Summary:

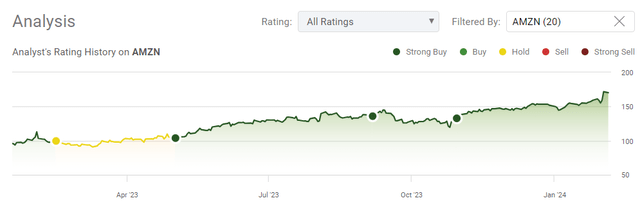

- Amazon’s shares have experienced a significant turnaround, doubling in value over the past 14 months and showing potential to reclaim all-time highs in 2024.

- The company’s Q4 earnings were positive, with strong contributions from its North American and international business segments.

- While there are risks to Amazon’s investment thesis, such as macroeconomic changes and competition, the company’s strong performance and expansion in operations, particularly in AWS, are bullish indicators.

FinkAvenue

What a difference a year makes. Shares of Amazon (NASDAQ:AMZN) have taken a round trip from making its all-time high around $186 in July of 2021 to falling by roughly 55% by the end of 2022, and then doubling over the past 14 months. In the spring of 2023, I was concerned about AMZN’s input costs and margins, causing me to become neutral on the stock. My concerns were quickly alleviated during the Q1 2023 conference call as the North American business segment started contributing to the bottom line again, and their international business significantly reduced the amount of money it was losing. AMZN operates at a thin margin, and falling under 5% was concerning for me. AMZN’s Q4 earnings were extremely positive, in my opinion, and I think there is a path to reclaim all-time highs in 2024 while possibly making a run on $200 per share. AMZN maintains a double-digit operating margin, generating more free cash flow (FCF) than it ever has, while continuously expanding its top-line.

Following up on my previous Amazon article

On October 30, I wrote an article on AMZN (can be read here) where I discussed the transformation it had undertaken and how shares looked inexpensive. I went through the operational improvements AMZN had produced while looking at how the changing macro environment was bullish for AMZN shares. I am following up on my investment thesis now that we have the full 2023 fiscal year results, as I am still very bullish on AMZN and think it can reclaim its all-time highs in 2024.

Risks to my investment thesis on Amazon

AMZN is synonymous with e-commerce and cloud computing. The fact that AMZN generated $574.76 billion in revenue for its 2023 fiscal year doesn’t mean it is impervious to macroeconomic changes or discretionary spending dynamics. We saw AMZN fall on hard times throughout 2022 and shares got cut in half, coming off a period when many thought stocks would just continue to climb higher. While AMZN looks to have turned the corner, it still faces challenges that investors should be aware of.

AMZN fell to a sub-5% operating margin during Q4 of 2022 as inflation was running hot and commodity pricing was expensive. Currently, the economy is strong, but elevated levels of unemployment could deal a blow to the strong GDP growth that has occurred. The majority of AMZN’s revenue comes from outside of the AWS segment, and a slowing economy could cause AMZN’s growth and margins in its traditional businesses to deteriorate. AMZN also faces steep competition from Microsoft (MSFT) in cloud computing, while Alphabet (GOOGL) is trying to close the gap between Google Cloud and AWS. Traditional retail is also trying to figure out how to compete with AMZN and is doing everything they can to become more attractive to customers and offer solutions to rival AMZN. If we experience a slowdown in GDP and higher levels of unemployment, it could directly impact AMZN’s revenue and margins. AMZN isn’t necessarily an inexpensive stock, so for my bull thesis to play out, it needs to benefit from continued momentum that will be fueled by a stronger operating environment.

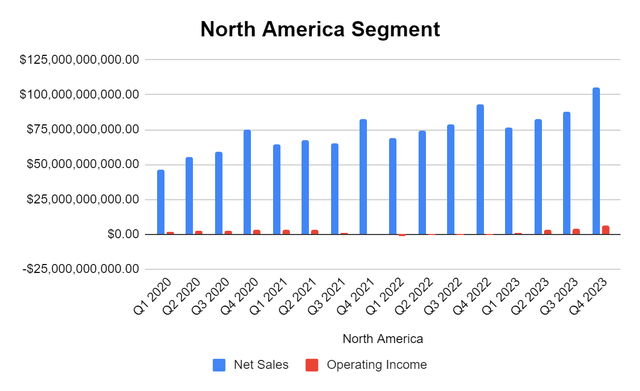

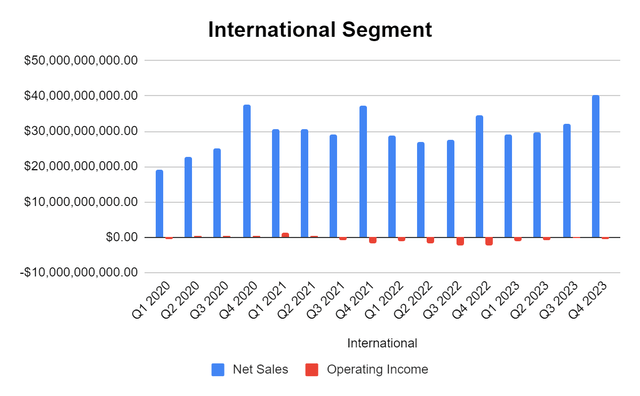

Amazon delivered strong Q4 results and I am still very bullish

Everything just got better in Q4 of 2023, and its fiscal year was a large success. AWS has been the profit center for AMZN, but the key to its success has been the North American and international business segments. This isn’t because they were more profitable than AWS, because they weren’t. It’s because North America contributed to the bottom line, and the International segment lost significantly less money YoY in 2023. In 2022, the North American segment generated $315.95 billion in revenue but produced -$2.85 billion in operating income. In 2023, AMZN turned things around, and the North American segment increased its revenue by 11.7% to $352.83 billion while growing its operating income by $17.73 billion to $14.88 billion. The round trip from negative operating income to generating almost $15 billion in profits is a significant boost for AMZN’s operations. On the international side, in 2022, it generated -$7.75 billion of operating income, which was a drastic blow to its overall profitability. In 2023 the International business did significantly better and closed the gap between losing and making money. The International operating income improved by $5.09 billion, as it only lost -$2.66 billion in 2023.

AMZN continues to expand its operations as it broke records in Q4 with its Black Friday and Cyber Monday holiday shopping events. Customers purchased more than one billion items over the 11 days that AMZN ran holiday deals. I think the more impressive aspect is that customers in the U.S. ordered more than 500 million items from independent sellers. This is important because independent sellers are typically smaller businesses, and it goes to show that AMZN’s marketplace continues to be the pinnacle for reaching a broad customer base. The other aspect that separates AMZN from its competitors is its supply chain. Through Prime, AMZN delivered more than 7 billion items throughout 2023 that arrived either the same day or the next day. There are more than 110 U.S. metro areas that are eligible for same-day delivery from AMZN. The amount of items delivered the same day or overnight increased by 65% YoY in Q4. Delivery speed can be the final decision of where a consumer will order from, and it’s unlikely that any of its competitors will be in a position to match AMZN’s logistical proficiency.

Steven Fiorillo, Amazon Steven Fiorillo, Amazon

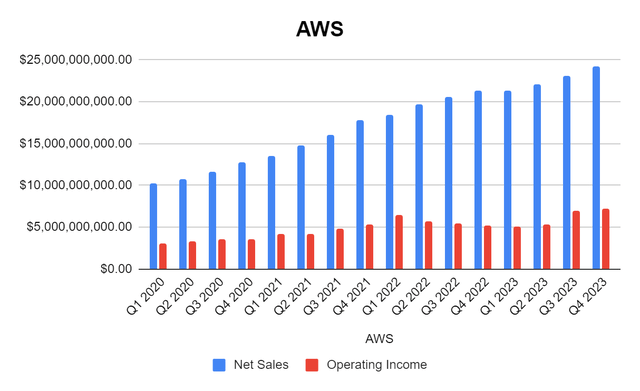

AWS is still the crown jewel and the reason AMZN trades at a tech multiple rather than a consumer staple multiple. The AWS infrastructure expanded as AMZN launched AWS Canada West and the AWS European Sovereign Cloud, which is an independent cloud for Europe. AMZN closed out 2023, with AWS having 105 availability zones within 33 global geographic regions. Their plans are to add 12 additional zones throughout four regions. AMZN provided details about their expansion into artificial intelligence as they provided Amgen (AMGN) the tools to create generative AI tools to drive efficiencies throughout their medicine segment. Several of AMZN’s customers are utilizing their proprietary AI chips, which AMZN estimates have 40% more price performance than other X86 alternatives. AMZN is building custom AI training chips and dozens of generative AI applications to solidify AMZN as a customer-first business further. AMZN introduced Rufus which is trained on AMZN’s product and customer data and is a shopping assistant. AMZN is at the forefront of how technology will advance as Rufus allows customers to interact with technology through conversation. From a shopping aspect, this will allow customers to ask precise questions and have results at their fingertips with an analysis of why these products fit their needs. Eventually, I see this technology transcending AMZN’s internal structure as it should become an offering through AWS for their clients.

This is very bullish for AWS as we have seen continuous adoption and expansion in its cloud offerings. Over the past year, AWS has grown its revenue by 13.31%, which is an increase of $10.66 billion, as its operating profit increased by 7.84% to $24.63 billion. I am expecting that growth in AWS will continue as new product offerings are embedded within AWS services. An example of this is how AWS and Salesforce (CRM) continue to expand their partnership. CRM runs most of its cloud workloads on AWS, and its products are now available in the AWS marketplace. This allows the end user to bring AWS data into CRM products and expands the data and AI integrations between the two products. This is a key differentiator for its competitors, and as we enter into a rate-cutting cycle, the cost of capital will decline, and businesses will be more inclined to expand.

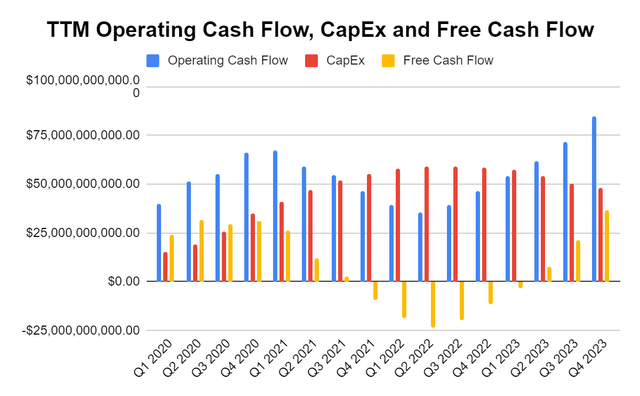

From a numbers perspective, AMZN just reported their largest amount of annualized FCF at $36.81 billion on a TTM basis. During 2022, AMZN continued to allocate what seemed to be extraordinary amounts on CapEx during a period where the amount of cash from operations they were producing was diminishing. Shareholders endured five consecutive quarters of cash from operations declining on a TTM basis while the amount of CapEx being spent was at all-time highs. The critical investments to their infrastructure have certainly paid off as AMZN is no longer FCF negative and significantly increasing the amount of FCF they are producing. As input costs decline and AMZN elevates its level of efficiency, the amount of FCF it is producing could continue to increase. Today, AMZN is trading for roughly 54x their FCF, which is significantly less than the 132x Tesla (TSLA) trades at. We have seen four consecutive quarters of CapEx on a TTM basis decline, and if these trends continue, AMZN could be generating more than $50 billion of FCF in 2024.

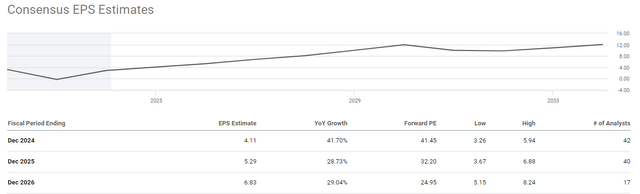

From a valuation perspective, I can’t remember when AMZN traded at these levels. The amount of FCF they are producing can allow them to buy back shares and enhance their future EPS. AMZN is trading at 41.45x 2024 earnings, but looking forward, AMZN trades at 32.2x 2025 earnings and 24.95 2026 earnings. AMZN has already predicted that its Q1 revenue will grow between 8-13% while its operating income could double YoY in Q1 with a range of $8-$12 billion. AMZN could start 2024 off with a bang, and depending on what they produce in Q1, these estimates for EPS could be revised. If AMZN continues to maintain and increase profitability, I believe it will follow its peers and implement a buyback program to reward shareholders. On the earnings call, management didn’t confirm that buybacks would be on the table, but in the Q&A session, they certainly indicated they discussed the capital structure policies and left the door open.

Conclusion

I am still very bullish on AMZN and think that shares can not only reclaim their all-time highs in 2024 but also reach $200. AMZN is at an inflection point, and there is a real possibility that as long as the macro environment holds up, AMZN will have another strong year of increased profitability. A declining rate environment will be strong for AWS and AMZN margins to continue to improve. I think there is a lot to like about the AMZN story as the cash flow continues to expand and its valuation improves. North America is expanding, AWS continues to drive profitability, and the International segment is losing less. AMZN could continue to see margin expansion as AI creates efficiencies, and we could see elevated spending on the AWS side as more generative AI tools are offered through AWS services. I believe AMZN will get less inexpensive and drive the stock higher throughout 2024.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN, GOOGL, TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. The investments and strategies discussed within this article are solely my personal opinions and commentary on the subject. This article has been written for research and educational purposes only. Anything written in this article does not take into account the reader’s particular investment objectives, financial situation, needs, or personal circumstances and is not intended to be specific to you. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters. Just because something may be an enticing investment for myself or someone else, it may not be the correct investment for you.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.