Summary:

- It may be easy to miss, but Amazon.com, Inc. stock has doubled over the past year.

- The company has shown resilient revenue growth and impressive margin expansion.

- Wall Street continues to overlook the dominant positioning of e-commerce operations, which is arguably the best business in the world.

- I rate Amazon stock a buy as I continue to see an attractive upside relative to the risk.

Cooper Neill/Getty Images Sport

Amazon.com, Inc. (NASDAQ:AMZN) seemingly does not get as much attention as other mega-cap tech names recently, due to avoiding the extremes on both fundamental performance and valuation. AMZN is not the cheapest mega-cap name, especially based on near-term financial metrics, and is seeing more moderate top-line growth courtesy of its large revenue base.

Yet investors should not ignore AMZN, as it remains arguably one of the strongest business models in the world with a competitive advantage that continues to grow with every dollar reinvested back in the business. AMZN might not offer a direct upside to generative AI hype, but the company has shown that it can boost profit margins at will, and this should lead to long-term multiple expansion. I rate the stock Buy on the attractive risk-reward proposition.

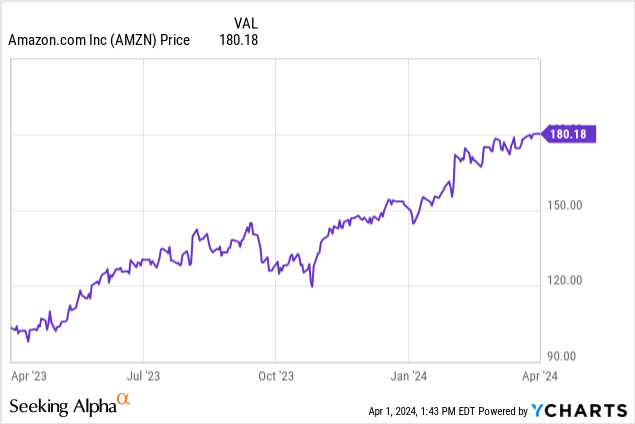

AMZN Stock Price

Amidst a rise in frothiness in the tech sector, many may have overlooked that AMZN has nearly doubled over the past year.

I last covered AMZN in January, where I rated the stock a Strong Buy due to the company showing dramatic margin expansion. I see continued upside ahead, as the company remains in an enviable position of being able to continually invest profits back into its infrastructure at high rates of return.

AMZN Stock Key Metrics

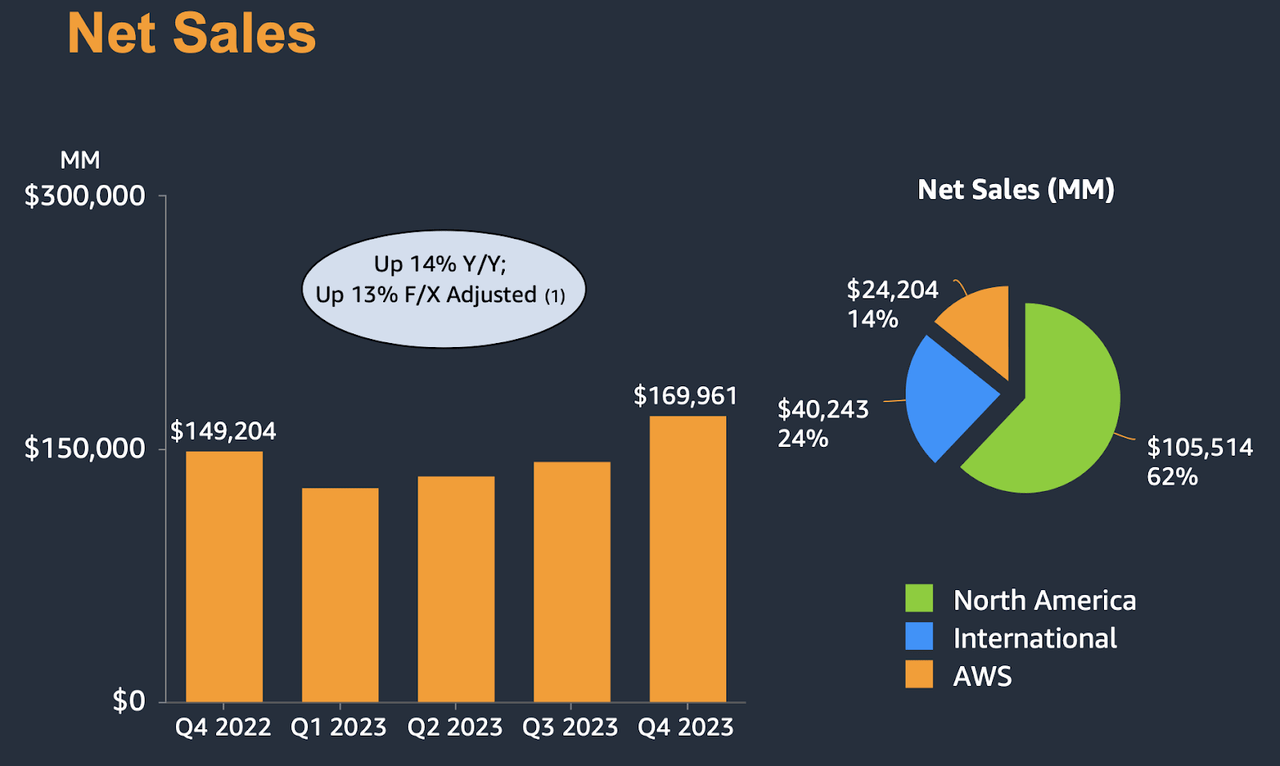

In its most recent quarter, AMZN generated 14% YoY revenue growth to $169.96 billion, surpassing guidance for between $160 billion and $167 billion.

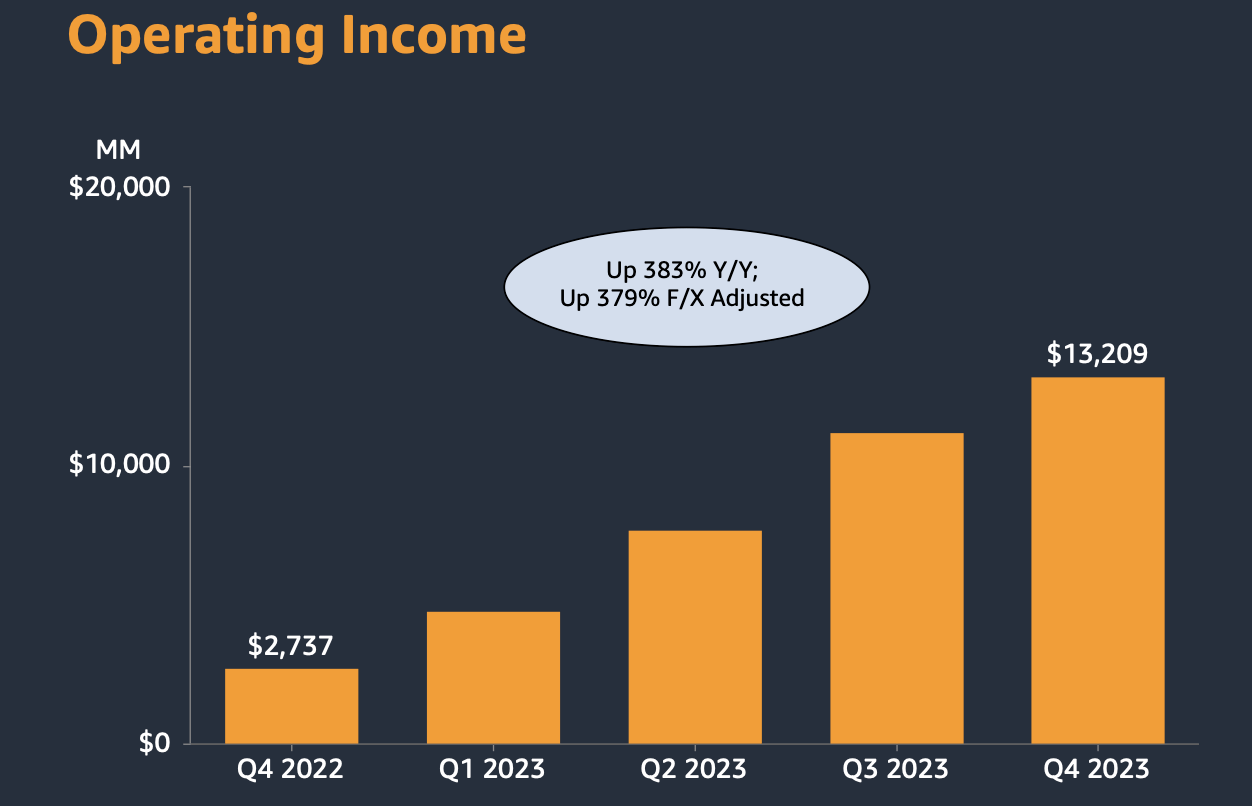

While the 1% QoQ acceleration in top line growth was impressive for a company of this size, I suspect that Wall Street was more impressed by the profit generation, as operating income soared 383% YoY to $13.2 billion, comfortably surpassing guidance for between $7 billion and $11 billion.

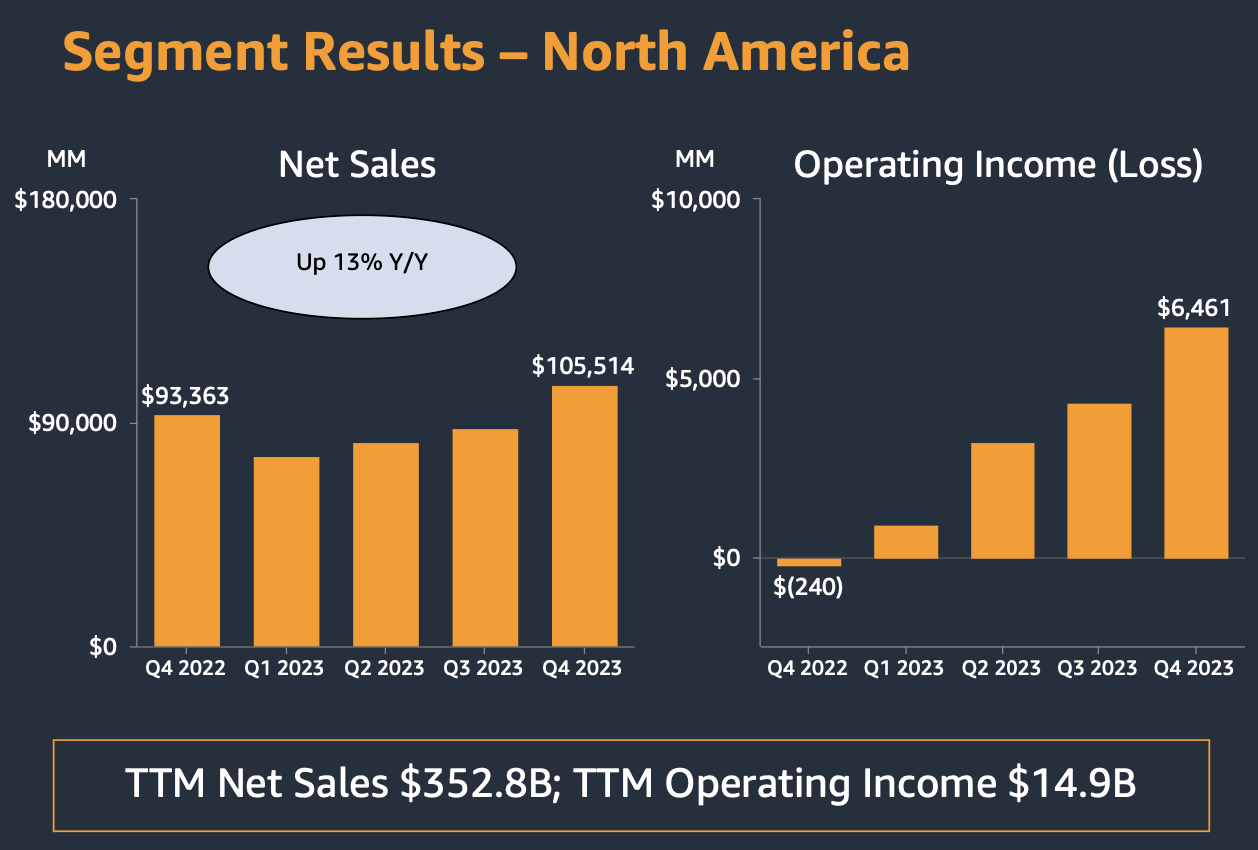

2023 Q3 Presentation

AMZN drove its margin expansion primarily by seemingly “deciding” to show that it can drive profitability at its e-commerce operations. The North American operations saw operating income swing from negative $240 million to $6.5 billion, making 7 consecutive quarters of margin improvement.

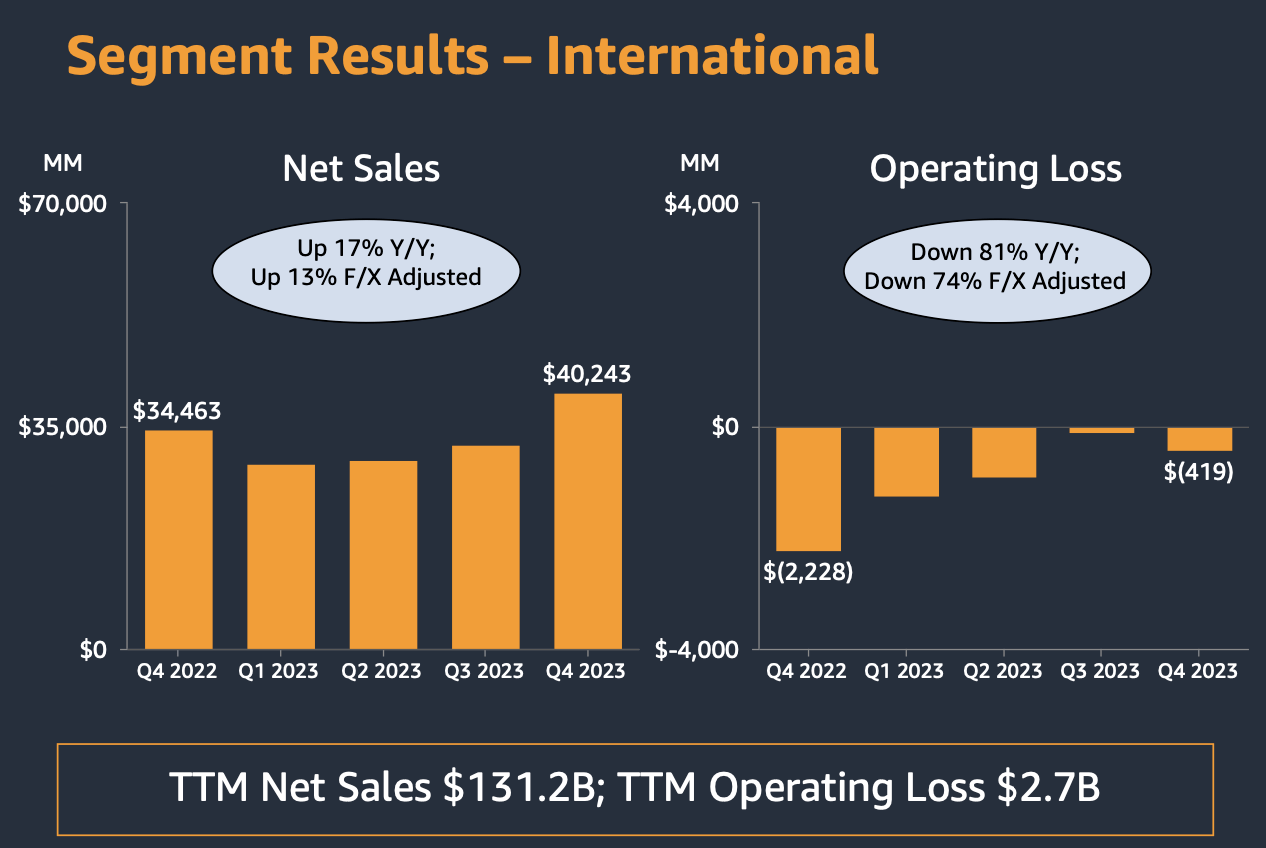

2023 Q3 Presentation

AMZN also reduced its losses in its International segment, which has much of its loss-generating growth markets.

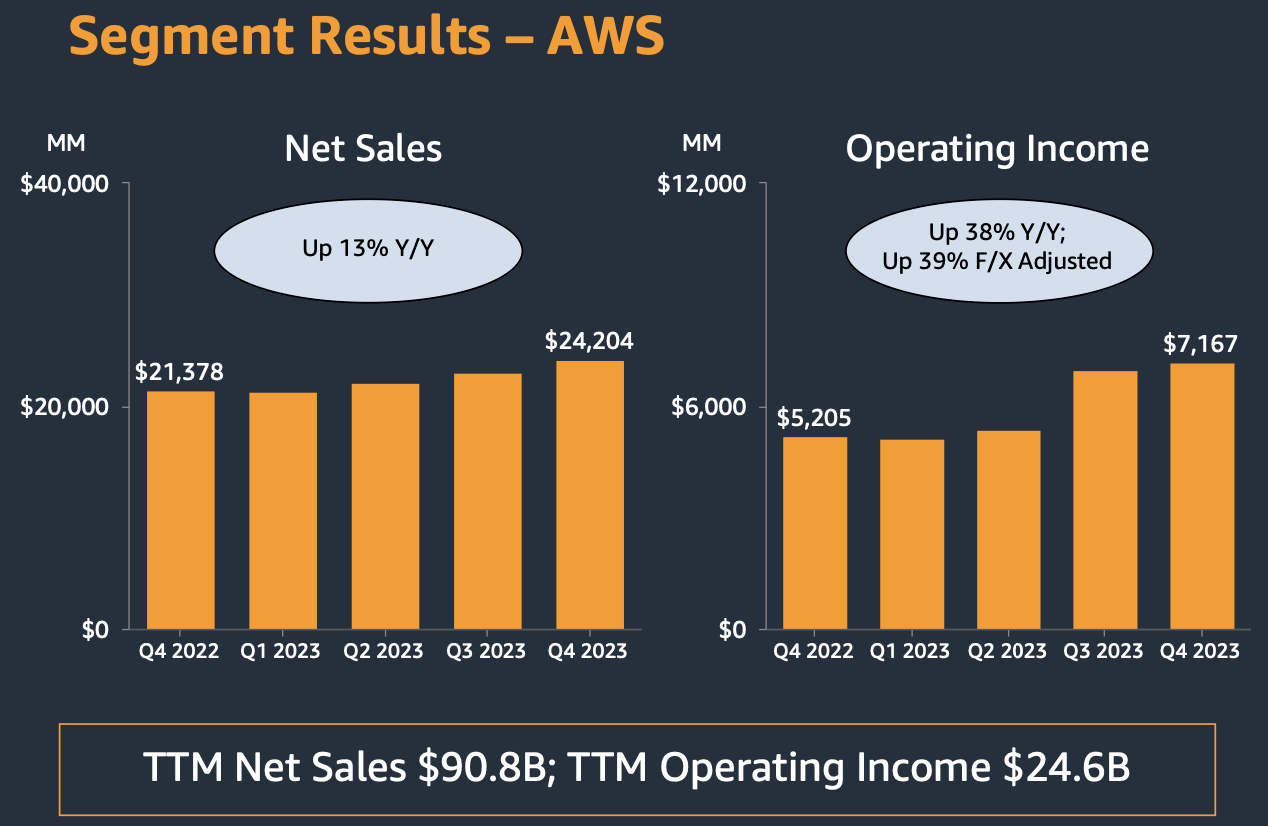

2023 Q3 Presentation

As usual, Amazon Web Services (“AWS”) was a cash cow and it saw operating margin grow by over 500 bps YoY. While much of Wall Street might still be of the long-standing view that AWS is subsidizing the e-commerce operations, it is worth noting that North America’s operating income is not far off from the $7.2 billion figure generated by AWS.

2023 Q3 Presentation

AMZN ended the quarter with $86.8 billion of cash versus $58.3 billion of debt, representing a $29 billion net cash position. That is a huge jump from the $2.9 billion net cash position in the third quarter and was due to the company’s astounding $28 billion free cash flow generation in the quarter. Subsequent to the end of the quarter, AMZN invested $2.75 billion in the AI startup Anthropic to bring its investment in the name to $4 billion. Wall Street does not seem to be viewing AMZN in the same gen-AI lens as MSFT, but I would not be surprised if that changes in the future.

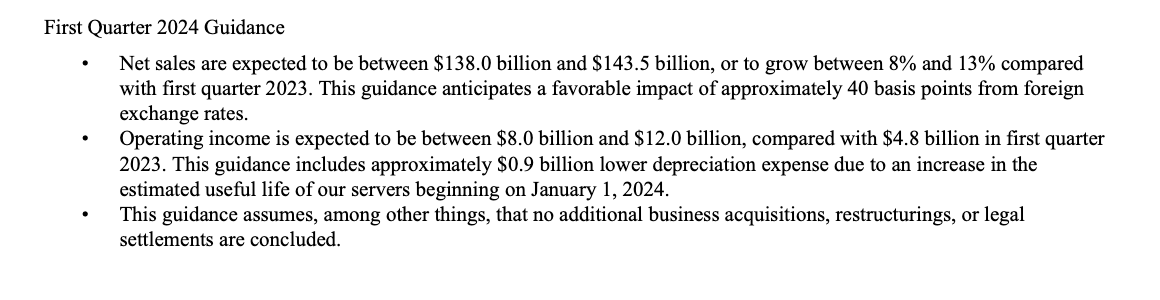

Looking ahead, management is guiding for the next quarter to see revenue growth of between 8% to 13% and operating income of up to $12 billion. As has been the case in the last several quarters, I suspect that this guidance may prove conservative, especially on the profitability front. Consensus estimates indeed are expecting revenue to come at the high end of guidance at $142.5 billion and earnings to come in at $0.85 per share.

2023 Q4 Press Release

On the conference call, management was upbeat about the potential for generative AI to drive “tens of billions of dollar of revenue” over the coming years. While AMZN’s AWS may stand to benefit from providing the cloud infrastructure powering generative AI operations, it is arguably the e-commerce business that stands to be the bigger beneficiary as a customer of generative AI. This is an important theme that has driven a lot of the gains at mega-cap tech peer Meta Platforms, Inc. (META).

I continue to be of the view that the e-commerce business is the real jewel here (though AWS is not bad itself). Management noted that approximately 60% of their $48 billion in CapEx in the full year was spent on their infrastructure. AMZN already has what appears to be a huge advantage in logistics infrastructure – I do not envy the task of any competitor seeking to catch up given both the head start as well as the gap in investment spend.

Management was asked about whether they viewed share repurchases to be on the horizon. I was pleased to hear management emphasize that they “have a lot of strong investments in front of us.” Most companies are unable to reinvest capital back into the business, and might instead use free cash flow to fund expensive M&A. AMZN is the rare exception where investors should be hoping for the company to generate as little free cash flow as possible and instead reinvest as much back into both its AWS and e-commerce operations. It’s one thing to be able to invest at high ROI – it’s another thing to be able to invest tens of billions of dollars at high ROI year after year. This is what makes AMZN the best business in the world.

Is AMZN Stock A Buy, Sell, or Hold?

AMZN has never been “dirt cheap,” at least not based on near-term metrics. The stock reached compelling valuations during the 2022 tech crash, but has never looked cheap relative to more typically cheap names like META or Alphabet Inc. (GOOG), (GOOGL). Now, with the company moving with peers to show a pronounced commitment to profitability, the stock finally looks as reasonable as ever, trading at around 43x this year’s earnings estimates.

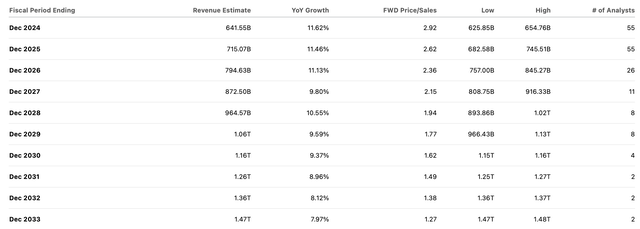

Consensus estimates call for the company to sustain double-digit top line growth over the medium term.

In my last report, I assumed that the company can achieve 7% net margins in its e-commerce segment long term. Considering that the company just turned in a 4.2% full-year margin in 2023 in its North American operations, this assumption is arguably too conservative. Applying a 25x earnings multiple that arrives at roughly $931 billion in value for the e-commerce segment on a forward basis, equating to $88 per share. I now lower my growth assumption for AWS from 18% to 15%. Based on 40% long-term net margins and a 30x earnings multiple, we arrive at a valuation of $1.25 trillion, or $118 per share. That totals out to $206 per share or a 14% potential upside over the next 12 months. The stock arguably deserves to trade at even more premium valuations given the high-quality nature of both its businesses, especially the e-commerce operations.

What are the key risks? At this point, I do not see much competitive risk to the e-commerce operations. The company has constructed high barriers to entry through long and aggressive investments in logistics infrastructure. Consumers appear to care most about price and delivery speed – it is exceedingly difficult for competitors to compete on either front. Instead, regulatory intervention is the main risk to e-commerce operations. It is possible that the government eventually views the e-commerce operations as a monopoly and may seek to break up the businesses. It is unclear how such a breakup might look like, when it might occur, or how it would impact shareholder value. However, the stock might begin to suffer a valuation overhang if investor fear increases.

AWS faces greater competitive risks from the likes of GOOGL and especially Microsoft Corporation’s (MSFT) Azure. While I currently view AWS as being a generative AI beneficiary, it is possible that MSFT may be able to transform the cloud market into a “winner that takes most” environment due to its head start in generative AI. It is not encouraging to see AMZN show weaker growth rates than peers, though that may be due to the larger revenue base.

This isn’t 2022 and AMZN is not offering incredible potential returns. But I still see market-beating returns coupled with below-market risk, making AMZN a compelling investment at current prices – though due to the more modest upside to my fair value target, I am now downgrading Amazon.com, Inc. stock from “strong buy” to “buy.”

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN, META, GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long all positions in the Best of Breed Growth Stocks Portfolio.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Sign Up For My Premium Service “Best of Breed Growth Stocks”

After a historic valuation reset, the growth investing landscape has changed. Get my best research at your fingertips today.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best deep-dive investment reports.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks Today!