Summary:

- Today, I will walk you through where we’ve been with Amazon stock and where we’re going.

- That is, we will discuss my thesis for Amazon that underlay my conviction in the business over the last year or so.

- Then, we will expand this thesis via an analysis of what I believe to be the most noteworthy component of Amazon’s business: its services segment.

- I will value Amazon’s services segment for you, providing key assumptions, such as margin structures that are not immediately obvious.

- In short, I like Amazon at $142/share, though I don’t particularly adore it at these levels.

Jeff Spicer/Getty Images Entertainment

At Long Last

In order to introduce my work on Amazon.com, Inc. (NASDAQ:AMZN), I ask that you allow me to spend a moment considering some adjacent ideas that I’ve been sharing with you in recent months (and over the last three to five years) in this very brief introduction.

I’ve been sharing recently that I, to some degree, have been basking in the results of my larger market cap investments, again, the theses of which I’ve shared with you recently and a handful of time over the years.

Amazon, Meta Platforms (META), and Chipotle (CMG) each produced stellar results in their most recent quarters, and these results represent my investment theses (ours, if you bought them with me) coming to fruition after a terribly grueling couple years of owning these businesses.

Notably, each thesis and the materialization thereof can be summarized via just one financial metric respectively:

- Amazon generated $15B in free cash flow in Q3 2023, or $60B in annualized free cash flow. At 25x EV/FCF, Amazon should trade at about $1.5T, which is the fair value we’ve been assigning the company, even through the depths of its declines in late 2022.

- Meta reported a 52% operating margin for its core Family of Apps business. This is the margin of an extremely dominant business, which has been my description of the company over the years and even through the depths in late 2022. I can think of only Visa (V) as a company that sustainably generates a 50%+ operating margin as Meta can.

- Chipotle reported an operating margin above 16% for the second straight quarter, which I maintained would materialize even through the depths of the 2022 selloffs that the company experienced.

In short, each of these businesses experienced substantial margin expansion (and by extension profitability expansion) over the last 6-12 months, justifying my decision to weight these companies so heavily as their share prices seemed to have no floor in 2022.

Let’s now begin a dedicated review of Amazon’s Q3 2023, of my thesis for the company, and of the business broadly.

What Is Amazon Stock Worth?

To our shareholders: Our ultimate financial measure, and the one we most want to drive over the long-term, is free cash flow per share.

CEO Jeff Bezos, 2004 Amazon Shareholder Letter (emphasis added).

Over the last couple years, it’s been difficult for investors, myself included, to discern the value of Amazon. The company’s decision to operate at a loss for approximately 18 months led to doubts about the company’s ability to sustainably generate free cash flow.

In late 2022, I watched in awe as this doubt caused the share price to decline into the low to mid $80s/share. At the time, it viscerally felt as if there were no floor to Amazon’s share price, and its lack of profitability became a relatively unsettling prospect: “Should we really invest in a free cash flow negative business in this market environment?”

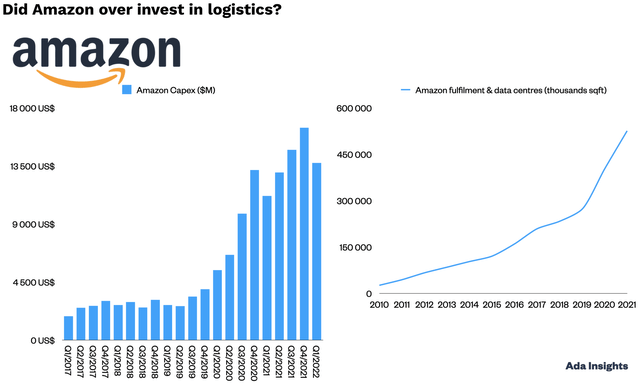

Amazon’s Reinvestment Cycle That Caused It To Run At A Loss In 2022. Blue Bars = Capital Expenditures.

Ada Insights

- Recall that free cash flow = cash from operations less capital expenditures.

- So as capital expenditures were soaring, Amazon was not generating cash flow, i.e., it was spending more than it was making.

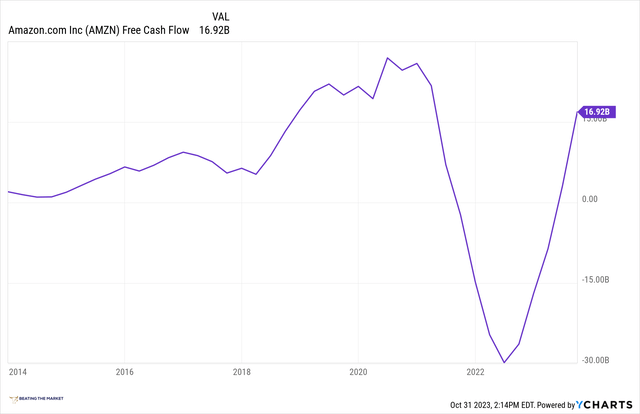

We Can See Amazon’s Negative Free Cash Flow, As An Inversion Of Above Chart, In The Chart Below

YCharts

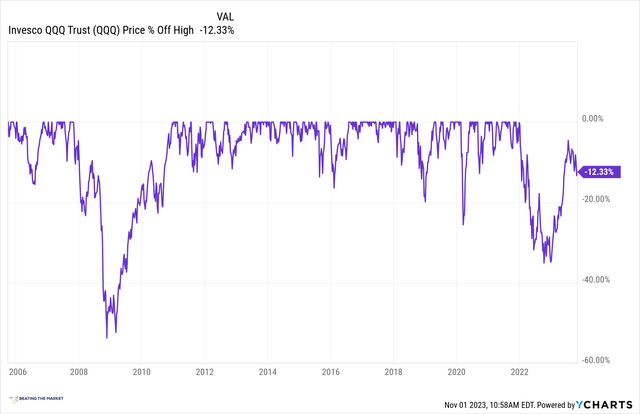

While Amazon’s negative free cash flow was, indeed, a bit unsettling as the Nasdaq (QQQ) experienced its worst decline since the Great Recession, I found the entire panic to be vastly, vastly too excessive.

The Nasdaq Recently Experienced Its Largest Decline Since The Great Recession

During late 2022, I would often remark something to the effect of, “Haven’t we already done this? Didn’t the market panic about Amazon’s ability to generate free cash flow in 2001/2002? Are we really doing this again?”

But, like the massive declines of all the best, young retail concepts over the last 50 years, e.g., Walmart (WMT) in 1973-1974, Lowe’s (LOW) in the mid 1980s, Amazon in 2000-2002, and MercadoLibre (MELI) in ’08-’09, history was, indeed, repeating itself yet again, as the market sent shares of Amazon down precipitously and investors questioned whether it would return to profitability quickly, if at all.

Of course, during that time, my central contention was that, instead of being fearful of Amazon’s lack of profitability, we should instead be fearful of just how scarily dominant the business had become over the last 30 years.

I reasoned that the market’s fear was precisely backwards. Amazon was not in a weakened state. Instead, it was the strongest it’d ever been!

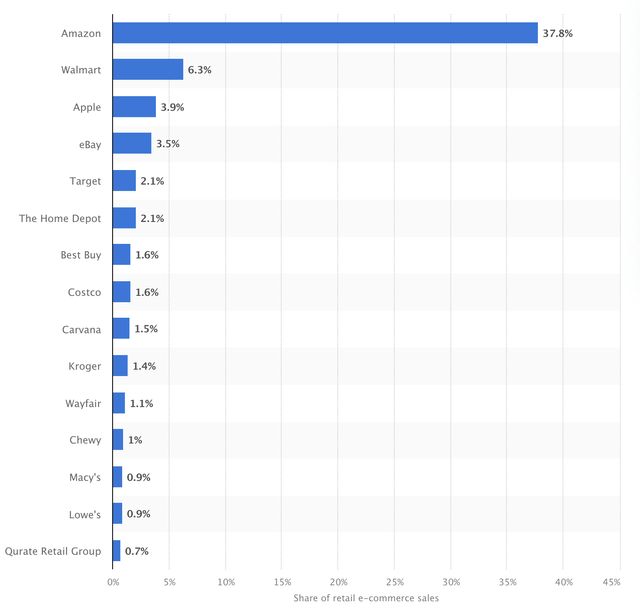

I reasoned that we, as a society, should be fearful of the fact that Amazon had created, in the retail and ecommerce industry and cloud computing industry, an overwhelmingly dominant set of businesses, with delivery speeds, scale, and efficiency that could not be matched.

That is, there was no profitability risk at ~$84/share. To quite the contrary, the real and most prominent risk was regulatory! (And we’ve seen this thinking come to bear recently.)

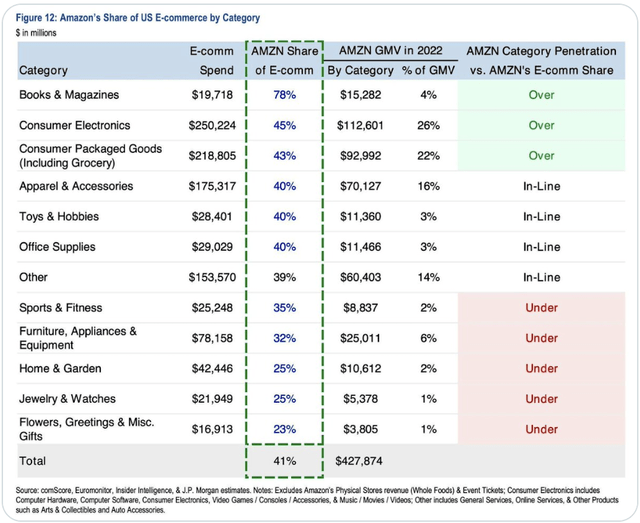

Amazon’s Incredible Dominance Of U.S. Ecommerce

LibertyRPF Newsletter

Market share of leading retail e-commerce companies in the United States as of June 2022

Shifting to free cash flow. On a trailing 12-month basis, free cash flow adjusted for finance leases was $20.2 billion, an improvement of $41.7 billion year-over-year. The largest driver of the improvement in free cash flow is our increased operating income which we’re seeing across all 3 of our segments. Key drivers of this improvement include reductions in our cost to serve, continued advertising growth and improved leverage on our fixed costs. We are also seeing improvements in working capital, notably with our inventory efficiency as we improve our inventory placement.

Brian Olsavsky, CFO, Amazon Q3 2023 Earnings Call (emphasis added).

With these contextualizing ideas as our foundation, let’s shift gears a bit here, and begin a consideration of the quantitative value of Amazon.

In Amazon’s 2004 master class of a shareholder letter, Mr. Bezos was correct in remarking that free cash flow per share was the fundamental driver of equity value over the long run, but he did not mention the other key variables associated with equity value creation (what buttresses share price value).

The four key variables to equity value are:

- How much free cash flow per share a business generates

- The durability, defensibility, and reliability of that free cash flow per share

- When that free cash flow will be received

- And our next best alternative (such as the 10 year treasury yield).

In the case of Amazon, market participants appear to have been overly focused on variables 1 (none at the time), 3 (perhaps not for a while), and 4 (rates were rising) throughout 2022, and they appear to have totally omitted a consideration of 2, which would have entailed a study of Amazon’s economic moats, which it has many, many of.

Had 2 been the focus, the value of Amazon would have been obvious to all market participants and the decline in its share price would not have been nearly as precipitous.

Distilling The Thesis

I’ve been a student of Amazon’s economic moats for many years, so I knew that there was a highly defensible set of cash flows that I could “pencil in” as Amazon eventually emerged from its investment cycle.

I specifically reasoned that Amazon’s business possessed the following moats:

- Brand (arguably the holy grail of economic moats)

- Network effects (more 3P sellers/more products = more buyers = more sellers/3P products = more buyers, and so on and so forth)

- Economies of scale (its logistics network has required three decades and, while I do not know the exact number, likely $100B+ in capital investment to create. Notably, as it builds out AI-powered, fully automated, robotically governed warehouses, this lead will continue to extend.)

- Embedding moats (I’ve often highlighted how difficult it is to switch data from AWS, and we’ve often discussed the incentives related to “bulk buying” from a cloud computing platform, which serves to lock customers into one cloud vendor predominantly.)

With an understanding of the economic moats Amazon possessed and in light of Amazon’s depressed valuation, I reasoned that we could distill the thesis to just the free cash flow per share that its digital ads and AWS businesses would produce over the long run, and we could invest based on that free cash flow per share.

Again, I reasoned that the free cash flow per share and associated margins could be penciled in because I started by understanding the economic moats that Amazon possessed.

I knew that the cash flows from its various lines of business would be highly defensible and highly reliable because its economic moats were so entrenched, so assuming future margins, while Amazon’s margins were negative, was not imprudent.

I also, as a student of the digital ads and cloud computing industry, knew what margins we should expect from these lines of business over time.

With these ideas in mind, I valued Amazon based solely on its digital ads business and its AWS business, which, today, generate $48B in annualized sales and $93B in annualized sales respectively.

You may review one version of that analysis here.

That said, today, I would like to revise this thesis a bit and incorporate Amazon’s entire “high margin service revenues” into my distilled thesis. Despite Amazon being up 30%+ in 2023, I believe it remains fundamentally undervalued, and still offers attractive returns, relative to its business risk, in the decade ahead, and I will demonstrate this idea for you today via an analysis of its services business.

Amazon Services: A Hulking $250B High-Margin Giant

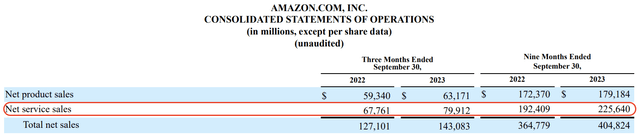

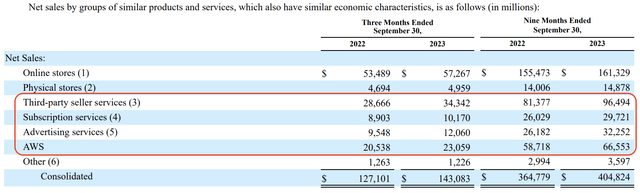

Amazon Services, depicted in the graphic just below, is comprised of all of Amazon’s very high-margin-revenue lines of business.

- Net sales include product and service sales. Product sales represent revenue from the sale of products and related shipping fees and digital media content where we record revenue gross. Service sales primarily represent third-party seller fees, which includes commissions and any related fulfillment and shipping fees, AWS sales, advertising services, Amazon Prime membership fees, and certain digital media content subscriptions.

As we read, Services includes AWS, digital ads, Amazon Prime membership fees, and its lucrative and scarily dominant 3P business, which is Amazon’s marketplace where sellers and buyers are matched, without Amazon itself selling/warehousing the products that the two parties exchange.

For a further breakdown, I invite you to review the data presented below:

Amazon 10-Q Q3 2023

While Amazon does not specifically report the aggregate profit margin of its services segment, we do have some clues as to where the margins of this segment will land long term. By understanding the industry margins of each segment, we can better estimate the value of Amazon’s Services business.

Specifically, we will model our assumptions based on the margin structures of:

- MercadoLibre’s Digital Ads business (70%-80% EBIT as reported by Meli’s management in Q3 2023)

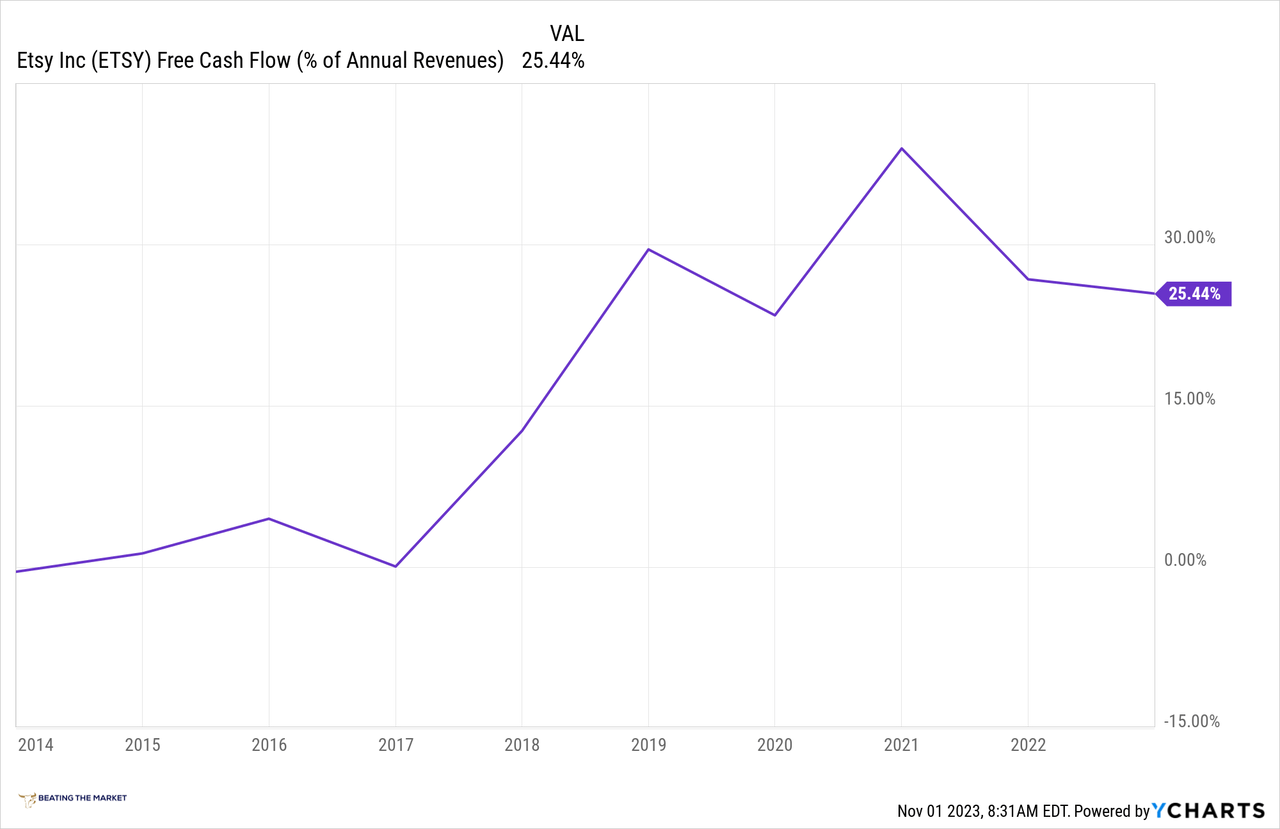

- 3P Marketplaces like Etsy (ETSY) and eBay (EBAY) (~20% free cash flow margins for each business)

- AWS has provided explicit guidance for AWS margins, though software industry margins can be employed as well (35% long run operating margins. Operating margins improved from 26% to 30%, Q2 to Q3 2023).

For instance, MercadoLibre often delineates the margin structure of its digital ads business, which is essentially identical to Amazon’s digital ads business.

I think advertising is beginning to scratch the surface of its potential. There’s room to increase the number of advertisers across many product categories, but obviously, as we grow into more and more categories. And equally important, as we grow our first-party business, which has a much higher attach rate of advertising in terms of percentage of GMV, that should also help. There’s room for increased engagement for advertising and all of this always driven by technology, so new formats and new positioning throughout our different ecosystems.

We’ve started experimenting with advertising in the Mercado Pago world and the Mercado Pago app. And we have other formats that we can launch going forward. So I think this continues to be an opportunity that we’re very enthusiastic about. And as I always say, is a very high margin one with EBIT margins in the high 70s, low 80s.

MercadoLibre Q2 2022 Earnings Call (emphasis added).

Additionally, analysts have speculated that Amazon’s 3P business may have a net margin of 20% or greater, which is in stark contrast to its ~5% net margin for its 1P retail ecommerce business. Considering Amazon is simply offering a digital marketplace on which buyers and sellers are programmatically matched, and from which Amazon generates a “take rate,” this exceptional net margin makes sense.

In this instance, the seller on Amazon’s platform is responsible for shipping, advertising, etc., of their products, and Amazon simply requires that they pay a fee for access to Amazon’s many millions of loyal customers.

The Free Cash Flow Margins Of Etsy, A Competing 3P Marketplace

YCharts

Its subscription services are comprised of its Prime Membership fees, which are also high margin sales, with the bulk of the true associated costs falling under its 1P business and fulfillment costs.

And, lastly, Amazon guided for 35% long term operating margins for its AWS business over the last 12 months, and, in Q3 2023, AWS’ operating margin grew from 26% in the prior quarter to 30% in Q3 2023.

Taken together, I believe we can conservatively model free cash flow (or net) margins for Amazon’s Services business, and, as I will demonstrate, Amazon’s Services segment alone is sufficient to justify an investment in Amazon.

Valuing Amazon Services

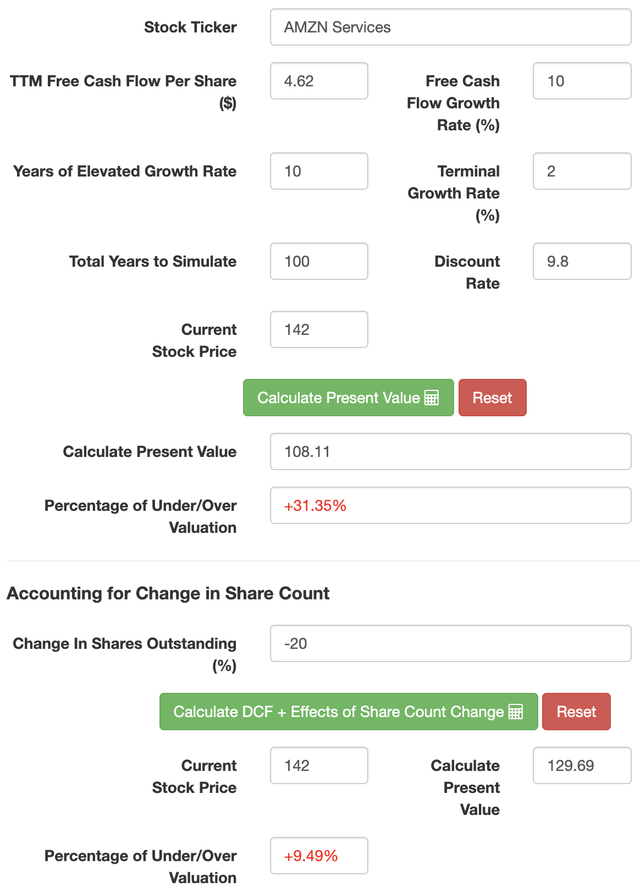

Below, you may review my assumptions for Meta:

- Notes that buttress assumptions:

- Amazon’s ads business likely generates 40%+ fcf margins, if not higher, based on MercadoLibre’s breakout of its digital ads margins

- Amazon’s 3P business has been estimated to generate 20% fcf margins, and this roughly aligns with other 3P marketplaces such as Etsy and eBay.

- Amazon has provided explicit long term margin guidance for AWS. It expects 35% operating margins, which roughly aligns with software/software infrastructure margins. This implies a free cash flow margin well above 20%.

- Amazon Subscriptions Services is inherently high margin as it mostly includes Prime Membership fees, and the costs thereof are baked into its product sales cost of goods sold.

|

TTM revenue [A] |

$250 billion |

|

Potential Free Cash Flow Margin [B] (conservative) |

20% |

|

Average diluted shares outstanding [C] |

~10.8 billion |

|

Free cash flow per share [ D = (A * B) / C ] |

$4.62 |

|

Free cash flow per share growth rate (conservative) |

10% |

|

Terminal growth rate |

2.5% |

|

Years of elevated growth |

10 |

|

Total years to stimulate |

100 |

|

Discount Rate (Our “Next Best Alternative”) |

9.8% |

And here are the results of the valuation exercise:

L.A. Stevens Valuation Model

Notably, I assumed a 20% reduction in shares outstanding, which should be achieved, granted Mr. Bezos follows the logic I shared here.

In my estimation, each day that Amazon does not routinely buy back shares, as it generates $60B+ in annualized free cash flow, is another day of shareholder value destruction.

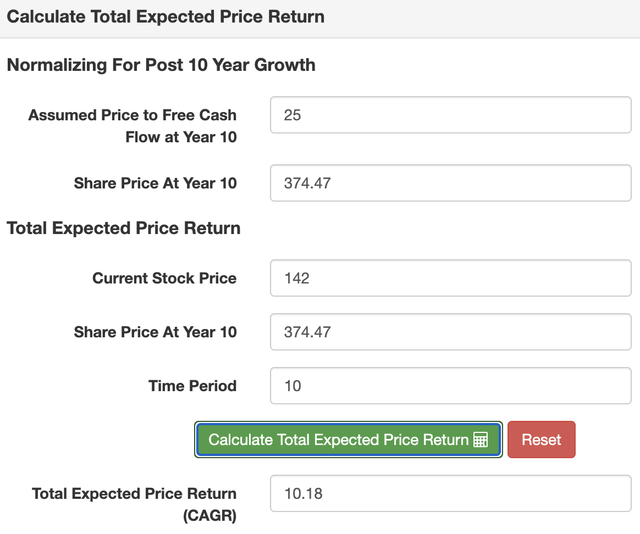

L.A. Stevens Valuation Model

As we can see, using only this segment and conservative estimates for future growth and profitability (free cash free cash flow margin could very well come in closer to 30%, or perhaps higher), we’re set to generate a healthy return.

Risks

The central risk to my thesis is that Amazon’s services sales do not grow at 10% annualized over the next 10 years.

That said, I baked in what I believe to be substantial conservatism in Amazon’s free cash flow margins for its services segment, so I believe that risk is being mitigated in buying Amazon at this valuation.

Thank you for reading, and have a great day!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN, META, CMG, MELI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.