Summary:

- Amazon’s stock has outperformed the S&P 500, rising 49% in the past year, driven by robust growth in AWS and international profitability.

- Revenue growth across all segments, especially AWS, which saw an 18.7% increase, highlights Amazon’s strong market position and future potential.

- Significant improvements in profitability, with net income doubling and operating cash flow up by 53%, demonstrate Amazon’s operational efficiency and scalability.

- Continued heavy investments in growth initiatives, particularly in cloud infrastructure, justify maintaining a ‘buy’ rating for Amazon as a GARP candidate.

JHVEPhoto

Those who follow my work closely know that I have been bullish on Amazon (NASDAQ:AMZN) for a little while. In fact, it has been almost exactly a year since I upgraded the stock from a ‘hold’ to a ‘buy’. In that article, published on October 9th of 2023, I talked about how the company was facing some legal and economic concerns. However, I saw signs of an early turnaround. My ultimate conclusion was that those signs would not reverse for a while and that the stock was attractively priced compared to the quality of the business and the growth that investors could anticipate.

Since then, things have gone remarkably well. While the S&P 500 is up 33.8%, shares of Amazon have risen by 49%. But that doesn’t mean that everything has gone perfectly every time I have written about the business. Earlier this year, in July, I reaffirmed my ‘buy’ rating for the stock. Even though shares had risen significantly, the business was showing robust growth, particularly on the bottom line. I continued to be impressed by its AWS segment and by the fact that the International segment had finally achieved profitability. However, since that article, shares are down 6% compared to the 3% increase the S&P 500 experienced. Looking at the picture again, I don’t believe that my decision to keep it a ‘buy’ was off. Management has come out with even more data that shows continued growth and big investments in its cloud operations should keep it growing for the foreseeable future. This is enough, when stacked up against how shares are currently valued, to justify keeping the ‘buy’ rating in my book.

Amazon is a true growth machine

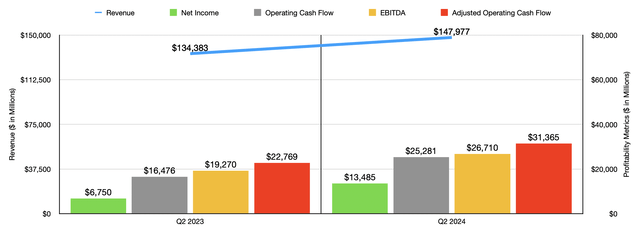

In my last article about Amazon, investors only had access to data covering through the first quarter of the 2024 fiscal year. But now, results extend through the second quarter as well. Fundamentally speaking, the second quarter was a great time for the business. Revenue during that time came in at $147.98 billion. That’s an impressive 10.1% increase over the $134.38 billion the company reported just one year earlier. To investors who are used to smaller businesses, this kind of growth rate may not seem all that great. However, for a firm of this size, I consider this robust.

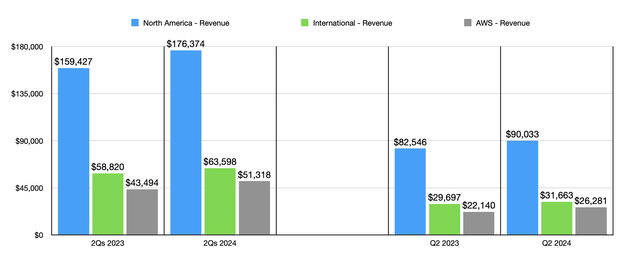

One of the things that I really appreciate about Amazon is that it is achieving growth across all three of its operating segments. The largest of these, the North America segment, saw revenue expand by 9.1% from $82.55 billion to $90.03 billion. Increased unit sales for its e-commerce business, which included higher sales from third party sellers, as well as higher advertising revenue and subscription services, all continued to bolster the business. In my most recent article of out the company that was published just a few months ago, I provided a pretty detailed discussion regarding the global e-commerce market and the opportunities that exist there. When it comes to the US specifically, which is where Amazon gets the bulk of its revenue from, the industry is expected to total about $1.22 trillion worth of revenue this year. And from 2024 through 2029, it’s expected to grow by about 8.99% per annum. That should take it up to roughly $1.88 trillion by the end of the forecast period.

After the North America segment, the largest set of operations the company has is its International segment. This achieved slightly worse growth of roughly 6.6% from $29.70 billion to $31.66 billion on a year-over-year basis. The exact same factors that played a role in pushing up revenue for the North America segment played a role in the firm’s International segment as well. Interestingly, revenue would have been even higher had it not been for foreign currency fluctuations. They impacted sales negatively to the tune of $974 million. If we add that back in, then growth would have been 9.9% on a year over year basis.

All of this is great to see. But to me, it all takes second and third place, respectively, to the real value generator that makes Amazon the behemoth that it currently is. That is its cloud business, known as the AWS segment. Revenue from the second quarter of 2023 to the second quarter of this year jumped 18.7%, climbing from $22.14 billion to $26.28 billion. Greater customer usage seems to be the primary driver of growth. This more than offset reduced pricing that the company was willing to accept in order to transition more of its contracts with customers to longer-term ones. We don’t know the extent to which this decreased sales. However, regardless of the amount, I consider this a small price to pay for locking in significant long-term revenue.

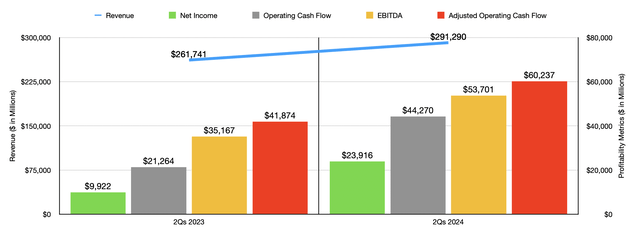

I would like to point out that, for the first half of this year as a whole, Amazon is doing really well also. Driven by an 18% growth rate for its AWS segment, the business saw its revenue during the first six months of this year jumped 11.3% from $261.74 billion to $291.29 billion. Of course, the other parts of the business have also grown as well. The 10.6% increase in sales achieved by the North America segment did the heavy lifting in pushing revenue higher. Meanwhile, the International segment grew by 8.1%. This just goes to show that recent performance is not a one-off for the company. It is part of a larger, consistent trend that is creating value for shareholders.

As much as I like the revenue side of Amazon at this point in time, the real story involves the miraculous improvements that the company has exhibited on its bottom line. The fact of the matter is that, even in just the past year, the business has seen some remarkable results. As management invests more and more capital into these core operations, and as revenue scales, the business becomes more efficient. The increase in revenue helps to spread out fixed costs across more dollars to boost profitability. Meanwhile, the company’s larger size grants it certain economies of scale.

During the most recent quarter, the company generated net profits of $13.49 billion. That’s roughly double the $6.75 billion in net income generated for the second quarter of the 2023 fiscal year. But this wasn’t the only improvement the company saw from a profitability perspective. Year over year, operating cash flow grew from $16.48 billion to $25.28 billion. If we adjust for changes in working capital, we get increase from $22.77 billion to $31.37 billion. Meanwhile, EBITDA for the company shot up from $19.27 billion to $26.71 billion. And for the first half of this year, the firm saw similar growth rates for all of these metrics.

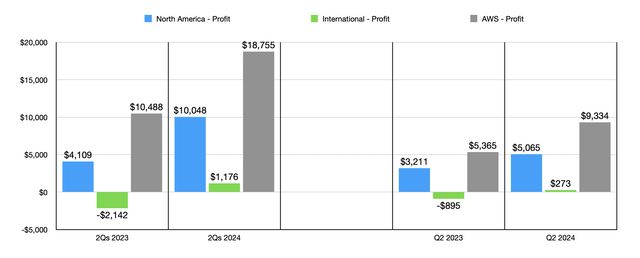

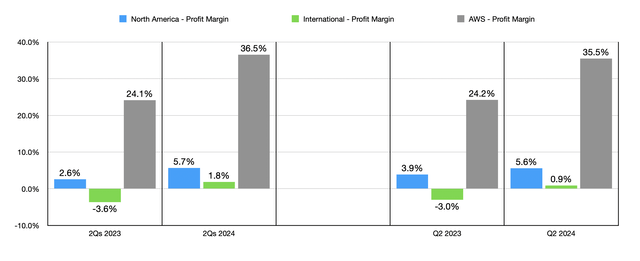

Digging in deeper, my favorite example of this is, of course, regarding the AWS segment. During the most recent quarter, AWS achieved segment profits of $9.33 billion. That’s almost double the $5.37 billion generated just one year earlier. When you do the math, you see that the segment profit margin jumped from 24.2% to 35.5% during this window of time. To be very clear, this big improvement on the bottom line is something that is newer. It has only been in the past year or so that the company has really started achieving some major improvements from a profitability perspective. For the first half of this year, the 36.5% profit margin achieved was well above the 24.1% achieved the same time last year. However, back in 2023, the 27.1% margin that the unit was responsible for was actually below the 28.5% generated in 2022. But between the positive effects of growth that the company has exhibited and certain cost cutting initiatives such as on the personnel side, the tide has finally turned in the company’s favor.

As I have detailed in my prior articles about Amazon, the company is one of the two big players in the cloud computing market. The other behemoth is Microsoft (MSFT). In a distant third place is Google parent Alphabet (GOOG) (GOOGL), which in its most recent quarter was only 39.4% as large as Amazon is from a revenue perspective. One of the really exciting things about the cloud market is that there is an opportunity for probably two or three big winners, followed by a number of smaller winners that will still be able to generate tens of billions of dollars or even hundreds of billions of dollars a year in revenue. I say this because, according to one source, the global cloud market is estimated to grow by 21.2% per annum through the year 2030. At that point, it would be worth about $2.39 trillion. Another estimate has a growing 16.8% per annum, eventually hitting $2.97 trillion in revenue by the year 2033. Even if we take the lower 2030 estimate, this would imply a size that would make it larger than the entire economy of Brazil today. That would make it the eighth largest country, economically speaking, right behind France.

Other parts of the company have achieved great performance as well. I know I have mentioned this before, but I am ecstatic to see that the International segment of the company is finally earning a profit. With segment profits of only $273 million in the most recent quarter, this pales in comparison to the profitability of the AWS segment. However, that’s still a massive improvement over the $895 million lost the same time last year. This takes the segment from a profit margin of negative 3% to positive 0.9%. Continued scaling and cost cutting has also been responsible for pushing the segment profits of the North America unit up from $3.21 billion to $5.07 billion. That translates to an increase in profit margin from 3.9% to 5.6%.

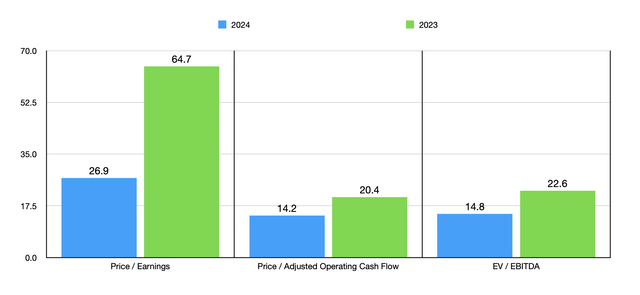

Obviously, we don’t know what the future holds. But it’s safe to say that the rest of this year will look better than the same time last year did. This is due in part to the fact that management continues to make heavy investments in growth initiatives. For the first half of this year alone, the company already spent $30.3 billion on capital expenditures, most of which is associated with its cloud infrastructure. Since we don’t have any firm estimates for management, though, I think the best approach is to simply annualize the results that we have seen so far this year. Doing so would give us net income of $73.34 billion, adjusted operating cash flow of $138.80 billion, and EBITDA of $130.58 billion. Using these figures, you can see in the chart above how the stock is currently priced. Using the 2024 estimates as opposed to the actual results from 2023 show us a company that, for the growth being achieved and the quality that investors get, should be considered quite appealing.

Takeaway

As a value investor, I am generally skeptical of growth prospects. But when those growth prospects are quality companies that are trading at multiples that I would typically associate as being fairly valued for most businesses, I can’t help but to see the prospects in question as GARP (growth-at-a-reasonable price) candidates. Because of this, and because of my belief that the markets that Amazon plays in will still continue to grow rapidly for the next few years at least, I do believe that keeping the company rated a ‘buy’ is logical.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!