Summary:

- AWS’s moat appears to be coming under pressure with declining margins and market share.

- Meanwhile, Amazon’s e-commerce business is extremely capital-intensive and isn’t what Warren Buffett would call a “wonderful business.”

- I’ll explain why growth may disappoint.

- At a normalized PE ratio of 56x, I think Amazon is about to roll over ~ Sell the rally.

Alex Wong/Getty Images News

The Thesis

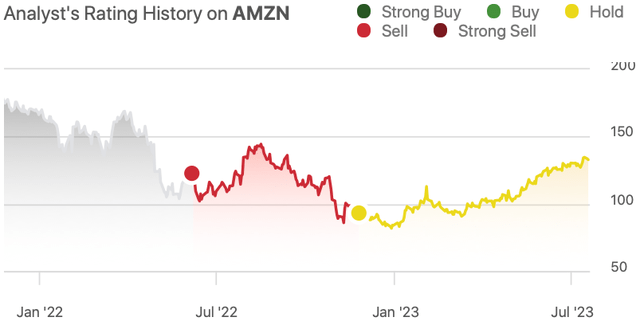

I’ve covered Amazon (NASDAQ:AMZN) twice before, first recommending a “Sell” in mid-2022, then upgrading to a “Hold” at the end of last year. Amazon’s since rallied 45%, but I think it’s about to roll over again. Let me explain why.

Author’s AMZN Rating History (Seeking Alpha)

Amazon’s Businesses Are Rolling Over

E-Commerce

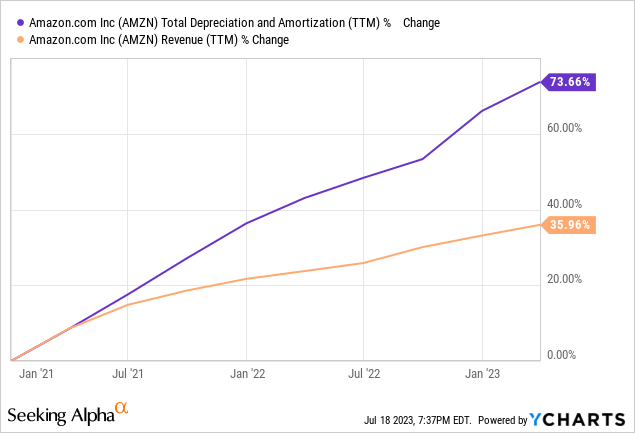

Amazon’s flagship E-Commerce business has had its fair share of struggles. Amazon made the mistake of over-investing in e-commerce warehouses and delivery vans during the abnormal lockdowns of 2020 and 2021. Next, Amazon compounded the issue by spending tons of money on depreciating movies and TV shows.

Thus, depreciation expense has outgrown revenues drastically:

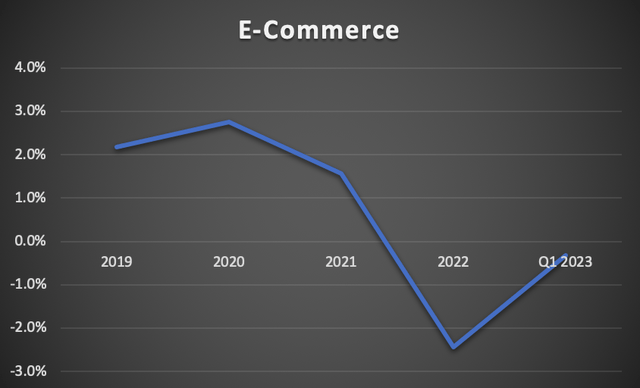

When the lockdowns eased, Amazon was “swimming naked” as it ran into the brick wall of inflation in 2022. Seeing wages skyrocket for its 1.5 million employees, Amazon started losing money on its e-commerce business:

Amazon’s E-Commerce Operating Margins (Author)

Wages tend not to go down and stay down, nor do depreciation costs, which Amazon accounts for on a straight-line basis. So, the argument for huge margin expansion looks somewhat weak.

Also keep in mind that tons of retailers now have a direct-to-consumer business, such as Nike (NKE) and American Eagle (AEO). This is just scratching the surface. So, consumers no longer have to buy everything e-commerce on Amazon.com; they can just go on Nike’s website to buy their next pair of sneakers or branded hoodie.

I think Amazon.com was at the peak of its power back in 2020, and there may be no going back. I recently asked my fiancee what she would do if Amazon raised its Prime membership fee by 50%, and without hesitation, she said she’d cancel it.

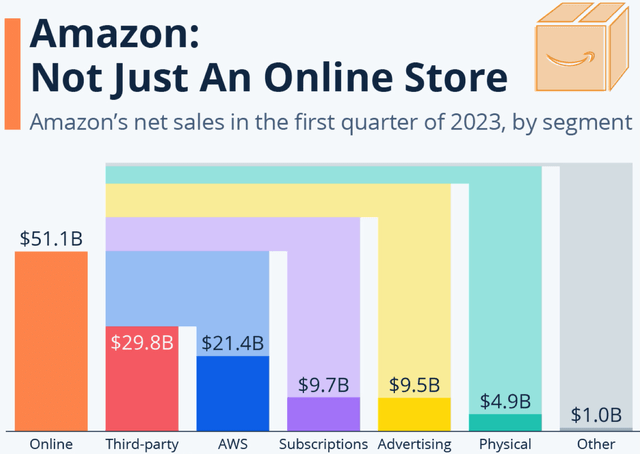

Amazon’s Q1 2023 Revenue Breakdown (Statista)

Not A “Wonderful Business”

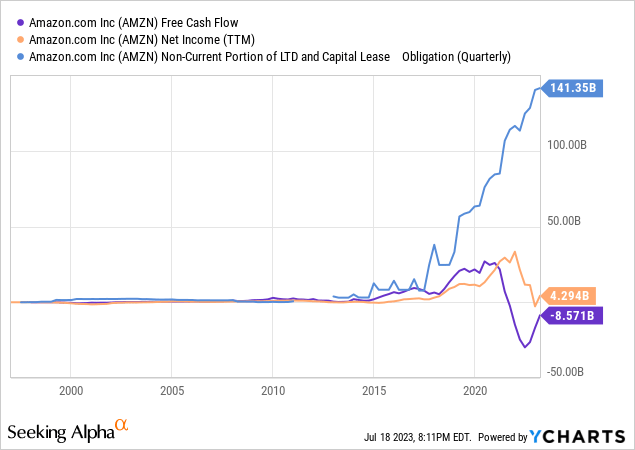

All that said, Amazon is trying to push advertising and other income streams, so it’s not that I think Amazon’s North American and International e-commerce segments won’t grow at all. It’s just that I think they are capital-intensive, low margin businesses (Not what Warren Buffett would call a wonderful business). For example, Amazon had $187 billion of property, plant and equipment on its balance sheet at the end of 2022. All of this shareholder capital is sitting there and earning next to no money. Free cash flow is negative, net income is minuscule, and debt is soaring higher:

This isn’t what you like to see. Amazon’s $141 billion long-term debt and capital lease obligation is enormous, especially compared to its falling profitability.

Cloud

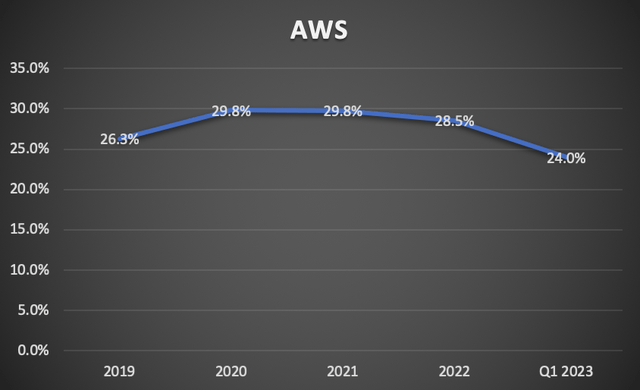

Moving on to cloud, operating margins are rolling over. Amazon’s CEO has cited slowing demand. But I’m seeing increasing competition as well.

AWS Cloud Operating Margins (Author)

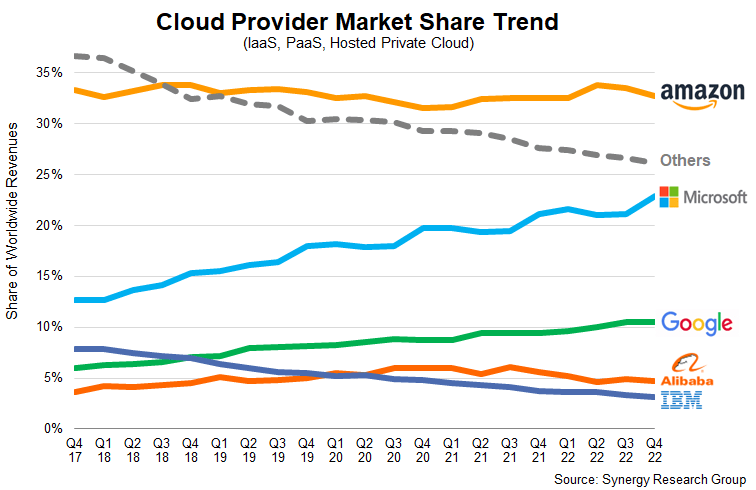

Amazon’s cloud business hasn’t gained an inch of market share over the past five years, meanwhile, Microsoft (MSFT) and Google (GOOG) continue to gain ground:

Global Cloud Market Share (Synergy Research Group)

Are Amazon’s cloud margins falling because of slowing demand, or is Amazon lowering prices to stop losing market share (Which has been falling for the past three quarters)? I lean towards the latter.

Moreover, I think AWS’s long-term moat (A.K.A. durable competitive advantage) in cloud be somewhat fickle. I would compare cloud computing to the semiconductor industry where you can have an advantage due to scale, offerings, technology, and brand, but these advantages can fade over the years as we’ve seen with the once great Intel (INTC), which has been displaced by Taiwan Semiconductor Manufacturing Company (TSM) and others. So, I cannot say if AWS will enjoy the same dominant position in 10, 20, or 30 years.

Normalized Earnings

I still believe Amazon is under-earning on a net income and free cash flow basis. If we assume Amazon’s e-commerce business (Segments ~ North America and International) returns to a 2% operating margin and that AWS can maintain its 24% operating margin, then Amazon would likely make $24.8 billion:

| E-Commerce Operating Income | $8.7 Billion |

| AWS Operating Income | $21.1 Billion |

| Interest Expense (Net) | ($1.4 Billion) |

| Earnings Before Income Tax | $28.4 Billion |

| Income Tax Expense | ($3.6 Billion) |

| Normalized Net Income | $24.8 Billion |

Note: This estimate excludes the effects of equity investments and foreign currency gains/losses, giving Amazon a normalized PE ratio of 56x.

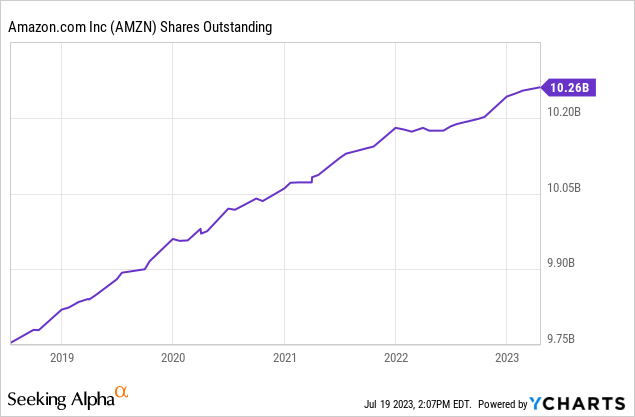

Turning over to Amazon’s operating cash flow, readers should understand that Amazon has $21 Billion of stock-based compensation. This makes operating cash flow a poor metric because it doesn’t account for the huge dilutive effects of this figure. Owners of Amazon stock are continually seeing their per-share ownership decline:

Amazon’s Stock Could Roll Over

Growth May Disappoint

Amazon is a terribly capital-intensive business, trading at 56x normalized earnings. Looking at Amazon’s core businesses, growth may disappoint. For example, Grand View Research has the global cloud computing market growing at 14% per annum through to 2030. AWS’s market share isn’t growing, and the company is concentrated in North America where cloud computing has been widely adopted, and companies are actually trimming back their cloud spend. So, I think AWS will actually grow slower than 14% per annum over the next ten years. Amazon’s also reached North American concentration in e-commerce, so future growth may depend on the company’s ability to increase ad spend on its platforms and raise Prime membership prices. Of course, Amazon is expanding into India and other markets, but its International business actually saw an 8% decline in revenue from 2021 to 2022. Also, I expect Amazon’s effective tax rates to increase over the next ten years alongside other American firms. Combine all of this, and I see Amazon growing normalized earnings at just 13% per annum.

Long-Term Returns

My 2033 price target for Amazon is $155, implying returns of just 1.5% per annum:

| Normalized EPS (Diluted) | $2.40 |

| Compound Annual Growth Rate | 13% |

| Year 10 EPS | $8.15 |

| Terminal Multiple | 19x |

| Year 10 Share Price | $155 |

| Compound Annual Returns | 1.5% |

Note: This is a base-case estimate. The compound annual growth rate is for dividends and earnings. The terminal multiple assumes an interest rate of 5% in 2033 (A reversion to the 5000 year mean). It also assumes a growth rate of 8% between 2033-2043, and accounts for the small probability that the business fails.

Given that I do not believe investors are being paid here to hold Amazon, with the 2-year treasury yielding 4.75% vs. Amazon’s prospective returns of 1.5% and a potential recession in North America looming, I am downgrading Amazon to a “Strong Sell.” AMZN could be about to roll over.

Thesis Risk

There is a wide range of outcomes for Amazon’s stock. My base-case factors in both the chance that Amazon loses substantial cloud computing market share, as well as the chance that Amazon’s margins surprise to the upside in e-commerce and cloud. Also, Amazon’s CEO said the company is working on AI chips but that they are competitive on a combination of price and performance (In other words, performance is lagging competitors). Anyway, there is a chance that some of Amazon’s investments pay off. There’s also a chance others lose big. Perhaps Amazon can increase e-commerce margins further than I expect if they effectively use AI to recommend products and integrate ads. But, this is being hindered by ongoing data privacy changes and regulation. Also, maybe the vast use of AI autonomous vehicles will reduce expenses and make Amazon’s shipping vastly more efficient 5-10 years out. This is the wide range of outcomes factored into my long-term returns estimate.

The Bottom Line

Amazon is doing great things, but it is also engaging in extremely capital-intensive things. At a normalized PE of 56x, I think now is a dangerous time to bet on massive margin expansion.

Amazon’s growth may disappoint. It seems the company has reached e-commerce and cloud concentration in North America. AWS’s cloud market share and margins are falling. Moreover, Amazon’s e-commerce business is not what Warren Buffett would call a “wonderful business,” with negative free cash flow and skyrocketing debt. Competition is heating up in direct-to-consumer and in cloud computing. Looking at my 1.5% prospective returns for Amazon vs. 4.75% on the two-year treasury, I think it’s time to get out. Thus, I’ve downgraded Amazon from a “Hold” to a “Strong Sell.” Whether you agree or disagree, I hope I shed light on the key issues surrounding Amazon.

Until next time, happy investing!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.