Summary:

- Amazon is scheduled to report its Q1 FY23 results after market close this Thursday.

- Investors may want to closely monitor its segment revenue, its margin profile and its management’s outlook.

- In spite of the risk factors surrounding Amazon, it makes for a good buy ahead of earnings.

4kodiak/iStock Unreleased via Getty Images

All eyes will be on Amazon (NASDAQ:AMZN) when it reports Q1 results after market close this Thursday. Investors will be eagerly watching how the slowing down global economy affects the e-commerce giant’s revenue. But in addition to tracking its headline sales figure, investors may also want to keep close tabs on its segment financials, its profitability and its management’s outlook for the quarter ahead. These items will shed light on Amazon’s near-term prospects and are likely to influence where its shares head next. Let’s take a closer look to gain a better understanding of it all.

Growth Trajectory

Let me start by giving credit where it’s due. Amazon’s revenue has grown by 850% over the last 10 years, driven by continued innovation, strategic decisions to enter key markets at the right time and scaling operations without worrying too much about profitability. This is a commendable feat in today’s time and an enviable position to be in. But now that we’re in somewhat of a recessionary environment, there’s no guarantee that Amazon will continue growing at its historic pace and its momentum might very well slow down.

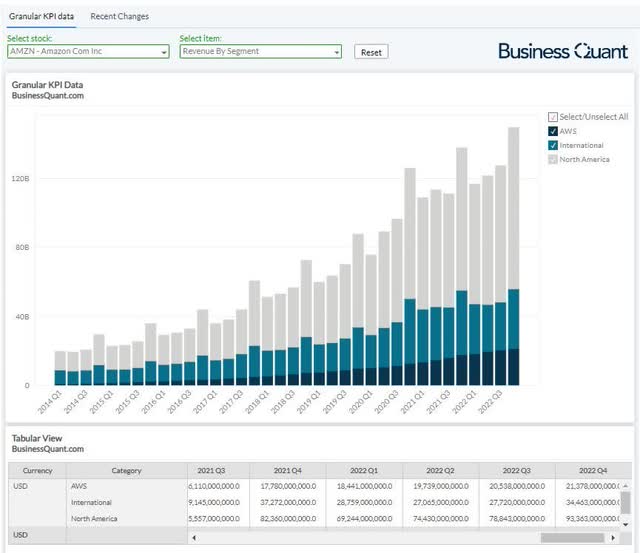

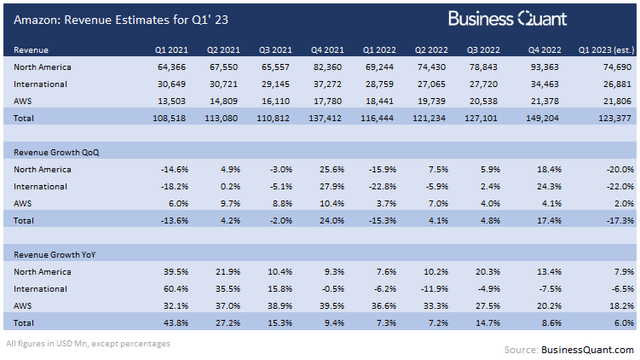

We can assess the extent of this damage by looking at Amazon’s bifurcated revenue. The ecommerce giant classifies its revenue in broadly three reporting segments, namely International, North America and AWS. The former two are Amazon’s conventional e-commerce operations and collectively contributed over 85% to the company’s total sales last quarter. It’s worth noting that these revenue streams are highly cyclical in nature – e-commerce sales around the globe are typically elevated in Q4, due to the holiday season, which eventually wane off in Q1 of each year.

To put things in perspective, Amazon’s North America and International revenue have sequentially declined between 14.6% and 22.8% in Q1’s of the prior 2 years. I expect this element of cyclicality to drag these revenue streams lower in Amazon’s upcoming Q1 as well. But the currently prevalent recessionary environment is likely to exacerbate the sales slump this time around. So, I estimate that Amazon’s North America and International segment revenue will sequentially decline by 20% and 22% respectively during Q1, with their collective sales amounting to $101.5 billion.

On the other hand, Amazon’s AWS segment has been the bright spot in its growth narrative. It’s by far the fastest growing segment for the e-commerce giant and it also has the least amount of cyclicality. The segment’s pace of growth has slowed down in the past 2 quarters as the business has become sizable and the recessionary environment is forcing enterprises across the globe to slash their discretionary spending. With continued interest rate hikes and the economy slowing down further, I’m anticipating Amazon’s AWS to post a growth deceleration in Q1, with revenue growing just 2% sequentially and the revenue figure amounting to $21.8 billion.

This brings us to an Amazon-wide revenue estimate of $123.3 billion for Q1 FY23. Coincidentally, this is in-line with the Street’s estimates that are currently spanning from $120 billion and $128.6 billion at the time of this writing. But having said that, also pay close attention to Amazon management’s outlook for the quarter ahead. It’ll shed light on how consumer spending trends are evolving and it’ll provide a tentative timeline around their sales resumption. With that said, let’s now shift focus to Amazon’s margin dynamics.

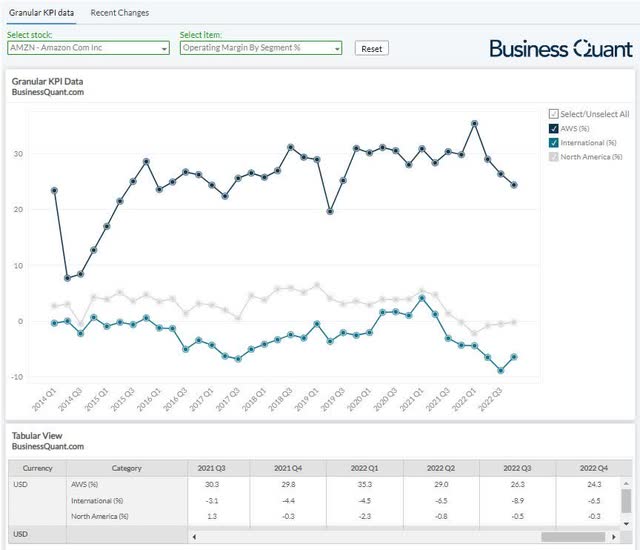

Margin Dynamics

There are two reasons, in my opinion, that are going to weigh down on Amazon’s margin profile. It’s worth noting that Amazon has already built a significant amount of warehousing capacity which will go underutilized if e-commerce activity is sluggish during Q1. A similar dynamic could unfold in the AWS division as well. As enterprises across the globe cut down on their discretionary spending, Amazon’s compute and storage capacities will be underutilized, even if it’s for the time being. This, altogether, is likely to result in diseconomies of scale and drag Amazon’s margin profile lower.

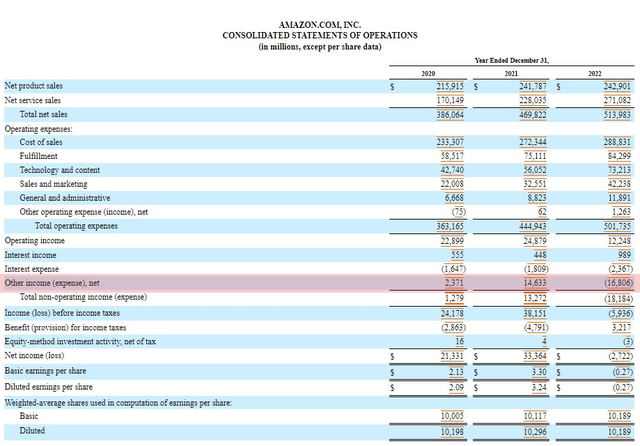

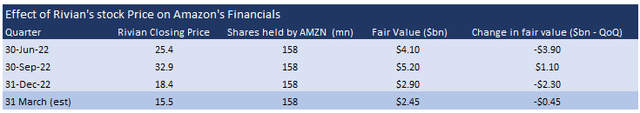

Second thing to note here is that Amazon owns 158 million Class A shares of electric vehicle manufacturer Rivian Automotive (RIVN). This wouldn’t be a big deal, but it is, given how it directly affects Amazon’s income statement. See, Rivian’s stock price has plummeted by 70% from its 52-week lows. This is largely in tandem with other technology stocks that are unprofitable. But the thing to note here is that Amazon is including these losses to its marketable securities, within its income statement, within the item called “Other Income”

From its last 10-K filing:

The primary components of other income (expense), net are related to equity securities valuations and adjustments, equity warrant valuations, and foreign currency. Included in other income (expense), net in 2021 and 2022 is a marketable equity securities valuation gain (loss) of $11.8 billion and $(12.7) billion from our equity investment in Rivian.

On September 30, 2022, when Rivian’s stock price was $32.9 apiece, Amazon’s equity investment in the company had a fair value of $5.2 billion. But by December 31, 2022, Rivian’s stock price declined to $18.4 apiece and Amazon’s equity investment value in the company dropped to $2.9 billion. Fast forward to March 31, 2023, and Rivian’s stock price was down to $15.5. This means its fair value would be somewhere around $2.45 billion on Amazon’s books (158 million shares * 15.5 price), down $450 million sequentially.

Since, this entire loss will be a component of Amazon’s “Other Income” item, it’s bound to drag Amazon’s margin profile lower. Strangely, nobody seems to be talking about this dynamic when assessing Amazon’s Q1 prospects.

Final Thoughts

Amazon’s shares are trading at 2.1-times the company’s trailing twelve-month sales, which is quite low and attractive on a standalone basis. Also, note how the multiple is hovering close to its decade-low levels. This indicates that the Street is already pricing in many of the risk factors surrounding Amazon and the stock offers little downside potential at current levels, with ample headroom to rally.

Also, the aforementioned slowdown and profitability-related concerns are due to macroeconomic recessionary factors and cyclicality, that are likely to last only a few months at best. In my prior article, I detailed how Amazon is quickly becoming a major player in the advertising industry and it might very well displace Google and Facebook in the years to come. So, I remain bullish on the company. Investors with a multi-year time horizon may want to lean into the fear and accumulate Amazon’s shares on price corrections.

(Read – Amazon: Last Chance To Hop On)

Having said that, as far as Q1 report is concerned, Amazon is the first major e-commerce company to report its results this earnings season which means we don’t have industry comparables to benchmark it against. This makes it all the more important for investors to track its bifurcated revenue, margin profile and its management’s outlook for the quarter ahead. These items will better highlight Amazon’s near-term prospects and are likely to influence where its shares will head next. Good Luck!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.