Summary:

- Amazon’s aggressive push towards automation is driving exponential EPS increases, leading to strong financial benefits and potential for stock acceleration.

- The company’s financial health is bolstered by strong free cash flow projections, and a large automation push.

- Despite challenges post-COVID, Amazon’s recent stock performance indicates a strong rebound, with a focus on profitability and automation to mitigate risks.

- The company is building a profitable business model that is far more resistant to recessions than it was before.

hapabapa

Investment Thesis

I believe that Amazon (NASDAQ:AMZN) remains a strong buy, driven by their aggressive push toward automation, which I believe we are now seeing causing exponential EPS increases. In my previous analysis, I mentioned that the company had recently invested $1 billion in a startup for automation to mitigate the escalating fulfillment costs that have plagued the company for years. This has started to yield financial benefits, with fulfillment costs growing at a slower rate than overall revenue, meaning an exponential increase in operating profits. The advanced systems are also poised to address persistent labor challenges, including wage pressures and unionization. The company’s profit drive as well is able to help the firm offset any recession risk that may be on their horizon as the US consumer weakens.

I believe there is a reason to anticipate that shares are about to accelerate out of a multi-year range, based on the stock’s trend going back to 2021. During Andy Jassy’s tenure as CEO, beginning in July 2021, the e-commerce giant’s stock has trailed the market, seen in the stock increase of just 13% compared to roughly a 28% rise in the S&P 500. Despite this underperformance, recent developments suggest significant upside potential.

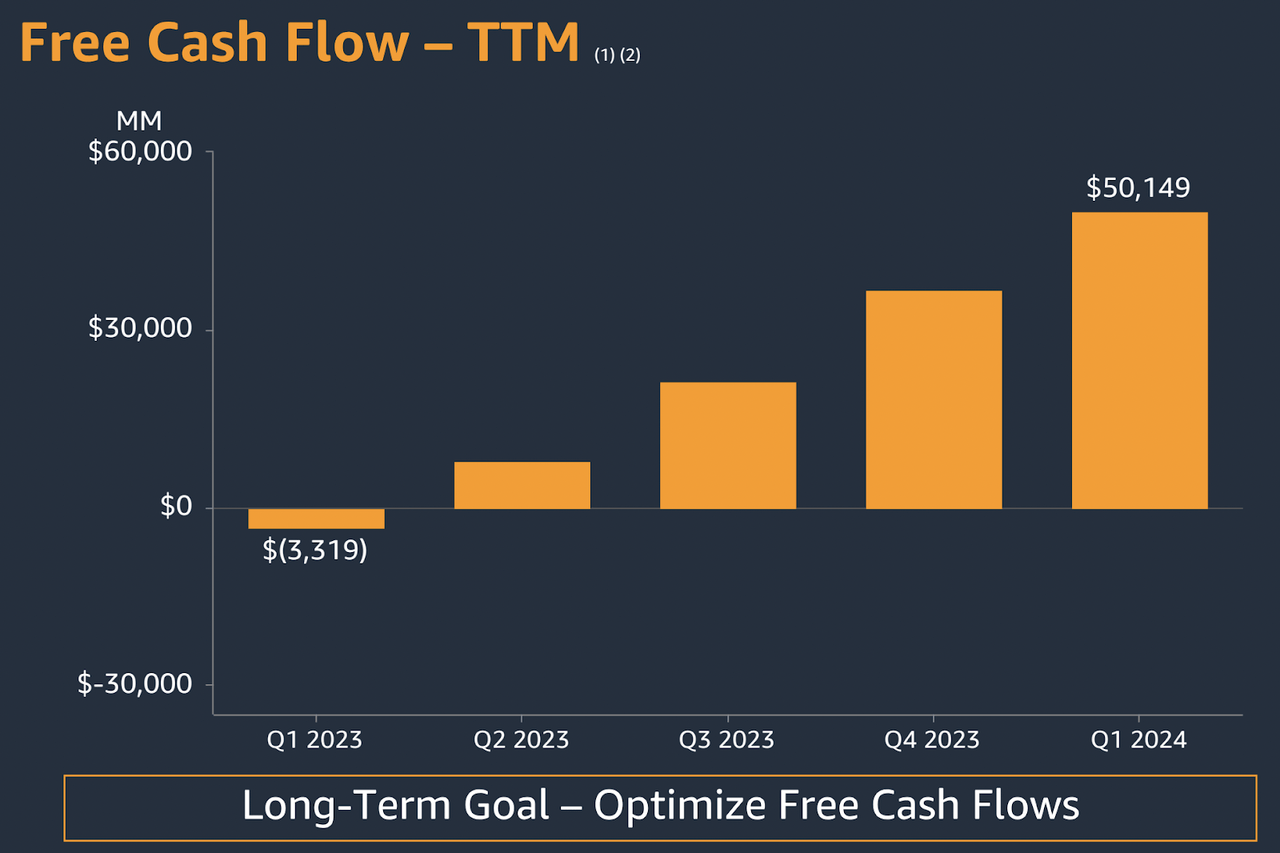

I believe the company’s financial health is further bolstered in part by strong free cash flow projections.

Amazon Free Cash Flow TTM (Amazon)

For 2024, Amazon is expected to generate $62.4 billion in free cash flow, with projections of $79 billion in 2025 and $102.7 billion by 2026. This expected cash flow growth, together with potential shareholder returns through potential buybacks or dividends, will further support Amazon’s stock appreciation, allowing them to break out of a 3-year range.

Despite a challenging period post-COVID, where growth rates stalled and market share in cloud computing was lost to competitors like Microsoft and Google, Amazon’s recent performance, I believe, indicates a strong rebound. The company has managed to re-accelerate AWS growth and regain market share in their e-commerce retail division, capturing 28% of all incremental retail sales in the U.S. The company is well positioned in the event of a recession, both on the e-commerce side and on the enterprise side.

I think profits could grow further from here, and I do not believe that Wall Street is fully pricing these in for now. I believe with accelerating EPS growth, the company is a strong buy.

Why I Am Doing Follow-Up Coverage

Amazon’s stock has gone up approximately 3.87% since my last writeup in April.

While the stock has underperformed the market since my last post, the surge from the 2022 lows in Amazon’s stock comes after the company’s profit growth has accelerated. The company reported their most profitable first quarter ever this year, with a net income of $10.4 billion. This is a sharp contrast to the $3.8 billion loss in the same period in 2022 and a $3.2 billion profit in 2023.

The rapid increase in profitability has outpaced the rise in share price, leading to a decrease in the price-to-earnings (P/E) multiple, a rarity for major tech firms such as Amazon. I believe the forward P/E ratio has now become far more attractive compared to historical levels, indicating that the stock may still be undervalued relative to their earnings growth.

Despite the impressive financial results, the market appears to be cautious about the sustainability of Amazon’s earnings growth, with the trailing 12 months PEG ratio sitting far below the sector median (0.07 vs. 0.58). However, with Amazon’s investments into high-growth areas like AI to help optimize their e-commerce division, I believe the company’s upward trajectory is just getting started. With this, I’m following up on my last coverage piece to show how this last quarter is helping them accelerate their EPS (and I believe share price as well).

Deep Dive On Profits

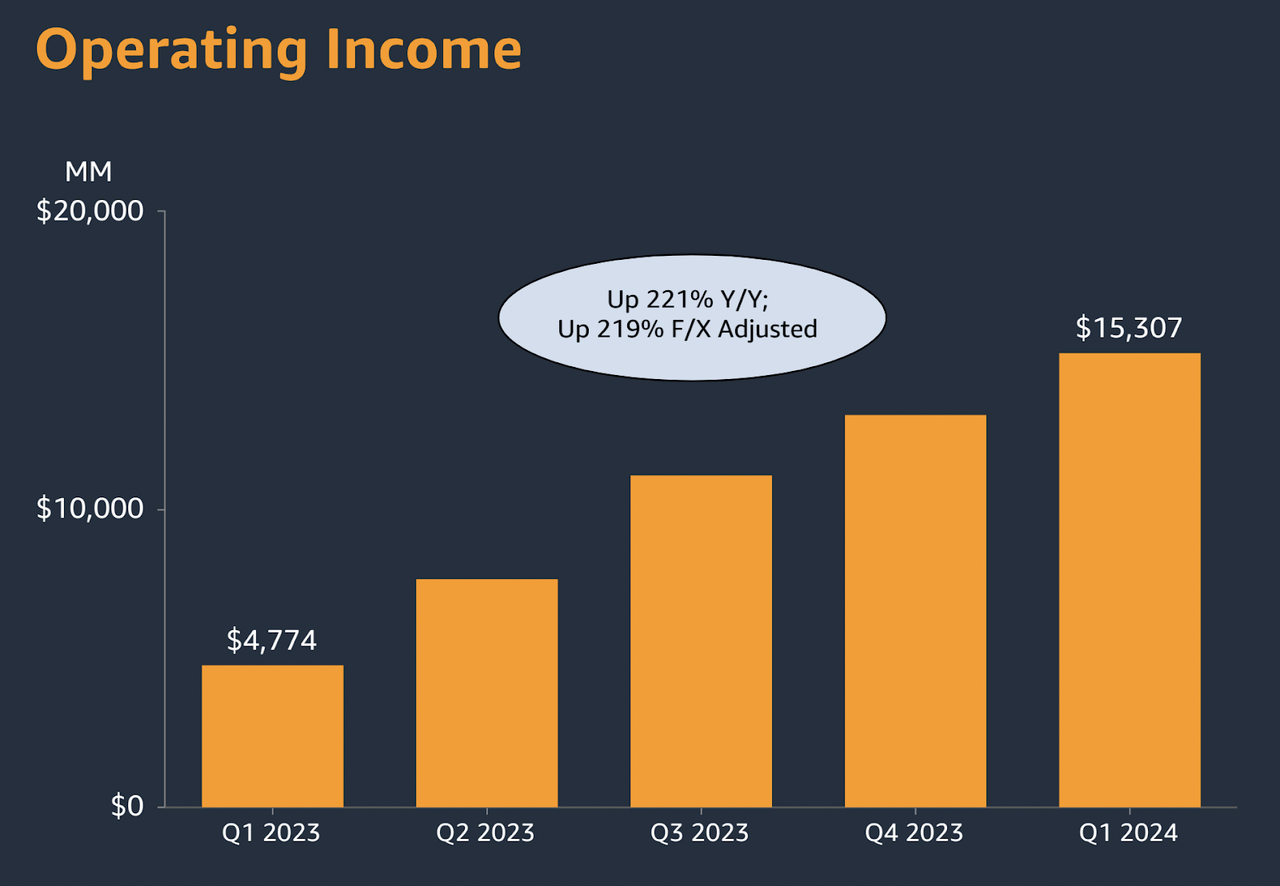

During the company’s Q1 2024 earnings call, Amazon reported a strong revenue growth complemented by improvements in operating income, which soared to $15.3 billion. This marked a 221% increase year-over-year.

Amazon Operating Income (Amazon)

CEO Andy Jassy mentioned the deployment of generative AI tools to streamline product listings for third-party sellers:

We’ve recently launched a new generative AI tool that enables sellers to simply provide a URL to their own website, and we automatically create high-quality product detail pages on Amazon. Already, over 100,000 of our selling partners have used one or more of our GenAI tools -Q1 2024 earnings call.

The key with this is that they’re enabling sellers to optimize their product pages to increase sales. This is, again, helping them accelerate e-commerce efficiency in ways I did not cover in the last research piece.

Adding to this, Jassy, also stated:

We also see quite a few companies that are building their generative AI applications to do inference on top of AWS. And a lot of it has to do with the services. And the primary example we see there is how many companies, tens of thousands of companies, already are building on top of Amazon Bedrock, which has the largest selection of large language models around and a set of features that make it so much easier to build a high-quality, cost-effective low latency, production-grade generative AI applications -Q1 2024 earnings call.

I also think this is big. While I think the biggest place Amazon will see their profits grow is, again, in the e-commerce division, getting AWS to remain as the bedrock of cloud infrastructure for future AI-driven cloud applications is huge. Some pundits have questioned Amazon’s AI strategy. This is the foundation of it.

To this point, CFO Brian Olsavsky also emphasized the impact of AI on the company’s revenue performance, stating:

We saw growth in both generative AI and non-generative AI workloads across a diverse group of customers and across industries as companies are shifting their focus towards driving innovation and bringing new workloads to the cloud -Q1 2024 earnings call.

Strong performance here indicates the widespread adoption of AI technologies across Amazon’s customer base. With the introduction of Amazon Q, a generative AI-powered assistant, Amazon is enhancing its AI AWS’s offerings, attracting major clients like Pfizer, Toyota, and the New York Stock Exchange. The company is really firing on all cylinders here. I expect profits to come with this.

The company’s “super aggressive” push on AI has been highly transformative so far.

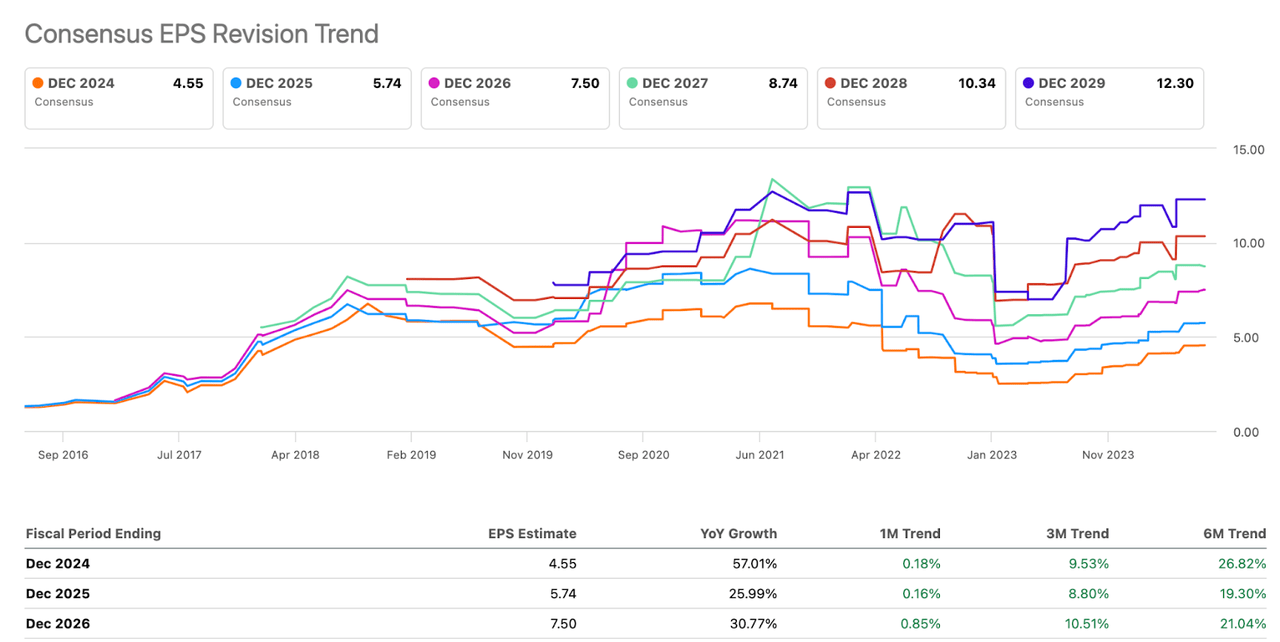

Valuation

Over the past year, the market has significantly underestimated Amazon’s PEG TTM GAAP ratio. This value currently stands at 0.08, which is 86.47% below the sector median. Looking forward, the market sets the company’s forward Non-GAAP PEG at 1.84 compared to the sector median of 1.50, just a 22% premium to sector median. Given the expected year-over-year EPS growth of 57% through the end of 2024 (far higher than the sector median 2.88% year over year EPS growth), the current valuation setup appears conservative in my opinion.

Amazon shares have seen an increase of 3.87% since my last report in April. However, this barely scratches the surface of Amazon’s potential.

If we saw the company’s PEG ratio converge on a 50% premium to sector median (to account for EPS growth that well outstrips the sector median), this would mean there is still another roughly 23% upside in shares as they move from a 22% PEG ratio premium to a 50% above sector median PEG ratio.

How This Compares To My Last Valuation Estimate

In my last research piece, I argued that Amazon had roughly 23% upside at that point as well. Since, however, shares have moved by about 4% since then, this would imply only roughly 19% in remaining upside.

I’m increasing my upside estimates given the street estimates for EPS are increasing exponentially as well. I am really optimistic.

Amazon EPS Revisions (Seeking Alpha)

Risks

The U.S. economy is showing signs of slowing down. Recent data from June 2024 reveals a notable decline in personal spending. The government revised personal spending growth down to an annualized rate of 1.5% for Q1 2024, a drop from the previous estimate.

Consumer behavior is also in a slowdown, with retail sales and housing activity slowing in the first half of the year. This shift in consumer behavior is likely a response to the Federal Reserve’s sustained high-interest rates, which have made borrowing more expensive and dampened demand across the board.

With this, core capital goods orders, a proxy for business investment, fell by 0.6% month over month in May. The job market is also showing signs of strain, with continuing jobless claims near their highest level since 2021. This indicates a slower reabsorption of unemployed workers into the labor force.

For companies like Amazon, which rely heavily on consumer spending, these trends could cap potential upside if the economic conditions do not improve.

The outlook for the U.S. economy remains cautious, and companies heavily dependent on consumer spending must navigate these uncertainties carefully to maintain growth and profitability.

However, I am counting on Amazon’s initiatives aimed at reducing operational costs and increasing efficiency across their extensive logistics and fulfillment networks. I believe they will live up to the challenge that management (and shareholders) put on them.

Amazon has deployed over 750,000 robots, which have already replaced approximately 100,000 human jobs (large cost savings). These are used in various stages of the fulfillment process, including sorting, packing, and transporting goods within warehouses.

In addition, according to CEO Jassy, the company restructured their U.S. fulfillment network into 8 self-sufficient regional networks, which reduced the distance products need to travel to reach consumers.

The company is lean and increasing profits in the face of a consumer weakness. It’s a really robust strategy. I’m excited to follow it.

Bottom Line

I believe that Amazon remains a strong buy, driven by their aggressive push toward automation which will help push profits higher, and help de-risk the company from a recession. The company has invested $1 billion in automation to mitigate the escalating fulfillment costs that have plagued them for years. By 1Q 2024, Amazon reported a 13% revenue growth to $143.3 billion, surpassing market expectations and operating profits up 221%.

Amazon’s stock has appreciated by approximately just 3.87% since April 2024, meaning the earnings are growing faster than the market’s forward expectations about the company. This is a rare position for Amazon.

While the U.S. economy is showing signs of slowing down, with a notable decline in personal spending and weakened consumer behavior, I believe Amazon’s initiatives at reducing operational costs and increasing efficiency across their logistics and fulfillment networks can mitigate these risks. They are building an automation system that has already eliminated 100,000 jobs and likely tens of billions of dollars in wages. Imagine where they will be in just two years?

Given this, I remain optimistic about Amazon shares, and believe the stock is still a strong buy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in AMZN over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Noah Cox (account author) is the managing partner of Noah’s Arc Capital Management. His views in this article are not necessarily reflective of the firms. Nothing contained in this note is intended as investment advice. It is solely for informational purposes. Invest at your own risk.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.