Summary:

- Amazon’s 3Q24 operating margin rose to 38%, driven by top-line demand, cost control, and the extension of server life.

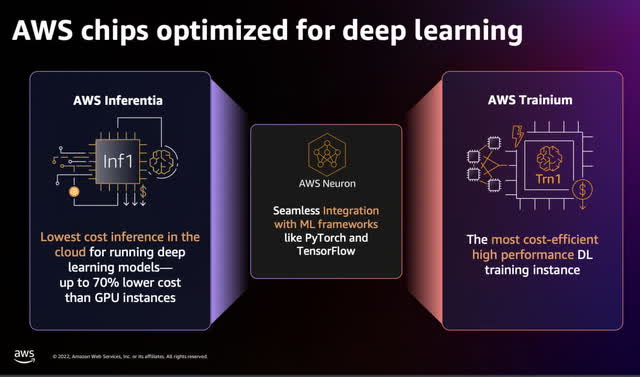

- AWS’s custom silicon and infrastructure investments, including Graviton, Inferentia, and Trainium chips, enhance cost efficiency.

- AI is a significant growth area for AWS, with demand outpacing supply; investments in AI infrastructure and custom hardware are expected to drive future revenue.

JHVEPhoto

Introduction

Per my August article, Amazon (NASDAQ:AMZN) uses their size effectively. Since that time, we’ve had the September Goldman Sachs (GS) Communacopia + Technology Conference, which we refer to as the September Goldman Sachs conference throughout this article. The 3Q24 results are now out, revealing AWS had a 3Q24 operating margin of 38% and YoY revenue growth of 19%. My thesis is that AWS is poised for continued excellence with respect to the operating margin and revenue growth.

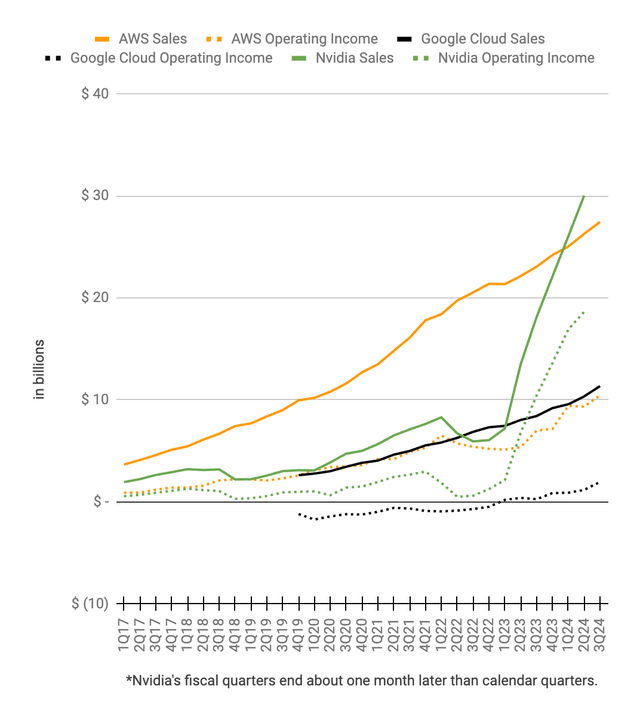

The Hyperscale Cloud Landscape

The hyperscale cloud companies are AWS, Microsoft Azure (MSFT), and Google Cloud (GOOG) (GOOGL). We don’t show Azure below because Microsoft obfuscates their numbers by including other businesses in the mix. In addition to designing hardware themselves, hyperscalers also buy hardware designed by partners. Intel (INTC) and AMD (AMD) are heavily used on the CPU side while Nvidia (NVDA) is by far and away the biggest supplier on the AI side. AWS designs Graviton on the CPU side, along with Inferentia and Trainium on the AI side. Nvidia is shown below because of their exceptional AI growth, but Intel and AMD are not.

Unfortunately, AWS and Google Cloud do not break out cash flow numbers, but based on what we see from accrual income statements, the hyperscale cloud industry is a good business. All these companies below have shown tremendous revenue growth over the years. They all have a history of attractive operating margins except for Google Cloud which took a big step in the right direction in 3Q24 when their margin jumped up to the 17% level:

AWS operating income & revenue (Author’s spreadsheet)

Operating Margin Drivers

The 3Q24 AWS operating margin was 38%, and it would have been closer to 36% were it not for an accounting change. This was much higher than the 3Q23 operating margin of 30%. CFO Brian Olsavsky talked about the accounting change in the 3Q24 call, saying they increased the estimated life of servers in 2024, which contributed roughly 200 basis points to the margin. JPMorgan (JPM) Analyst Doug Anmuth then asked for more drivers of the margins, and CFO Olsavsky gave some specifics (emphasis added):

The primary drivers of the year-over-year margin increase are threefold. So first is accelerating top-line demand. That helps with all of our efficiencies, our cost-control efforts and of course, what you just mentioned, I believe, the change in the useful life of our servers this year. Let me remind you on that one. We made the change in 2024 to extend the useful life of our servers. This added about 200 basis-points of margin year-over-year. On cost-control, it’s been a number of areas. It’s – first is hiring and staffing. We’re being very measured in our hiring and you can tell as a company where our office staff is down slightly year-over-year and it’s flat to the end of last year. So we’re really working hard to maintain our efficiencies not only in the sales force and other areas and production teams, but also in our infrastructure areas. Infrastructure is a big part of our cost structure in AWS and we’re probably the best at matching up supply and demand and driving cost efficiencies and driving those operations very, very strongly.

In the 3Q24 call, Barclays Analyst Ross Sandler asked how long it will take for the AI margins to improve as the business scales. CEO Jassy said AWS has a history of doing well with logistic challenges, which is one of the reasons why their CPU margins are high. Additionally, he believes today’s GPU/AI margins are lower than what he thinks they will be over time:

And I think that one of the differences if you were able to get inside of the economics of the different types of providers here is how well they manage that utilization and that capacity. It has a very direct impact on what kind of margins you have over time and what kind of capital efficiency you also have over time. And so I think you’re right, Ross, that there are some similarities in the early days here of AI, where the offerings are new and people are very excited about it. It’s moving very quickly and the [AI] margins are lower than what they – I think they will be over time. The same was true with AWS. If you looked at our margins around the time you were citing, in 2010, they were pretty different than they are now. I think as the market matures over time, there are going to be very healthy margins here in the Generative AI space.

Being Early Boosts Prospects For Operating Margin And Revenue Growth

AWS is not the same type of subscription business as Netflix (NFLX) or Spotify (SPOT) but there are some considerations that rhyme among the businesses. Barry McCarthy used to be the CFO of Netflix before he explained the advantages of being the first company in a new space when he was the CFO of Spotify. Here is what then CFO McCarthy said about being first at Spotify’s March 2018 Investor Day (emphasis added):

So if you and I both run competing subscription businesses, and yours is older than mine, then even if our services are equally liked with exactly the same churn curves by customer cohort, your average churn rate will be lower than my average churn rate, which means that more of your marketing dollars are going to support new subscriber growth and more of my marketing dollars are going to replace churn subs, which means you can grow faster than I can and beat me like a drum. And that is a really good example of why scale matters.

Goldman Sachs Analyst Eric Sheridan interviewed AWS CEO Matt Garman at the September Goldman Sachs conference, and they covered many topics such as innovation. AWS CEO Garman said they have been designing their own custom silicon since about 10 years ago while competitors were protecting their legacy business as opposed to innovating. I don’t believe Oracle (ORCL) was singled out individually in this particular discussion, but they have been mentioned in the past in this regard. By designing some of their own hardware for over a decade, AWS doesn’t have to buy all their hardware from third parties, which allows them to lower their cost. Having a low-cost model helps AWS boost its operating margin and revenue growth.

Analyst Sheridan asked about capex investments for AI goals during the September Goldman Sachs conference, and AWS CEO Garman revealed some of the factors that make AWS special with his answer. Investing in infrastructure for more than a decade, AWS started building their own network devices about 15 years ago. It wasn’t long before they were building their own chips (emphasis added):

And then we went into building custom chips, and we build custom chips for our own virtualization technology, we call Nitro. And that means that we don’t have to go buy those from third parties, that allows us to lower our cost. We long ago, many of the – and folks in the industry and AI in particular, kind of really leaned into InfiniBand, seeing that they thought that, that was the best performing network that you could get, which is true if you’re going to run a small cluster that you’re going to custom configure to run your own small cluster. We saw long ago that if you really want to run at scale, and you have to run these really large scales and you have to operate them in a really efficient way that ethernet was going to be a much better path over the long term. And so we’ve invested in high-performance Ethernet for the last decade plus for HPC systems. And now we have Ethernet networking for building large training clusters for AI that will often outperform InfiniBand on an absolute performance basis and is a much lower cost and much more efficiency and much more operable and it’s much better uptime.

The above discussion led to Analyst Sheridan asking about chips designed directly from AWS vs chips designed from partners. AWS CEO Garman said customers like having choices in this regard. He then explained the landscape and the advantages custom silicon can have with respect to price and performance (emphasis added):

And so we firmly believe that AWS is the absolute best place to run Intel, to run AMD, to run NVIDIA processors and we think that we can offer some differentiated capabilities by offering our own processors as well. And so we started out – actually, we started out with our own internal chips, which are Nitro chips that ran our whole virtualization layer and moved all the virtualization off of the core compute into a dedicated side processor. From there, kind of built up this expertise, and we launched our very first processor chip called Graviton and that has been a wild success. It’s a general purpose processor based on ARM, and we’re at Graviton4 now. And Graviton4 absolutely outperforms the best other processors, x86 processors at a 20% lower price. And so many of our customers to — get 40% to 50% price performance gains while also using less power and improving their carbon footprint using Graviton.

AI Use Cases

Some skeptics say there aren’t many real use cases for AI, which means companies like AWS may be making bad investments. Obviously, this will be harmful to the future operating margin and future revenue if true, but I am optimistic that AI has real use cases and I believe investments in this area will prove to be wise. After being asked about AI use cases at the September Goldman Sachs conference, AWS CEO Garman talked about pharmaceutical companies inventing and discovering new proteins. He talked about financial firms using AI for fraud detection. He mentioned Japan using AWS AI for new and existing bullet trains.

AI Revenue Growth

JPMorgan Analyst Anmuth asked about capex in the 3Q24 call, and CEO Jassy repeated the figure of $75 billion for 2024 and a higher amount for 2025. He then said their AI business is growing three times faster than AWS was growing itself at the same stage, and he stated it is an unusually large opportunity – maybe a once in a lifetime. Customers have a hearty appetite for AI, and AWS is capacity-constrained right now. They need more supply – both hardware they designed themselves and hardware designed by Nvidia. Revenue is expected to pick up when Nvidia makes their new Blackwell hardware available to AWS in the months ahead. Additionally, AWS has gone back to their manufacturers to get more of their custom-designed Trainium hardware, seeing as this is an attractive option for customers who are more price sensitive. During the 3Q24 call, Bank of America (BAC) Analyst Justin Post asked about being capacity-constrained and wanted to know if the new AWS Trainium chips or Nvidia chips will drive sales growth faster. CEO Jassy spoke about their deep partnership with Nvidia before answering about cost savings with custom silicon:

It’s also true that for customers that start to scale out their implementations on the inference side, particularly, they realize pretty quickly that it can get costly. And it’s really why we have pursued building Trainium and Inferentia, which is our custom silicon. And the second version of Trainium, Trainium2 will start to ramp up in the next few weeks. And I think it’s going to be very compelling for customers on a price performance basis. And we have a lot of customer interest. We have gone back to our manufacturing partners a couple of times now to produce a lot more Trainium than we anticipated. Some of that, for sure, is due to the fact that we just – we have very large demand, and we want more capacity and supply to be able to provide them. But a lot of it is that customers are excited about the price performance that they believe they’re going to get in Trainium.

Regarding the types of cost savings mentioned by CEO Jassy above, a 2022 AWS re:Invent presentation shows what is possible with Inferentia and Trainium:

AWS is able to boost their revenue by promoting low prices from custom silicon such that they get new customers and also get more business from existing customers. Speaking at the September Goldman Sachs conference, AWS CEO Garman said Trainium2 is coming out at the end of the year, and he made remarks about Alexa saving 70% when switching from a standard GPU to Inferentia:

And so we have a great partnership together and we really need them together. And we think that there are some use cases where our own custom processors can help customers save money. The very first one we launched was called Inferentia. And it was very focused on inference. And I can use our own company. Alexa, moved all of her inference to Inferentia and saved 70% versus doing it on a standard GPU part.

Valuation

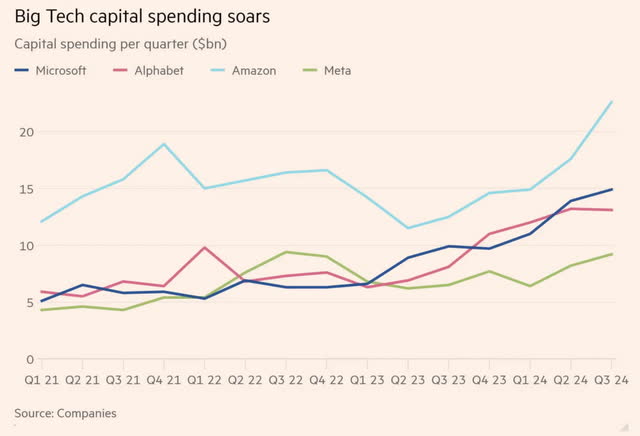

One area of concern with respect to valuation is high capex and the question as to whether the depreciation accounting on accrual statements is correct. As we see from this FT visual, capex spending is high for big tech companies, especially Amazon:

AWS is a capital-intensive business and I think when they start breaking out cash flow, we’ll see FCF is never as high as accrual earnings – similar to the gap between FCF and net earnings with railroads but hopefully to a lesser degree. As such, I don’t use the same operating earnings multiple for AWS and non-AWS. All of AWS is capital intensive whereas parts of Amazon’s non-AWS business are capital intensive and parts are not. For example, fulfillment requires significant capex whereas advertising does not.

I use a very high multiple to value the non-AWS business of Amazon and one of the reasons for this is because of all the growth ahead and much of it is hidden by investments within income statement expense lines. Looking at the pharmaceutical landscape for example, in the 3Q24 call CEO Jassy says there are many ways in which a company like Amazon can make the experience better for patients:

Brick-and-mortar pharmacies account for just over 90% of prescriptions dispensed in the US that require customers to make trips to forlorn physical venues with much of the selection behind locked shelves, waiting lines for meds and only finding out about pricing at the point of purchase. The largest mail order pharmacies offer delivery in 5 to 10 business days. We think customers deserve better. Today, we can deliver to 95% of first-time Amazon Pharmacy customers in the US within two business days and to 20% of US Prime members within 24 hours. Next year, we plan to launch operations in 20 new cities, so nearly half the US will have the ability to have their medications delivered to their door within hours.

AWS investments used to be hidden in income statement expense lines, so Amazon could get a head start on competitors. I believe the same thing is happening now in the North America segment for opportunities such as the pharmaceutical business. Looking at the 3Q24 10-Q and the 2023 10-K, the North America segment has TTM operating income of $22,172 million or $15,711 million + $14,877 million – $8,416 million for a 5.9% margin on revenue of $377,425 million or $271,911 million + $352,828 million – $247,314 million. Again, they already have a 5.9% margin even as there is a strong possibility of hidden investments in income statement expense lines, meaning the true margin is likely higher. They’re in more of a retail growth-rate state on the International side such that the current margins of that segment don’t tell us much about the future. Eventually, I think they can have a combined steady-state operating margin of 6% on cumulative North America and International revenue. TTM International revenue is $139,729 million or $99,486 million + $131,200 million – $90,957 million. As such, the cumulative TTM revenue of North America and International is $517,154 million and if we apply a hypothetical margin of 6%, then we have an operating earning power of $31 billion. Applying a multiple of 35 to 40x gives us a non-AWS valuation range of $1,085 to $1,240 billion when rounded to the nearest $5 billion.

AWS had 3Q24 operating income of $10,447 million on revenue of $27,452 million for a 38% margin and an operating run rate of $41,788 million on revenue of $109,808 million. Valuing the segment at 25 to 30x the operating income run rate gives us a valuation range of $835 to $1,255 billion when rounded to the nearest $5 billion. This is a much higher multiple range than the one I use for Google Cloud because AWS has significant advantages from being the first hyperscale cloud provider.

My sum of the parts valuation is as follows:

$1,085 to $1,240 billion non-AWS

$835 to $1,255 billion AWS

—————————————

$1,920 to $2,495 billion total

Per the 3Q24 10-Q, there were 10,515,011,008 shares outstanding as of October 18. The market cap is $2,209 billion based on the November 7 share price of $210.05. The stock is within my valuation range and I believe it is a hold for long-term investors planning to own it for at least 3 more years.

Forward-looking investors should keep tabs on developments from AWS re:Invent on December 2nd.

Disclaimer: Any material in this article should not be relied on as a formal investment recommendation. Never buy a stock without doing your own thorough research.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN, AAPL, ASML, BABA, GOOG, GOOGL, META, MSFT, NFLX, NVDA, SPOT, TCEHY, TSLA, TSM, VOO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.