Summary:

- I am bearish on AMZN heading into Q1 earnings, as I believe that the market may be too optimistic about the e-commerce giant’s earnings power.

- There is much evidence that the macro economy continues to pressure the e-commerce giant’s consumer business, while AWS is also struggling vs Q1 2022.

- Amazon‘s Q1 report will likely once again reveal that Amazon is slowly transitioning away from being a growth company.

- Going into Q1, I suggest investors consider AMZN 95/85%-moneyness put spreads with a May 5th expiration date.

HJBC

I am worried about Amazon’s (NASDAQ:AMZN) Q1 2023 report, which is expected to be released on Wednesday 26th after market close. There is much evidence that the macro economy continues to pressure the e-commerce giant’s consumer business, while inflationary trends pressure the labour-heavy cost structure, while a slowdown in AWS is expected to have continued throughout the January quarter of 2023.

In my opinion, Amazon’s Q1 report will once again reveal that Amazon is slowly transitioning away from being a growth company, while the conglomerate must yet prove adequate profitability to justify its current $1,100 billion market cap. So, being neither a growth nor a value company, Amazon stock remains a difficult pitch.

Personally, I continue to view AMZN stock as overvalued; and a weaker-than-expected Q1 report might pressure the stock to trade lower – towards a more reasonable value based on fundamentals, which I see at around $70.65/share (target price).

For reference, Amazon stock is a relative outperformer YTD: AMZN shares are approximately 25% since January, as compared to a gain of about 10% for the S&P 500 (SPY).

Amazon Q1 Earnings Preview

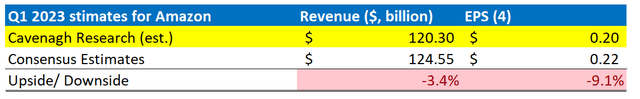

According to data from Seeking Alpha, as of April 24th, 37 analysts have provided their estimates for Amazon’s Q1 results. They expect total sales to be between $120 billion and $128.7 billion, with an average estimate of $124.6 billion. Assuming the average analyst consensus estimate as a benchmark, it is suggested that Amazon’s Q1 2023 sales may increase by around 7% as compared to the same period one year earlier. Additionally, analysts have provided EPS estimates ranging from $0.1 to $0.32, with an average of $0.22, which would indicate a material improvement versus the $0.38 loss in Q1 2022.

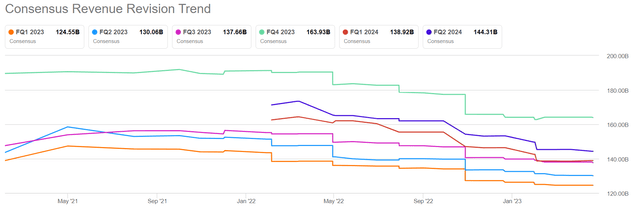

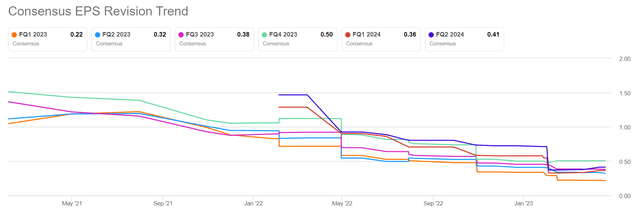

Referencing consensus analyst expectations, I would like to point out that revenue estimates have steadily deteriorated during the past 12 – 14 months, with sales expectations now being approximately 20% below September 2021 estimates. This trend is evident for both Amazon’s topline…

…as well as bottom line.

Estimates Might Be Too Optimistic

Referencing the earnings preview, it is clear that analysts are starting to turn increasingly bearish on the e-commerce giants’ business, and are downgrading their expectations. However, I argue that estimating a 7% YoY revenue expansion and an approximate $0.5 EPS improvement versus Q1 2022 might still be too optimistic, considering the evidence in the context of a weakening consumer sentiment/spending, as well as a slowdown in the cloud business.

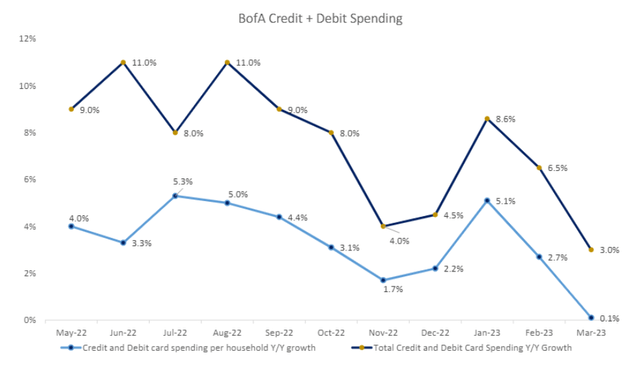

Building a bearish argument on Amazon’s retail business, including e-commerce and nascent brick-and-mortar sales, I would like to point out the latest BofA research on credit and debit card spending per U.S. household, which implies a sharp deterioration in consumption sentiment since the end of 2022.

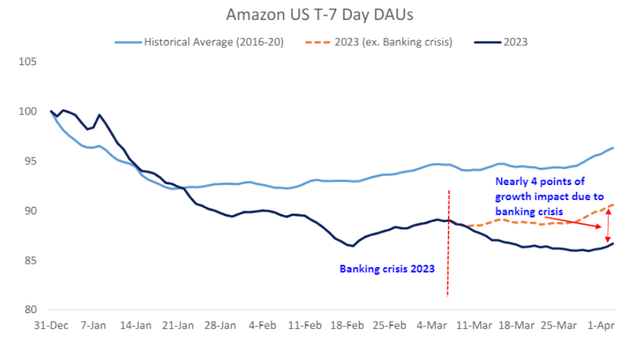

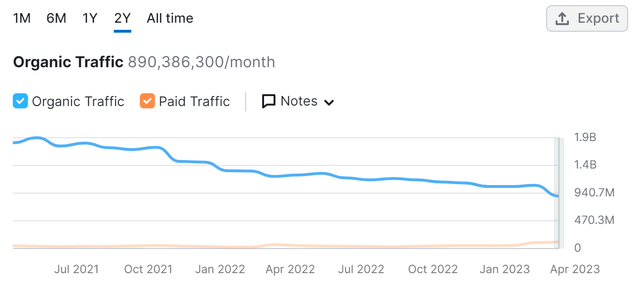

In addition, investors should note the latest research note from Deutsche Bank analyst Lee Horowitz and team, which highlights that – according to insights mapped on Sensortower data – Amazon’s web traffic in Q1 2023 is trending materially below the historical pre-COVID average, a trend that has been further supported by the banking crisis. (Deutsche Bank Research, E-Commerce Earnings Preview, 18th April).

Finally, investors may also confirm falling web traffic for Amazon through accessing insights provided by Semrush, which monitors estimated global web traffic to “Amazon.com”, and reports rapidly falling visitor interest.

Now, it is also worth highlighting that Amazon’s AWS business will not only present a slowdown in revenue growth when reporting Q1 2023 versus Q1 2022 but also some margin pressure. According to CEO Andy Jassy, during the ongoing economic downturn, corporate clients are inclined to reduce their cloud expenses as they seek ways to save money wherever possible. And for reference, in the post-Q4 earnings call, Amazon CFO Brian Olsavsky warned that:

… although we had a 28 percent growth rate for the quarter for AWS, the back end of the quarter, we were more in the mid-20 percent growth rate. So we’ve carried that forecast through to the fourth quarter.

adding that:

With the ongoing macroeconomic uncertainties, we’ve seen an uptick in AWS customers focused on controlling costs

With regards to margins, Olsavsky pointed out that AWS is not immune to inflationary pressures:

[energy bills] are materially higher … up more than 2x over the last couple of years … So we’re fighting through some of that as well, which is a new thing for the AWS business

Conclusion

Personally, I believe Amazon will miss on Q1 2023 analyst consensus expectations, given a deteriorating consumer environment complimented by worse-than-expected cloud business. In detail, I model Q1 2023 topline for AMZN at $120.30 billion, versus $124.55 billion estimated by consensus (about 3.5% downside).

Analyst Consensus EPS; Author’s Calculation

Following a likely miss on revenue and earnings estimates, I believe AMZN stock has room to trend towards about $70.65/share, which remains my target price for the e-commerce giant.

As a short-term strategy, I am increasing my exposure to AMZN stock Q1 2023 buying time-sensitive put options. Given the speculative nature of options trading/speculation, I suggest investors consider 95/85%-moneyness call spreads with a May 5th expiration date, as they have the potential for an approximate 4:1 payoff if AMZN stock closes at or below $90/share.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Not financial advice; this is market commentary and a reflection of the author's opinion only

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.