Summary:

- Amazon’s AWS business is experiencing significant growth due to ongoing cloud migration and AI adoption.

- Amazon’s AWS business enjoys higher margins than other ventures, and the company’s investments in AI and cloud infrastructure could greatly benefit AWS in the near future.

- Despite some risks, such as moderated spending on discretionary categories and high capital expenditure, I believe Amazon’s stock price is significantly undervalued given its growth potential.

Noah Berger

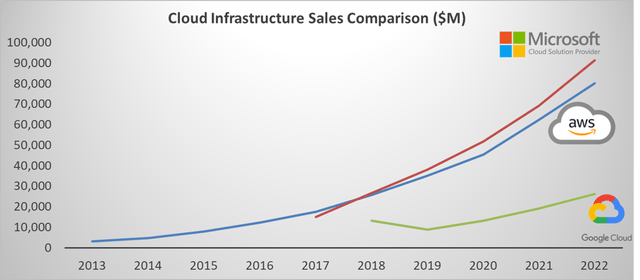

I believe Amazon (NASDAQ:AMZN) has been leading the cloud infrastructure competition alongside Microsoft (MSFT). The ongoing cloud migration and increasing adoption of AI could benefit Amazon’s AWS business. Amazon’s investments in cloud infrastructure enable enterprises to carry out data analytics, machine learning, and process automation. In my opinion, AWS’s future growth has been significantly underestimated, and the stock price is undervalued.

Growth Drivers

AWS’s growth from cloud migration: I believe Amazon and Microsoft are leading the cloud infrastructure competition, while Google (GOOG) (GOOGL) is lagging behind. Amazon’s AWS holds the advantage of scalability, cost-effectiveness, and the largest partner ecosystems, offering a wide range of services including computing, storage, databases, networking, machine learning, analytics, and more. Microsoft excels at leveraging their software and applications, ensuring security and reliability. Google is attempting to attract customers through their data analytics capabilities; however, concerns over their security and privacy persist among CIOs, in my opinion.

Microsoft, Amazon, Alphabet 10-Ks, Author’s Calculation

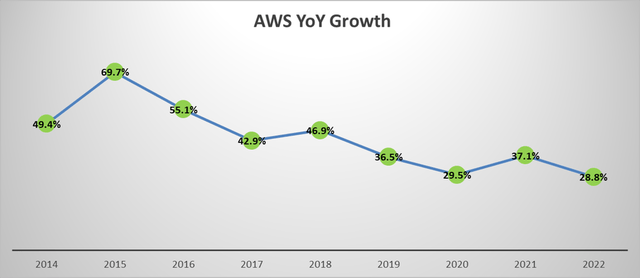

Amazon’s AWS business has experienced significant growth in recent years as more and more enterprises have migrated their workloads to the cloud. The cloud migration trend began a decade ago, and AWS has been a pioneer in cloud infrastructure. I believe that the migration to the cloud is still ongoing for most enterprises, providing AWS with a long runway for further growth. According to Amazon’s management team, more than 90% of global IT spending is still on-premises.

Furthermore, Amazon’s AWS business enjoys much higher margins compared to their other ventures. In FY22, AWS delivered an operating margin of 28.5%, which is significantly higher than the company’s overall average. I have always believed that Amazon has been utilizing the profits and cash flow generated from AWS to fund their lower-margin e-commerce businesses. By offering competitive pricing on Amazon.com, they have effectively outperformed many of their online and retail competitors.

Amazon’s 10Ks, Author’s Calculation

Growing AI technology will accelerate AWS’s growth: Amazon has continued to invest in infrastructure to support the needs of AWS customers, including investments in Large Language Models and generative AI. From an enterprise perspective, migrating workloads to the cloud is a crucial step before building up machine learning or AI capabilities. Therefore, I believe that the increasing adoption of AI will greatly benefit AWS in the near future.

Amazon’s investments in cloud infrastructure enable enterprises to perform data analytics, machine learning, and process automation. As an example, Amazon has developed a specialized chip called “Trainium” for machine learning training, which can also be used for inference or predictions through the “Inferentia” model. They anticipate that a significant portion of machine learning training and inference will be conducted on AWS in the future.

Fulfillment by Amazon (FBA): In Q1 FY23, third-party sellers, including businesses that opt for Fulfillment by Amazon for their storage and shipping services, accounted for 59% of overall unit sales. This represents an increase from 55% compared to one year ago. More and more sellers are recognizing the advantages of utilizing FBA and opting for this service. Additionally, FBA is closely linked to Amazon Prime, and the growth of FBA aligns with the increasing popularity of Prime membership.

FBA offers higher margins compared to Amazon’s own online store. Therefore, I believe that a greater mix towards FBA can help Amazon expand its margins over time.

Key Risks

Moderated spending on discretionary categories in e-commerce business: Amazon experiences a moderated spending on discretionary categories as well as shifts to lower-priced items while health demands in everyday essentials such as consumables and beauty. These discretionary spendings have higher elasticity, and are sensitive to inflation. I think over time, inflation will cool down, and these demands will come back.

Weak cloud spending in the near term: As anticipated, customers are actively seeking ways to optimize their cloud spending in response to challenging economic conditions. Amazon has observed these optimization efforts continuing into Q2, with April revenue growth rates approximately 500 basis points lower than those in Q1 FY23. Given the weak macroeconomic environment, I believe that the subdued cloud spending could persist for several quarters.

High capital expenditure: Over the past three years, Amazon has spent over $164 billion, surpassing the total cash flow generated from operations ($159 billion). The primary areas of expenditure were growth capex, specifically related to fulfillment, transportation, and AWS.

For the full year 2023, Amazon expects capital investments to be lower than the $59 billion invested in 2022, primarily due to an anticipated decrease in fulfillment network investments compared to the previous year. According to management, they plan to reduce spending on fulfillment and transportation while allocating more funds towards Large Language Models and generative AI. As discussed earlier, I believe these investments are necessary, and Amazon has the potential to reap profits from these growth capital expenditures in the future.

Outlook and Valuation

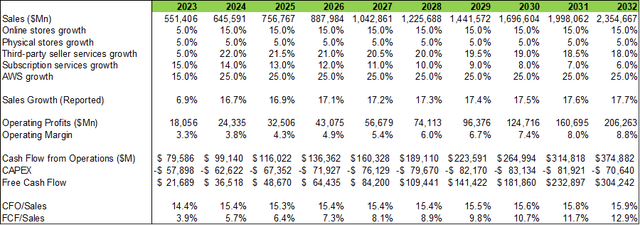

To estimate future growth, I have broken down the growth projections by each business segment. I assume that AWS, third-party seller services, and online stores will continue to experience high growth rates. The detailed projection can be found in the table below.

Amazon’s DCF Model – Author’s Calculation

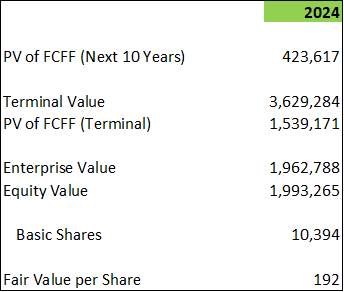

Overall, I still anticipate Amazon to grow at mid-to-high teens over the next decade. In my DCF model, the operating margin will expand to 8.8% in FY32 due to higher mix towards AWS and operating leverage. The model also assumes 10% of WACC and 4% of the terminal growth rate. With these assumptions, Amazon’s present values of FCFF over the next 10 years and terminal value are calculated to be $423 billion and $1.54 trillion, respectively. Adjusting the cash and debt, the fair value is $192 per share, as per my estimates.

Amazon’s DCF Model – Author’s Calculation

Verdict

I conclude that the ongoing workloads migrations will continue to boost AWS’s growth, and the investments in Large Language Models and generative AI could make AWS more competitive over the next decade. While Amazon’s near-term growth is clouded by the weak macro, their growth potential is underappreciated by the market, and their stock price is significantly undervalued. I give Amazon a “Strong Buy” rating.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN, MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.