Summary:

- Amazon’s increasing automation is expected to significantly boost margins over the next 5-10 years, potentially reaching a 9% net margin by 2029.

- Long-term stock price target of $500+ by 2029 indicates a 23% CAGR, driven by efficiency gains from AI and robotics.

- Risks include regulatory challenges, macroeconomic impacts, and potential deflationary pressures from widespread automation adoption.

imaginima/E+ via Getty Images

I last covered Amazon (NASDAQ:AMZN) in May; I put out a Buy rating at the time, and since then, the stock has lost -0.85% in price. Since my first analysis of Amazon in January, the stock has gained 23.35% in price. All of my ratings for Amazon are long-term oriented, as I believe it is the right company to buy and hold rather than to trade on for valuation or growth momentum. That being said, I do think that the present valuation is currently vulnerable to contraction if the markets turn more bearish surrounding AI capabilities in the next 9 to 18 months. The technology sector at large is exposed to such risk, and I think what Amazon has that strengthens it is diversification in retail operations and entertainment, which acts as some security if AI sentiment shifts downward periodically for the worse.

In my opinion, over the long-term, Amazon is positioned to radically increase its margins through higher automation capabilities, which I believe have the likelihood of beginning to play out significantly over the next 5 years. In July 2029, it is conceivable that Amazon will have a stock price of over $500 as a bull-case outcome, indicating a 5Y price CAGR of 23% from the present stock price of $183.

Operational Analysis & Financial Introduction

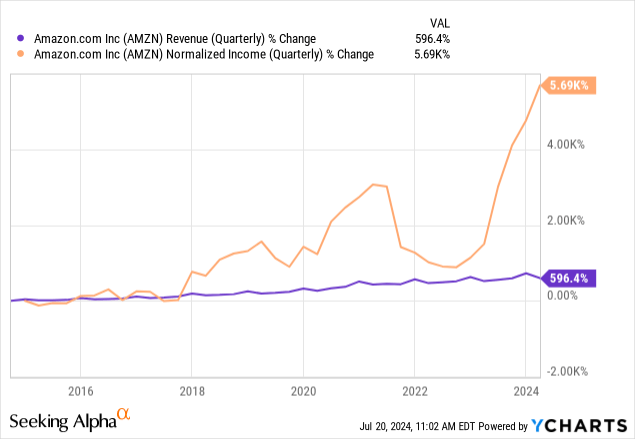

Amazon has begun to plateau in top-line growth, but it has notably begun to scale its bottom-line growth to levels before unprecedented for the company:

Despite periods of volatility, including a significant loss around 2022 as a result of its Rivian (RIVN) investment, you can notice in the above chart trends that the company has become much more proficient in recent years at maximizing net profit. This starkly contrasts with the early days of Amazon, when Bezos famously touted long-term growth over short-term profit reports. Today, Amazon is safely past its growth stage, so a lot of what it is looking to do is capitalize on higher efficiency in its organizational structure.

For example, Amazon reduced its cost to serve by more than 45 cents per unit in 2023 compared to 2022 through regionalization of its U.S. fulfillment network. In addition, the company has laid off 27,000 jobs since late 2022 and optimized its real estate operations to reduce costs—it has sublet excess space and streamlined its inventory management. Andy Jassy and Amazon’s executive management team and board have clearly outlined an efficiency strategy here. This is likely to significantly bolster the stock price over the next 5 to 10 years.

Despite cost-cutting measures, Amazon is continuing to invest in new growth areas. In Jassy’s 2023 shareholder letter, he mentioned the company’s focus on generative AI, AWS, and Project Kuiper, which aims to provide broadband connectivity via low Earth orbit satellites. In my opinion, as this strategy has already been implemented, I do not see why it will not continue to be actualized as the capabilities of AI, robotics, and automation become more acute. I find it likely that Amazon will be one of the most relentless companies in implementing autonomous operations across its product and service portfolio. As a result, I expect significant further margin expansion for the company over the next 5 to 10 years.

Amazon plans to deploy advanced robots in its fulfillment centers, including item sorters, pallet movers, and automated guided vehicles. In addition, the Universal Robotic Labeler is a high-speed auto-labeling technology that helps to reduce packaging dimensions and waste, and the Universal Item Sorter is an automated packaging technology that creates custom-fit bags, optimizing packaging processes.

Amazon is also heavily investing in generative AI, such as through the AWS Generative AI Accelerator program, which supports startups developing AI applications. The company has already introduced AI-powered tools like Amazon Q, a generative AI assistant, and AI models are used to streamline inventory, demand, and supply chain operations. Furthermore, Amazon’s investment in Rivian is one example of how it is investing in autonomous vehicles for delivery, and the company is also heavily developing its drone delivery capabilities.

All of these developments make me confident that Amazon is working toward becoming a highly, and perhaps even one day fully, autonomous company at the labor/operational level through robots, autonomous vehicles, and AI operations management. Therefore, significant margin expansion is likely, in my opinion, and management’s role will be to streamline these operations and also to have people on hand to fix any errors that might require human intervention. The results of such an operational model would be fantastic for shareholders, but large job losses will affect the economy in new ways, and while the price of goods may drop significantly, the ability of working-class and middle-class people to afford these if they do not have jobs could decrease more. This is why Amazon must navigate its future autonomy strategy in unity with governments across its core markets to sustain demand during the economic shift.

Financial & Valuation Analysis

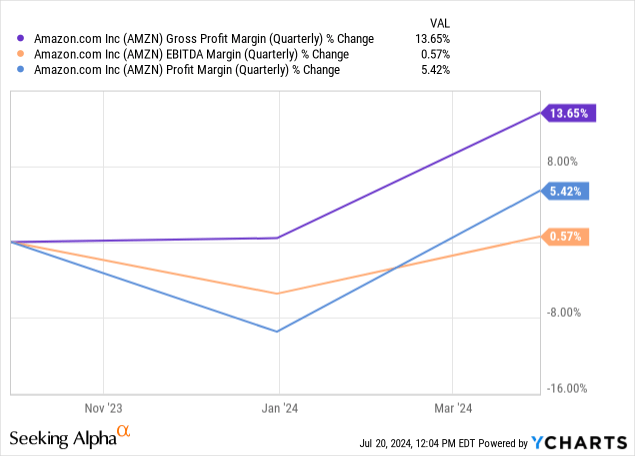

Amazon currently has a net margin of just 6.38%, which is remarkably low. The company has already significantly improved its operating income and free cash flow due to efficiency gains from automation and AI. For example, in 2023, Amazon’s operating income grew 201% YoY, and its operating margin improved from 2.4% to 6.4%. Furthermore, the AWS segment has high revenue growth and high margins, and this accounted for approximately 62% of Amazon’s overall operating income in the first quarter of 2024.

Despite the recent growth, this is arguably one area where Amazon has a lot of room for improvement. It is understandable that it has such low margins because, unlike a SaaS company, Amazon is a full-stack retail, delivery, entertainment, and technology services company. However, I think we have barely even begun to see the large effects that AI will have on business profitability, and so I think an allocation to Amazon now is prudent, even though the valuation is a tad high, in my opinion.

Q2 Earnings Expectations & Reactions

Amazon’s Q2 earnings results are due to be reported on 8/1/2024 post-market. The consensus is that AMZN will deliver 56% YoY growth in EPS, which is remarkably strong. Last quarter, it beat the consensus by $0.15, and it has made remarkable beats for the past four quarters. I do not expect this to change this time around, especially as the company has been experiencing high demand for its AWS services as a result of the recent on-ramp of AI across all industries.

I think due to the high growth indicated for Q2, the stock price has risen slightly too high for a short-term or medium-term investor to allocate. I do not think it is unlikely for the stock price to experience some high sentiment if the company beats the Q2 consensus estimate, but then as Q3 nears, the YoY growth expected is a much lower 21.77%. As a result, I think some short-term price volatility might make itself present, which could open up a more prudent buying opportunity circa Q3 2024. However, as a long-term investor looking to hold for 10+ years, I think investing now is not a problem, as the overvaluation is only moderate, in my opinion.

2029 Margin Expansion & Price Target

If Amazon’s net margin increases from 6.4% to 9% by 2029 and its revenues grow at a CAGR of 12.5% over the next 5 years, the CAGR for its earnings would be approximately 20%. I think this is possible, although optimistic, and it is the foundation for my bull-case outcome based on the heightened capabilities of automation within Amazon by 2029.

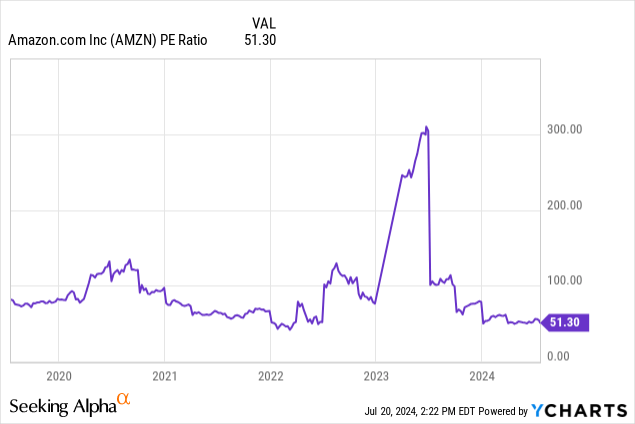

The current diluted EPS is $3.56; if this compounds at 20% for 5 years, its diluted EPS will be $8.90 in July 2029. I think that as a result of this margin expansion and the possibility of even further expansion toward 10+ years from now, the valuation multiples will expand. I believe that the PE ratio is likely to expand toward 57.5 by July 2029. As a result, the stock could be worth over $500 in July 2029, indicating a 23% 5Y price CAGR from the present stock price of $183.

For a base case, Amazon’s margins may expand to 7.5% if automation at scale takes much longer than anticipated for various macroeconomic, regulatory, and internal issues that are mounting. If Amazon also grows its revenues at a more moderate 10% over the next 5 years, its CAGR for EPS would be approximately 13.5%. The result of this growth would be a diluted EPS of $6.70 in July 2029, as the current diluted EPS is $3.56. In this instance, the PE ratio may be just 53.5, indicating a stock price of $360 in July 2029—a 5Y stock price CAGR of 14.5% from the present price of $183.

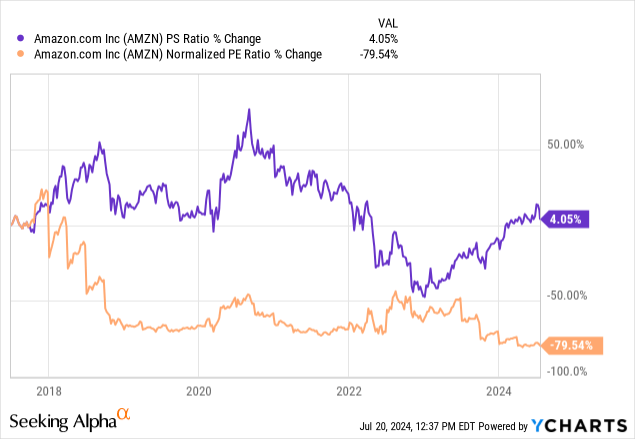

In the following chart, we can see the discrepancy that is arising in Amazon’s PS ratio versus its PE ratio, and I think this is going to become more distinct moving forward. I think AMZN investors are going to place much more emphasis on the PE ratio now that the company is sustainably profitable at scale, and the automation benefits should likely build sentiment around its profitability. As a result, I expect AMZN’s PS ratio to expand much more substantially compared to its PE ratio over the next 5 to 10 years.

Risk Analysis

There are likely to be periods of operational challenges related to automation, which includes but is definitely not limited to regulatory pressures, for example related to autonomous delivery vehicles and delivery drone safety. However, I think beyond this, there is the risk of the automation network Amazon develops running into system failures and problems. The large issue with this is that unlike a single van breaking down or one delivery driver not being available, technology network failures can happen across the digital ecosystem. As a result, I think it is valuable for Amazon to continue to regionalize its digital operations to secure them against system errors that could significantly disrupt its operational capabilities.

Furthermore, I would like to reiterate the risk I mentioned in my operational analysis related to macroeconomic change. If Amazon successfully implements near-full autonomy into its labor operations, I think that the company could face lowered demand if, across the U.S. and its international markets, job security becomes less available. A failure of the U.S. and international governments to provide economic security and means of sustenance if job shortages arise as a result of automation could mean a lack of profits for AMZN amid recessionary periods and, in the worst case, macroeconomic failure.

Furthermore, Amazon’s margins may not expand as much as I have predicted if it is forced to lower its product and service prices as a result of new levels of pricing competition in the market related to automation, AI, and robotics benefits. Amazon is not going to be the only company benefitting from these capabilities, and the effect of multiple conglomerates and smaller companies utilizing automation capabilities is likely to have a deflationary effect and could inhibit margin expansion somewhat. That being said, Amazon is one of the largest and most vertically integrated companies to work with automation, so it will certainly be able to command economies of scale that keep it at the top of the competitive hierarchy.

Conclusion

My conclusive, bull-case price target for AMZN is $500+ in July 2029, indicating approximately a 23% stock price CAGR over the next 5 years. I think this will largely accrue due to Amazon’s margin expansion as a result of its integration of autonomous capabilities across its labor operations.

While there are risks related to macroeconomic conditions, particularly with deflationary effects, Amazon’s long-term vertically integrated business model provides some protection from this.

Furthermore, these projections are not speculative in my opinion, as they are predicated on the continuation of results already evident in Amazon’s financial reports that have been the result of the company instigating AI, automation, and robotics capabilities across its business in recent years.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.