Summary:

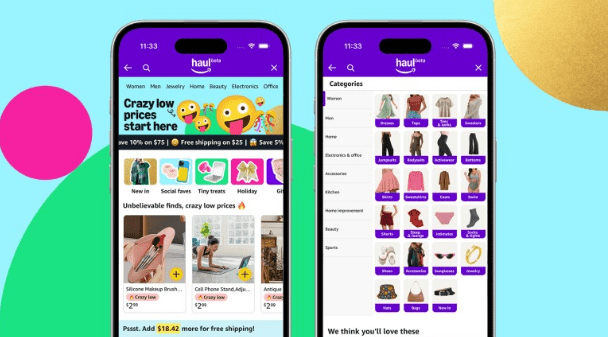

- Amazon launches Haul, a low-cost platform to compete with Temu and Shein, offering products under $20 to attract value-seeking US consumers.

- Key features include Amazon’s A-to-Z Guarantee, free delivery on orders over $25, and consumer incentives for larger purchases.

- Success hinges on product quality, consistent shipping speeds, and favorable unit economics, with potential risks to Amazon’s marketplace profitability.

- Long-term commitment to Haul could pressure Amazon’s profits, impacting investor sentiment amid increasing e-commerce competition.

Rat0007/iStock via Getty Images

Amazon.com (NASDAQ:AMZN) (NEOE:AMZN:CA) is rolling out Haul, a Temu competitor that features products priced less than $20, to cater to the value-seeking US consumers that have been gradually shifting their online purchases to low-cost platforms such as PDD’s Temu (PDD) and Shein, and to prevent Temu from gaining critical mass in terms of user base and become a material threat to AMZN’s e-commerce market share in the long-run similar to what PDD has done to Alibaba over the past six years (See: PDD Holdings: Brand Migration Driving Long-Term GMV Growth).

Amazon

Key features of Amazon Haul include:

- All products are priced under $20 and backed by Amazon’s A-to-Z Guarantee.

- Key categories will include fashion, home, lifestyle, and electronics.

- Free delivery on orders over $25 with an average delivery time of around two weeks.

- Consumer incentives include 5% off on orders over $50 and 10% off on orders over $75.

- Free return on all purchases of over $3 within 15 days of purchase.

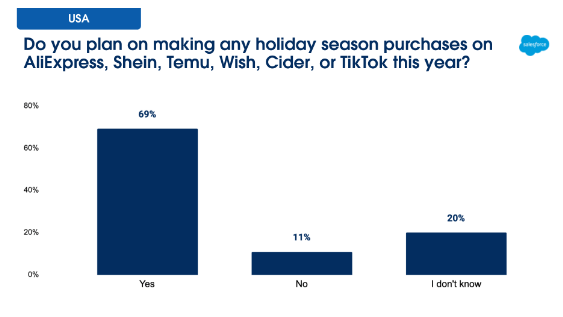

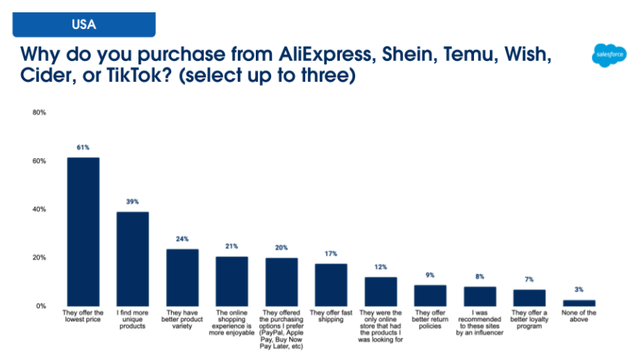

Amazon Haul is currently in beta and available to US users when they next update their Amazon Shopping App. The introduction of Haul before the holiday is timely given that 69% of the users surveyed by Salesforce indicated that they are looking to purchase in the low-priced e-commerce platform this holiday season, with the lowest price being the single biggest driver behind their decision.

While it is still early to determine how successful Haul can be compared with Temu and Shein, we believe that there are a few key factors that AMZN should focus on in order to become competitive vs. the Chinese platforms.

First, value for money in terms of product quality. Although low price is certainly a key determinant of consumer purchasing decisions, we feel that price for the money is a far more important factor. We have witnessed that not all low-price providers can survive in the e-commerce space. Most notably, Wish operated on a similar business model, providing low-cost cross-border online shopping to US consumers, only to see the business model suffer due to poor user experience and product quality.

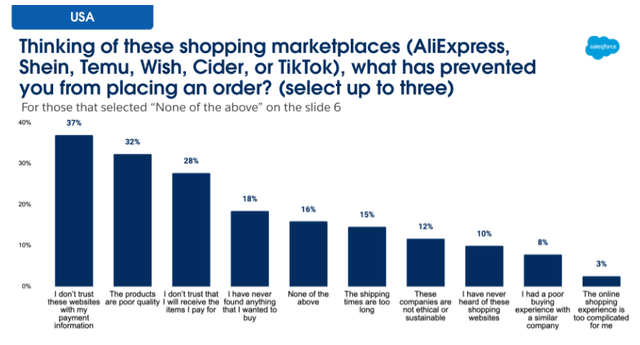

Initial review of Haul has been mixed, with some pointing out that product images may not entirely be accurate as they seem to be AI-enhanced. We note that Temu has significantly cut back on AI-driven product listings over the years to ensure image and product consistency. If AMZN Haul does not address this issue, Haul may fail on arrival given that a key reason for US consumers to avoid discount e-commerce platforms is lack of trust, per the survey by Salesforce.

Second, consistent shipping speed is critical in ensuring a good user experience. AMZN Haul advertised its shipping time to be one to two weeks, compared with Temu’s shipping time of around two weeks. Temu’s shipping time has improved significantly since its entry in the US, when the average shipping time was 3 to 4 weeks. Over the years, Temu has expanded its logistics partners to a dozen companies with USPS, DHL, FedEx (FDX), and UPS (UPS) being its key partners.

To be competitive against Temu, AMZN may be required to expand its logistics partners or utilize more air cargo to ensure timely delivery. While this may ensure a stable user experience, the additional logistics cost could be unfavorable to the business model’s overall unit economics, in our view.

Finally, unit economics may not be favorable for AMZN. Considering all the points we have pointed out above and given that the majority of the products that Haul sources originate from China, AMZN is essentially competing against PDD, Alibaba (BABA), and TikTok in securing a broad spectrum of suppliers that can provide quality products at a discount and relying on its own and partnered logistics providers to deliver the product within a time frame to ensure a good user experience.

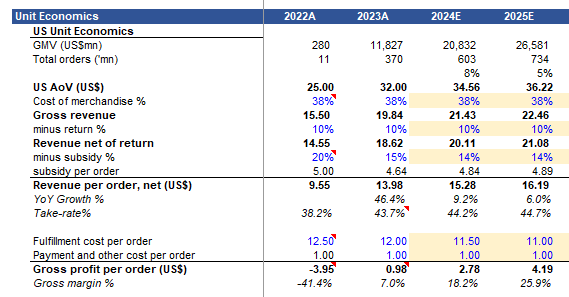

From a financial perspective, this could be a negative for AMZN, depending on how serious AMZN is about capturing the discount e-commerce market. To put it in perspective, we estimate Temu’s US unit economic to be $35 in average order value, with the cost of merchandise to be around 38%. Assuming a 10% return, revenue net of return is around $20. With the amount of subsidy declining, the take rate per order could be around 44%. With roughly $12/order in fulfillment cost and payment-related costs, Temu could be generating a gross profit between 15% and 20%, based on our calculation. Worth flagging that this is only for the fully managed model, not the semi-managed model that it recently rolled out (See: Amazon 3Q24: Strong Beat Overshadows Rising Temu Risk).

Astrada Advisors, Company Report

Haul’s unit economics could be much worse than Temu’s and may be closer to Temu’s UE in 2022 when it initially started. Given that the majority of the quality suppliers have locked in an agreement with the Chinese cross-border e-commerce players, AMZN will need to sacrifice take rates and margins to onboard those merchants. Otherwise, AMZN would be only onboarding lower-quality suppliers that may not provide reasonably good products compared with those sold on Temu or Shein, and this would negatively impact user experience and potentially hurt AMZN’s brand equity in the discount e-commerce space. Assuming that AMZN is looking to scale and commit to the low-cost strategy, the losses at Haul could pressure AMZN’s marketplace profitability level, and this may not be taken positively by the investment community as most of the investors are starting to be content with AMZN’s marketplace profitability level.

In conclusion, we believe that AMZN’s decision to launch Haul is the right decision in that it is a clear sign that AMZN is addressing the competitive pressure from the Chinese discount platforms. However, AMZN will be in it for the long haul given that building a reliable cross-border low-cost business will take years to achieve scale and reliability, especially when AMZN’s suppliers are all based in China and dominated by its key competitors. If AMZN decides to make a significant commitment to Haul, the marketplace could see further profit erosion, and this could be a negative for the stock and investor sentiment, since e-commerce competition is the last thing AMZN investors need right now.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.