Summary:

- Amazon’s core ecommerce operations have experienced profitability issues, while its cash cow, AWS, faces margin contraction and slowing growth.

- AWS has seen segment profit declines for four consecutive quarters, despite revenue continuing to climb.

- Although Amazon is expected to grow and thrive in the long run, investors should approach the company cautiously for now due to these challenges.

Noah Berger

With a market capitalization comfortably in excess of $1 trillion, ecommerce giant Amazon (NASDAQ:AMZN) is one of the largest and most successful companies that has ever existed. In addition, it’s also one of my favorites from a business perspective and from the perspective of a customer. The sheer amount of convenience that the company has created in this modern era truly was unprecedented. And in the long run, I fully expect this trend for the enterprise to continue. Recently, however, the firm has come under some pressure. When you dig deep into its financial condition, you find out that its cash cow is none other than AWS. This is the set of operations the company has that’s dedicated to cloud computing and related services. Even though the company is typically viewed as an online shopping place, it has been AWS that has created much of the profitability of the enterprise. I don’t expect this trend to change in the long run. However, slowing growth, margin compression, and industry pains are all coalescing to create a rather uncomfortable situation for the company and its shareholders. There is additional pain elsewhere within the organization and I do believe that investors would be wise to approach the firm cautiously for now.

Where the money is

The Amazon that we all know today is really comprised of three core sets of operations. The largest, by far, is none other than its North America business. This is part of the ecommerce giant that is centered around generating revenue from retail sales on consumer products, as well as subscriptions from certain online and physical stores. Next in line, we have the International segment, which includes the same kinds of activities but for countries outside of the US, Mexico, and Canada. And finally, we have AWS. Once considered a small side business for the company, this has become a true cash cow for the firm. Its operations include global sales of compute, storage, database, and various other services, for all sorts of customers.

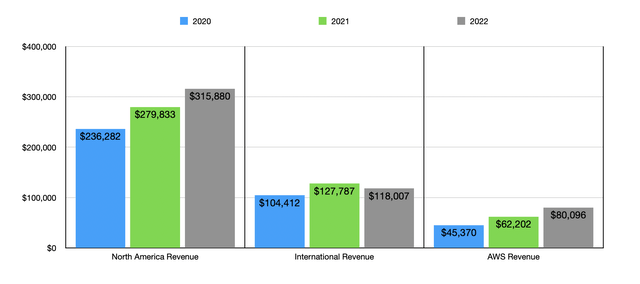

Year after year, investors could have faith in growing revenue associated with at least two of these segments. From 2020 to 2022, for instance, the North America segment saw revenue climb from $236.3 billion to $315.9 billion. Even more impressive was the growth associated with AWS. Over the same window of time, revenue here expanded from $45.4 billion to $80.1 billion. The International segment of the company has generally grown over time. But after peaking at $127.8 billion in 2021, it dipped to $118 billion in 2022.

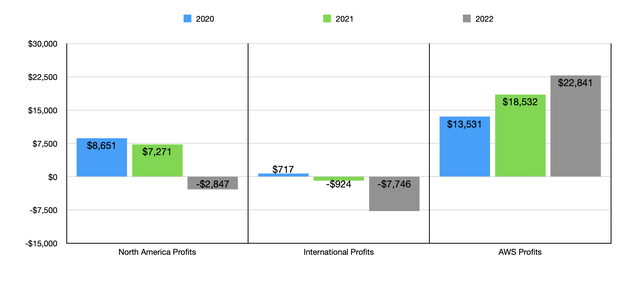

While revenue is important, it’s not the most important metric to be paying attention to. After all, the value of a company is determined by how much profit it can transfer to shareholders during its lifetime. And when you really come to understand Amazon stock, you understand that its cash cow has been none other than AWS. In 2020, for instance, the firm received $13.5 billion worth of segment profits from AWS. It garnered another $8.7 billion worth of segment profits from its North America segment, while the International segment brought in profits of only $717 million.

Based on these figures, at least you can say that all three of the segments that Amazon operates have been profitable. But as you can see in the chart below, that picture has changed. In 2022, for instance, only AWS brought in profits, with those coming in at $22.8 billion. Its core ecommerce operations, both here at home and abroad, actually generated losses. In its North America segment, the company suffered from higher fulfillment and shipping costs, due in part to increased investments in the company’s fulfillment network. Transportation costs, wage increases and incentives, higher technology and content costs, and other factors, also contributed to this pain. Internationally, the very same factors affected the company. In addition to that, in 2022 at least, foreign currency fluctuations hit profits to the tune of $857 million.

So long as overall profitability for the company continues to be robust, the firm as a whole can find itself in a really great spot. And during that three-year window, this was the case from a cash flow perspective. It is true that operating cash flow plunged from $66.1 billion in 2020 to $46.8 billion by 2022. But if we adjust for changes in working capital, we would have seen the metric increase year after year, climbing from $52.6 billion to $67.6 billion. But if you look only at what occurred over that three-year window, you start to miss out on something more problematic. And this is that, in addition to experiencing weakness when it comes to its core operations, the company is now seeing problems with AWS and it must contend with what looks to be a slowdown in the market.

To see what I mean, first let’s focus on financial results for the first quarter of 2023. During that time, revenue across all three operating segments for the company came in higher than what it was the same time one year earlier. And we did actually see some improvement when it comes to its North America segment. Even though the company suffered from increased investments being made in technology and content costs, as well as higher fulfillment and shipping costs, it benefited more from higher unit sales, largely associated with its third-party sellers, and it benefited from increased advertising revenue. Meanwhile, the International segment actually reported some fairly stable results, with its segment loss narrowing from $1.28 billion to $1.25 billion. This was in spite of $174 million of increased losses associated with foreign currency fluctuations.

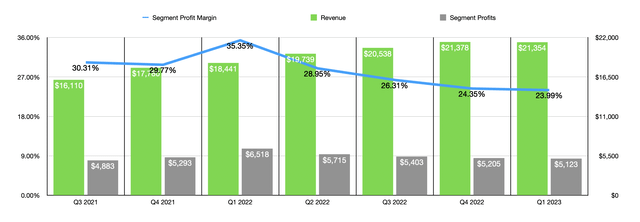

The real pain for the company, then, came from AWS. Even though revenue grew from $18.4 billion in the first quarter of 2022 to $21.4 billion the same time this year, segment profits fell from $6.5 billion to $5.1 billion. Higher payroll and related expenses, as well as increased spending on technology infrastructure, hit the company on this front. Interestingly, the picture would have been even worse. However, the segment benefited positively from a $272 million increase in profits associated with foreign currency fluctuations. This decline was instrumental in hitting cash flow for the company. On an adjusted basis, operating cash flow came in at only $15.3 billion. That was down from the $19.1 billion reported one year earlier.

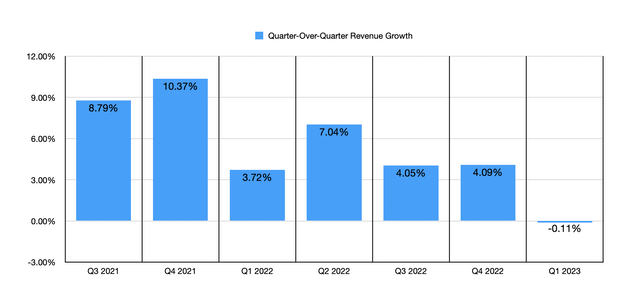

One quarter does not make a trend, but at this point, we have seen more than one quarter of pain. As you can see in the chart above, segment profits for AWS have declined in each of the past four quarters now. This is particularly shocking when you consider that revenue continues to climb. The end result is a consistent drop in the segment’s profit margin from a high point of 35.35% in the first quarter of 2022 to a low point of 23.99% in the first quarter of this year. And as you can see in the chart below, there has been a general trend, since the final quarter of 2021, of sequential revenue growth for the segment growing weaker. In fact, revenue growth in the first quarter of this year was actually negative compared to what it was in the final quarter of last year.

It’s unlikely that these problems are affecting Amazon alone. Because of massive investments that were made in the cloud over the past few years, and concerns over the economy more broadly, we were bound to see some sort of slowdown eventually. Just recently, for instance, Alibaba Group (BABA) announced that it was reducing its cloud workforce by 7%. And in an article from February of this year, CNBC pointed out that both Microsoft (MSFT) and Google parent Alphabet (GOOGL) (GOOG) were experiencing slowdowns in this space.

This is not to say that we are going to see some sort of decline in the market. We are going to see a slowdown for sure. In fact, we are already in that slowdown. In the long run, this is still a space that has great potential. According to one source, for instance, the global cloud market should be around $678 billion this year. By 2030, it’s forecasted to hit $2.43 trillion. And there’s no denying that Amazon will be one of the biggest beneficiaries of this growth. One market niche that Amazon is almost certain to benefit from is the specialization of clouds in what is currently being referred to as industry clouds.

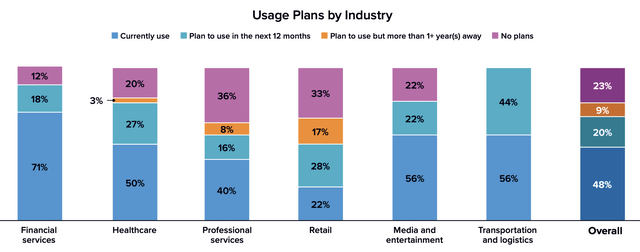

These are cloud platforms that are specialized to cater to specific industry needs. The company actually made a big push in this direction back in 2021. And today, it offers services that cater to governments, education providers, financial services companies, retailers, automotive firms, and more. According to PricewaterhouseCoopers, only about 48% of companies surveyed said that they currently use industry clouds. Another 20% said that they plan to use some in the next 12 months. This is very lopsided based on industries. For instance, 71% of financial services firms already use industry clouds. For retail, that number is only 22%.

Takeaway

In the long run, I fully expect that Amazon will continue to grow and thrive. But this doesn’t mean that the road will be one of constant growth. Over the past few years, its core operations have come under pressure from a profitability perspective. Management says that a lot of this is due to increased investments. That very well could be the case. But how many years of continually worsening profitability is acceptable before the market should demand to see a return on that investment?

At the same time that the picture looks the worst on this front, the cash cow that is AWS Is experiencing significant margin contraction and slowing growth. It’s likely that the growth itself is transitory, but it’s uncertain if the profitability issue is. Those who are critical of my thoughts on the matter are accurate when they say that the other big cloud providers are also experiencing pressure at this time. But for none of those companies do we see cloud activities account for 100% or more of their profits. This could subject Amazon and its investors to greater pain and volatility in the near term. And because of that, I do believe that a more cautious rating of a ‘hold’ is appropriate for the company at this time.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.