Summary:

- Amazon disappointed investors with weaker revenue growth projections and high spending on AI and cloud infrastructure, raising concerns about slower growth.

- Amazon’s diversified business model enhances profitability through synergies, but its leadership in AI is uncertain compared to Microsoft and Google.

- Valuation estimates Amazon’s stock price at $178 per share, with risks related to AWS losing market share in the battle for AI leadership.

Anderson Coelho

Context

BigTech companies differ from each other because their models are complex, capturing unique pieces of the market. Amazon.com (NASDAQ:AMZN) stands out as a special company.

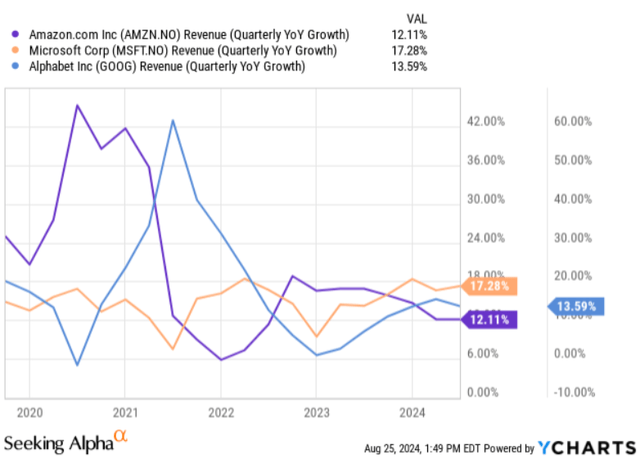

During its last earnings call, Amazon disappointed investors primarily due to weaker-than-expected revenue growth projections and announced continued high spending, especially related to AI and cloud infrastructure. Despite reporting a 12% rise in total sales and higher-than-expected profits, the company’s forward guidance on revenue fell short of Wall Street expectations, leading to concerns about slower growth (Figure 1) in the coming quarters. Amazon’s significant capital expenditures, particularly in building out its AI capabilities, raised worries about the impact on short-term profitability.

Amazon is a compelling investment opportunity due to its exceptional business model and ability to control costs and improve margins. However, it is lagging behind artificial intelligence (AI), and it is hard to estimate how it will evolve over the years. My price estimate is $178 per share, essentially in line with the current stock price. So, I suggest waiting to see how the AI battle progresses among the three main players: Amazon, Microsoft, and Google.

Business Model: A Diversified Powerhouse

Amazon’s business model is highly diversified in various industries, such as e-commerce, cloud computing advertising, logistics, video production, and distribution. Despite the highly competitive markets in which Amazon operates, Amazon’s integrated approach not only mitigates risks but also enhances synergies that improve profitability.

In my opinion, one of the strongest features is that Amazon operates businesses that enhance the value of its other operations. For example, AWS provides the entire company’s technological capabilities and innovation to the rest of the company. E-commerce generates consumer data that feeds into the advertising business and Prime Video, enabling more targeted advertising and content creation. The Prime membership program-which exceeded 200 million members globally by 2024-creates a loyal customer base that fuels repeat purchases across all Amazon services. The critical acclaim and awards won by Amazon’s original series and movies attract new users to the Prime membership, further expanding the ecosystem. Amazon’s advertising revenue grew by 20% in Q2 2024 to $12.77 billion, highlighting its potential to become a significant profit center.

The other feature is that Amazon has proven to develop capabilities that serve internal and external business needs, thereby financing its operations and attracting new revenue streams. For instance, initially built to support its e-commerce unit, Amazon’s logistics network now competes with UPS and FedEx by selling delivery services to third parties on its platform. Similarly, AWS was created to meet Amazon’s IT needs and has since become a leading global cloud services provider, serving millions of external customers and contributing significantly to Amazon’s profitability. AWS contributes over $91 billion in revenue in 2023 with a robust operating margin of 35.5%.

Capacity to Control Costs and Improve Margins

I think Amazon can continue controlling costs and improving its margins. The first reason is that Amazon is a leader in technology and innovation. They are not afraid to experiment with many products, technologies, and capabilities. They have tried using drones to carry bags to rural areas; they have been attempting to sell smartphones or even Amazon Restaurants.

They have done it, especially in its logistical network. Amazon’s investment in automation across its fulfillment centers has significantly improved efficiency, reducing labor costs and enhancing order processing. By 2024, over 75% of the items processed in Amazon’s fulfillment centers involved some form of automation. Additionally, Amazon’s regionalization of its fulfillment network-reducing the average distance items travel from warehouse to customer by 15%-has lowered transportation costs and delivery times, further improving margin.

Besides, opposite Jeff Bezos, Andy Jassy has started a review of the most unprofitable businesses, even the greatest Bezos’ pet project, Echo + Alexa, or Twitch, which grew exponentially in its users during the pandemic but has lost steam lately and has never been profitable.

Uncertain Leadership in Artificial Intelligence

Artificial intelligence represents the next strategic move for Amazon, and the company is making significant investments to position itself as a leader in this space. Amazon’s capital expenditures (CAPEX) in Q2 2024 were $17.62 billion, 11.9% of revenue. Amazon’s AI strategy is centered around leveraging its cloud computing capabilities, integrating AI into its consumer products, and driving innovation across its business lines. I think this is the weakest point for Amazon.

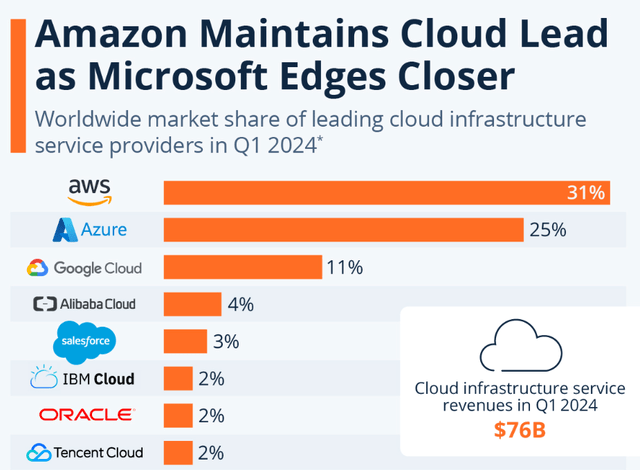

Despite its strong position in cloud computing, AWS faces stiff competition from Azure and Google Cloud, particularly in AI services. AWS’s recent focus on AI has been well received, but its AI capabilities are more focused on infrastructure rather than leading AI innovations. Besides, it doesn’t control a large language model (LLM). It invested $2.75 billion in Anthropic, whereas Google had invested before. Even Anthropic is under inquiry by the UK regulator.

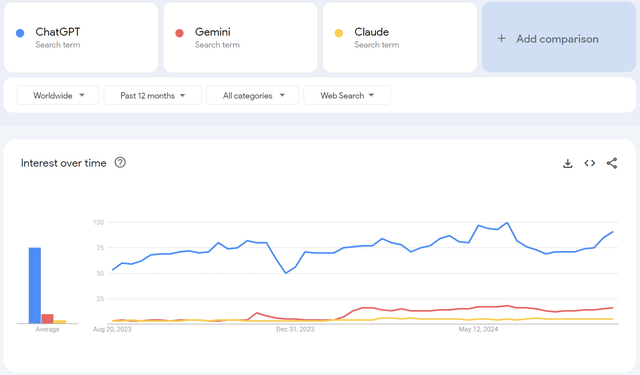

I estimate Amazon is in a low market share position based on general knowledge of the industry, which is reflected in Figure 2. While AWS is a dominant player in cloud infrastructure and provides essential tools for AI development, it does not lead in AI research or consumer-facing AI applications. It focuses on enabling customers to build and deploy AI models, rather than leading AI innovation.

Valuation

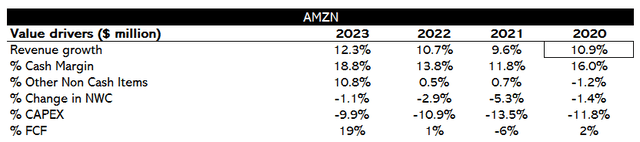

In Figure 3, it is shown the value drivers of ACM Research, considering a year as the last four quarters to capture the latest information. Regarding margins, I utilize a measure I call Cash Margin, which involves adjusting net income for non-cash items such as amortization and depreciation, stock-based compensation, and deferred income tax.

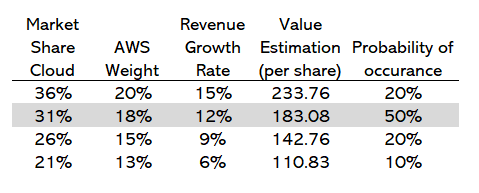

I foresee a 12% growth rate. I expect revenues to keep growing due to Artificial Intelligence and its continuous innovation capacity. Still, as its revenue base is so large, it will be challenging to grow at this rate. 12% is slightly higher than the average historical value. Behind this 12% rate is a scenario where AWS will lose market share to Microsoft and Google due to its lack of leadership in AI. I don’t expect to lose too much share because, in the B2B segment, AWS is a driving force. From a 31% market share, I expect to decrease to 30%.

I expect cash margins to improve by three percentage points over ten years, reaching 22% in 2033. As I said in previous sections, the technology and profitability review of unprofitable businesses will raise those margins steadily over the next ten years.

I project the same investment ratio (net working capital and CAPEX) as the historical average: 3% in net working capital and 12% in CAPEX. I don’t expect a lower investment rate. Even with AI being at an initial phase, the investment rate is higher; when this cycle finishes, Amazon will keep investing at the same intense pace in another opportunity that time will be available at that time.

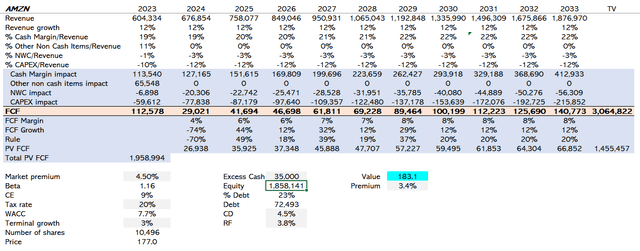

Cash flows will be discounted at a 7.7% WACC because the beta is 1.16 and risk-free at 3.8%. Given the company’s low leverage of 23% of total capital debt, WACC is weighted towards the cost of equity. The terminal growth rate is set at 3%.

As shown in Figure 4, my value estimate is $183.1 per share, a 3.4% premium over its current stock price. This premium usually doesn’t provide a reasonable margin of safety for me to consider it a buying opportunity. Let’s analyze risks to assess better the risk-return profile.

AWS and the Battle for AI Leadership: The Main Risk

The battle for AI leadership is a significant risk for Amazon, as it faces intensifying competition from Microsoft Azure and Google Cloud. Microsoft’s deep integration of AI into its enterprise ecosystem and strategic partnerships, along with Google’s strengths in AI research and machine learning, can erode AWS’s competitive edge. If AWS fails to match the pace of innovation and customer adoption in AI, it risks losing market share to these rapidly advancing competitors.

The main concern regarding the risk of AI is not only about the significance of having a dominant LLM in the market but also about the potential risk to the current cloud business. AWS holds the leading position with a market share of 31% (Figure 5) and stands to lose the most if it fails.

Figure 6 projects different scenarios for AWS’s market share in the cloud industry, ranging from 21% to 36%, and how these scenarios impact Amazon’s revenue growth rate and the value estimation per share. I estimate the base scenario, outlined in the Valuation section, has a 50% chance of occurrence. I assign 20% of AWS’s gains in market share to Amazon’s innovation and execution capacity, which is leveraged by the current leadership in the Cloud business. I assign a 30% chance that AWS will lose market share, getting 26% or 21%. The lowest value estimation is $111 per share. Considering all the scenarios and probability, the estimated value is $178 per share.

Figure 6: Author

Conclusion

Amazon’s diversified business model and cost control strengths make it a strong player, but its leadership in AI is uncertain. With fierce competition from Microsoft and Google, Amazon’s heavy investment in AI may not be enough if it fails to innovate at the pace of its rivals. This competition poses a significant risk to AWS’s market dominance.

My $178 per share valuation reflects a modest premium, indicating limited upside given the risks. Therefore, it’s prudent to hold off on investing until Amazon’s position in the AI battle becomes clearer, ensuring a more secure investment opportunity.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.