Summary:

- Amazon’s Q4 results showed strong growth in online, cloud, and advertising, leading to a 7.8% increase in stock price over the past week.

- The company’s expansion through third-party sellers and its own brands has the potential to increase global gross merchandise value to over $1 trillion.

- AWS’ first-mover advantage in the cloud infrastructure space and the integration of generative AI is expected to drive further growth.

tigerstrawberry

Thesis

Earlier in January, I covered Amazon.com, Inc. (NASDAQ:AMZN), where I discussed the company’s Q3 earnings and the growth prospects in AMZN’s increasing financial offerings. Since then, the company has reported Q4 results, which were marked by improving growth and margins and positive forward guidance that propelled the stock price upwards over the past week. In this article, I will be reviewing the company’s latest results and why I still believe that the stock remains an attractive buy at current levels.

Q4 Earnings Outlook: Firing On All Fronts

AMZN stock has increased 7.8% since the announcement of Q4 results due to strong sales and EPS beat. The company’s positive Q4 result was driven by sustained momentum in online, cloud, and advertising. Amazon surpassed the forecast in terms of first-party sales and third party, with 9% and 20%, respectively. This enabled Amazon to grow its digital advertising footprint and hence, the ad revenue was up by 26% in Q4 as compared to an increase of only 25% registered during Q3. This drives the company’s ad-revenue run rate close to $60 billion, a critical driver of North American profitability. I expect more investments in cloud and retail to drive higher efficiency over time, pushing margins up every year. Consumer and enterprise spending is unpredictable; however, Amazon’s initiatives can lead to share gains.

The Q4 operating margin of AWS at 29.6% was up by nearly about 530 bps YoY, which captures head-count reductions that were done earlier in 2023 along with tepid hiring. I do not expect the company’s position on hiring to change significantly as sales begin picking up steam. This conforms to my belief that the company will maintain a slow but steady margin growth in the long run, perhaps reaching approximately 40% as cloud growth matures and approaches a rate similar to overall IT spending.

The fourth-quarter results of Amazon, along with the positive remarks from the management support my view that there might be a major jump in cloud sales during 2024. The statements from the management imply that companies are moving away from reducing cloud services and instead focusing on investing more in emerging fields such as generative artificial intelligence. These sentiments echo similar statements made by Microsoft’s CEO on January 30th.

Marketplace Has Room To Grow

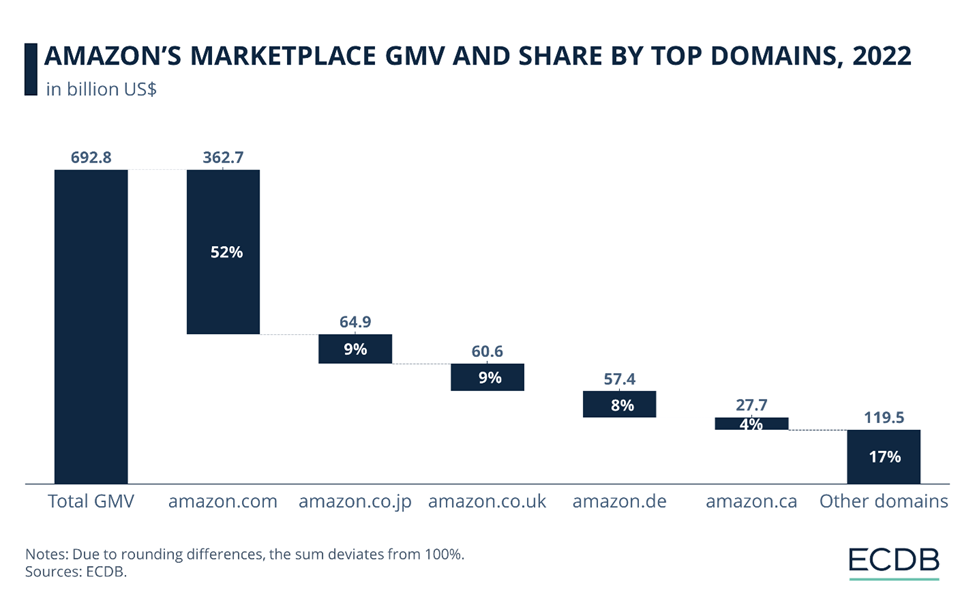

As of 2022, the e-commerce sector represents only about a quarter of retail spent across America. I believe that Amazon’s growth through third-party sellers and its own brands has the capacity to continue growing, reaching over $1 trillion of global gross merchandise value in the medium term. This growth will be fuelled by moderate to high increases in online sales and significant third-party seller transactions, especially for Amazon fashion, home goods, beauty products, pet supplies, etc. Moreover, the implementation of generative AI technology can increase efficiency and scalability and will help shoppers navigate through Amazon’s large product assortment resulting in increased online sales. The spread of social media and its impact on improving shopping functionality will also contribute to the growth of sales in Amazon’s marketplace.

ECDB

Indian Market Provides High Growth Potential

Amazon.com’s overseas reach, at about 30% of GMV, is growing and has more potential to expand, notably within rising middle-class markets. With China off the menu given Taobao and Tencent’s dominance there, the opportunity to gain share lies largely in markets including India, Europe, and Japan. Amazon is the second-largest e-commerce market leader in India at 35% of the market, behind Walmart’s Flipkart offerings. It’s made significant investments to fuel growth there, including $13 billion in Amazon Web Services spending announced in May and an additional $6.5 billion in planned investments that were revealed in June, bringing total anticipated spending in the country to $26 billion by 2030. Younger demographics could help boost e-commerce penetration and draw consumers to Amazon’s marketplace. In the next four years, 200 million more people are expected to shop online in India, bringing the total to nearly 400 million, according to Redseer data. Although the competition is high and infrastructure remains in development, Amazon can leverage its reputation for speed to gain dominance in the market.

Financial Outlook & Valuation

AWS’ first-mover advantage in the pay-per-you IT infrastructure, providing infinite scale and capacity is arguably still the biggest disruption to hit the technology industry over the past 20 years. As companies continue to spend more, I expect Amazon’s cloud sales to also increase. I think AWS can achieve more than $125 billion in revenue by 2025 and have a margin of around thirty percent. The incorporation of generative AI is likely to lead to more growth in the cloud infrastructure arena, and AWS stands a good chance of grabbing significant market share despite Microsoft’s early entry. Furthermore, with the pace of digital transformation increasing in companies I expect an increase in cloud commitments, which bodes well for cloud growth beyond 2026.

The recovery in cloud spending, increase in digital advertising revenue, and development within the retail marketplace are major factors behind Amazon’s continued growth. I think that Amazon could reach over $730 billion in sales by the year 2025, driven by double-digit growth across its main business lines. I also see profit expanding, aided by contributions from Amazon Web Services and advertising, with the latter making retail operating margin positive.

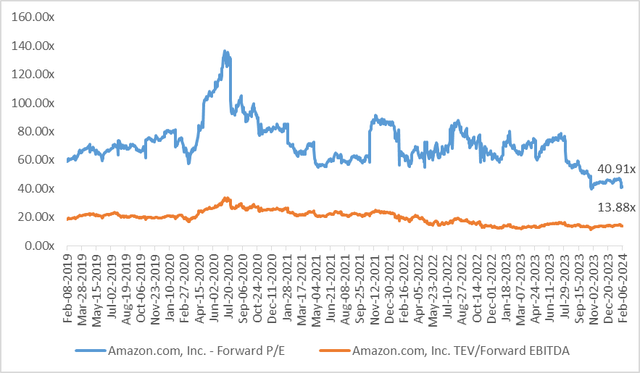

Amazon is currently trading significantly below its historical average valuation multiples. AMZN’s two-year & five-year historical forward P/E is 64x and 71x, whereas the company’s forward two-year & five-year forward EV/EBITDA stands at 15x and 19.6x as per Capital IQ. Amazon’s current forward P/E multiple of 40.9x and forward EV/EBITDA multiple of 13.8x are well below the company’s two-year and five-year averages, which I believe presents an attractive opportunity for long-term investors. The company still has a lot of room for expansion, and I see the current multiple as still attractive, which is why I re-iterate my buy rating on the stock.

Investment Risks

The Marketplace business of Amazon is challenged by traditional department stores, warehouses, and discount retailers as well as general merchandise outlets coupled with online shopping platforms. For Amazon to sustain its growth momentum, it has to keep on diversifying its product lines. Not capturing market share from competitors may result in a decline in the company’s stock price. Any changes or disturbances in retailing would have an impact on Amazon’s ability to attract and retain buyers and sellers. Also, a broader economic downturn could reduce the share of consumer spending allocated to online retail.

Conclusion

Amazon provided positive 1Q guidance led by strong fourth-quarter results driven by robust growth in online, cloud, and advertising which resulted in an increase of operating profit. I expect further investments in cloud and retail will lead to more efficiency over time, driving up margins. Additionally, I believe that the Amazon marketplace still has plenty of room for growth driven by online sales, third-party seller transactions, and the use of generative AI technology. I continue to be positive about the company’s growth prospects and reiterate my buy recommendation for its stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.