Summary:

- AWS has been a historical juggernaut of earnings and profitability.

- Customer demand has slowed in recent quarters, however, and may continue.

- AWS’s customer base is not an optimal mix for current economic conditions.

- Amazon’s leadership continues to spend to build new capacity, despite these headwinds.

georgeclerk

Life On The Margins

Amazon (NASDAQ:AMZN), for being a ubiquitous presence in most people’s lives, has always presented a degree of mystery for investors. The company is notoriously opaque in its earnings and breaks down most revenue segments only at the highest levels. The company’s earnings presentation look as though as much effort was put into them as a middle school public speaking project. It was only in 2021, for example, that investors learned for the first time how many households subscribed to Amazon Prime (it was 200 million). Before then, everyone was left to guess at how many subscriptions were built into Amazon’s revenue figures, and since that initial revelation investors have had to resort once again to estimates. Amazon has been able to get away with revealing so little about its business to shareholders because, well, at some level, it’s Amazon. The company has a reputation for ruthless execution, and shareholders are generally supposed to take their market-beating returns and smile in exchange.

The business known as ‘The Everything Store’ reports its earnings in only three segments: North America (59% of sales), International (27%), and Amazon Web Services–AWS–(14%). Within North America and International lie a tremendous diversity of business activity, from online shopping to the Whole Foods grocery chain, from Audible audiobooks to the NFL’s Thursday Night Football, from an investment in Rivian to multiple healthcare endeavors.

AWS is the only business unit of the three that has a relatively narrow focus and as a result is a bit easier to parse out. North America and International provide relatively little in the way of transparency (although the company has, admittedly, provided more detail in recent years than in years past).

AWS came to dominance almost by accident. Originally run by Andy Jassy–Amazon’s current CEO–AWS emerged as an incredibly profitable business, generating cash by the fistful and allowing Amazon to make risky bets in other areas and to prioritize growth in other business units by keeping prices (and, by extension, margins low).

In fact, it has become almost a tenet of investor dogma over the years that AWS is so valuable, and that its cash-generating abilities are so great, that the stock has essentially only priced in AWS, and that when investors purchase the stock they are only buying AWS and are getting the online retail business for free. Several articles over the years have been written to point this out (including on this site).

We don’t think it’s controversial to say, then, that Amazon’s overall margin and profitability are strongly correlated to the growth or decline in AWS (whether or not this is actually true could be debated, but this is certainly the case in the minds of most investors).

Storm Clouds for AWS?

For this reason it was troubling to have management and analysts begin to sound the alarm that there were problems on the horizon for AWS in Amazon’s Q3 2022 earnings call.

In a quarter that was overall positive, the topic of AWS dominated. During the call, AWS was mentioned 28 times and was the subject of 5 out of 6 analyst questions. The primary focus was the effect of deteriorating macro-economic conditions on the AWS business. Throughout its North American and International business units Amazon felt the sting of inflation in Q3 as costs outpaced growth–leaving it up to AWS to close the gap.

To this point, CFO Brian Olsavsky pointed out in the earnings call that there was an “uptick” in the AWS customer base which was interested in “controlling cost.” He followed on by saying that Amazon is “proactively working to help customers cost optimize, just as we’ve done throughout AWS’ history, especially in periods of economic uncertainty.”

The corporate-speak translation of the above quote is: customers are struggling to pay their bills.

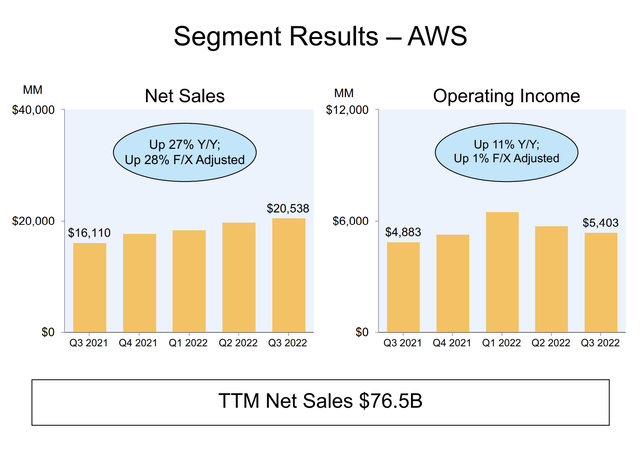

AWS Quarterly Revenues (Amazon)

Despite the rise of cost-conscious customers, Olsavsky pointed out:

[O]ur teams across AWS continue to work relentlessly to expand that breadth and depth, including recent launches of new EC2 machine learning training instances in AWS IoT FleetWise. And we continue to expand the AWS infrastructure footprint to support customers with the launch of the AWS Middle East region in August and the recent announcement to launch AWS Asia Pacific region in Thailand.

This sends a mixed signal. Cost-conscious customers are coming to AWS, hat-in-hand and asking for billing reductions. And yet, Amazon continues to invest in capacity expansion? On the face of it, this seems… odd. (We’ll return to this later.)

Of course, customers in distress is something to be expected in the current environment, but it presents a conundrum for Amazon investors–how many customers have been affected, to what degree, and what could the impact be to the overall business? These are certainly questions that investors would like to have answered, but Amazon, as is their corporate tradition, is not exactly forthcoming with answers.

It is almost a foregone conclusion that softness in consumer demand will rear its head in many of this earnings season’s reports. The effect of this has been, we believe, priced into Amazon’s consumer-centric e-commerce business. But what can we expect from AWS in the upcoming quarter, given its non-consumer orientation?

Given that retail investors have been more or less conditioned to believe that when they buy a share of Amazon that they’re buying a share of AWS, a deeper dive into AWS and what we might expect in the Q4 call is in order.

The AWS Customer Base

The focus of AWS for many years has been relentless growth. From server capacity to customer count, Amazon has focused on growing the business in every way possible. To this end, AWS appeals to many small and medium businesses, as well as start-ups. Until recently, AWS was the primary provider of cloud services for these sorts of companies, as its chief competitor Azure–Microsoft’s (MSFT) cloud service–catered principally to an enterprise audience.

Looking into AWS’s own case studies yields some interesting insights as to who they market to principally. Of the 2,437 available case studies, 318 are for startup companies. 40 are for small businesses, 204 are for non-profit and public sector entities, while the remaining 1,000 or so are dedicated to enterprise level customers.

Armed with that information, and seeing that there are multiple case studies concerning household names like Verizon and Korean Air–not to mention partnerships with sports leagues such as the NFL–investors might conclude that AWS’s exposure to small and micro-sized business is fairly minimal. This would be important in light of deteriorating macro conditions and a non-zero interest rate environment, as a customer base made up largely of enterprise-scale customers would be better suited to endure such conditions.

Unfortunately, this does not seem to be AWS’ customer mix.

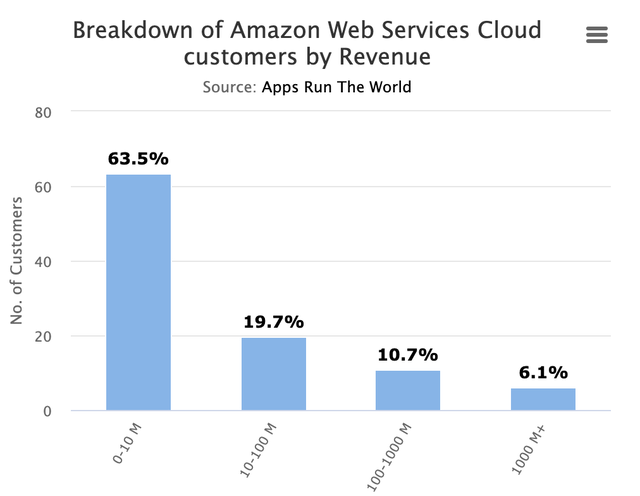

According to research and marketing firm Apps Run The World, AWS’s client base is far more skewed to the lower end of both the headcount and revenue spectrum.

AWS Customer Base Revenue (Apps Run The World)

According to their data on AWS’s customer base, more than 80% of AWS customers are estimated to generate less $100 million in revenue per year, with 63.5% of that generating between $0 and $10 million.

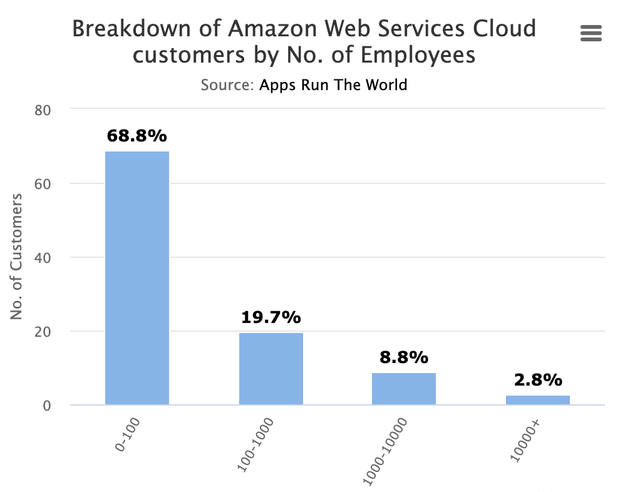

Customer head count also skews to the smaller end of the spectrum:

AWS Customer Headcount (Apps Run The World)

Naturally we can only infer certain things from this data, some more useful than others. For example, there’s a large difference in customer risk between a startup with 25 employees and no revenue, and a small business with 25 employees that generates $5 million per year.

Azure’s Edge

So what can we reasonably glean from this? The best way to answer, this question, we think, is to compare AWS with their largest competitor Azure.

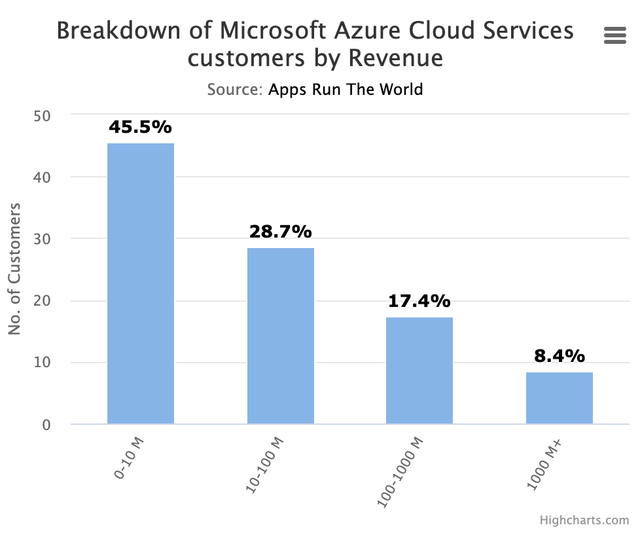

Azure Customer Revenue Mix (Apps Run The World)

We’ll use data from the same firm since it will produce an apples-to-apples comparison. Azure, it seems, has a less-skewed customer base, with 45% of its customers estimated to generate between $0-$10 million per year compared with AWS’s 63%.

The companies themselves–and the concerns expressed by analysts–seem to back this up as well. While AWS was the primary source of concern among analysts in the latest Amazon earnings call, Microsoft executives were largely positive about Azure’s performance its prospects. Azure experienced some margin contraction in the last quarter, executives said, but this was primarily due to higher energy costs.

Importantly–and unlike Amazon–customers’ bill paying abilities were not a source for concern.

Based on management’s own words and the data above, we believe it’s reasonable to conclude that AWS does, in fact, have higher degree of exposure to a sub-optimal customer mix than Azure. We think this could threaten the near-term performance of Amazon stock.

Earnings Season Cometh

Investors have long rallied behind the earnings power of AWS and believed that the business was so stellar that its value comprised essentially every penny of Amazon’s current stock price–which left the other parts of the business to be bought ‘for free’ in a sum-of-the-parts situation.

AWS, however, has its own risks. Its customer base is skewed to the smaller end of the business spectrum, which is precisely the area of the economy one could expect to be hit hardest by recession and a rising-rate environment.

If AWS were to falter in the near term, the effect could be negative for the stock in the short (1-2 year) term. The effect could be magnified if Amazon’s core consumer business continues to soften as well over the next few quarters.

Amazon, for its part, seems to think that it remains prudent to continue to build out server capacity despite these headwinds. While this may be a fruitful long-term strategy, investors may not like the near-term results. After all, Amazon’s track record for accurately building capacity is not exactly stellar–the company overshot significantly on its warehouse capacity only recently. Amazon seems likely to do the same when it comes to AWS.

Given a slew of bank earnings in the last week that showed consumer demand to be as soft as expected in Q4, this could mean trouble for Amazon.

The Bottom Line

While we have presented some critical points in this article, we are long-term positive on Amazon. The company has an incredible track record of execution and operational excellence. In the near term, however, the company appears to be over-shooting capacity in its AWS business just as the economy tilts against its largest customer segment, creating conditions for less-than-optimal business performance.

We will be watching Amazon’s earnings closely to see if our thesis is correct, and how management responds. This upcoming earnings will set the tone, in our view, for the rest of the year for investors. Stay tuned.

Disclosure: I/we have a beneficial long position in the shares of AMZN, MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.