Summary:

- AWS, Amazon’s profit center, benefits from user lock-in and scale advantages, especially among startups and SMEs.

- AWS faces strong competition from Microsoft, which threatens its long-term leadership despite AWS’s first-mover advantage and scale.

- Microsoft Azure leverages its robust software ecosystem, connection with the developer community, hybrid cloud solutions, and SaaS profitability to erode AWS’s market share, now a duopoly in the public cloud market.

- In summary, despite its current leadership, we think AWS’s position in the long run cannot be guaranteed given the rise of Microsoft Cloud.

- We, therefore, advise investors not to base investment decisions solely on AWS’s performance and prospects.

JHVEPhoto

As the crown jewel of Amazon (NASDAQ:AMZN), AWS has become Amazon’s major profit centre thanks to its first-mover advantage, scale, and ecosystem. However, based on our analysis, AWS’s leading position is far from unrivalled. So if investors put their money in Amazon largely due to their belief in AWS, we recommend them think twice.

Before going into details, it is necessary to review the history of the cloud computing industry. Historically, cloud computing has gone through several stages of development. 2006 marked the birth of cloud computing when Amazon launched its EC2 cloud computing service, pioneering the cloud service industry. In 2008, giants like Microsoft (MSFT) and Google (GOOG) followed suit. By 2018, the cloud service industry entered the hybrid cloud era, in which hybrid deployment mode gradually became mainstream. The AI era began in 2020, with Microsoft securing an alliance from OpenAI and ChatGPT officially released in 2022, accelerating the commercialisation of AI. In 2023, Microsoft launched Azure OpenAI services, pushing the cloud service industry into the phase of Model as a Service.

Understanding the logic behind the creation of AWS is considered pivotal to make sense of Amazon’s business philosophy. The birth of AWS surprised the tech world back then but is considered reasonable given that Amazon’s DNA is featured with two key elements: The proactive way to create potential customer needs rather than passively meeting existing ones, and the tradition to open its own infrastructure to external partners (e.g., from 1P to 3P).

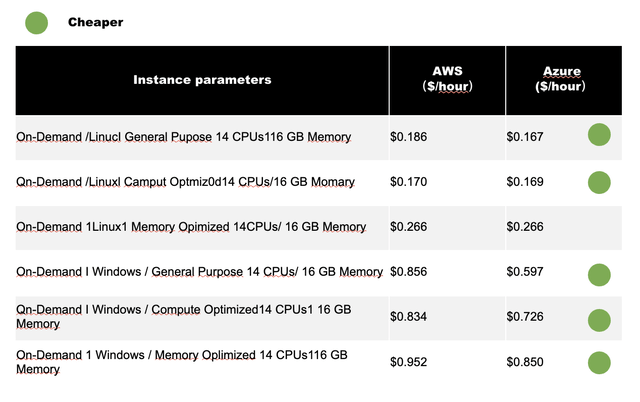

Hence, we want to highlight that AWS inherits DNA from Amazon’s retailing business, which is the strategic focus on enhancing the user experience to maintain long-term customer relationships (i.e., the pursuit of operating efficiency rather than hefty margin). We think this point is particularly worth noting because the investment community rarely recognise the business logic between Amazon’s retailing business and AWS. Like its e-commerce, Amazon tries to strengthen the position of AWS by keeping its leadership both in a wider selection of products and services and more competitive pricing. For one thing, AWS has provided the industry’s most extensive range of products; AWS offers more than 250 products and services, while Microsoft Azure offers about 200. For another, AWS maintains a price advantage; according to 2023 data from Liftr Insights, AWS products are generally cheaper than Azure’s, although the price gap is narrowing.

We think AWS’s current leadership in scale is sustainable to some extent, thanks to the above-mentioned first-mover advantage and the strong user lock-in effect. As there are obstacles in data migration costs, compatibility issues, and proprietary personnel skills, the user lock-in effect in the public cloud industry is deemed significant. Therefore, AWS has maintained the industry lead so far, while Azure has been able to secure second place mainly because of Microsoft’s software ecosystem (which will be discussed in detail later).

Thanks to the said user lock-in effect and the scale advantage, AWS has two unique edges over its competitors in our view.

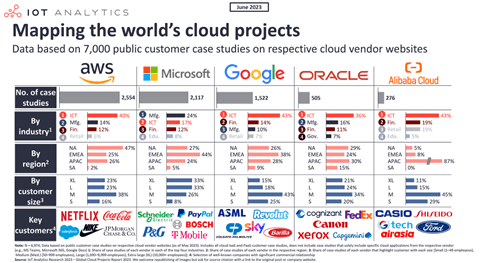

Firstly, given that startups and SMEs tend to be more flexible, with fewer barriers to cloud adoption, AWS’s above-mentioned strategy has given it an edge in acquiring these customers. Therefore, startups and SMEs form AWS’s core customer base; over 80% of unicorns choose AWS. In terms of revenue breakdown in 2022 and 2023, small customers (with monthly spending below $1k) contributed 77% of AWS’s revenue, compared to only 49% for Microsoft Azure based on the same source. However, it is noted that AWS’s revenue from larger customers was lower than Microsoft’s.

Secondly, due to its scale advantage, AWS has a cost structure advantage. Given that the IaaS industry is becoming increasingly commoditised in our view, cost advantages are expected to become even more critical. The primary costs for data centers include fixed costs (e.g., depreciation, leasing) and variable costs (e.g., electricity). According to our calculations, AWS’s fixed costs as a percentage of total costs decreased from 32% in 2019 to 19% in 2023, which is deemed more favorable than Google Cloud and Microsoft Azure. The main reason behind this is that AWS data centers appear to have better utilisation by generating higher revenue per megawatt of capacity compared to Google Cloud and Microsoft Cloud.

However, despite all the said, competitive advantages above, we remain cautious about whether AWS is able to sustain its lead in the long run, with Microsoft being the major threat.

Historically, Microsoft has multiple successful attempts to overcome competitors’ first-mover advantages due to its strong ecosystem and robust business model. In the PC era, Apple Computer (AAPL) is finally crashed by Wintel alliance despite the former’s pioneer in the sector. In the internet era, Netscape nailed it for browser at the beginning but has fallen due to Microsoft’s grip over the operating system.

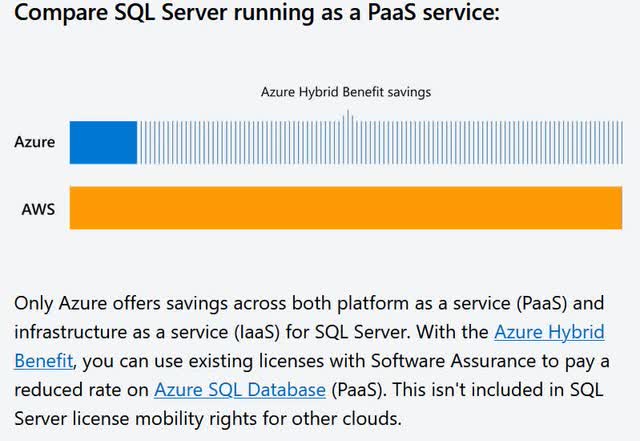

Microsoft Cloud is therefore AWS’s strongest rival in our opinion, thanks to its significant software ecosystem advantages. Microsoft has a dominant position in the business productivity software market, with key products including Office 365, Dynamics 365, and Azure. Moreover, Microsoft has further solidified its strong relationship with developers community and enterprise through its Windows ecosystem, which includes products like Windows Server, Active Directory, and SQL Server. To leverage its existing client base, Microsoft Azure offers existing Microsoft product customers significant discounts when they migrate to Azure cloud services. For example, according to the official website, customers who have purchased SQL Servers can enjoy large discounts on Azure SQL Servers. Therefore, Microsoft Azure provides a lower total cost of ownership (TCO) for companies migrating to Azure who are existing Microsoft customers.

What’s more, Microsoft’s strength in large enterprise relationships gives it a competitive advantage in hybrid cloud solutions. Given that large enterprises are more sensitive to data security, they presumably deem hybrid cloud solutions more practical, an area where Azure excels. 5% of Azure’s customers are mid- to large-sized companies (with monthly spending exceeding $100k), higher than 2.3% of AWS.

Major CSPs’ client base in 2022 (IoT Analytic)

Last but not least, the said price leadership of AWS can be overcome by Microsoft Cloud’s strength in SaaS business. As the margin of SaaS is much higher than IaaS which AWS relies on, Microsoft Cloud is theoretically able to subsidise the IaaS products by profits from its lucrative SaaS business. But for Amazon, it is difficult to follow a similar strategy as AWS already has a higher operating margin than its e-commerce business. In fact, some pricing of Microsoft Cloud products is more competitive than AWS.

Microsoft Cloud Margin Leads due to SaaS (10-K, Author Created) AWS Pricing vs Azure (netapp.com, Author Created)

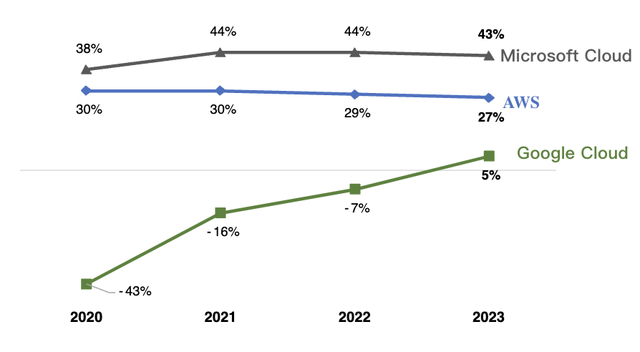

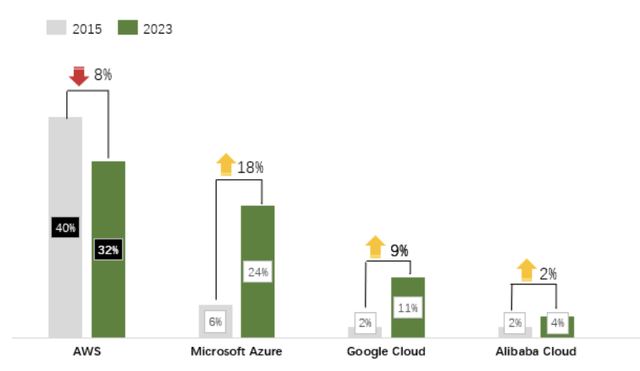

Therefore, the continuing market share loss of AWS in recent years can be well explained. In 2015, the public cloud market was dominated by AWS, which captured 40% of the market. However, since then, Microsoft Cloud has eroded AWS’s market share by capitalising on its vast enterprise customer base and the famous bet on OpenAI. In 2023, the public cloud market instead becomes a duopoly between AWS and Microsoft Cloud, with AWS’s share down to 32% versus Microsoft Cloud’s 24%.

Market Share of Major IaaS Players (Gartner, Author Created)

In summary, despite its current leadership, we think AWS’s position in the long run cannot be guaranteed given the rise of Microsoft Cloud. Having said that, we value AWS at $773 billion assuming a 20X multiples of its expected 2024 operating income, which accounts for only 32% of Amazon’s current market value. We therefore advise investors not to base investment decisions solely on AWS’s performance and prospects. Instead, in light of the overall strength built across e-commerce and logistics by Amazon which is deemed unrivalled with more certainty, we think Amazon’s retailing sector should still be the main focus for investors. At the current reasonable thought not undervalued valuation, we think a hold is fair.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.