Summary:

- Amazon is facing labour strikes across multiple countries, which could potentially lead to higher costs and have implications for operating margins.

- The strikes, including one on Black Friday, may not have a significant impact on Amazon’s performance in Q4 2023, however. The company’s recent revenue growth and rising profits also go into favour.

- Its forward P/E also looks good compared to historical averages, making Amazon a Buy. However, ongoing labour challenges should be considered as a factor in future performance.

4kodiak/iStock Unreleased via Getty Images

As I write this Friday evening, e-commerce giant Amazon (NASDAQ:AMZN) is seeing labour strikes across countries. This is hardly an isolated event. As I had mentioned recently in the context of the banner EV company Tesla (TSLA), which has faced its own discontent from labour in Sweden, industrial action is on the rise.

While Amazon hasn’t buckled under union pressure so far, the mood of the moment suggests that potentially higher labour costs can’t be ruled out. This, of course, can have implications for the company’s operating margins. Its margins have only just recovered on somewhat improved macroeconomic conditions, after more than halving in 2022 compared to 2021. Here I look at these aspects in greater detail to assess what’s next for Amazon.

The labour challenge

First, let’s look at the matter of the day. As I write this Friday, “the largest day of industrial disruption in Amazon’s thirty-year history” as per the GMB Union of the UK is underway.

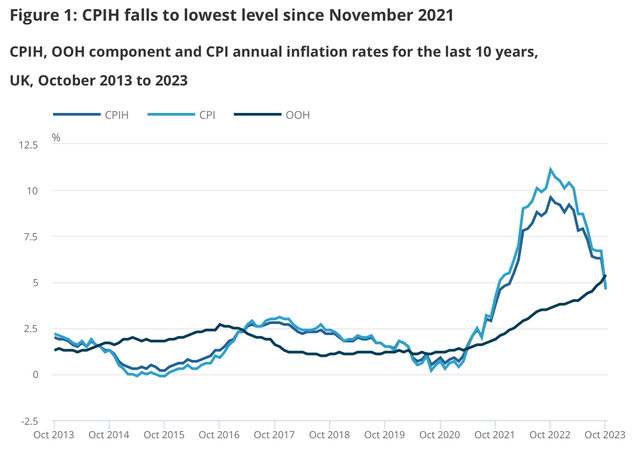

Union members at the UK’s Coventry warehouse, among the busiest in the country, have been on for 28 straight days demanding better pay. While inflation in the country has come off from the double-digit rates seen in October last year, they’ve done their damage, and inflation is still at 4.6% in October 2023. Additionally, the UK economy is weak.

UK, Inflation (Source: Office of National Statistics)

Black Friday strike impact

Today, they have been joined by workers from across 30 countries including the US, Germany and Italy, coinciding with the busy Black Friday sales that roughly mark the start of the busy festive season. The question now is, what’s the likely impact on Amazon?

The fact is, that a single day’s strike might not affect the company’s performance materially in Q4 2023, as it can make up for the time lost. Moreover, in the US, unionisation so far is limited to the JFK8 warehouse at Staten Island, which means that its biggest market will only be affected in a small way. Also, even factoring in the longer strike period in the UK, the fact is, that the entire international segment is 22% of Amazon’s revenues as of Q3 2023. The UK of course, would have a much smaller share.

The bigger context

But the latest issue isn’t just about today, or even about this month. It needs to be seen in the context of ongoing labour related issues at Amazon since the pandemic. Despite the company’s opposition to unionisation, the JFK8 did see the formation of the Amazon Labor Union [ALU] in the US last year. Amazon on its part, has been vehemently opposed to unionisation. And going by its latest numbers, it can clearly perform despite the ongoing challenges.

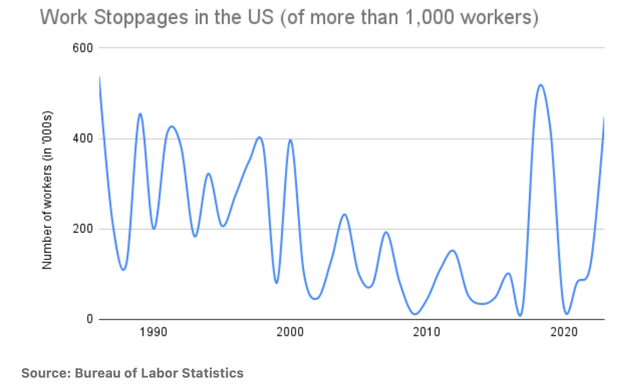

Source: Bureau of Labor Statistics

But at the same time, as I pointed out in my Tesla article (see chart above), this is turning out to be quite the year of strikes in the US. And if the mood continues or accentuates, Amazon’s response would be key. Tesla, for instance, on its part has increased worker pay by 4% in Germany recently and also offered additional payouts.

It’s possible that as inflation slows down even more, especially in Europe where multiple countries have joined the strike, the urgency of demands might subside. Already, inflation in the EU has come off to 2.9% YoY in October compared to 4.3% even a month ago. But that can’t be taken for granted.

The point here is this. Labour troubles might or might not be avoided by the company. We’ll have to see. But especially in keeping with today’s events, they are worth bearing in mind for what can come next.

Growing margins

This is especially so, considering that the company has seen a recovery in operating margins only this year, after they shrank last year, which unsurprisingly coincided with high inflation. However, somewhat supportive macroeconomic factors like a slowing down in the pace of interest rate hikes, continued growth in the US economy and a significant come-off in inflation to close to the Fed’s comfort levels have helped.

The company saw revenue growth of almost 11% year-on-year (YoY) for the first nine months of 2023 (9M 2023) and operating profit increase of 146%. The operating margin, as a result, is now at 5.9%, more than doubling from 2.6% during 9M 2022.

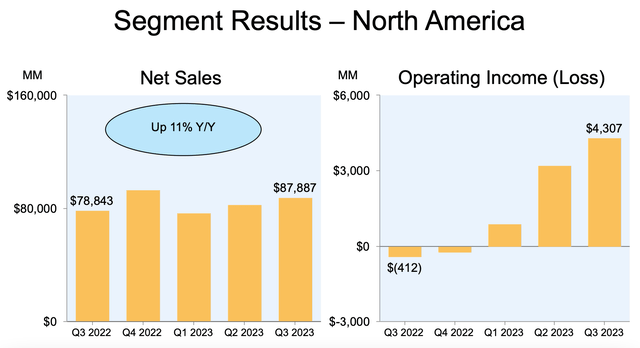

Improvements are visible across Amazon’s segments. The important North America segment with a 61% revenue share as of the third quarter (Q3 2023) has in particular seen positive trends recently. Not only has it seen a sequential rise in operating income in each of the three quarters this year, it has recovered from a loss last year (see chart below). It now has an operating margin of 4.9%.

Source: Amazon

The International segment continues to be loss-making on an operating basis, though the extent of losses is declining halving in 9M 2023 from the same time last year. The jewel in Amazon’s crown as far as profits go, continues to be AWS, which accounted for 62% of the total operating profits in Q3 2023. It already had a healthy 24% margin in the first half of the year (H1 2023) that jumped to 30% in the third quarter (Q3 2022: 26.3%).

The key point here is that while there has indeed been margin recovery, one segment is still loss making. And another one was so until recently. While the AWS segment can still hold the fort, a risk to margins is still very much prevalent.

The outlook and market multiples

For now, though, there are unlikely to be big surprises. The company’s Q4 2023 guidance indicates that it expects the scenario to look broadly similar for the full year, with 11.3% revenue growth and a 164% operating profit growth. This reflects an expected operating margin of 5.7% for the year.

Assuming that the results come in just as the company expects in 2023, let’s look at market multiples. If the net income to operating profit ratio stays constant in Q4 2023 at 83.7% as seen for 9M 2023, the forward non-GAAP price-to-earnings (P/E) ratio comes in at 55.3x.

This is high against the average consumer discretionary stock that’s trading at a multiple of 14.8x, of course. But it is certainly not high compared to Amazon’s past five years’ average of 186.5x. Even if the company’s profits were impacted by the current labour challenges the P/E is unlikely to go back up to the five-year average. Further, the forward P/E is also lower than the trailing twelve months [TTM] non-GAAP P/E of 76x.

What next?

The company’s share price has certainly been unaffected by any labour issues so far, with a YTD rise of 71%, a significant improvement after it halved last year. Its 2023 outlook also indicates little surprise ahead and the market multiples look good too.

I am uncomfortable with lingering labour problems, with little visible by way of resolution, though. At a time of increased industrial action in the US, coupled with the recent cost-of-living challenges, it’s an aspect to look out for in the near future. On balance though, there’s more going for Amazon than not. I’m going with a Buy rating, which is subject to change if the matter escalates.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in AMZN over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.