Summary:

- Profit margins at Amazon have struggled over the past few years.

- The company has been investing aggressively in boosting delivery speeds for its online marketplace.

- There are indications that this investment has reached an inflection point.

- The stock looks too cheap on a sum-of-the-parts basis even using conservative assumptions.

Daria Nipot

Amazon (NASDAQ:AMZN) is one of those stocks which, in spite of seeing an acceleration in e-commerce and cloud computing growth from the pandemic, now sees its stock price trading at or below pre-pandemic levels. It seems that after inflation and heavy investment led to a deterioration in e-commerce margins, investors turned their focus squarely on Amazon Web Services (AWS). Yet when the company guided for a steep deceleration in AWS growth rates, that had a negative impact on the stock price. Wall Street is too pessimistic on the long term growth potential for AWS and is assigning little value to the arguably more important retail business – especially as the company shows indications of a greater focus on profit margins.

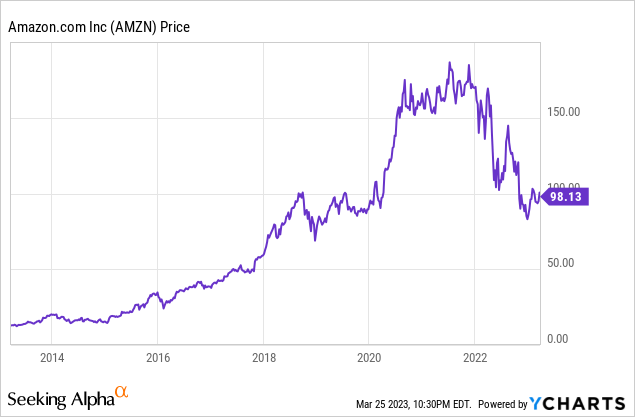

AMZN Stock Price

Amidst a broader crash in tech stocks, AMZN has seen its stock fall down to levels as low as where it traded in 2018. While the stock may have been richly valued in 2018, the company has grown its revenue base by 120% since then. Operating income remains at the same levels as they were in 2018 – that may play a role in the pessimistic sentiment surrounding the stock.

I last covered AMZN in January where I discussed my conviction on the stock in light of the pessimistic assumptions baked into the stock price. The stock has since returned 16%, likely due to a recovery in the broader tech sector. I continue to see AMZN as having great potential for multiple expansion alongside the potential for accelerating growth rates as economic conditions stabilize.

AMZN Stock Key Metrics

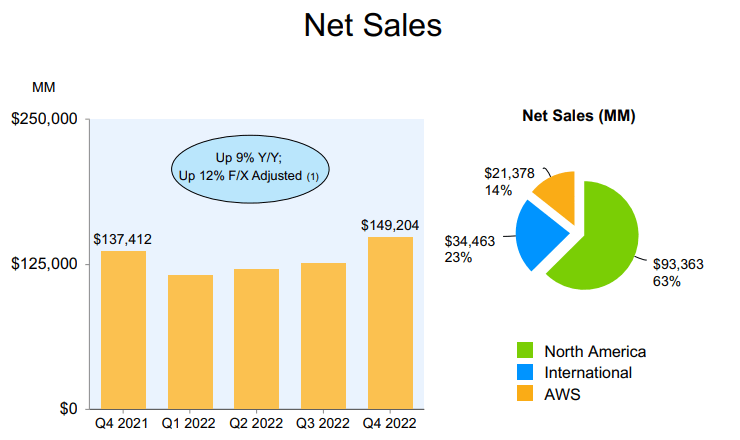

The most recent quarter saw AMZN deliver a small beat on revenue, with net sales coming in at $149.2 billion, representing 9% YOY growth (the company had previously guided to revenue between $140.0 billion and $148.0 billion).

2022 Q4 Presentation

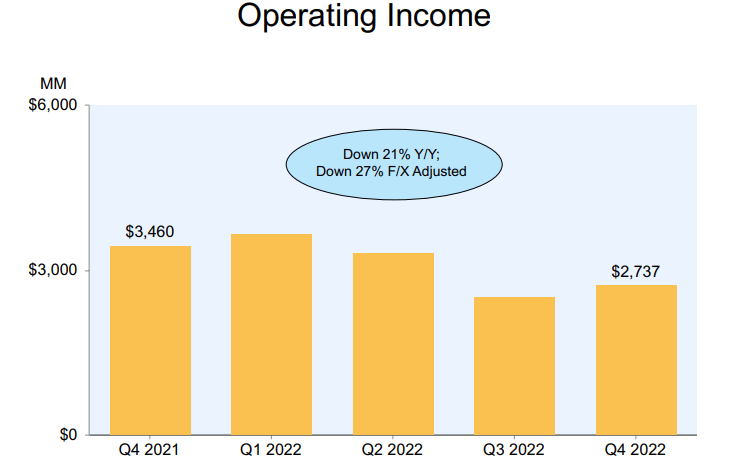

Operating income came in at $2.7 billion, within the guidance for between $0 and $4 billion.

2022 Q4 Presentation

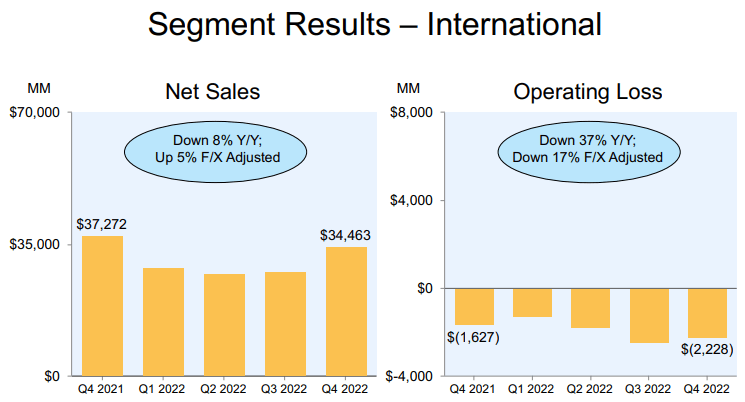

On the conference call, management noted that excluding “employee severance, impairments of property and equipment and operating leases and changes in estimates related to self-insurance liabilities,” operating income would have been $2.7 billion higher. AMZN saw its weakest results in its international business as revenues declined 8% YOY, but on a constant currency basis, revenue actually grew 5% YOY.

2022 Q4 Presentation

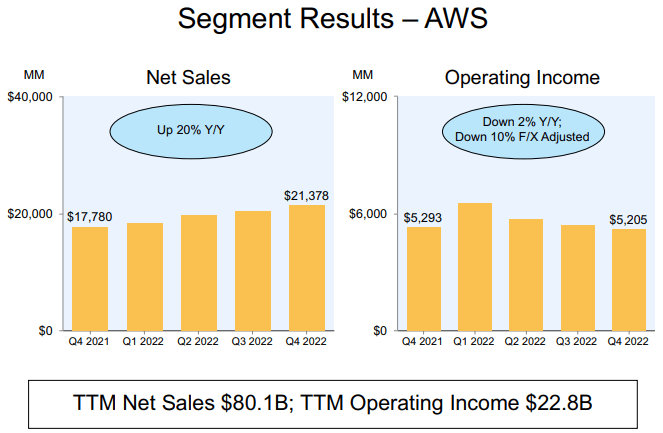

I suspect most investors were focused on the results in AWS, which disappointed with only 20% YOY sales growth and 5.5% of operating margin compression.

2022 Q4 Presentation

Management cited some weakness due to the rising interest rate environment, especially in sectors like financial services and mortgage companies. But the bulk of the slowdown seems to be due to “optimization efforts” in which their customers are seeking to reduce cloud computing spend, with AMZN presumably yielding on pricing. Management expects those headwinds to persist “at least the next couple of quarters.” Management also noted that AWS growth was in the “mid-teens” in the first month of the next quarter, suggesting further deceleration in growth rates. I continue to view such deceleration as being near term in nature and due to the macro environment. Management noted that they believe that “90% to 95% of global IT spend remains on-premises,” offering a very long growth runway for the shift to cloud computing.

AMZN ended the quarter with $66.3 billion of cash and $3.7 billion of equity investments (made up primarily of its investment in EV producer Rivian (RIVN)) versus $67.2 billion of debt. I see this balance sheet position as being quite strong as AMZN can arguably support ample leverage over the long term.

Looking ahead, management expects the first quarter of 2023 to see up to 8% revenue growth to $126 billion, which is inclusive of an anticipated 210 basis point unfavorable impact from foreign exchange rates. Management once again is guiding for operating income to be between $0 and $4 billion.

While these results may disappoint some investors on account of the low profit margins, it is important to note that the company has been aggressively building out its e-commerce infrastructure. AMZN has been pushing the envelope in terms of shipping speeds, doubling its fulfillment center footprint in only a couple of years to improve their ability to offer 2-day or even 1-day shipping speeds. Management did offer optimism for improving retail margins, stating that they “made good headway in 2022” and “expect to make big improvements in 2023.” Since the end of the quarter, the company has announced another 9,000 layoff – following the prior 18,000 layoff in January. Investors may be underestimating the mega-cap tech giant’s ability to offset top-line headwinds with cost optimization

Is AMZN Stock A Buy, Sell, or Hold?

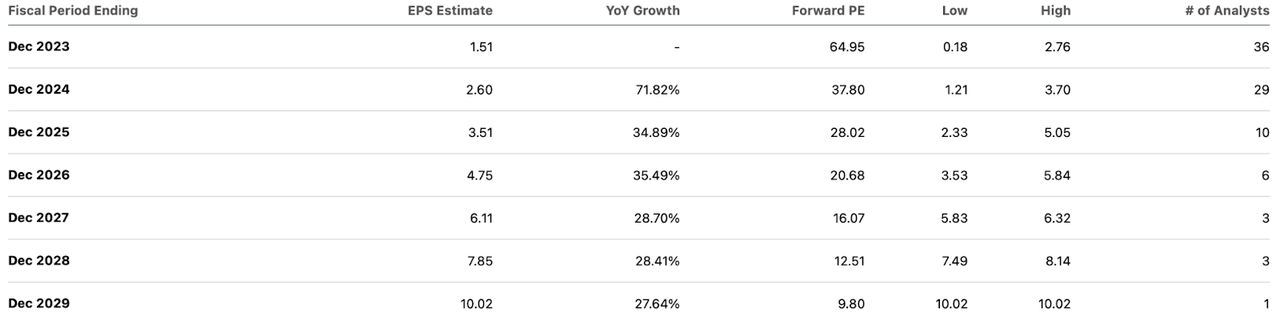

AMZN stock can confuse value investors due to it seemingly always trading at high P/E ratios. Even based on robust consensus estimates, the stock does not look cheap until many years later.

Seeking Alpha

But we must consider that AMZN is likely over-investing in their products, something that I have touched on in the past. We can calculate a fair valuation for the stock by assigning value first to Amazon Web Services and then to the retail business. AWS generated $22.8 billion in TTM operating income. If that’s valued at 50x earnings then that already accounts for $1 trillion in value. That valuation looks reasonable assuming 20% revenue growth and faster earnings growth due to operating leverage. Alternatively, based on 20% revenue growth, 40% long term net margins, and a 1.5x price to earnings growth ratio (‘PEG ratio’), I could see AWS being valued at 12x sales, or $1.03 trillion. The retail business did $433.9 billion in TTM revenues. The retail business was not profitable in either North America or international regions, but AMZN generated a 3.6% operating margin in North America in 2020. I expect AMZN to generate margins in far excess of that over the long term as they reap the benefits of their multi-decade investments in logistics infrastructure. But even assuming just 3.6% operating margins (7% or higher is my best bet), that would yield roughly $15.6 billion in profits. This segment arguably deserves a higher multiple than the likes of a Target (TGT) or Walmart (WMT) due to it having a great amount of subscription and advertising revenues. Yet applying a similar 20x earnings multiple and we arrive at $312 billion in value. Adding these together and we arrive at around $125 per share in fair value. I find my assumptions and multiples conservative in this estimate and would not be surprised to see AMZN surpass those profit expectations – and stock price – over the coming years. The aforementioned latest round of layoffs may help to remind investors that this company is still focused on driving strong margins over the long term – and may be able to show an unusual ability to accelerate that margin expansion in spite of a tough macro environment.

What are the key risks? AMZN may face a great deal of near term headwinds on account of the macro backdrop. The company’s growth in its retail business has already stalled due to tough pandemic comparables and recessionary fears, and AWS is now showing visible signs of headwinds as well. It is possible that the “cloud optimization efforts” by customers referenced earlier prove more long term in nature or are signs of price competition. It is also possible that long term growth rates are far lower than consensus estimates, perhaps AMZN is just too big now. While AMZN might not show accelerating top-line growth until the broader economy improves, I can see the company appeasing investors with margin improvements that should help lead to multiple expansion. Again it bears repeating – it would be extremely impressive if AMZN can drive margin improvements even amidst such a tough macro backdrop, and I expect the stock to enjoy substantial multiple expansion over the long term if management can execute on such ambitions. AMZN continues to be a top pick in the portfolio as one waits out a broader tech recovery – I reiterate my buy rating.

Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am long all positions in the Best of Breed Growth Stocks Portfolio

Growth stocks have crashed. Want my top picks in the market today? I have provided for Best of Breed Growth Stocks subscribers the Tech Stock Crash List Parts 1 & 2, the list of names I am buying amidst the tech crash.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best 6-8 investment reports monthly.

- My top picks in the beaten down tech sector.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks today!