resilience of the American consumer is likely to boost Amazon’s e-commerce business in the following months.

- Despite this, Amazon’s stock leaves little of margin for investors at the current price.

Justin Sullivan

Amazon (NASDAQ:AMZN) has been silencing the naysayers in recent months as its business has been performing above expectations while its growth story appears to be intact. Going forward, the company has everything going for it to continue to show an impressive performance as the resilience of the American consumer is likely to give a boost to its eCommerce business while the increased demand for AI-related tools and platforms could help its cloud business to aggressively expand. The only major issue with Amazon’s stock is that at the current market price, it offers little margin of safety to investors, which might prompt investors to wait for a pullback before accumulating a position in the company.

Amazon Silences the Naysayers

After giving relatively successful BUY ratings for Amazon in late 2022 and early 2023, I decided to change the rating to SELL last October. Back then there was a possibility that the potential worsening of the macroeconomic environment could negatively affect the company’s performance in the coming months.

That call didn’t play out well as Q4 became one of the best holiday quarters in Amazon’s history. This was possible thanks to the improvement of consumer confidence in the United States where the acceleration of the disinflationary process led to the rise in consumer spending. When the Q4 report came out last month, investors saw that Amazon’s revenues during the quarter increased by 13.9% Y/Y to $170 billion, which was above the street consensus by $3.74 billion. What’s more, is that international sales increased Y/Y as well due to the fact that the global economy has managed to avoid a recession so far despite the tight monetary policy of central banks across the globe.

Considering all of this, I’m changing my rating to HOLD as it appears that there are no major macro challenges for now that could undermine the strength of consumers in the coming months. The Federal Reserve has recently improved its outlook for the economy, while some reports suggest that the eCommerce business in the United States is expected to grow by ~51% by the end of the decade. Therefore, it’s safe to assume that Amazon’s core eCommerce business has everything going for it to retain its momentum for a while.

On top of that, Amazon’s AWS business is likely to continue to grow at an aggressive rate as well since the cloud industry itself is expected to grow at a CAGR of 16.40% by the end of the decade. In Q4, Amazon’s AWS business already generated $24.2 billion in revenues, which translates to a Y/Y growth of 13% and closely correlates with the industry’s growth rate. Add to all of this the fact that Amazon slowly disrupting the Meta-Google (META)(GOOG) duopoly in the digital advertising industry and expects to account for 15.2% of the total ad spend in the United States next year and it becomes obvious that Amazon’s growth story is not over yet.

Given all of those growth catalysts, the street has recently made dozens of upward revisions for Amazon’s stock. This has helped the stock to retain its momentum and continue to rally. It’s safe to assume that Amazon will be able to grow its revenues and earnings at an aggressive double-digit rate as it appears that its growth story is still far from over.

Major Risks To Consider

While Amazon has managed to exceed expectations in recent quarters thanks to the improvement of the overall economy, there’s nevertheless a risk that the macro picture might worsen over time and kill the company’s momentum. The deflation in China might negatively affect the global economy over the coming quarters while the potential escalation of the Sino-American trade war later this year could undermine Amazon’s efforts to drive sales higher.

Considering that the company already trades at a forward P/E of over 40x, which is above the market’s average P/E of ~28x, there’s a risk that it will be hurt the most if the overall market tumbles on macro challenges. Seeking Alpha’s Quant system also gives the company a rating of D- for valuation.

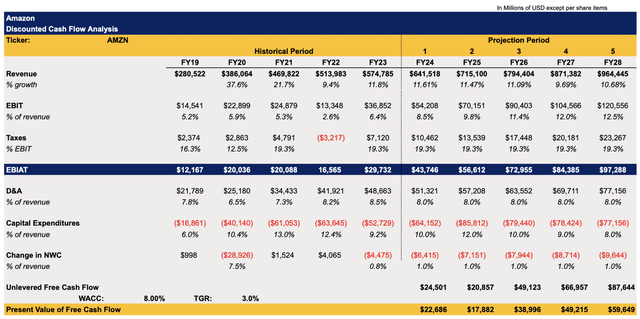

To figure out what is Amazon’s fair value I created a DCF model that can be seen below. The revenue and earnings assumptions in the model for the following years are mostly in line with the consensus on the street. The capital expenditures are expected to increase in the next couple of years and later start to decrease since the management plans to invest more this year into the cloud infrastructure to support the growth of the AWS business and its generative AI initiatives. The assumptions for other metrics mostly correlate with Amazon’s historical performance. The weighted average cost of capital in the model stands at 8%, while the terminal growth rate is 3%.

Amazon’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

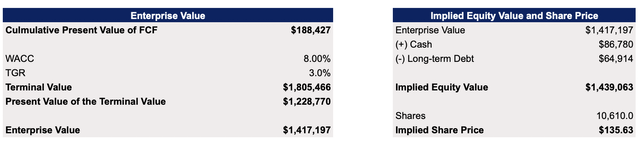

This model shows that Amazon’s fair value is $135.63 per share, which represents a downside of ~25%.

Amazon’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

This indicates that if Amazon starts to lose its momentum due to various macro issues – then there’s a possibility that shares will rapidly begin to depreciate closer to those fair value levels. That’s why buying the stock at the current levels leaves little margin of safety for investors.

In addition to macro and valuation risks, Amazon also faces increased competition in the cloud industry from Microsoft (MSFT). While AWS continues to hold the biggest share of the cloud market, its share nevertheless decreased to 31% by late 2023, down from 33% a year ago. At the same time, Microsoft’s share has increased to an all-time high of 24% in Q4 and the company may continue to establish a stronger footprint in the cloud industry thanks to its generative AI advantages. Therefore, it’s possible that Amazon’s dominance in the industry could be undermined even more in the following quarters.

Last but not least, Amazon’s eCommerce business is also being threatened by the rise of ByteDance’s TikTok (BDNCE) and PDD’s Temu (PDD). Both TikTok and Temu have been aggressively expanding in the United States in the last year and if they are successful in attracting American customers, then the growth of Amazon’s business could slow down in the coming years.

The Bottom Line

I was wrong about Amazon a few months ago when I closed my long position too soon. Given the company’s great performance since that time and the fact that its growth story is far from over, it makes sense to change the rating to HOLD. This is the most appropriate rating right now since there’s a clear indication that further appreciation is possible, but the valuation leaves little margin of safety to make a BUY call at the current price. That’s why my play for now is to wait for a pullback and only then accumulate a long position in the company.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Bohdan Kucheriavyi is not a financial/investment advisor, broker, or dealer. He's solely sharing personal experience and opinion; therefore, all strategies, tips, suggestions, and recommendations shared are solely for informational purposes. There are risks associated with investing in securities. Investing in stocks, bonds, options, exchange-traded funds, mutual funds, and money market funds involves the risk of loss. Loss of principal is possible. Some high-risk investments may use leverage, which will accentuate gains & losses. Foreign investing involves special risks, including greater volatility and political, economic, and currency risks and differences in accounting methods. A security’s or a firm’s past investment performance is not a guarantee or predictor of future investment performance.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.