Summary:

- Amazon stock has faced selling resistance at the $190 level over the past two months.

- AWS and Advertising will need a more robust growth inflection to deliver a valuation re-rating in AMZN stock.

- The market remains confident in Amazon’s bullish thesis, as buying momentum is incredibly resilient.

- AWS is still the market leader and scaling rapidly outside of the US.

- I argue why staying invested in AMZN is the right way to bet on its long-term growth opportunities.

hapabapa

Amazon Stock’s Buying Momentum Stalled

Amazon (NASDAQ:AMZN) investors have seen AMZN stock’s buying momentum stall below the $190 level over the past two months. As a result, I have assessed possible profit-taking as the market reassesses AMZN’s bullish thesis. I provided a bullish AMZN update in my previous article in April 2024. I urged investors to maintain their bullish posture, as the rally in AMZN stock seemed far from over.

Amazon’s first-quarter earnings release in early May 2024 wasn’t enough to spur a decisive breakout rally above the $190 level. Why? Arguably, the market had already baked in high optimism into AMZN’s valuation at the current levels. As a result, investors will likely need a more pronounced growth inflection in its key earnings drivers to justify a multiples re-rating. What could these be?

Monitor AWS And Amazon Advertising Closely

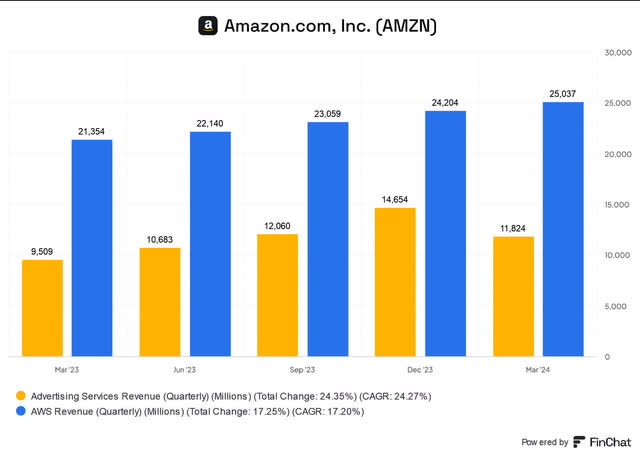

AWS and Advertising revenue growth % (FinChat)

There’s little doubt that Amazon Web Services and Advertising Services will be increasingly crucial as AMZN looks to justify its growth premium. As a reminder, AWS posted a 17% increase in revenue in Q1, while Advertising saw its revenue surge 24%. The market is likely confident about the growth potential of these crucial growth vectors, as AMZN stock remains close to its all-time highs. As a result, investors are urged to continue monitoring the sustainability of their growth prospects, particularly in generative AI.

There’s little doubt that AWS is the cloud market leader, with a 31% market share in Q1. However, Microsoft Azure (MSFT) and Google Cloud (GOOGL) (GOOG) reported more robust growth rates than AWS as they look to close in on AMZN’s leadership. AWS witnessed a recent CEO change as Adam Selipsky stepped down. His replacement, Matt Garman, is tasked with leading the cloud computing leaders as his key rivals have made GenAI their primary imperative in cloud computing.

Don’t Understate AWS’s Modular AI Strategy

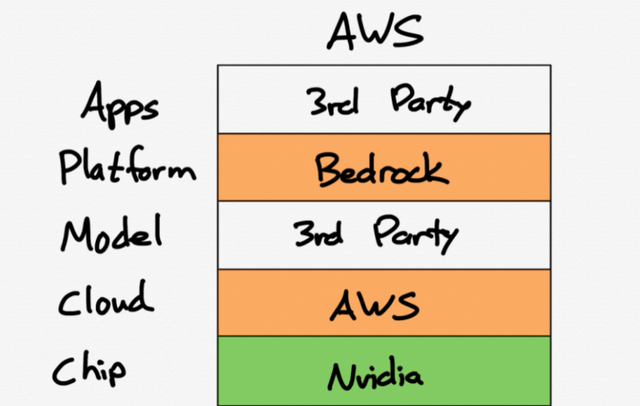

AWS tech stack (Stratechery)

AWS operates a modular approach compared to the more tightly integrated tech stack employed by Google and Microsoft. As a result, unlike its leading peers, AWS doesn’t rely on proprietary AI models and apps. Instead, it relies on its “data gravity” to attract and retain enterprise customers. While its early market leadership has been instrumental in gaining market share, it’s also possible that the multi-cloud growth opportunity could intensify, benefiting its peers.

With the increasingly advanced AI models being developed by Microsoft and Google, questions could be asked about AWS’s strategic imperative to maintain its lead. Business Insider reported recently that Amazon “is circumventing data-collection limits on Microsoft’s GitHub to gather metadata crucial for training its in-house AI models.” Therefore, Amazon has likely understood the criticality of making sure it must develop market-leading proprietary AI models. Despite that, the debate about LLMs commoditization would not likely be settled in the near term. Therefore, Amazon’s modular approach with its AI tech stack remains appropriate while it hedges its developments with potentially leading in-house models.

Amazon has aggressive data center expansion plans to increase its footprint outside of the US. While the US is primarily the most critical region, APAC has the potential to grow faster. Therefore, AWS is reinvesting its robust cloud profitability into growth CapEx to stretch its IaaS leader further. With that in mind, AWS seems well-positioned to leverage its scale and capabilities to expand its exposure into faster-growing opportunities.

Amazon Advertising Raises The Stake

Let’s also not forget that Amazon Advertising is gaining ground against its peers. The Information reported that Amazon “has made a splash in the streaming TV ad market so far in the upfront negotiations.” As a result, it has drawn a defensive response from the streaming leaders (YouTube and Netflix (NFLX)). Accordingly, Amazon’s streaming ad leaders “have begun planting seeds of doubt in advertisers’ minds about how big Amazon’s audience really is.” It’s a critical development in Amazon’s multi-billion ad business, given its clout as the third-largest player in the market. Amazon Prime Video’s more aggressive push into ad-supported streaming has shaken the landscape as it “flooded” the market with ad supply. As a result, it has led to “downward pressure on prices for everyone in the upfront ad market.”

I believe Amazon is ramping up its opportunity to build a sizeable ad-supported streaming business, lowering the concentration risks from its core Amazon.com advertising exposure. Accordingly, “90% of Amazon’s advertising revenue is derived from its core retail media network,” highlighting the potential for Amazon to do more in streaming ads. Given the headstart that Netflix has achieved in ad-supported streaming, Amazon likely envisaged a more aggressive push into the space is warranted. Despite that, Netflix has a significant engagement lead ahead of Amazon Prime Video, suggesting why Amazon is likely leveraging more competitive pricing to outcompete its peers.

Amazon’s business practices have drawn intense regulatory scrutiny, with the US FTC filing a lawsuit alleging that Amazon is “protecting a monopoly over swaths of online retail by squeezing merchants and favoring its own services.” However, a recent development could cast doubt on the FTC’s case against Amazon. A Wall Street Journal opinion piece highlights contradictions in the FTC’s arguments, mainly due to the FTC’s opposition to the American Booksellers Association joining its lawsuit. The ABA claims Amazon “unfairly negotiates deals with publishers, allowing it to sell books at lower prices, which undercuts small booksellers.” As such, it implies that Amazon also faces intense competition with offline retailers, potentially undermining the FTC’s assertion that Amazon holds an illegal online monopoly. Therefore, I assess that the outcome of the FTC’s case isn’t straightforward. Consequently, I have the confidence that investors will remain rational even as they consider the developments of the FTC’s case against Amazon.

AMZN Valuation Isn’t Cheap But Justified

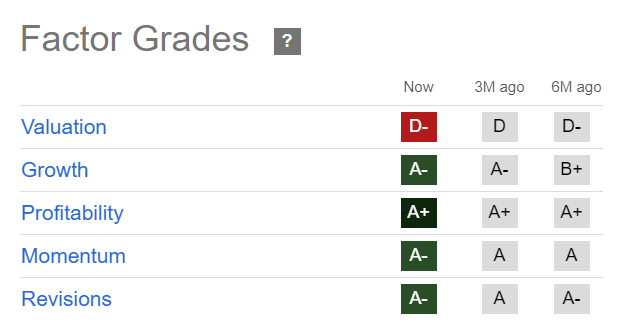

AMZN Quant Grades (Seeking Alpha)

As I highlighted in an AMZN article in January 2024, AMZN’s valuation could continue to befuddle bearish investors. However, AMZN’s robust “A-” momentum grade suggests the market hasn’t been unduly concerned. Bolstered by a fundamentally strong business model (“A+” profitability grade), AWS and Amazon Advertising are expected to underpin Amazon’s growth profile. With four “A” range grades justifying Amazon’s bullish thesis, the most significant risk is likely assessed to be its premium valuation.

AMZN’s forward adjusted PEG ratio of 1.7 indicates a 13.5% premium over its sector peers. Therefore, potentially slower growth impacting AWS or advertising could affect the market’s assessment of Amazon’s growth profile. Consequently, it could lead to a valuation de-rating, intensifying downward volatility.

Is AMZN Stock A Buy, Sell, Or Hold?

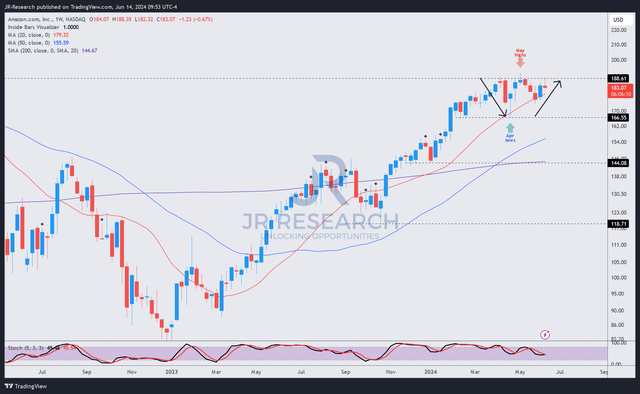

AMZN price chart (weekly, medium-term) (TradingView)

AMZN’s price action demonstrates the resilience of AMZN’s buying momentum. AMZN suffered a transitory pullback in April but formed a robust bottom in May 2024 above the $165 level.

However, AMZN’s buying momentum has continued to find significant resistance at the $190 level, suggesting profit-taking likely occurred. Notwithstanding my caution, AMZN’s bullish medium-term uptrend has remained intact, corroborating my bullish thesis. Therefore, a potential bullish breakout is looking increasingly likely, suggesting shareholders should consider holding on to their positions.

Rating: Maintain Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN, MSFT, GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!