Summary:

- Despite market turbulence, savvy AMZN investors who bought more at its January lows still outperformed the S&P 500.

- Amazon’s success in H2’23 hinges on AWS returning to growth mode – attracting long-term buyers back.

- But don’t wait until H2 arrives. The market’s forward-looking and savvy investors have already returned in early January.

- Seize the opportunity from the recent pullback. Volatile market conditions are your chance to bulk up before the rest return.

HJBC

Amazon (NASDAQ:AMZN) investors have had a good start in 2023, as AMZN surged toward its pre-earnings highs before the expected pullback. Accordingly, AMZN is still up nearly 20% from its early January bottom as investors returned to battered consumer discretionary stocks in 2023.

After posting a mixed FQ4’22 report, and highlighting further struggles for AWS in FQ1’23, investors who chased its recent highs have likely bailed out, fearing a further slowdown in Amazon’s most critical profitability driver.

Hence, investor positioning has likely shifted slightly more cautiously after the rapid recovery from its recent lows. Despite that, we believe those lows will probably not be revisited, with risk-on sentiments back in full view.

Still, it doesn’t mean that AMZN is ready to retake its 2021 highs, as it’s still facing significant macro, consumer spending, and efficiency challenges. However, we are confident that most of these challenges have been priced in at its January lows, as reflected by its NTM EBITDA multiple, well below the two standard deviation zone under its 10Y average.

Hence, what could help drive a further AMZN recovery from the current levels, sending the bear fleeing to the hills?

All eyes will still be on AWS. Why? According to Trefis, AWS accounts for more than 55% of its sum-of-the-parts (SOTP) valuation. Hence, it’s easy to understand why AWS will need to improve its performance further to lift investors’ sentiments over AMZN moving ahead.

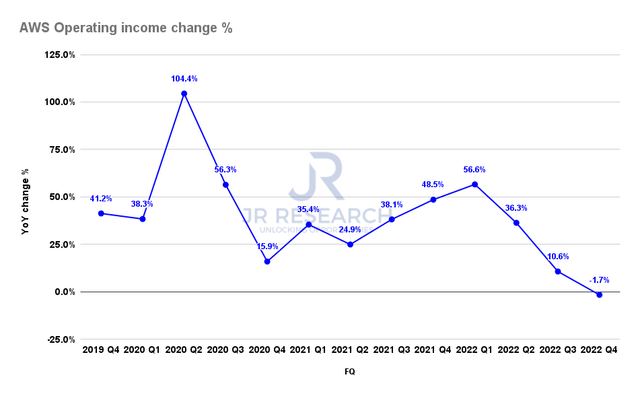

AWS operating income change % (Company filings)

With AWS posting a -1.7% growth in its operating income for FQ4, investors will want to know whether an inflection point could appear soon. However, management’s commentary at its FQ4 earnings call suggests that Q1’s operating performance could worsen, with revenue growth in the “mid-teens.”

It’s down markedly from FQ4’s 20% YoY growth for AWS, as Amazon’s outlook likely attempted to reset investors’ expectations ahead of time to “prevent” a nasty surprise down the road.

Despite that, the critical driver for AMZN’s SOTP valuation still has strong underpinnings as the leading hyperscaler, given its scale. However, AWS is not immune to the macroeconomic headwinds, which drove companies to cut back on enterprise IT spending in the near term, including cloud spending.

Notwithstanding, we believe green shoots of recovery could be over the horizon for investors. Company CEOs were worried about a broad downturn and judiciously pulled back spending.

However, the economy could dodge a significant recession, even as the Fed remains hawkish. Even though a mild recession could occur, the duration might not be debilitating to cause the resilient job market to collapse. Even Atlanta Fed President Raphael Bostic remains hopeful of engineering a soft landing, despite pressure to keep rates “higher for longer.”

We believe investors need to consider a critical commentary by CEO Andy Jassy in the earnings call. He accentuated:

One of the advantages that we’ve talked about since we launched AWS in 2006 of the cloud, which is that when it turns out you have a lot more demand than you anticipated, you can seamlessly scale up. But if it turns out that you don’t need as much demand as you had, you can give it back to us and stop paying for it. And that elasticity is very unusual. It’s something you can’t do on-premises, which is one of the many reasons why the cloud is and AWS are very effective for customers. We have a very robust, healthy customer pipeline, new customers, migrations that are set to happen. (Amazon FQ4’22 earnings call)

So, it’s pretty clear that Jassy articulated that if business leaders don’t expect the downturn to be as bad as they anticipated (planning for the worst but hoping for the best), AWS could recover pretty quickly.

With its operating income down YoY, we believe AWS’ inflection point is closer to the bottom than the top. Furthermore, market operators have likely shifted their sentiments positively and no longer held the conviction that we could be in a debilitating recession.

Bloomberg reported recently that fund managers had covered a significant extent of their bearish positions, with positioning now in line with long-term averages. We also highlighted in our service in October 2022 that:

Money managers are sitting on the highest levels of dry powder waiting to be deployed in twenty years…yes, twenty years. (October 19 daily update – Ultimate Growth Investing)

Hence, fund managers have likely deployed that dry powder, convinced that we would not likely fall into a deeper downturn than what the pessimistic media and some market strategists are telling us.

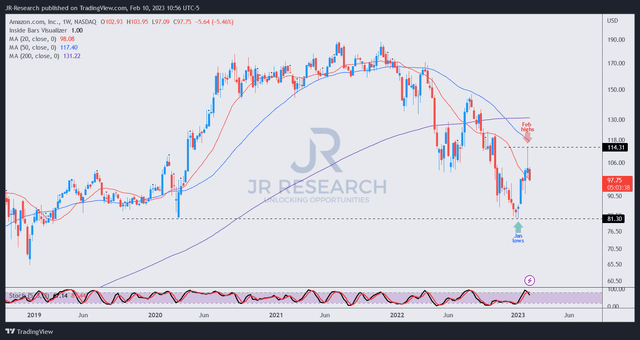

AMZN price chart (weekly) (TradingView)

AMZN price action is not ideal, with the bull trap hammering investors who added at its February highs still nursing their wounds.

However, with the market back to risk-on, and AWS potentially inflecting upward in H2, Amazon’s operating performance could recover faster than expected, driving more investors back to the fold.

Therefore, we believe AMZN is still in the early stages of a medium-term recovery.

As such, investors should remain confident about buying dips or weakness as the broad market pulls back.

Rating: Buy (Reiterated).

Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Are you looking to strategically enter the market and optimize gains?

Unlock the key to successful growth stock investments with our expert guidance on identifying lower-risk entry points and capitalizing on them for long-term profits. As a member, you’ll also gain access to exclusive resources including:

-

24/7 access to our model portfolios

-

Daily Tactical Market Analysis to sharpen your market awareness and avoid the emotional rollercoaster

-

Access to all our top stocks and earnings ideas

-

Access to all our charts with specific entry points

-

Real-time chatroom support

-

Real-time buy/sell/hedge alerts

Sign up now for a Risk-Free 14-Day free trial!