Summary:

- Amazon.com, Inc.’s AWS has been thinking ahead with their training and inference chips.

- The company is focused on improving the customer experience by delivering items faster and reducing costs.

- Amazon’s healthcare initiatives, including Amazon Pharmacy and the acquisition of One Medical, are part of its future plans.

Brett_Hondow

Introduction

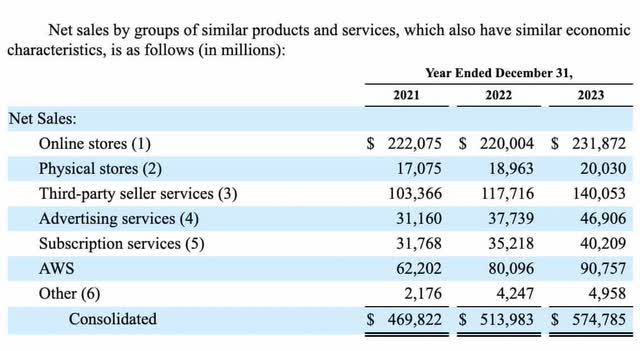

Per my November article, Amazon.com, Inc. (NASDAQ:AMZN) is well positioned for the future. The full year 2023 numbers have come out since then and we see exciting developments. Per the 2023 10-K, the advertising segment grew 24.4% from $37.7 billion in 2022 to $46.9 billion in 2023. The third-party seller services (“3P”) segment was also impressive, growing 18.9% from $117.7 billion in 2022 to $140 billion in 2023:

Management often talks about numbers which exclude F/X so the percentages they cite can be slightly different from those above. My thesis is that Amazon continues looking forward as they find new ways to improve all aspects of the customer experience.

Retail

Amazon is always looking to the future, such that the unit volume of their ecosystem is growing much faster than competitors like Walmart (WMT):

Amazon volume (Author’s spreadsheet)

Amazon has been looking forward with respect to delivery for years. Per a November 2023 WSJ article, they passed UPS (UPS) and FedEx (FDX) with U.S. deliveries:

Per CEO Andy Jassy’s remarks in the Q4 2023 call, Amazon continues to look forward as they figure out how to deliver items faster (emphasis added):

In 2023, Amazon delivered to Prime members at the fastest speeds ever, with more than 7 billion items arriving [the] same or next day including more than 4 billion in the U.S and more than 2 billion in Europe. In the U.S this result is the combination of two things, one is the benefit of regionalization, where we’ve architected the network to store items closer to customers. The other is the expansion of same day facilities, where in the U.S in the fourth quarter, we increased the number of items delivered the same day or overnight by more than 65% year-over-year. Our regionalization efforts have also brought transportation distances down which has helped lower our cost to serve. In 2023, for the first time since 2018, we’ve reduced our cost-to-serve on a per unit basis globally. In the U.S alone, cost-to-serve was down by more than $0.45 per unit compared to the prior year.

Looking toward 2024, CEO Jassy said Amazon can lower costs while also delivering items faster. Robotics are a key part of the ecosystem that makes this possible, and Charting Disruption 2024 reveals the staggering number of mobile robots in use by Amazon. They show Amazon’s total of mobile robots going from 10,000 in 2013 to 750,000 in October 2023.

In the North America segment, Amazon went from an operating loss of $2,847 million on sales of $315,880 million in 2022 to an operating profit of $14,877 million on sales of $352,828 million in 2023. In the International segment, Amazon went from an operating loss of $7,746 million on sales of $118,007 million in 2022 to an operating loss of $2,656 million on sales of $131,200 million in 2023.

Health Care

A January post by Amazon staff discusses the way Amazon Pharmacy is looking ahead and using AI to help with processing speeds, stocking, price, support and delivery. As an example for improving processing speeds, Amazon Pharmacy senior principal engineer Alexandre Alves says digital prescriptions can say “take by mouth” or “take orally” such that the language is unstructured. Generative AI helps fix this challenge (emphasis added):

Amazon solved this challenge by running the original “unstructured” data through a generative AI model. That model uses a process called “named entity recognition” to create a structure for the text, using categories such as “dose” and “frequency.” From there, it helps Amazon Pharmacy clinical staff fill prescriptions and provide clear instructions for patients. Every prescription is still reviewed by a pharmacist because provider guidance can be incorrect for reasons that AI cannot detect. Sometimes the prescriber will put “volume” in the field meant for “strength,” for example. But by combining a generative AI approach with the expertise of a pharmacist, Amazon is able to increase order processing speed by 90%, and, most importantly, reduce the rate of human error.

CEO Jassy spoke about the healthcare space in the Q4 2023 call, saying the addition of a pharmacy is a natural extension to their retail side. He envisions the future where Amazon helps make things better for everyone in this space. Amazon’s acquisition of One Medical is a key part of future improvements (emphasis added):

And I think that when we tell our grandkids that the way we used to have to go get primary care was to make an appointment 3 weeks in advance and then drive 20 minutes to the doctor, park, wait in the reception for 15 minutes, get put into an exam room for 15 minutes. Doctor comes in, talks to you for 5 to 10 minutes and then you got to drive 20 minutes to the pharmacy. People are just not – our grandkids will not believe that was the experience and it’s not going to be, and you already see that changing. And its part of what attracted us in such a significant way to One Medical. It’s just their application, their app is so easy to use. You have all your healthcare data in one spot.

I believe there are non-itemized healthcare investments in income statement lines, particularly in the North America segment. We saw this in the years before AWS was broken out separately, and I believe it is happening again in spaces like health care.

Advertising

Seeing as retail sales are between 2.5 to 3 times higher in North American than Internationally, we can conjecture that much of the advertising revenue comes from North America. Amazon had Q4 2023 advertising revenue of $14.7 billion, which is between Meta Platform’s (META) overall revenue of $13 billion in Q4 2017 and $16.9 billion in Q4 2018. Showing the potential of a business with a strong digital advertising presence, Meta’s valuation is now around $1.2 trillion.

This segment continues to grow nicely as management thinks ahead and finds more ways to make improvements. Per CEO Andy Jassy’s 2022 shareholder letter which was written in early 2023, investments are being made in Amazon Marketing Cloud (“AMC”) in order to give marketers better planning and measurement solutions (emphasis added):

AMC is a “clean room” (i.e. secure digital environment) in which advertisers can run custom audience and campaign analytics across a range of first and third-party inputs, in a privacy-safe manner, to generate advertising and business insights to inform their broader marketing and sales strategies. The Advertising and AWS teams have collaborated to enable companies to store their data in AWS, operate securely in AMC with Amazon and other third-party data sources, perform analytics in AWS, and have the option to activate advertising on Amazon or third-party publishers through the Amazon Demand-Side Platform. Customers really like this concerted capability. We also see future [opportunities] to thoughtfully integrate advertising into our video, live sports, audio, and grocery products.

Prime Video now has ads, and this is one reason why CEO Andy Jassy made a powerful statement about the subscription services segment in the Q4 2023 call:

We have increasing conviction that Prime Video can be a large and profitable business on its own.

AWS

I like to visualize the hyperscale cloud ecosystem when thinking about AWS:

Cloud ecosystem (Public Comps blog)

Per CEO Andy Jassy’s 2022 shareholder letter, AWS continues to invest in long-term inventions such as chip development. Designed by AWS subsidiary Annapurna Labs which was acquired in 2015, the Graviton CPU processor is manufactured by TSMC (TSM) and it is replacing comparable x86-based instances from Intel (INTC) and AMD (AMD). Powered by Graviton, AWS went from 1.82% of global data center CPU market share in 2021 to 3.16% in 2022 per a February 2023 Counterpoint article:

Data center CPU market share (Counterpoint)

Public Comps blog explains that Graviton is arm-based unlike Intel and AMD CPUs (emphasis added):

For years, Arm has been the preferred architecture for smartphones due to its efficiency. Recently, that trend has been carrying over to the data center as well. Amazon leads this movement. It first released its Graviton processor in 2018.

An August article from The Register cites a Bernstein report saying Graviton climbed to a high level by mid-2022 (emphasis added):

Bernstein’s report estimates that Graviton represented about 20 percent of AWS CPU instances by mid-2022, most of which would have been the 7nm Graviton2, but Amazon is moving to deploy 5nm Graviton3 and 3E instances and is expected to introduce a Graviton4 with the Armv9 architecture fabricated using TSMC’s 3nm production process in 2025.

Hopefully Counterpoint will come out with 2023 figures soon and my guess is AWS will be up significantly from their 2022 level of 3.16% based on comments from CEO Jassy in the 3Q23 call (emphasis added):

So for example, if you look at the growth of customers using EC2 instances that are Graviton based, which is our custom chip that we built for generalized CPUs, the number of people and the percentage of instances launched their Graviton base as opposed to Intel or AMD base is very substantially higher than it was before. And one of the things that customers love about Graviton is that it provides 40% better price performance than the other leading x86 processors. So you see a lot of growth in Graviton.

I don’t see CPU data center revenue broken out from generic data center revenue for Intel and AMD but their overall data center revenue figures still give us perspective. Intel’s 2023 10-K shows data center and AI operating income of $7,376 million on revenue of $22,774 million in 2021. These respective numbers were $1,300 million and $19,445 million for 2022. The respective numbers were a disappointing $(530) million and $15,521 million for 2023. AMD’s 2023 10-K shows data center operating income of $991 million on revenue of $3,694 million for 2021. These respective numbers grew nicely to $1,848 million and $6,043 million for 2022. In 2023 the respective AMD numbers were $1,267 million and $6,496 million. The data center market is growing prodigiously and AMD’s dollar gains have been smaller than Intel’s losses so we know other providers are doing well.

In addition to the Graviton CPU chips, Amazon’s Annapurna Labs also has alternatives for the Nvidia (NVDA) GPUs used for machine learning. Amazon’s first training chip, Trainium, was delivered in 2022 and it can be faster and have a lower cost than Nvidia GPUs. Amazon’s fist inference chips, Inferentia, were launched in 2019 and they also save costs. Per the 2022 letter, AWS still has a tremendous amount of innovation on the way (emphasis added):

With the enormous upcoming growth in machine learning, customers will be able to get a lot more done with AWS’s training and inference chips at a significantly lower cost. We’re not close to being done innovating here, and this long-term investment should prove fruitful for both customers and AWS. AWS is still in the early stages of its evolution, and has a chance for unusual growth in the next decade.

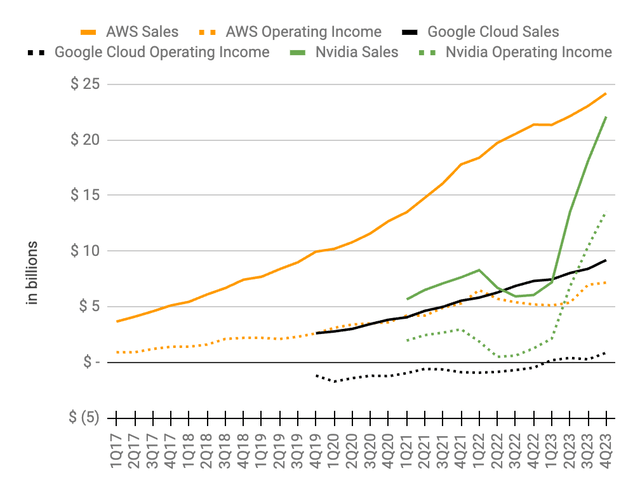

The calendar year of 2023 was an inflection point for GPU king Nvidia. They’re not just worth more than AWS, Nvidia is now worth more than all of Amazon. AWS still had more sales when the last set of quarterly numbers came out, but Nvidia’s growth rate powered by GPUs is unbelievable:

AWS operating income and sales (Author’s spreadsheet)

*Fiscal quarters for Nvidia end about 1 month late and the year label is confusing. For example, Nvidia’s fiscal 4Q24 quarter ended January 28, 2024 and we put those numbers in the 4Q23 calendar period above.

*Microsoft (MSFT) Azure numbers can be a bit obfuscated so they’re not shown above but a recent estimate says they had 34.3% market share in 4Q23 relative to 47.6% for AWS and 18.1% for Google Cloud.

Per CRN, one of the main reasons Nvidia is in a dominant position with GPUs is their CUDA software:

At the heart of Nvidia’s advantage is the CUDA parallel computing platform and programming model. Introduced in 2007, CUDA enabled the company’s GPUs, which had been traditionally designed for computer games and 3-D applications, to run HPC workloads faster than CPUs by breaking them down into smaller tasks and processing those tasks simultaneously. Since then, CUDA has dominated the landscape of software that benefits accelerated computing.

AWS is thinking ahead in terms of helping engineers who are used to CUDA:

AWS Neuron SDK helps developers deploy models on the AWS Inferentia accelerators (and train them on AWS Trainium accelerators). It integrates natively with popular frameworks, such as PyTorch and TensorFlow, so that you can continue to use your existing code and workflows and run on Inferentia accelerators.

I don’t see Nvidia’s data center operating income on their latest 10-K through January 28, 2024, but it does show data center revenue was $47,525 million relative to overall revenue of $60,922 million. These respective figures for the previous year were just $15,005 million and $26,974 million. Numerous articles cite Omidia’s approximations for the 2023 calendar year where they estimate Meta Platforms (META) and Microsoft bought about 150 thousand H100 GPU units each from Nvidia. Their estimates say Amazon, Google (GOOG, GOOGL), Oracle (ORCL) and Tencent (OTCPK:TCEHY) bought about 50 thousand each. Sources say these GPU units can cost between $15 and $40 thousand each so the dollar amounts are staggering. The 3 hyperscale cloud companies, AWS, Microsoft Azure and Google, will continue to be among the leading providers of GPU units for developers and I’m optimistic that their earnings will flourish as this market grows.

The AWS operating margin has been elevated by 500 basis points the last 2 quarters as GPUs have grown in importance. It was 24.2% in 2Q23, and it jumped up to 30.3% in 3Q23 and 29.6% in 4Q23. Profitability has also improved for Google Cloud as the operating margin went up from 3.2% for 3Q23 to 9.4% for 4Q23.

4Q23 AWS operating income was $7,167 million on revenue of $24,204 million. The operating income run rate is $28.7 billion. If Nvidia continues to dominate the GPU side such that Trainium and Inferentia don’t do well then I think AWS might only be worth 20x the $28.7 billion run rate, which comes to nearly $575 billion. However, if Trainium and Inferentia do well then the multiple could easily be 30x, implying an AWS valuation range of $575 to $860 billion when rounding to the nearest $5 billion.

Overall Valuation

In the past, I have valued the non-AWS part of Amazon as 2 Walmarts. Given the impressive Q4 2023 numbers, I now think the non-AWS part of Amazon is worth between 2 and 2.5 Walmarts. The 10-Q for Walmart through the end of October shows 2,692,233,703 shares as of November 28th, and there has been a 3:1 split since that time. The March 1st share price was $58.76 such that Walmart’s market cap is about $475 billion. When rounding to the nearest $5 billion, the amount for 2 Walmarts is about $950 billion and the amount for 2.5 Walmarts is $1,190 billion.

Here is my sum of the parts valuation:

$950 to $1,190 billion non-AWS

$575 to $860 billion AWS

——————————-

$1,525 to $2,050 billion

Per Amazon’s 2023 10-K, there were 10,387,381,291 shares outstanding as of January 24th. Multiplying by the March 1st Amazon.com, Inc. share price of $178.22 gives us a market cap of about $1,850 billion which is closer to the high end of my valuation range than the low end. As such, I view Amazon stock as a hold right now.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN, AAPL, ASML, BABA, GOOG, GOOGL, META, MSFT, NVDA, TCEHY, TSM, VOO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: Any material in this article should not be relied on as a formal investment recommendation. Never buy a stock without doing your own thorough research.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.