Summary:

- I believe Amazon’s cash flow problem is even worse than on the surface when its financial leases are considered.

- The key conclusion from this analysis is that its lease obligations are significant, real, and reoccurring expenses.

- Our usual impression of leases being one-time and minor expenses does not apply in Amazon’s case.

fatido/iStock via Getty Images

Investment thesis

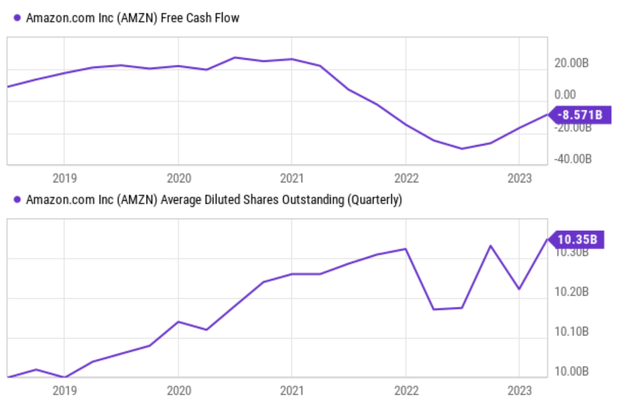

It is common knowledge that Amazon (NASDAQ:AMZN) has been bleeding cash for a few quarters by now (see the chart below). Its Free Cash Flow (“FCF”) nosedived since 2021 from positive levels (more than $20B) into the red and remained there. In the meantime, the company has also issued a few more common shares. Thus, the deterioration is even worse when interpreted on a per-share basis. A variety of factors have caused the cash flow problem, including changes in the company’s operating expenses, capital expenditures, COVID impact, and investment activities.

The thesis of this article is to explain why its cash flow problem is even worse than the accounting FCF that is shown in the chart. I believe the typical definition of FCF (operating cash flow minus CAPEX) substantially underestimates its CAPEX obligations and therefore overestimates its FCF. And to understand AMZN’s finances correctly, it is crucial to consider the impact of its lease accounting, as we will dive into immediately next.

AMZN’s lease obligations

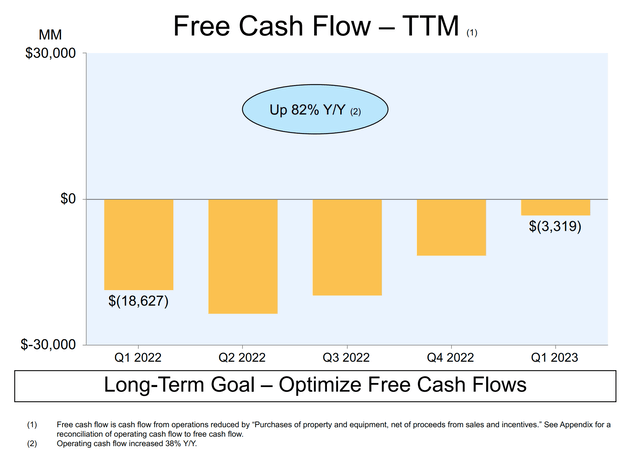

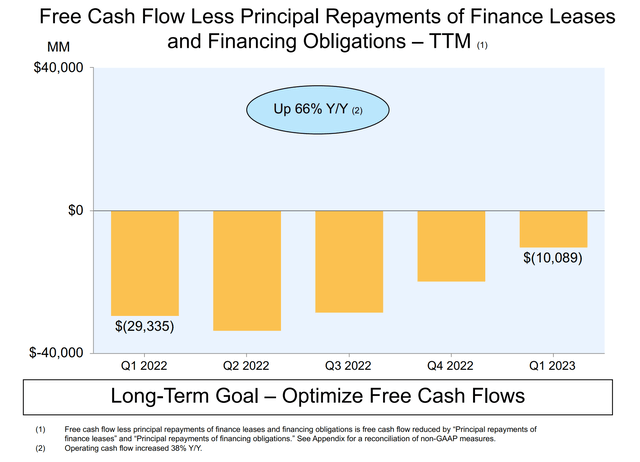

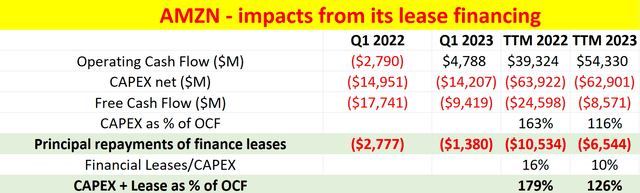

AMZN reports two versions of its FCF, shown in the next two charts. And as seen, the inclusion or exclusion of lease obligations in FCF calculations can significantly impact the reported figures.

The first version of FCF excludes lease obligations, which is the traditional approach that we are more familiar with. This calculation focuses solely on operating cash flow minus capital expenditures, and this version reported a negative $3.3B of FCF for its most recent quarters (“MRQ”).

The second version of FCF includes lease obligations, also known as lease-adjusted FCF. This calculation takes into account the impact of lease expenses, such as lease payments for buildings, equipment, and other assets. And this version reported a negative $10.1B of FCF for its MRQ, far worse than the previous version.

As investors, we, therefore, need to understand these concepts and interpret them correctly to help with our investment decisions. And that is what we will do next.

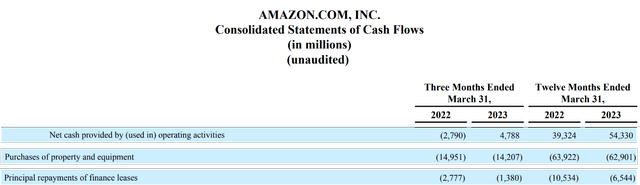

Amazon 2023 Q1 Earnings Report Amazon 2023 Q1 Earnings Report

Why is lease accounting important for AMZN?

To interpret its FCF, we will need to understand the magnitude of leases in AMZN’s overall financials and why AMZN needs these leases.

First, the magnitude. In the analysis of most companies, the capitalization of leases typically has a minimal impact (and that’s why most of us never bothered with lease obligations). However, AMZN is different. As seen from its cash flow statement below, its lease obligations consistently represent a large portion of its operating cash flow (“OCF”) and also its CAPEX expenditures. The second chart expresses these numbers in percentages, so it’s easier for us to grasp. As seen, its CAPEX exceeded its OCF by 63% in 2022 and 16% in 2023 (which is just another way of showing its negative FCF). You can also see that its financial leases represent about 16% and 10% of the total CAPEX expenses in 2022 and 2023, respectively. By no means a negligible amount.

Amazon 2023 Q1 Earnings Report Author Based on Amazon 2023 Q1 Earnings Report

Then does Amazon really need such large leases on an ongoing basis? Would it be possible for AMZN to operate its business without them? Unfortunately, my view is no.

Most of us get the impression that leases are one-time and non-reoccurring expenses, which is true in many cases (like leasing a moving truck only when we need it). However, Amazon’s substantial lease obligations are primarily driven by its extensive logistical operations and infrastructure requirements. The company operates a vast network of fulfillment centers, data centers, and distribution facilities to support its e-commerce business, and cloud services (Amazon Web Services). And its lease obligations are an integrated part of these vast networks now. Take its AWS as an example. AWS heavily relies on leased equipment for its infrastructure needs. As long as Amazon intends to maintain its AWS business, I see it as a necessity for AMZN to keep renewing or replacing the leased equipment when the lease agreements expire.

Other risks and final thoughts

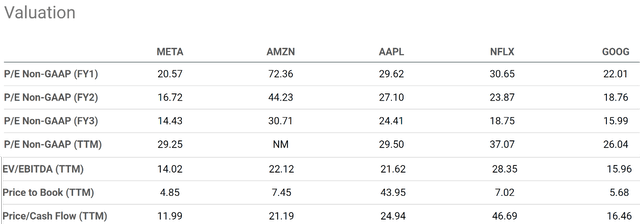

There are both downside and upside risks to my thesis. First, let’s look at the downside risks. Besides the negative cash flow problem, investment at its current price also carries substantial valuation risks. As you can see from the following table, it is one of the more expensively valued stocks even among the FAANG group stocks in terms of all the common metrics such as P/E ratio and P/cash flow ratio.

And bear in mind that the impacts of the lease obligations supplication are not included in these common valuation metrics. Thus, its valuation can be even higher than what’s on the surface. The company is also facing supply chain pressures and some operating challenges caused by macroeconomic disruptions (such as inflation, high fuel prices, etc.). Amazon has reduced its workforce and implemented other cost-cutting measures. The effectiveness of these measures is yet to be seen.

Upside risks. There are many growth catalysts at AMZN, which are thoroughly discussed by other SA authors. Here, I will just focus on the positive of using leases to provide a balanced view since my article so far has been emphasizing the “obligation” aspect of it. The heavy use of leases offers a few key advantages for AMZN, including flexibility, scalability, the possibility for rapid expansion, and also experimentation with pilot projects. The use of leases allows Amazon to access the necessary assets without incurring the upfront costs of purchasing and owning them outright.

In the end, the focus of this article is not to argue whether the heavy reliance on leases is a good or bad thing – which is an extremely interesting topic in itself. But we will leave it for another day. The focus is to help potential investors correctly understand and interpret its financials. And my key message is that its lease obligations are significant, real, and reoccurring expenses. Our usual impression of leases being one-time and minor expenses does not apply in this case. I see many of the forces that caused its negative cash flow in 2021 still in play, and the lease obligations are one of them. As such, I am maintaining my neutral view of the stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.