Summary:

- Amazon’s stock price has not fully reflected its success in various aspects of its business, leading to relative underperformance compared to other tech companies.

- I anticipate accelerated retail revenue growth and improved profitability through margin expansion, driven by increased Fulfillment by Amazon utilization and higher pricing for Amazon Prime.

- Bullish on Amazon’s long-term growth story, citing strong AWS growth, potential surge in cloud demand driven by Generative AI, cost optimization in North American retail, and advertising as growth drivers.

- Bull case warrants a target price of $173 per share, indicating a potential upside of 25%.

AWS, Cloud, Amazon Noah Berger

Despite Amazon’s (NASDAQ:AMZN) consistent success in various aspects of its business, including AWS and Retail e-commerce, technological innovation, in my opinion, the stock price has not yet fully reflected these accomplishments. When comparing Amazon’s stock performance to that of other tech companies, it has exhibited significant relative underperformance in recent years.

Taking a positive outlook on the growth trajectory of the Amazon key growth drivers, in this article, I am going to delve into the best-case scenario. In this optimistic scenario, I anticipate that retail revenue growth will accelerate to 10%. This acceleration is driven by swift adoption in emerging product categories, coupled with a higher gross profit margin of 40%. The margin boost is attributed to increased Fulfillment by Amazon (FBA) utilization and higher pricing for Amazon Prime, resulting in a significant incremental profit flow.

I maintain a confident outlook on Amazon’s shares based on two key factors:

AWS Resurgence: I expect Amazon Web Services (AWS) to rebound strongly in the second half of 2023, bolstering Amazon’s overall performance.

Retail Margin Expansion: I anticipate Amazon’s core retail business to achieve improved profitability through margin expansion.

While AWS growth expectations for the third quarter may differ slightly from the street consensus, I have high confidence in a strong AWS recovery and positive commentary later in the year.

Regarding Amazon Web Services (AWS), this estimation suggests a faster-than-expected reacceleration in growth. This acceleration is linked to enterprises swiftly transitioning to cloud-based solutions once more. Even with this more positive outlook, it’s important to note that I am only attributing a portion of the potential benefit from a higher valuation multiple compared to software and Software-as-a-Service (SAAS) companies. This approach may still be considered conservative, as there’s room for Amazon to potentially receive a more favorable valuation multiple given its growth prospects and market position.

Evidence: Q2 2023 saw Acceleration in Non-Store Retail Sales

The advance monthly non-store retail sales data for June has revealed a striking trend in the eCommerce sector. If we look at the recent quarter data – In June, eCommerce sales surged by an impressive 9.9% year-over-year (y/y), demonstrating a significant acceleration compared to the 9.3% y/y growth in May and the 5.3% y/y growth observed in April. In contrast, the overall retail sales for June remained relatively stagnant, registering a modest increase of 0.6% y/y, following a more robust 2.3% y/y growth in May.

However, it’s essential to acknowledge that Amazon’s official guidance for 2Q revenue falls within the range of $127 billion to $133 billion, slightly below the street consensus of $132 billion. Notably, Amazon does not provide a specific breakdown of its North America sales within its overall revenue guidance.

Growth is the key:

Key questions every long-term investor should ask themselves and reflect:

- Enterprise Cloud Optimization: What’s the cadence of enterprise cloud optimization efforts, and are there any indications of AWS growth reacceleration?

- Retail Margin Improvement: How fast is retail margin improvement progressing, and what are the medium-term targets for retail profitability?

- Capex Outlook for 2023: What’s the outlook for capital expenditures in 2023, especially considering increased investments in AWS?

- Generative AI Positioning: How is the company positioning itself in Generative AI, and can you provide insights into recently announced GenAI products like Amazon Bedrock, including timing for broader release and potential contributions to growth?

- Margin Improvements: What progress has been made in achieving margin improvements through the regionalization of fulfillment operations and broader cost control efforts?

I am very Bullish on Amazon long term growth story due to following key points:

- Strong AWS Growth: In the second quarter, AWS achieved an impressive 12% year-over-year growth, surpassing the Street’s expectations of 10% year-over-year growth. This growth is attributed to customers adopting new workloads and the gradual decline in optimization efforts. This sets the stage for a potential resurgence in AWS growth.

- GenAI-Driven Cloud Demand: Since Amazon announced recently Amazon Bedrock and multiple generative AI services and capabilities , AWS may be at the precipice of experiencing a significant surge in cloud demand driven by Generative AI (GenAI), which could open new growth avenues.

- Cost Optimization in North America Retail: Notably, there was a remarkable improvement in cost optimization efforts within North American retail, resulting in a 473 basis point increase year-over-year. This improvement is reflected in North American operating income margins, which reached 3.9%, far surpassing the Street’s expectations of 1.8%. Management has indicated that further margin improvements are in progress, extending through 2024.

- Advertising as a Growth Driver: Advertising remains a potent growth driver for Amazon, offering high-margin revenue streams.

Retail Profit Margins Poised to Gain from Declining Fuel and Shipping Costs:

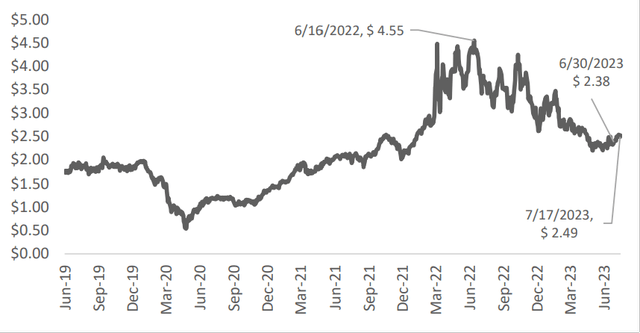

Amazon’s retail margins are poised to benefit from a sustained decrease in fuel prices throughout the year. Notably, wholesale diesel prices in June saw a remarkable decline of approximately 50% year-over-year, marking a significant departure from the record-high levels witnessed in mid-2022. While prices have experienced a slight 3.5% increase since the company’s guidance in Q1 2023, the overall trend has been a consistent downward trajectory since the beginning of the year.

To provide context, ultra-low sulfur diesel prices concluded June at $2.38 per gallon. Although this figure remains above the 2019 average of $1.90, it represents a substantial reduction compared to the elevated levels observed in mid-2022, which were nearly twice as high. This favorable development in fuel prices is expected to contribute positively to Amazon’s retail margins as the year progresses.

Ultra Low Sulfur Diesel price per gallon in June have declined by nearly 50% y/y

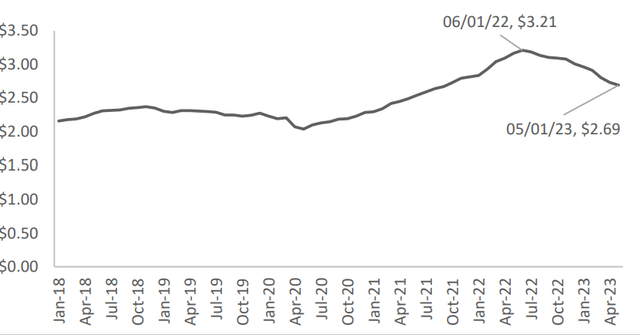

According to Bloomberg, the revenue-per-mile for vans, inclusive of fuel costs, has seen a notable decline this year. This decline amounted to a decrease of 15% year-over-year in May, following previous declines of 12% in April and 8% in March.

Revenue-per-mile Van incl. Fuel

Valuations:

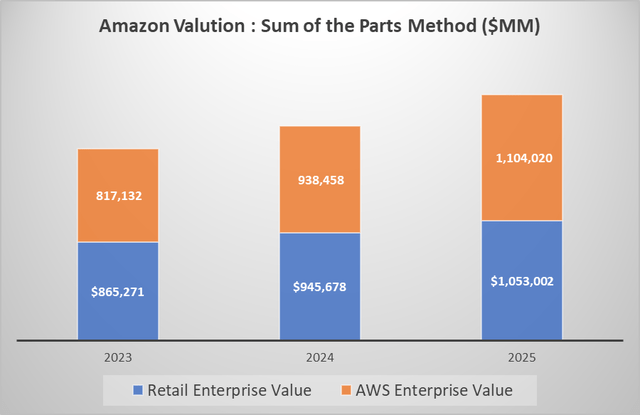

Considering above factors, bull case warrants a target price of $173 per share, indicating a potential upside of 25%. This optimistic outlook is rooted in expectations of accelerated AWS revenue growth, a favorable 9X multiple valuation for AWS, and a 5X EV/GP (Enterprise Value to Gross Profit) multiple for the retail business.

My valuation methodology employs a “sum of the parts” approach, considering the two core segments: retail and AWS.

Retail Segment: I utilize a 5X multiple on retail gross profit. This valuation is justifiable given that retail Softline stocks are currently trading at a median multiple of ~ 2.8x on estimated 2025 gross profit. Amazon’s retail segment is expected to outpace this growth rate.

AWS Segment: For AWS, I apply an 9X multiple on AWS revenue. This approach accounts for the expected slower top-line growth in the short term and the uncertainty surrounding normalized long-term growth. Additionally, there is limited scope for margin expansion in the near term.

|

Retail — EV/Retail Gross Profit ($MM) |

2023 |

2024 |

2025 |

|

Retail Gross Profit |

$173,054 |

$189,136 |

$210,600 |

|

Multiple |

5X |

5X |

5X |

|

Retail Enterprise Value |

$865,271 |

$945,678 |

$1,053,002 |

|

AWS — EV/Revenue |

$90,792 |

$104,273 |

$122,669 |

|

Multiple |

9X |

9X |

9X |

|

AWS Enterprise Value |

$817,132 |

$938,458 |

$1,104,020 |

|

Sum of Parts |

|||

|

Total Enterprise Value |

$1,682,403 |

$1,884,135 |

$2,157,022 |

|

(-) Net Cash (Debt) |

($17,469) |

($13,165) |

$41,095 |

|

Equity Value |

$1,664,935 |

$1,870,970 |

$2,198,117 |

|

Diluted Share Count |

10625 |

10837.5 |

10838 |

|

Price Per Share |

$157 |

$173 |

$203 |

|

Target Price |

173 |

||

|

Potential Upside |

25% |

Chart made by author using valuation data

Bear Case: The bears could make the following points:

-

It’s unclear how much re-acceleration the company can genuinely achieve at AWS, especially given the escalating competition.

-

Capital expenditures (CAPEX) are becoming more dependent on AWS, which is expected to keep growing, especially in anticipation of increased demand related to GenAI.

-

There might be an impending investment cycle, with discussions surrounding grocery and healthcare ventures.

-

The macroeconomic outlook for the retail sector remains uncertain, as management has observed ongoing indications of customers opting for lower-priced options.

Conclusion:

Amazon retail sector is poised to reap the rewards of extended regionalization initiatives, decreasing line-haul trucking expenses, reduced diesel prices, and an overarching commitment to efficiency. These factors are anticipated to propel retail margin enhancement throughout the year. Also Amazon Web Services (AWS) to rebound strongly in the second half of 2023, bolstering Amazon’s overall performance.

Risk Statement:

Amazon faces competition from various online and offline retailers, search engines, local service websites, and cloud infrastructure providers. Risks for Amazon include economic conditions, changing consumer spending patterns, seasonality, regulatory challenges (like taxes), and foreign exchange and political uncertainties.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.