Summary:

- Amazon has been operating for almost 30 years and still seems content to sacrifice short term profit for long term growth.

- Investors need to start asking themselves if this is in their best interests, or if the company should be returning capital to shareholders while it has a strong competitive advantage.

- I believe AMZN shares are trading above fair value using optimistic DCF assumptions.

krblokhin

Executive Thesis

For years, Amazon (NASDAQ:AMZN) has sacrificed short term profits for long term growth. This creates a bit of a halo effect, where losses are written off as investing in the future, and gains are celebrated as a potential long-term shift to profitability. Since the company has been operating for almost 30 years, it seems unacceptable that focus has not been shifted to profits. Even when accounting for growth capex, the company appears to be trading above fair value using optimistic DCF assumptions.

Company Overview

Amazon’s vision is to be the earth’s most customer centric company. The company serves its consumer with its online and physical store offerings, with quick and efficient delivery services. It serves sellers by providing fulfillment options to grow their businesses. It serves enterprises with AWS, which offers technology solutions such as storage, databases and analytics. It also serves creators with Twitch and serves advertisers via paid promotions on Amazon.com.

How Much Cash Flow is Really Being Generated?

There is no easy way to do this, as the company continues to spend heavily on growth. How much of the expenses, particularly research and development, are for growth and how much are maintenance? How about capex? This may be easier when looking at 2022 and beyond, as changes in accounting rules require R&D to be capitalized.

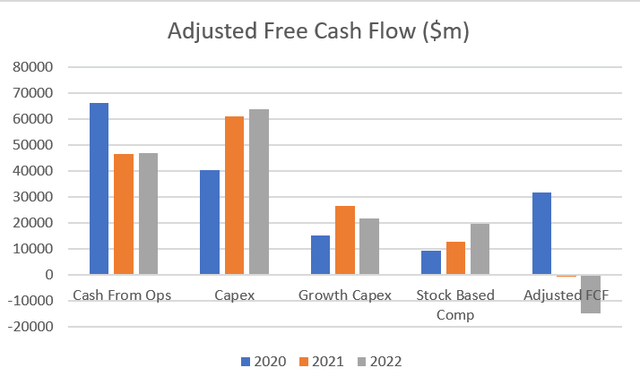

I am going to take the conservative approach here, and just assume the difference between depreciation and amortization and capex can be contributed to growth capex. I will add this value back into free cash flow and subtract stock-based compensation to get a better understanding of how much cash is getting attributed to shareholders. This can be visualized over the last 3 years as follows:

The company is indeed investing heavily in growth, though over the last 2 years stock based compensation has detracted heavily from shareholders swinging our calculation of adjusted FCF to -15 billion in 2022 and a -800 million in 2021. 2020 was a fantastic year, but Amazon benefited immensely from the pandemic, with the forced closing of many retail competitors. Recent performance is less than stellar, but many other retailers have been experiencing massive losses in FY 2022. What is more alarming is the poor performance in FY 2021, as that was a massive year for many companies due to pent up demand.

Valuation

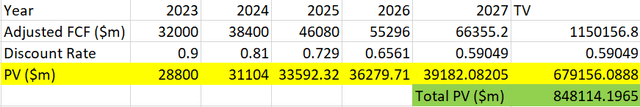

How can a 1 trillion Amazon market capitalization be justified? I took an optimistic approach to my valuation, assuming the company would be able to move past retail headwinds in 2023 and grow adjusted FCF (excluding growth capex, including stock-based compensation) with the aid of strong growth in AWS (Revenue and operating income nearly doubled in the last 2 years) and return to 2020 levels of profitability. This would lead to growth in adjusted FCF by 20%/y for the next 5 years, with my terminal value assuming the company can continue to grow by 4% until its eventual decline. This puts the present value of future cash flow at approximately $850 billion.

Risks

Shareholder dilution

Despite 2021 being a record year for many companies, including stock-based compensation swung AMZN’s free cash flow to a loss for the year even when accounting for growth capex. This effect was even more pronounced in 2022, and this dilution trend may continue regardless of company performance. If growth of the company is exceeded by stock dilution, shareholder value will not be created.

Retail Competition:

Amazon has historically kept retail margins low to improve customer loyalty and expand the business. This has worked in the past, and investors accepted the long-term goals. As more competitors continue to enter the field and improve their logistics, Amazon may find that they may not ever be able to expand margins and reward shareholders. If this occurs, investors may end up wishing Amazon operated in a more profitable manner when their competitive advantage was more pronounced.

Over Reliance on Amazon Web Services

AWS is a high margin growth machine, and has nearly doubled its revenue in the last 2 years with most of this revenue able to fall into the bottom line. If competitors can erode this margin and/or growth slows in this segment, performance of the retail divisions would become more pronounced. This also begs the question if shareholders would be better off if AWS, or even the low margin international operations were spun off from the legacy business.

2020 Exaggerated Results

If investors are looking at 2020 as a potential indicator of future results, they will be likely be disappointed, as AMZN performed much better due to pandemic online shopping driving sales. A tailwind to start, but also a headwind moving forward as the pandemic forced many retailers to adapt to online or die, so to speak.

Conclusion

I am skeptical of investing in AMZN at current market quotations, as the company has not demonstrated its ability to return value to shareholders. It is acceptable for a company to sacrifice short term profitability for long term growth for a period of time, but it should not be acceptable to do this forever. AMZN has been in business for almost 30 years, has paid no dividends, and consistently diluted shareholders. It’s questionable whether the growth of the business adequately compensates investors for this dilution, especially in recent years.

In its legacy online retail business, it had a clear first mover advantage, but this competitive advantage seems destined to erode over time as traditional retailers catch up and new players enter the field. This is a great business for customers, a great business for high level employees but offers questionable returns to shareholders based on traditional valuation metrics. Our admittedly optimistic DCF models indicate that AMZN stock is trading above fair value of $850 billion, with a premium being paid, likely for the strong balance sheet with $146 billion in equity. I am going to hold on to my shares for now, but I will keep watching the company carefully to see if margins and growth can be restored after a tough 2022.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.