Summary:

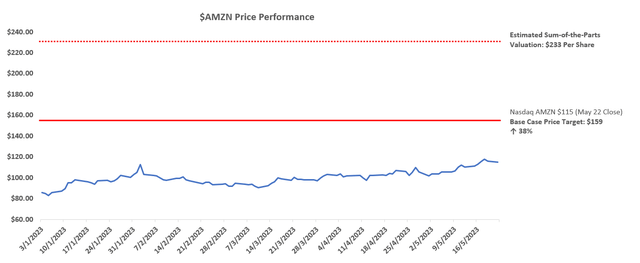

- Amazon’s stock has gained close to 40% this year, helped by a rally supported by the risk-off market’s search for tech havens with robust balance sheets.

- Yet, the recovery continues to trail those observed across its big tech peers.

- The following analysis will provide an overview of both challenges and opportunities facing each of Amazon’s five core businesses and use peer-group trading multiples to gauge their respective standalone valuations.

HJBC

Despite Amazon’s (NASDAQ:AMZN) moat in e-commerce, the segment has continued to be a drag on the company’s fundamental and valuation performance in recent years following the pandemic-era boom. The unit’s substantial exposure to deteriorating financial conditions and slowing growth have only emphasized multiple compression risks for the stock by highlighting the weight of retail’s low-valuation nature due to the industry’s lack of lucrative profits. Meanwhile, deceleration in Amazon’s profit engine – AWS – has only further dampened sentiment on the stock in recent quarters.

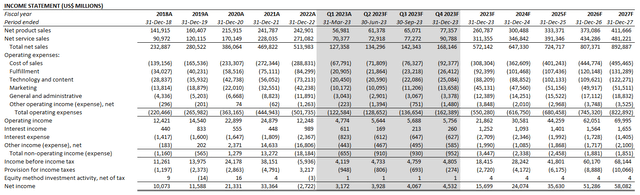

Despite being primarily known for its e-commerce and cloud-computing moats, Amazon’s operations span across as many as six key segments, including also brick-and-mortar retail, digital advertising, and other subscription services. For much of the past several years, AWS has emerged as a key contributor to the company’s sprawling cash flows, mitigating losses stemming from some of its speculative bets to even its sprawling e-commerce unit in the aftermath of overexpansion during the pandemic-era boom. Yet, the robust AWS cash flows have largely been overshadowed by modest valuation multiples attributable to other areas of the company’s mixed operations – including low-multiple segments like retail and e-commerce.

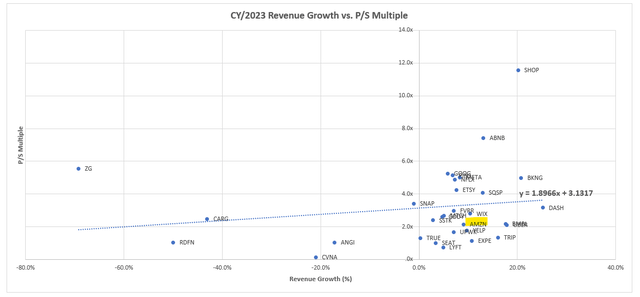

Although Amazon’s stock has recouped some of its losses this year as investors sought haven in “technology behemoths” with robust cash flows amid the largely risk-off market, it still trades at a substantial discount to both its tech and internet peers, as well as its historical levels based on all relevant valuation metrics, primarily sales and cash flows. And much of this valuation lag is likely attributable to the mixed performance across Amazon’s foray in different tech-oriented industries, with some exhibiting greater sensitivity to macroeconomic challenges than others. Until cyclical tailwinds return to restore acceleration at AWS and margin expansion at e-commerce, we think little credit will be given to resilience and improvements observed across some of Amazon’s emerging segments, including digital advertising and subscription services. This underscores pent-up value in the stock, and represents an attractive risk-reward set-up at the currently discounted levels until cyclical tailwinds and, inadvertently, risk-on market sentiment returns.

E-Commerce

Underutilization and slowing growth have been core themes in Amazon’s e-commerce business over the past year after the pandemic-era boom quickly came and went. The rapid dissipation of global e-commerce demand acceleration has left Amazon with nothing but the heavy burden of unwinding an overly aggressive expansion strategy, resulting in costly impairment charges on top of contracting margins.

Despite consistent improvements in retail margins – particularly in North America – in recent quarters, which have largely defied market concerns over persistent inflationary pressures, the company’s slowing growth remains a key challenge. In addition to decelerating e-commerce TAM expansion as consumers returned to shopping in physical stores in the post-pandemic era, cyclical headwinds amid the deteriorating economy, paired with stiffening competition have also limited the Amazon online marketplace’s growth in recent quarters to single-digits.

This is in line with slow expansion of Amazon’s international market share and challenges to scaling those forays to profitability in recent years, which is key to offsetting stabilizing growth that comes with maturity in its sprawling North American e-commerce business. Although management has recently alluded to its international business as a combination of both profitable and loss-incurring regions, much of the segment’s growth will rely on the latter in the coming years – including India, which is expected to become one of the fastest-growing e-commerce markets buoyed by its expansive population and rising middle class.

I will remind you that, again, that international is an aggregation of established countries which are already profitable and who look a bit like North America, perhaps at an earlier stage of development and working their way to parity on profitability. We have forward-loaded Prime benefits in a lot of these countries that are ahead of the curve that we saw in North America…What we’re seeing is if you looked back to North America long ago, it took 9 years for us to reach breakeven profitability in the United States. We see a similar curve in a lot of countries overseas. There’s, in fact, additional challenges that we usually have to deal with, things like lack of payment methods, lack of the established infrastructure for — especially for transportation and infrastructure for the internet and everything else…So, the adoption can be slower but we feel good about the businesses we’re building.

Yet, with benefits of its first-mover advantage in the e-commerce field having largely faded, Amazon’s overseas e-commerce ambitions are becoming increasingly challenged by local online marketplace retailers, including Walmart’s (WMT) Flipkart. This is corroborated by recent data that shows Amazon is gradually losing its market share dominance to rival Flipkart in India – e-commerce’s next core growth region, which is expected to become a $135 billion market by mid-decade.

Flipkart’s market share was 48 per cent last year and Amazon’s was 26 per cent, according to research firm Redseer Strategy. Bernstein estimated that Flipkart recorded gross sales of $23bn in India during 2021, while Amazon took in $18bn to $20bn. Redseer’s figures suggest Flipkart has been growing more quickly than Amazon in India. It calculates that Flipkart’s gross sales rose 40 per cent year-on-year in 2021 and 23 per cent in 2022. The comparable figures for Amazon were 26 per cent and 10 per cent, it said.

Source: Financial Times

As such, we view Amazon’s recent efforts in bolstering both market share retention and expansion at home as key to improving the economics of its e-commerce moat. This includes the company’s recent deployment of a revamped fulfillment strategy for its e-commerce business in the U.S., with increased focus on improving the customer experience by reducing delivery times and product availability:

The company’s overhaul has cut delivery times, transformed inventory management and altered the search results customers see on its flagship e-commerce website, according to executives, analysts and sellers who list their items on Amazon…In the past year, Amazon created eight regions that are designed to work self-sufficiently. The arrangement means Amazon doesn’t move items outside of each region unless it has to…Items commonly bought are now increasingly placed throughout the country to be closer to customers…

Source: The Wall Street Journal

This is expected to create a meaningful impact on Amazon’s e-commerce profitability over time, and offset some of the impacts of slowing growth on the segment’s bottom-line. The company has already seen immediate results from the revamped logistics strategy, including shortened delivery times and distance traveled, mitigating the impact of rising global freight costs on its margins and catering to consumers’ growing preference for speed.

The company said it has seen a 15% reduction in the distance items travel from fulfillment centers to customers, and a more than 12% decrease in “touches,” or how often a package is handled. The pace at which Amazon’s global shipping costs are rising has started to slow, increasing by about 2% in the first quarter, compared with a 14% jump for the same period a year earlier.

Source: The Wall Street Journal

The latest development also bodes favourably with our expectations for fast and free shipping to remain a key competitive advantage for not only Amazon’s online sales, but also the appeal of its Prime membership.

Continued commitment to providing fast and free shipping is another plus for Amazon in securing new and existing Prime memberships – more than three-quarters of online shoppers have indicated fast delivery times as a core driver of purchase decisions, while free shipping remains the dominant preference.

Source: “Amazon: Here Is Why Inflation-Driven Deal Hunting Will Benefit Prime”

With more than half of the company’s third-party sellers also latched onto “Fulfillment by Amazon” (“FBA”), the recently improved logistics strategy is also expected to remain an “accretive part of the [e-commerce] business” by catering to merchants’ demands. The revamped strategy is also expected to reinforce Amazon.com’s appeal to merchants as the preferred platform for “optimizing and growing their brands…over chasing revenue growth on other platforms that typically would yield lower margins”.

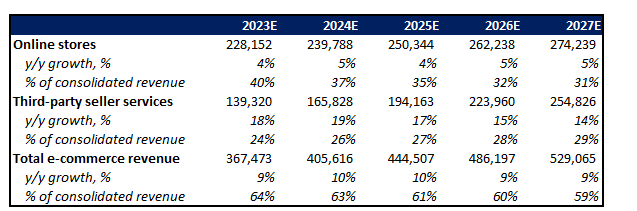

The improved experience for both Amazon.com’s merchants and customers is expected to bolster its market share gains – especially in core, profitable regions where more than 80% of commerce remains offline – and sustain e-commerce cash flows. This is expected to drive Amazon’s e-commerce growth at a CAGR of 7.8% over the next five years, with higher-margin third-party seller services sales – including FBA – to account for a larger mix.

Author

Author

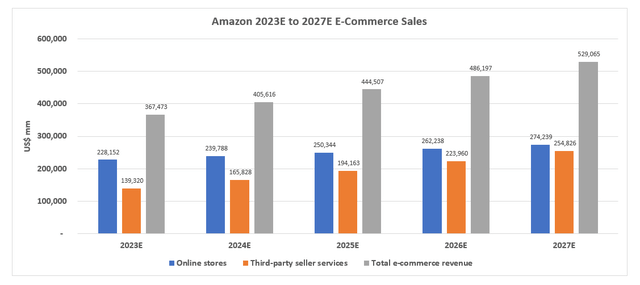

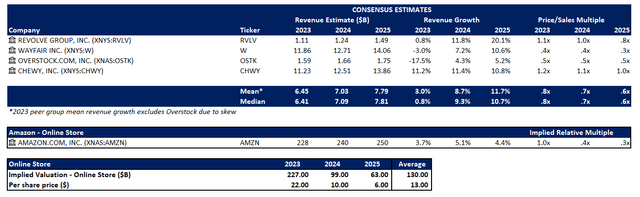

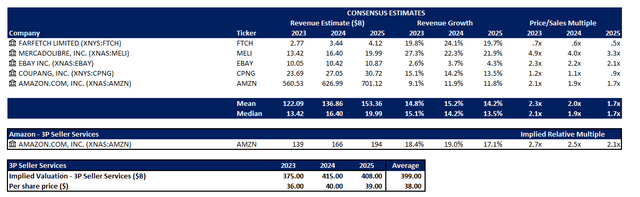

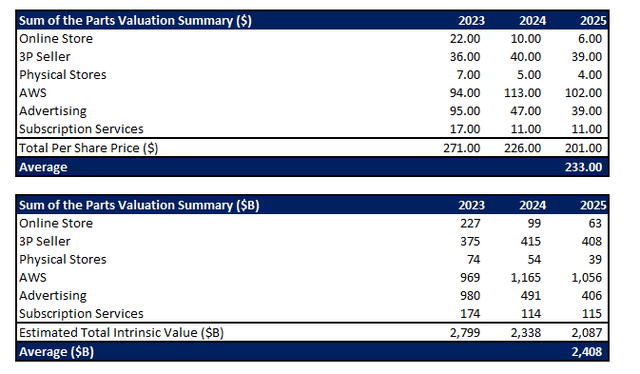

Considering lower valuation multiples attributable to slower-growing and less profitable online direct sales businesses, offset by the higher valuation multiples attributable to faster-growing and higher margin online marketplaces facilitating third-party seller services sales, Amazon’s e-commerce operations is estimated to worth about $530 billion.

i. Direct-to-Consumer Online Store Peer Comp and Amazon Online Store Segment Valuation

Data from Seeking Alpha

ii. Online Marketplace Peer Comp and Amazon Third-Party Seller Services Segment Valuation

Data from Seeking Alpha

iii. Estimated Amazon E-Commerce Standalone Valuation

Author

AWS

In addition to e-commerce headwinds, deceleration at AWS has been another key drag on the stock’s recent performance. Even the cloud-computing leader’s participation in generative AI has done little to assuage immediate investors’ concerns over the cash cow’s slowdown observed in recent quarters. As discussed in our previous coverage, the cautious IT spending environment amid mounting macroeconomic uncertainties, stiffening competition, and a broad-based shift in end-market preference towards cloud optimization have been key risks to AWS’ near-term growth profile.

Starting back in the middle of the third quarter of 2022, we saw our year-over-year growth rates slow as enterprises of all sizes evaluated ways to optimize their cloud spending in response to the tough macroeconomic conditions…Our customers are looking for ways to save money, and we spend a lot of our time trying to help them do so…I think it’s important to remember that customers are pretty explicitly telling us that this is not a cost cutting effort where we intend on spending less money on technology or on the cloud. This is our reprioritizing what matters most to our business at this time and trying to reallocate resource so we can build new customer experience [and change what’s possible].

Source: Amazon 4Q22 and 1Q23 Earnings Call Transcripts

The headwinds have brought forth challenges to not only AWS’ top-line growth, but also the high-margin business’ cost structure. Increasing end-market demand for cloud optimization – or value for money – have pressed AWS to offer more for less. While we have previously discussed how Amazon’s early-on initiatives in addressing growing demands for optimization will be a key competitive advantage amid rising competition in the cloud-computing space, the related efforts and ensuing economics will take time to ramp up and scale. Specifically, cloud optimization will continue to be an immediate headwind on AWS’ profitability, but continued ramp up of market share gains enabled by catering to the shift in end-market preference is expected to drive improved scale back towards a long-term trajectory of sustained margin expansion.

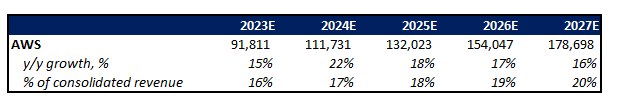

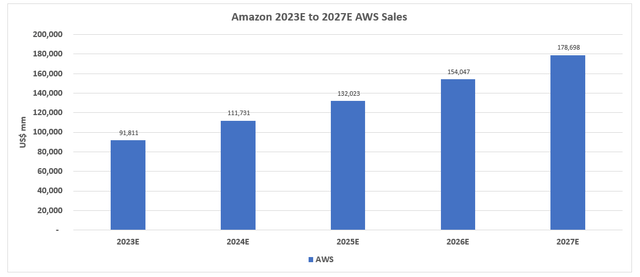

Ongoing efforts in addressing the shift in end-market preference for cloud optimization and other customer demands – which AWS claims to be deeply ingrained in its “DNA” – is also expected to reinforce its ability in capitalizing on secular growth headroom stemming from the 90% of global corporate technology spend that has yet to migrate to the cloud. The recent momentum and interest in generative AI is also expected to further expand the cloud TAM, meaning substantial tailwinds will likely drive “eventual AWS reacceleration”. Eventual reacceleration in AWS is expected to improve its share of Amazon’s revenue mix towards the 20% range over the next five years, and bolster Amazon’s long-term cash flows.

Author

Author

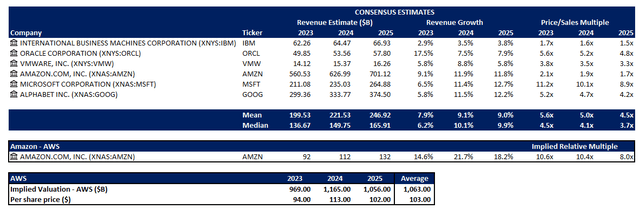

The high-margin nature of hyperscaler services also supports improved returns on invested capital, hence the industry’s generous valuation multiples compared to the earlier analysis on e-commerce. The relative premium attributable to cloud services is also in line with investors’ growing shift in preference for businesses that exhibit both stable revenue and quality cash flows amid the risk-off market climate that has been blighted by elevated borrowing costs and persistent inflationary pressures, amid other macroeconomic headwinds that have weighed on broader market valuations.

Considering the valuation comparables of cloud service providers with similar growth profiles, AWS exhibits an estimated worth of more than $1 trillion, in line with consensus expectations for the unit to have been a primary driver of Amazon’s market value today.

Author, with data from Seeking Alpha

Advertising

Although advertising’s growing strength at Amazon got more airtime at its latest earnings call, the results have gotten little credit from investors as deceleration and margin contraction at AWS continues to take precedence.

On the advertising side, we’re continuing to buck wider advertising trends and deliver robust growth…First, even in difficult economies, most people still shop. And with the largest e-commerce shopping venue, we have a lot of customers that companies seek to reach. That, coupled with our very substantial investment in machine learning to make sure customers see relevant ads when they’re looking for various items, have meant that these advertisements have performed unusually well for brands, which makes them want to advertise on Amazon.

Source: Amazon 1Q23 Earnings Call Transcript

Amazon’s growing market share in the high-margin retail media and search advertising business, paired with its competitive advantage in possessing one of the largest first-party data troves on consumer behaviour is expected to emerge as a key cash flow driver over the longer-term. Advertising strength is expected to offset some of the “capital shortfall” resulting from AWS’ tempering profit margins, and play an increasingly critical role at Amazon in funding other growth opportunities across the broader business.

In addition to retail media and search ads, Amazon’s massive first-party data trove is also expected to complement its foray in fast-growing AVOD opportunities via its Prime Video platform.

It’s also worth noting that we’re still very early in our efforts to find a way to thoughtfully place ads in our broader video, live sports, audio and grocery properties. We have a lot of upside still in advertising.

Source: Amazon 1Q23 Earnings Call Transcript

Specifically, demand for digital video and AVOD ad formats are expected to be a driving force in the digital advertising market, with media intelligence firm Magna Global forecasting double-digit growth for the distribution format in 2023 despite macroeconomic challenges. This is consistent with continued acceleration observed in Amazon’s advertising business, an impressive feat amid a no- to slow-growing market due to the inherently macro-sensitive nature of the industry.

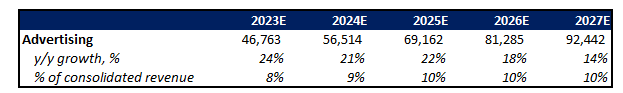

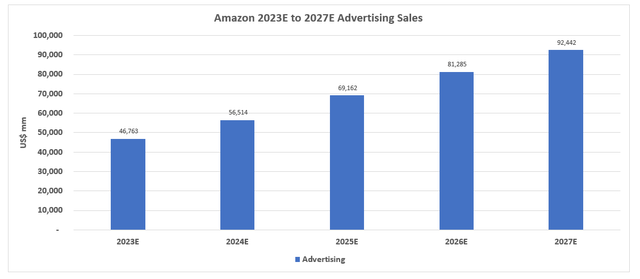

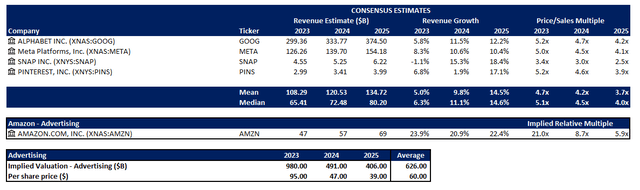

As discussed in the earlier section, continued acceleration in Amazon’s high-margin advertising revenue stream will be key to mitigating some of the near-term margin contraction risks stemming from AWS’ deceleration due to the macroeconomic slowdown and shift towards a better “value for month” optimization strategy. Despite its nominal share of the revenue mix relative to AWS, Amazon’s advertising segment is expected to expand at a comparable five-year CAGR of more than 14%, and potentially account for a tenth of the broader business’ consolidated sales.

Author

Author

The valuation appeal of high margin and durable growth businesses as discussed in the earlier section on AWS also applies for the advertising segment. Considering the segment’s growth profile relative to its digital advertising peers, the unit supports an estimated standalone value of more than $600 billion, helped primarily by a premium attributable to its competitive advantage with 1P data that has helped it buck the trend on a slow-growing market dragged by deteriorating macroeconomic conditions.

Author, with data from Seeking Alpha

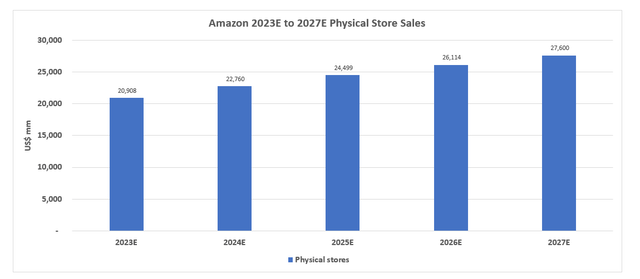

Physical Stores

In his latest shareholder letter, Amazon CEO Andy Jassy has highlighted ambitions to bolster its physical stores footprint, with an aim to better penetrate the $800 billion market opportunity pertaining to grocery sales in the U.S. alone. This aligns with Amazon’s focus on preserving growth at Whole Foods, Amazon Fresh and Amazon Go, which is further complemented by its expanding online grocery delivery services, while letting go of other “physical store concepts” like Bookstores and 4 Star. Instead, to bolster participation in the physical retail industry beyond groceries, the company has opted to sell its innovative technologies – such as “Just Walk Out” – to physical retailers via AWS, underscoring Amazon’s advantage with integration.

However, management’s recent decision to take a step back on its physical stores strategy, including some closures and suspended expansion of Amazon Fresh and Amazon Go locations, continues to highlight challenges in disrupting the current norm that has been dominated by big box brick-and-mortar equivalents of Amazon.com, like Walmart and Costco (COST). It is effectively looking to enter a business that its core e-commerce business has already disrupted despite innovative efforts aimed at improving in-store operations and customer experiences (e.g. Just Walk Out integration at Amazon Go; competitive pricing and selection on both produce and non-perishables, as well as convenience through Amazon Fresh physical store and online-ordering integration).

Although Amazon’s acquisition and integration of Whole Foods into the Prime network has played a key role raising the brand’s awareness and bolstering its demand environment, it still lacks the competitive pricing that the majority of American consumers care most about when it comes to their weekly grocery haul. More than 80% of American households earn less than $150,000 per year, with Whole Foods’ premium lifestyle-oriented “organic grocery space” effectively pricing out a sizable portion of Amazon’s prospective grocery store demand environment. This is in line with management’s acknowledgement of the need to find a “mass physical offering”, which they consider Amazon Fresh a probable answer to, though they have hit a wall when it comes to execution.

And if you really want to serve as much of grocery as we’d like to, you have to have a mass physical offering. And that’s what we’ve been working on for a few years with the brand we’ve called Amazon Fresh. We wish we were further along at this point. We’ve tried lots of ideas. We haven’t yet found conviction around the format that we want to go expand much more broadly. We have a set of experiments and ideas and concepts that we’re working on across our dozens of stores there. And we’re pretty optimistic that we have something that may very well work. And we’re hopeful over this next year we find that.

Source: Amazon 1Q23 Earnings Call Transcript

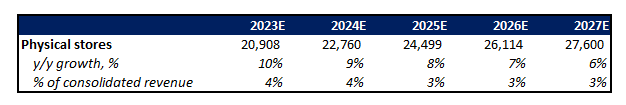

When it comes to its physical stores strategy, Amazon is trying to “have its cake and eat it, too”. Despite management’s ambitions to make physical stores – particularly grocery stores – one of Amazon’s key growth areas, we expect the ensuing results to remain modest, especially given the business’ slim margins even with the help of innovative technologies like Just Walk Out, which is aimed at reducing labour and other costs, such as theft and/or manual error at checkout.

Author

Author

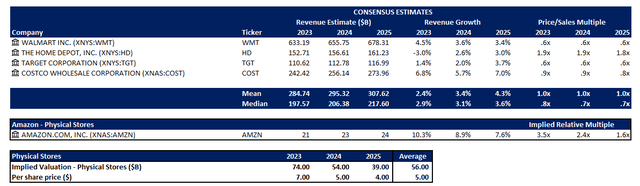

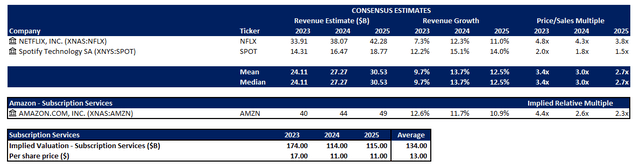

Taking into consideration the comparative valuations of its retail peers with similar growth prospects, the physical stores unit is estimated to be worth a modest $56 billion on a standalone basis.

Author, with data from Seeking Alpha

Instead, the combination of Amazon’s physical store strategy and relevant innovations is expected serve value in other key growth areas of the broader business. This includes bolstering its 1P data advantage critical to the budding advertising business, as well as providing tangible validation on the usability of its next-generation technologies targeting prospective AWS customers in the retail vertical.

Subscription Services

Amazon’s Prime membership has been a key standout for the broader business, with a critical role that ranges from attracting customers to its e-commerce platform and other content services (e.g. Prime Video, Amazon Music, etc.) to bolstering 1P data generation key to supporting other key growth areas such as advertising. On the e-commerce front, Amazon has recently introduced “Buy With Prime” to further expand its market share beyond the internal marketplace and facilitate the online shopping and seller experience on “direct-to-consumer websites”. Meanwhile, the continued expansion of the Amazon Business Prime Membership is expected to further reinforce Amazon’s footprint in global e-commerce by bolstering its share in the enterprise vertical, and potentially driving demand to key adjacent areas including advertising and AWS.

Amazon Business launched in 2015 and today drives roughly $35 billion in annualized gross sales. More than six million active customers, including 96 of the global Fortune 100 companies, are enjoying Amazon Business’ one-stop shopping, real-time analytics, and broad selection on hundreds of millions of busies supplies.

Source: Amazon 2022 Shareholder Letter

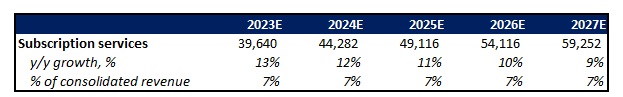

Similar to the physical stores business, we view Amazon’s subscription services as gateway revenue stream that plays a more important role in driving value and opportunities to other higher growth areas. We expect subscription services sales, primarily driven by Prime memberships, to expand at a moderate pace of about 8% on average per year and maintain a 7% revenue mix as it continues to play the critical role in supporting sustained growth across Amazon’s core commerce business (i.e. third-party fulfillment and first-party gross sales), as well as other adjacent revenue streams such as advertising and AWS. This is in line with market forecasts for each Amazon Prime membership to have brought about $1,400 in gross merchandise value transacted on Amazon.com per year, and management’s disclosure per the 2022 Shareholder Letter that Amazon Business-specific Prime memberships have driven $35 billion in annualized gross sales.

Author

Author

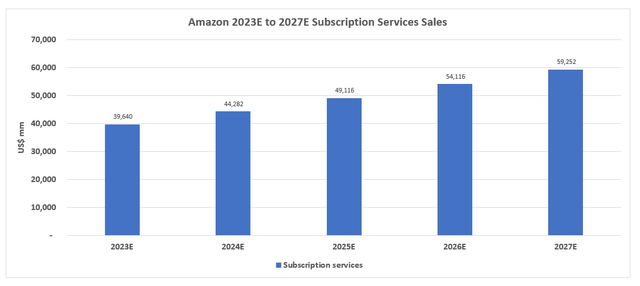

Based on valuation multiples of its subscription industry peers, Amazon’s related unit is estimated to be worth more than $130 billion on a standalone basis, though likely contributing to greater value-add across the broader-business.

Author, with data from Seeking Alpha

Valuation Summary

Author

Drawing from the foregoing analysis on Amazon’s key businesses, the company exhibits a sum-of-the-parts valuation of close to $2.4 trillion, or $233 apiece.

Author

Author

But despite the stock being undervalued at current levels relative to peers with similar growth profiles as well as its own historical trends, it is unlikely for the Amazon stock to reach $2.4 trillion within the foreseeable future as conglomerates and multi-faceted businesses typically trade at a discount to its sum-of-the-parts valuations. However, the sum-of-the-parts valuation premium to the stock’s current levels provides clarity that each of Amazon’s key businesses – whether on a standalone basis or integrated basis – exhibits substantial growth headroom and, inadvertently, upside valuation potential over the longer-term.

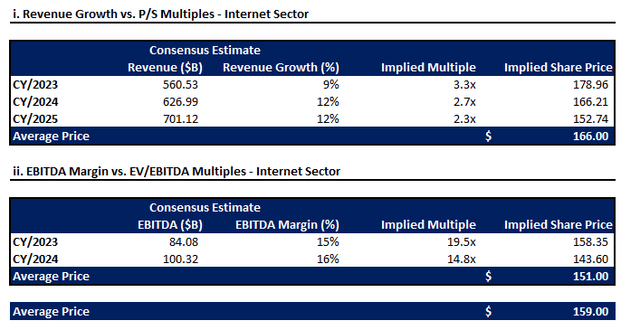

This is further corroborated by Amazon’s relative discount to peers when considering its sales and EBITDA multiple relative to its growth and profitability profile. We believe sales and EBITDA multiples are reasonable multiple-based valuation metrics for Amazon’s stock, given its expansive role in the growth-oriented tech sector and cash flow-driven valuation, which forecasted EBITDA is a reasonable proxy for (recall that earnings is not a reasonable valuation metric for Amazon, given the figure is influenced by material below-the-line items, including unrealized pre-tax valuation gains/losses on its common stock investment in Rivian (RIVN).

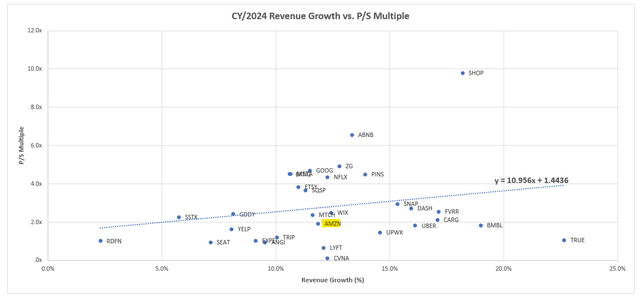

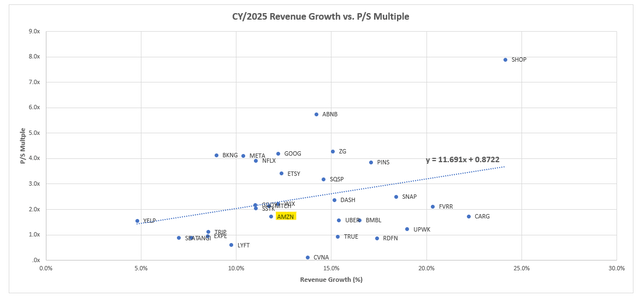

i. Revenue Growth vs. P/S Multiples – Internet Sector

Data from Seeking Alpha

Data from Seeking Alpha

Data from Seeking Alpha

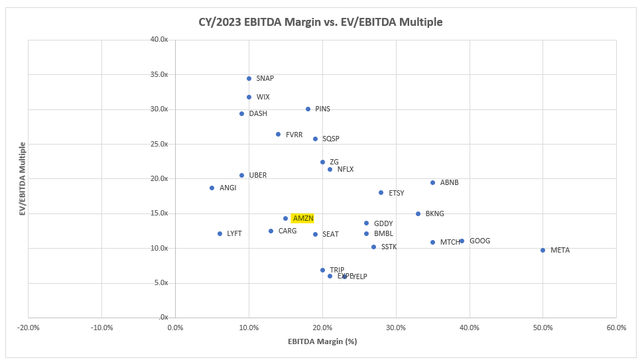

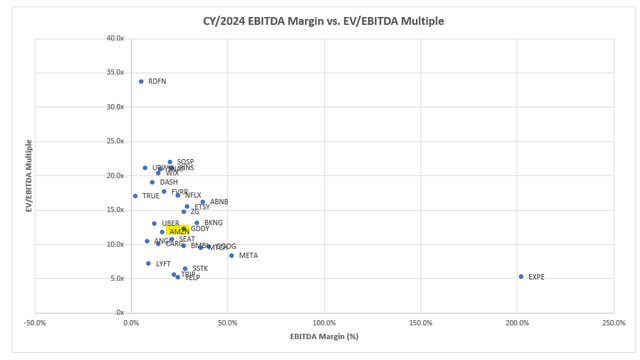

ii. EBITDA Margin vs. EV/EBITDA Multiples – Internet Sector

Data from Seeking Alpha

Data from Seeking Alpha

Relative to its internet peers, we believe Amazon’s fair value should trade closer to $159 per share. The price is determined by equally weighing Amazon’s estimated intrinsic value of $166 per share based on its growth prospects, and $151 per share based on its EBITDA prospects relative to peers.

Author

The $159 base case price target would imply upside potential of close to 40% based on the stock’s current share price of about $115 (May 23 close). The estimate is also in line with the anticipated discount to Amazon’s estimated sum-of-the-parts valuation of $2.4 trillion, or $233 per share, as discussed in the earlier section. This is consistent with the disconnect observed between some conglomerate market values relative to their net asset values, which can reach as high as 50%.

The Bottom Line

While Amazon’s stock performance continues to lag in the near-term due to macroeconomic risks facing its recession-prone e-commerce business, and the impact of a more structural shift in enterprise end-market preference facing its core profit-driving AWS unit, the company remains well-positioned for the eventual return of cyclical tailwinds that will benefit its moat in key secular trends that remain largely intact. These include third-party seller services which will bolster Amazon’s e-commerce market share, digital advertising, and cloud-computing. The gradual expansion of growth initiatives in its smaller segments spanning physical stores and subscription services, which are key gateways to attracting customer base growth critical to driving value accretion at adjacent offerings, will also benefit Amazon’s valuation prospects.

While much of Amazon’s stock gains in recent months have been driven by risk-off market sentiment in search for tech havens that exhibit quality earnings and stable cash flows, we believe the eventual return of risk-on market sentiment is likely to unlock further upside reflective of pent-up value attributable to strength in the underlying business’ fundamental prospects. This includes expectations for eventual reacceleration in AWS driven by secular trends, as well as the hyperscaler’s efforts in catering to end-market cloud optimization demands, as well as continued margin expansion assisted by the budding digital advertising business and third-party seller services.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Thank you for reading my analysis. If you are interested in interacting with me directly in chat, more research content and tools designed for growth investing, and joining a community of like-minded investors, please take a moment to review my Marketplace service Livy Investment Research. Our service’s key offerings include:

- A subscription to our weekly tech and market news recap

- Full access to our portfolio of research coverage and complementary editing-enabled financial models

- A compilation of growth-focused industry primers and peer comps

Feel free to check it out risk-free through the two-week free trial. I hope to see you there!