Summary:

- A cautious consumer and more limited room for further cost optimizations are putting a lid on continued swift operating margin expansion in Amazon’s Retail segment.

- Meanwhile, demand for cloud and AI services seems increasingly robust, making AWS the main profit engine for the company again.

- In light of the continued strong profit growth prospects, the valuation of shares seems quite conservative at current levels.

Andy/iStock via Getty Images

The past several quarters at Amazon (NASDAQ:AMZN) have been characterized by a swift rebound in retail margins. The previous status quo, where profits from cloud services financed investments in the retail segment came to an end. However, the most recent earnings print of the company showed that the majority of margin improvements in the retail segment could have been accomplished, which could turn back the focus to AWS.

Luckily, demand for cloud services began to pick up again in recent quarters as companies continued their migrations to the cloud after a prolonged period of cautiousness. This, coupled with increasing AI-related revenues, could continue to fuel Amazon’s profit engine in 2024 and beyond, supporting the share price after the recent pullback. I find the valuation of shares appealing at current levels, making me stick to my Strong Buy recommendation.

Retail profit growth shifting into lower gear

The complete overhaul of Amazon’s fulfillment network has brought significant margin improvement to the North America segment since the beginning of 2023. The company’s regionalization strategy, which took shape in the form of creating 8 self-sufficient regional networks, enabled it to handle increased transportation volumes more efficiently. Thanks to these efforts, Amazon managed to improve its North America segment operating margin to pre-pandemic levels of ~6%:

Created by author based on company fundamentals

In the light of the fact that Amazon has increased its offerings (including those available for same-day delivery) significantly over the past 5 years, this is a significant achievement in my opinion. This resulted in operating profits for the segment of ~$5-5 billion over the previous two quarters, not to mention the International segment, which began to finally generate operating profit as well.

Based on management comments, the pace of margin improvement in these segments could shift into a lower a gear as low-hanging fruits have been picked, while further optimizations could take more time to bear fruit:

“We have a number of opportunities to further reduce costs, including expanding our use of automation and robotics, further building out our same-day facility network, and regionalizing our inbound network. These cost improvements won’t happen in one quarter or one fell swoop. They take technology and process innovation with a lot of outstanding execution, but we see a path to continuing to lower our cost to serve, which as we’ve discussed in the past, has very meaningful value for customers in our business.” – Andy Jassy, CEO on Q2 earnings call

Besides continued cost optimizations in fulfillment, the increasing proportion of advertising revenues within the North America segment should contribute to further margin improvement as well. In Q2 advertising revenues reached $12.8 million, growing 20% yoy significantly faster than online store’s revenue growth rate of ~5%. Looking at competitors, Q2 growth rates have been somewhat softer in advertising than those for Q1, but I expect Amazon to turn the tide soon:

Created by author based on company fundamentals

The reason I believe that Amazon’s advertising growth could diverge positively from competitors in the future is that there are still many untapped opportunities among its assets on the top of sponsored ads. The most important one of these could be Prime Video ads, which Amazon began to monetize really this year. Now that NBA games will join the streaming platform soon, combined with Thursday Night Football, the value of the platform to advertisers could increase further.

Another important event in the advertising space has been the turning off of third-party cookies by Google this year, thanks to increasing security regulations. These are those cookies that are attached to users by websites other than those visited, making them an important tool in ad targeting. Now, advertisers are looking for efficient third-party cookie alternatives, so Amazon launched its new AI-assisted, Ad Relevance service in June. This could attract additional interest for its demand-side platform, where advertisers can display their expressions on Amazon’s retail and non-retail properties.

Another important development worth monitoring in the North America segment is the impact of Amazon’s new fee structure on third-party sellers. Amazon introduced a new inbound placement service fee, which increased placement fees for sellers if they don’t split up their shipments between different locations. This makes Amazon easier to deal with spreading third-party inventory, but it increases the charges for sellers, resulting in potentially lower seller activity.

On the top of that, a new low-inventory fee came also into effect recently, making many sellers disappointed. The result of these changes could have already been evidenced in Q2 numbers, where revenue from third-party seller services grew only 13% yoy after growing 16% in Q1 and 19% in Q4 2023. As third-party sellers represent the core pillar of the company’s advertising business, it’s worth monitoring these trends closely. Based on the Q2 earnings call, management has also been somewhat surprised by these developments:

Third, our seller fees are a little lower than expected given the behavior changes we’ve seen from our latest fee changes.” – Andy Jassy, CEO, on Q2 earnings call

Finally, everybody began to talk about a possible U.S. recession after the recently published non-farm payroll report, which sparked a significant sell-off in stocks. Although currently we are far from a recession, the shopping trends at Amazon seem to signal some caution among customers:

…we’re seeing lower average selling prices, or ASPs, right now because customers continue to trade down on price when they can. More discretionary higher ticket items, like computers or electronics or TVs, are growing faster for us than what we see elsewhere in the industry, but more slowly than we see in a more robust economy. – Andy Jassy, CEO on Q2 earnings call

These observations are in line with recently softening consumer confidence, which is represented by the survey of University of Michigan:

After peaking around 80 in the first quarter of the year, there has been a decline in recent months with a reading of 68.2 in June. These developments are reflected in Amazon’s online store business as well, where revenues grew 6% yoy to $55.4 billion after growing 7% in Q1 and 8% in Q4 2023. Although an unemployment rate ticking up to 4.3% doesn’t give reason for concern in my opinion, in case these trends amplify, it could put pressure on Amazon’s online and physical store businesses. The increasing share of everyday essentials in sales provides a natural hedge against a possible economic backdrop, but even with that in mind, it could still act as a significant drag on profit growth.

Based on these observations, I believe the Retail segment of Amazon consisting of North America and International segments should continue to increase operating profits meaningfully over the upcoming years. A key driver of this will be continued growth in ad revenues, where a substantial portion of sales make it to the bottom line. Meanwhile, further investments into the fulfillment network should positively impact margins going forward, although to a lesser extent than over the previous 2 years. These investments also result in an increased product lineup that could positively impact sales, but this is currently counterbalanced by cautious spending patterns. Finally, the growing number of Prime memberships and the company’s ability to increase subscription prices is a key element of maintaining profit growth in the Retail segment over the medium term as well.

AWS stealing the spotlight again

After the exponential growth in retail operating profits seemed to come to an end, investors’ attention slowly turned back to Amazon’s cloud and AI businesses. The AWS segment made an important comeback in recent quarters as its annual revenue growth rate started accelerating again. Besides customers completing their cost optimization efforts and reaccelerating their migrations to the cloud, the AI business of AWS has also been an important contributor to this. Looking at competitors, we can see a same tendency at Google Cloud, while Microsoft’s cloud business growth experienced some moderation in recent quarters:

Created by author based on company fundamentals

I believe this could be an important cornerstone for AWS as it looked like at the beginning that Microsoft was better at monetizing AI, however based on these numbers, AWS is catching up nicely. I believe an important driver behind this is Amazon’s chip business, especially its Graviton lineup, which entered its 4th generation recently and made up close to 10% of AWS revenues already a few years back. Lengthening server replacement cycles and cloud cost optimization efforts could’ve pressured Graviton revenue growth over previous quarters, but based on management comments, this is slowly coming to an end. The launch of Graviton4 could accelerate this rebound in the second half of 2024, providing a strong pillar for continued growth in the AWS business.

AWS also launched its 2nd generation of Trainium chips recently, which provide a cost-efficient solution for training large language models. For inferencing workloads, there is Inferentia2 a chip designed in similar perception. Although the chips themselves seem to provide excellent price performance, their software support is lagging Nvidia’s CUDA by a mile, a fact that even AWS employees admit. Currently, it doesn’t seem there could be a breakthrough soon, so investors must wait until these chips achieve similar success than its CPU equivalents.

The reason that the company’s AI business reached a multibillion-dollar revenue run rate could be the early success of its AI services like Amazon Bedrock for building gen AI applications based on pre-trained models, or Amazon SageMaker that allows data scientists and developers to build their own ML models.

Besides accelerating revenues in the segment, margins are holding up strong as well despite increasing investments in GPU capacity:

Created by author based on company fundamentals

Non-GAAP operating margin jumped significantly above 30% in recent quarters, showcasing real strength in AWS’s operating model. However, this could change soon. Capex could top $60 billion in 2024, and most of it could support the growth of AWS business. This could be at least 25% higher than the $48 billion in 2024, where a large part went into the reorganization of the Amazon’s fulfillment network. Based on this, Capex in the AWS segment experiences a significant increase during 2024, which will lead to increased depreciation expense going forward resulting in lower operating margin.

If we assume that the company invests an additional $30 billion in AWS infrastructure this year compared to 2023, which will be amortized over 6 years (similar to useful life of servers) this means an additional $5 billion annual burden on the bottom line. Calculating with ~100 billion AWS revenue for 2024 this means a drag of 5%-points on operating margin, which will be fully felt in 2025, but already impact the company’s bottom line this year.

However, even with this negative impact we’re talking about an operating margin of 30%, which is still very impressive among well-established companies. So, investors should prepare for decreasing margins going forward, which could be counterbalanced by a better price mix resulting from increasing share of AI-related revenues to some extent.

Finally, another important risk factor to point out is the muted growth of remaining performance obligations over recent quarters, which are tied mostly to the AWS business:

Created by author based on company fundamentals

After a significant bump at the end of 2023, we could have witnessed stagnation over the previous two quarters. The yoy growth rate fell back to 19%, which is in line with the current revenue growth rate for the business, so this isn’t concerning yet. However, if this tendency continues, it would mean a bad omen for continued topline growth reacceleration. I can imagine that more and more customers began to renew their commitments at the end of the calendar year, which could provide an explanation for this phenomenon, but anyway, it’s worth monitoring this metric closely over the upcoming quarters.

In a nutshell, Amazon’s cloud and AI businesses showed encouraging signs in recent quarters, which could continue into the year. However, increasing investments could pressure margins going forward, which should be measured against improving topline growth going forward. Let’s see how this could impact the valuation of share over the upcoming years.

Valuation

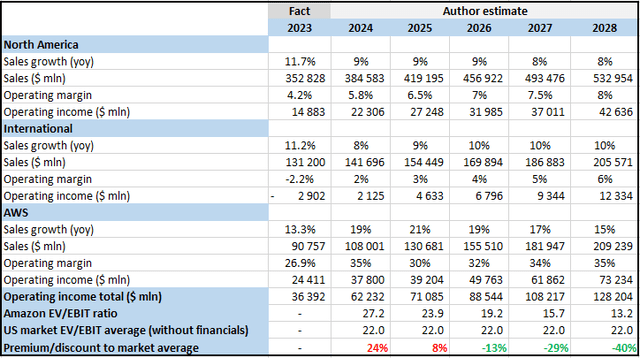

Based on the developments described above, I updated my relative valuation framework for Amazon. Resulting from somewhat softer consumer spending, I decreased the growth trajectory for the Retail segment. On the top of that, I also decreased my operating margin estimates for the segment, as further cost optimizations will take time to exert their effect. These effects result in lower operating income for the upcoming years than in my previous estimate.

However, this is counterbalanced by better-than-expected growth rates and operating margin for AWS, which could remain the key profit driver through 2024 and 2025. Looking at the numbers, my valuation framework looks as follows:

Created by author based on own estimates

Calculating with an operating income of $62 billion for 2024, Amazon shares trade at a forward EV/EBIT ratio of 27.2. This is only 24% higher than the U.S. market average, which premium would decrease to 8% in 2025 and turn into a discount for the years that follow. As Amazon has significant growth levers to pull for the upcoming years, I believe its operating profit growth rate will be significantly higher than the market average, so its shares should continue to trade at a premium in my opinion. Based on this, I think its shares should outperform the market in general. To keep its current valuation premium, shares should outperform the market by almost 40% in 2 years, which is a realistic scenario in my opinion. In the case of positive fundamental surprises – like higher growth rates or margins in the AWS segment – this could be even higher. However, in the case of a more severe economic downturn leading to a collapse in consumer spending, this outperformance could be postponed for later years.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.