Summary:

- Amazon has shifted its focus towards profitability and rewarding shareholders. Operating income has grown 221% year-on-year, and management has promised to manage share dilution efficiently.

- The company grew in eCommerce, Cloud, and Advertising, with the latter surpassing the size of YouTube’s advertising business. In my view, this shows management can execute with excellence.

- Potential further catalysts for AMZN stock include a return to a low-interest rate environment and the possibility of the company starting to pay a dividend.

- “Day 1” is integral to Amazon’s culture. Some investors worry that “Day 2” means the end for the company, but I disagree. I see at least a 30% upside in Amazon’s stock from current levels.

hapabapa

Investors in Amazon.com, Inc. (NASDAQ:AMZN) will be familiar with the company’s “Day 1” culture. This relates to the ability of Amazon to serve customer needs with innovative solutions, and focus on long-term category growth rather than short-term results. When Jeff Bezos decided to resign as CEO of Amazon, some analysts argued the company would enter “day 2”, without the guidance of its original founder. In this article, I will discuss how I believe Amazon has indeed entered a new phase of growth, but I believe this will result in the creation of superior shareholder value.

Thesis: Amazon is focusing on profitability and rewarding shareholders, while maintaining excellence in commercial execution

I see significant catalysts for Amazon’s stock in the near future. The most important one is a radical shift in management’s focus. Amazon’s management is now intentionally optimizing free cash flow, efficiently managing share dilution, and significantly increasing profitability.

Additionally, the company has achieved double-digit growth in eCommerce, Cloud, and Advertising. In the case of Advertising, I think Amazon’s growth is nothing short of extraordinary, as the company has revamped this division and managed to grow it to more than the size of YouTube’s advertising business.

Final potential catalysts for Amazon’s stock include a return to a low-interest rate environment and the possibility of Amazon starting to pay a dividend. I believe Amazon has lagged behind tech peers for the past five years, partly because it only recently began focusing on profitability. In a high-interest rate environment, more profitable companies tend to outperform those that are less profitable. Additionally, paying a dividend has historically been a positive catalyst for companies like META Platforms (META) and Alphabet (GOOG) (GOOGL).

For the past year, management has shown an ability to enter “day 2” – focusing on significantly increasing the company’s profitability – while maintaining the commercial excellence that has always kept Amazon a leader in all its categories.

I believe the market has not yet realized just how profitable Amazon will become, and I see an upside of at the very least 30% from the current level for the company’s stock.

Amazon’s financials show management is focused on rewarding shareholders and executing with excellence

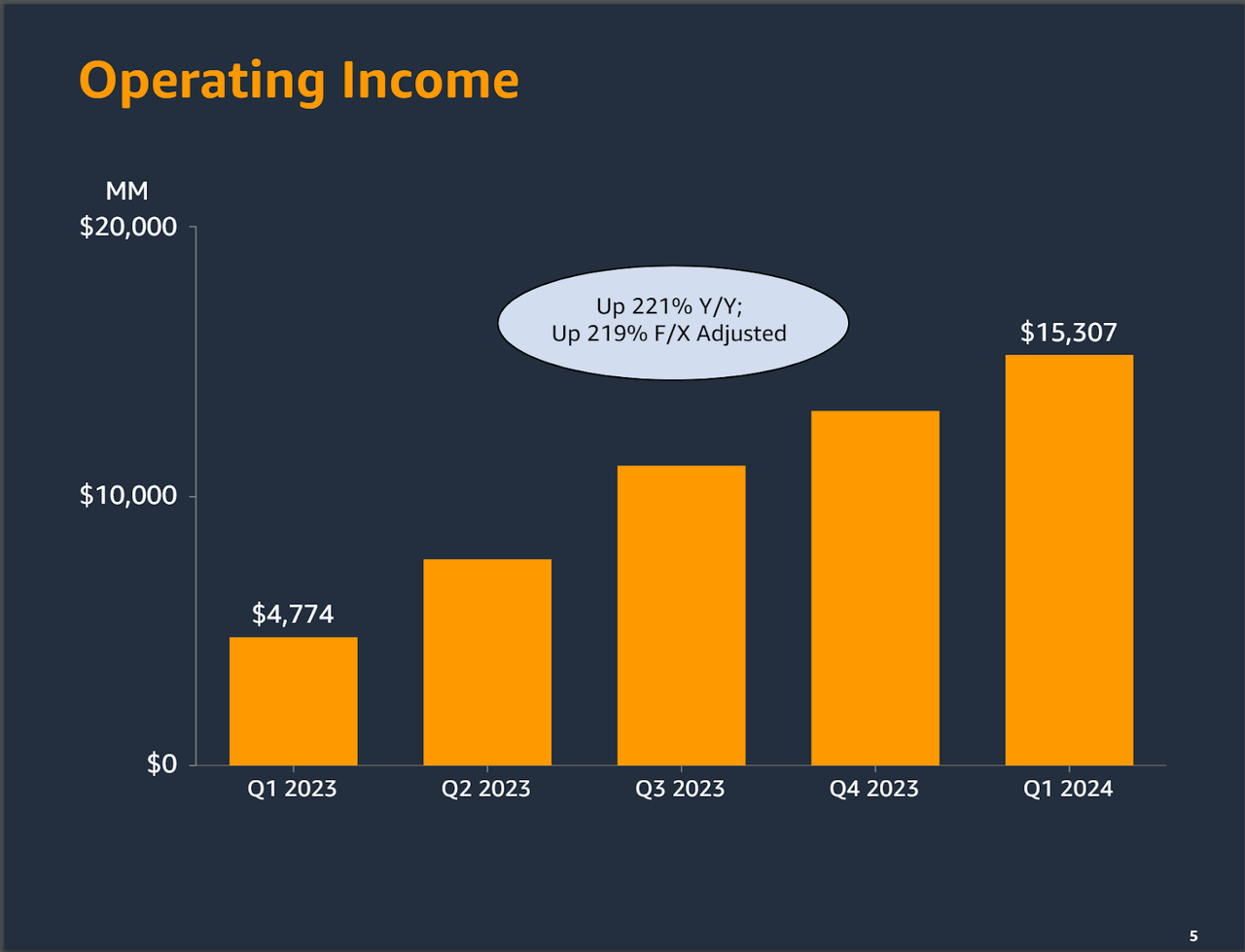

Amazon’s Operating Income, Q1 (Amazon’s Q1 2024 Presentation)

Looking at Amazon’s financials, I see the following picture: for the past two years the company has been disproportionately focusing on increasing its profitability, and the trend is rapidly accelerating.

Amazon grew Operating Income by 221% year-on-year in Q1 2024. I think Amazon is well on track to generate at least between $60 – $70 Billion in 2024, based on the company’s current market guidance and growth trajectory. That figure would be roughly double the total Operating Income generated in 2023. The Operating Income for the Trailing Twelve Months (TTM) has already surpassed that of the year 2023.

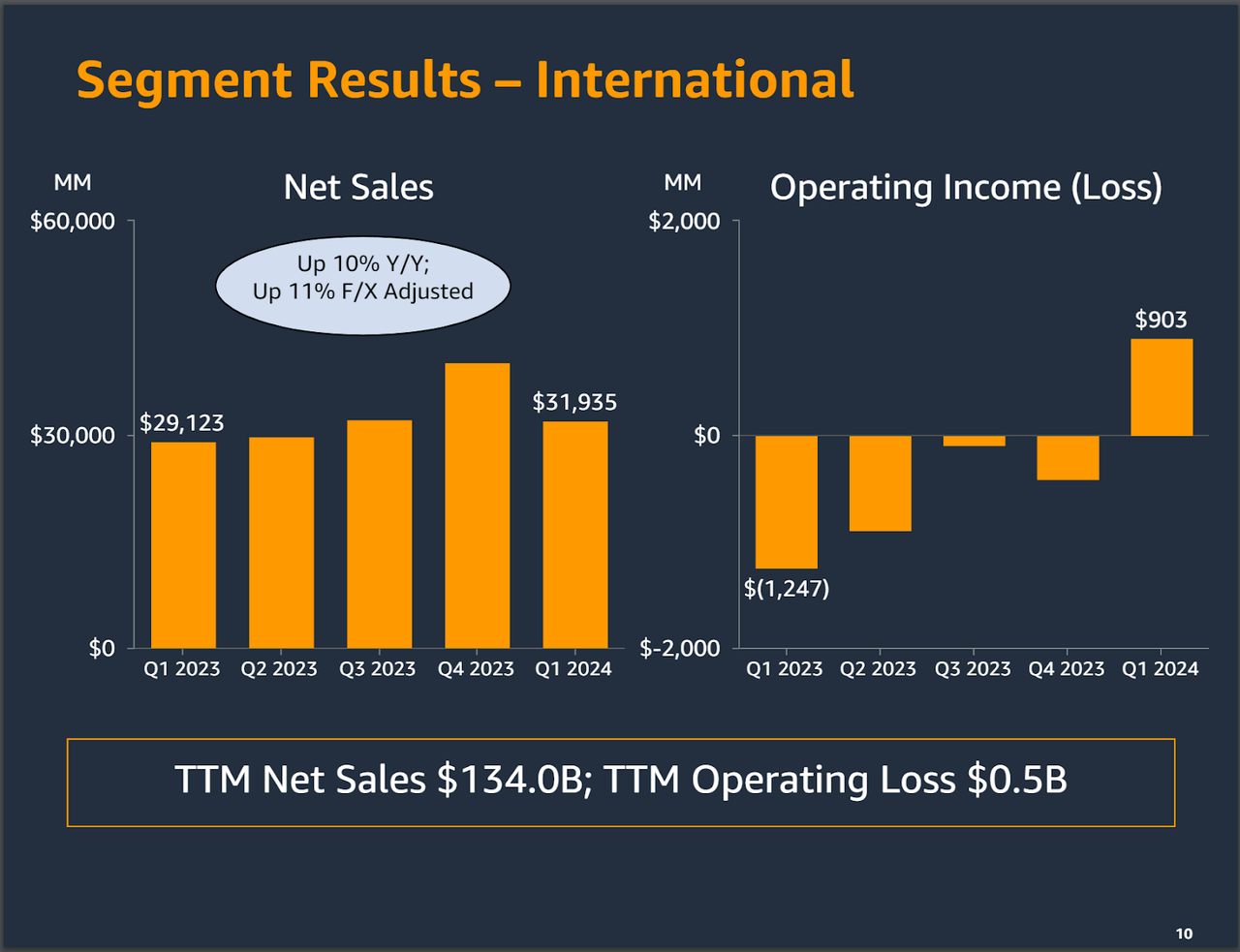

AMZN Results for International Ops (Amazon’s Q1 2024 Presentation)

What’s remarkable as far as Q1 results go in my view is how Amazon has been able to bring to profitability its international operations segment. These have historically been always unprofitable, as eCommerce is generally not growing as much abroad as in the USA.

For reference, Germans spend on average just above half what Americans spend on eCommerce per capita per year. The United States is also still the country where eCommerce is expected to grow at the fastest rate, surpassing India and China.

How has Amazon managed to become so profitable, so quickly? I believe it is a function of a three-legged strategy:

-

Significant Cost Cutting measures. Amazon just underwent the largest round of layoff in its history, with more than 27,000 jobs affected. I think many of these jobs were a legacy from the pandemic, a time when most Tech companies went through a significant hiring spree.

-

Disproportionate strategic focus on the most profitable segments. Amazon is focusing on the growth of AWS and Advertising, two segments that are far more profitable than the company’s eCommerce business. I believe this shows how, while focusing on profitability, Amazon is still demonstrating an ability to diversify its business model into more profitable categories. I will cover this in more detail in the next section.

-

Increased efficiencies in the company’s shipping operations, especially in North America. Back in 2023, Amazon announced a “regionalization” strategy related to their shipping operations. In my view, this is now paying off. The company enjoys a moat in eCommerce-related activities that has been slowly built through decades. It is not perfectly positioned to reap the rewards of its strong position for the foreseeable future.

I believe Amazon’s plan for profitability shows management is fully in control. They are focusing on investing in the businesses that bring more profits, while also tackling the cost areas that are most significant for Amazon – shipping and personnel.

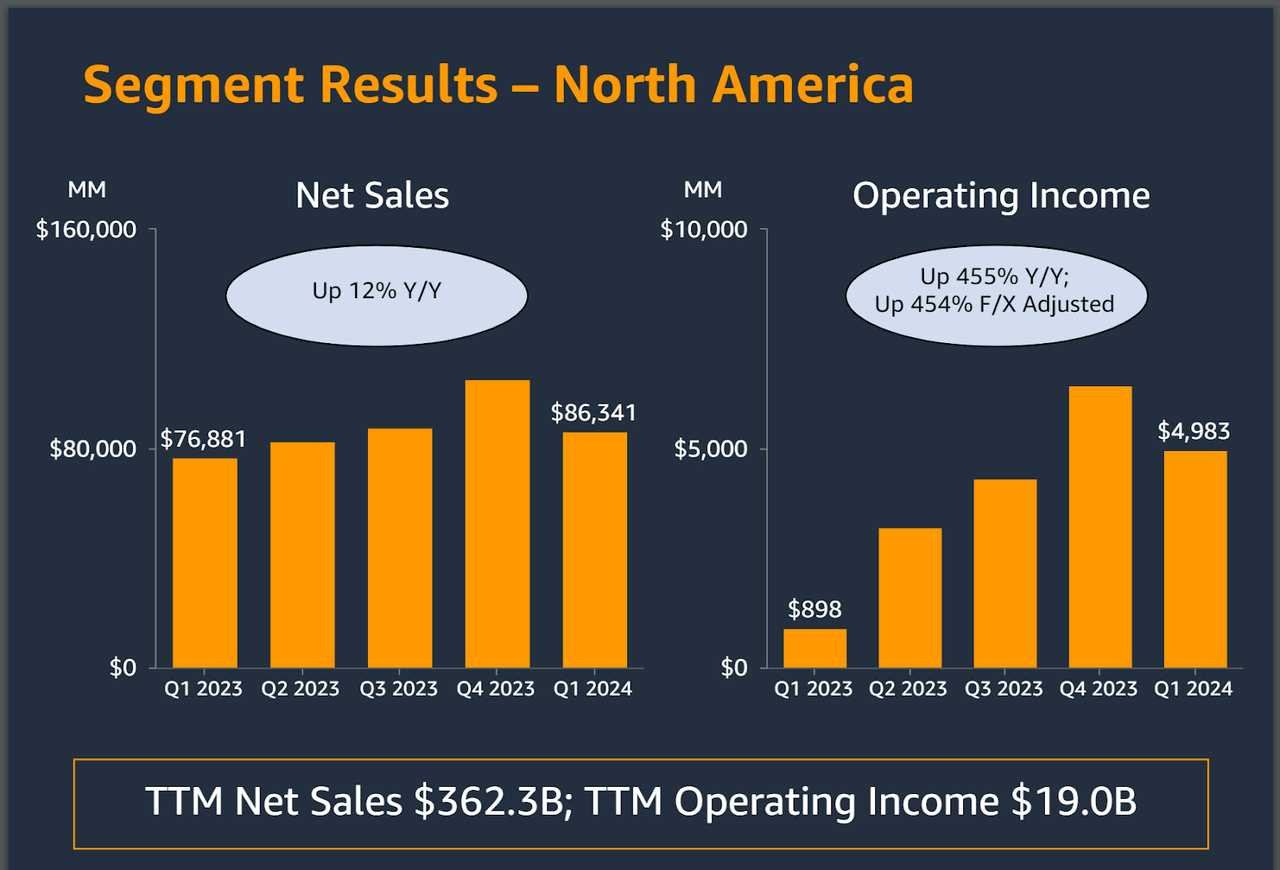

AMZN Results for North America Operations (Amazon’s Q1 2024 Presentation)

The North America segment results are in my view a good proxy for what’s to come for Amazon. Q1 2024 Operating Income has more than quadrupled when compared to Q1 2023, reaching almost levels seen in Q4 last year. Management did this while revenue “only” increased by 13% between these two time periods. North America is the area where Amazon generates the most revenue and its main market

Is Amazon worthy of Tech Royalty? I believe so

In Amazon’s early days, Jeff Bezos famously said: “Your margin is my opportunity.” This meant Amazon wasn’t focused on making a profit but aimed to outcompete others and capture a larger share of the eCommerce market.

I think one of the long-standing challenges with Amazon’s investment thesis – a function of its “day 1” culture – is exactly its lower profitability compared to other tech companies. Despite its profitability issues, Amazon was always seen as a tech company because of its size, rapid growth, and innovative business model.

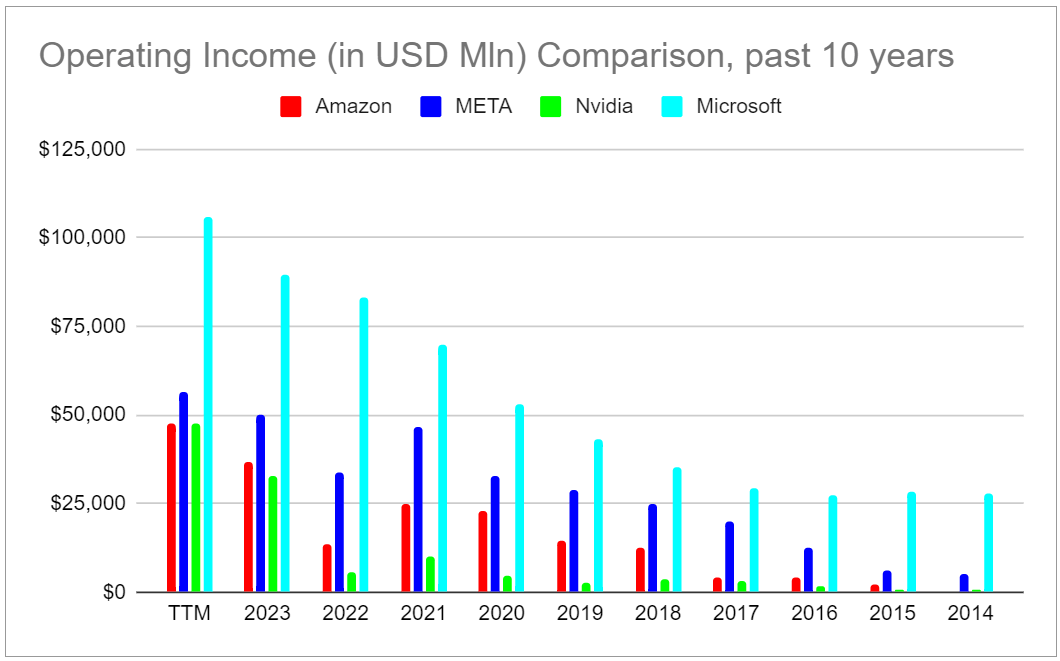

Operating Income comparison, AMZN, META, NVDA, MSFT (Author’s elaboration of Seeking Alpha data)

Today, also, Amazon’s profits are beginning to resemble those of established tech companies like Microsoft Corporation (MSFT). The company’s TTM Operating Income has now matched that of Nvidia Corporation (NVDA) and it is not too far from that of Meta.

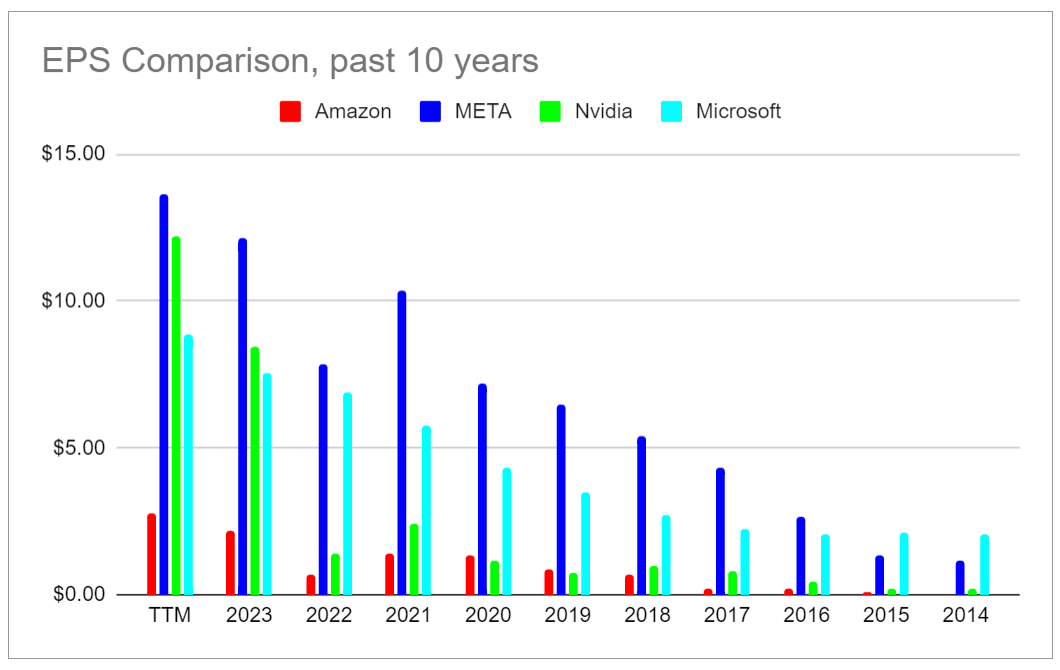

EPS Comparison, AMZN, META, NVDA, MSFT (Author’s elaboration of Seeking Alpha data)

Amazon is also slowly catching up with other Tech companies when it comes to Earnings Per Share (EPS). Obviously, there is still a lot of work to be done and Amazon is nowhere near as profitable as its Tech peers when considering EPS. The company also currently trades at a 40 P/E ratio, significantly higher than the P/E ratio between 25 and 35 of its Tech peers. However, I believe the trend that starts to show in the above charts is clear: Amazon is rapidly catching up with its Tech peers in terms of profitability.

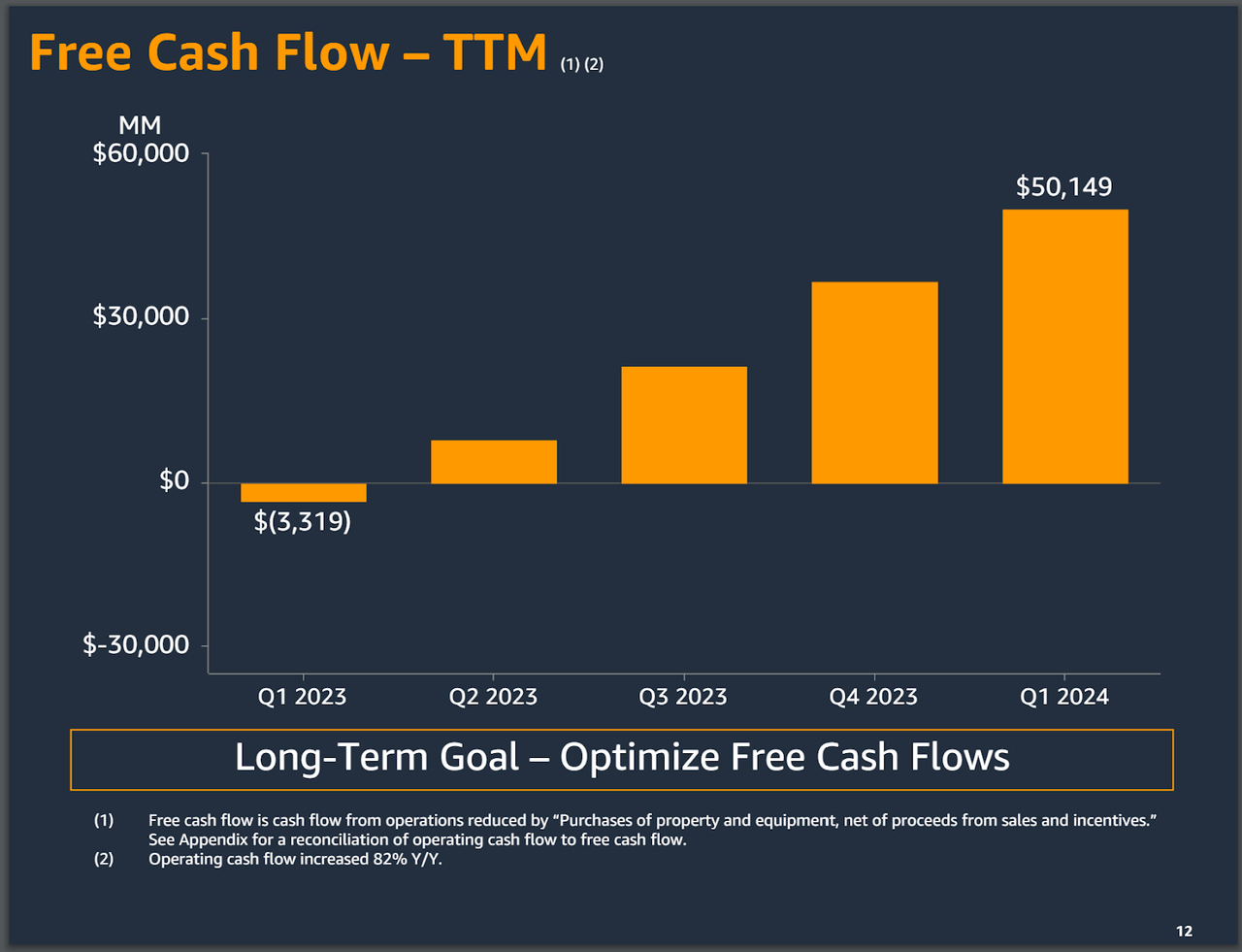

Free Cash Flow, TTM (Amazon’s Q1 2024 Presentation)

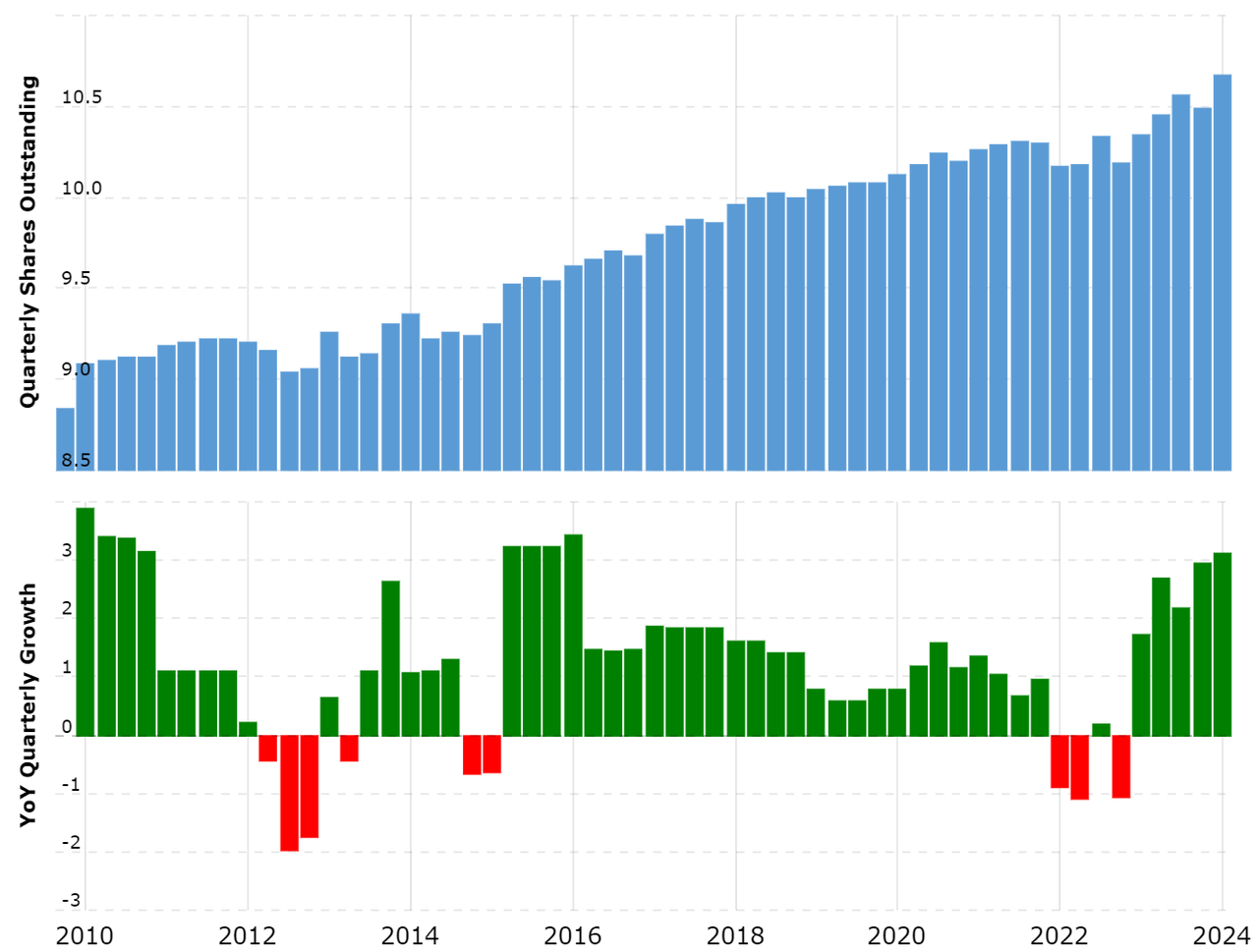

The final two elements that make me are very bullish on Amazon, are the promise of Amazon’s management to start optimizing Free Cash Flows and to “Efficiently Managing Dilution” of shares.

These are yet radical changes from the past. Amazon was one of the few large Tech companies that did not engage in significant stock buybacks during the past decade. As a result, shares outstanding have been growing by more than 10% in the past 14 years. As for Free Cash Flow, the company never spelled out the intent of optimizing it, as management did in the past earnings’ call.

Amazon’s Shares Outstanding, past 14 years (MacroTrends.com)

Is “Day 2” a bad thing? I don’t think so. Amazon still demonstrates the operational and excellence of “Day 1”

I believe Amazon is in a unique position. It has spent decades investing in the growth of its eCommerce and Cloud operations, expanding both categories. Now, the company can focus on increasing its margins while benefiting from the strong market position it has established in all its categories.

There is no doubt in my mind that a switch to focusing on profitability (“day 2”) is not a bad thing for Amazon. The company is clearly exhibiting how it can continue to grow its categories while simultaneously focusing on profitability. Nowhere this is more clear than with AWS and Amazon Advertising – the two growth engines of profitability for Amazon.

Amazon Advertising is relatively new, since the company has effectively relaunched it completely in 2021. In only three years, Amazon Advertising now generates more revenue than YouTube Advertising – something I covered in my recent article about Google, where I recommend a hold for the company.

A focus on Advertising makes sense for Amazon because it is a way to increase the profitability of its eCommerce business, which is historically difficult to monetize significantly. Amazon provides Ads that run on Amazon’s eCommerce platform as well as on Amazon’s Prime Video. This in my view shows how Amazon’s management keeps having great strategic vision on how to monetize and grow their prime category of eCommerce.

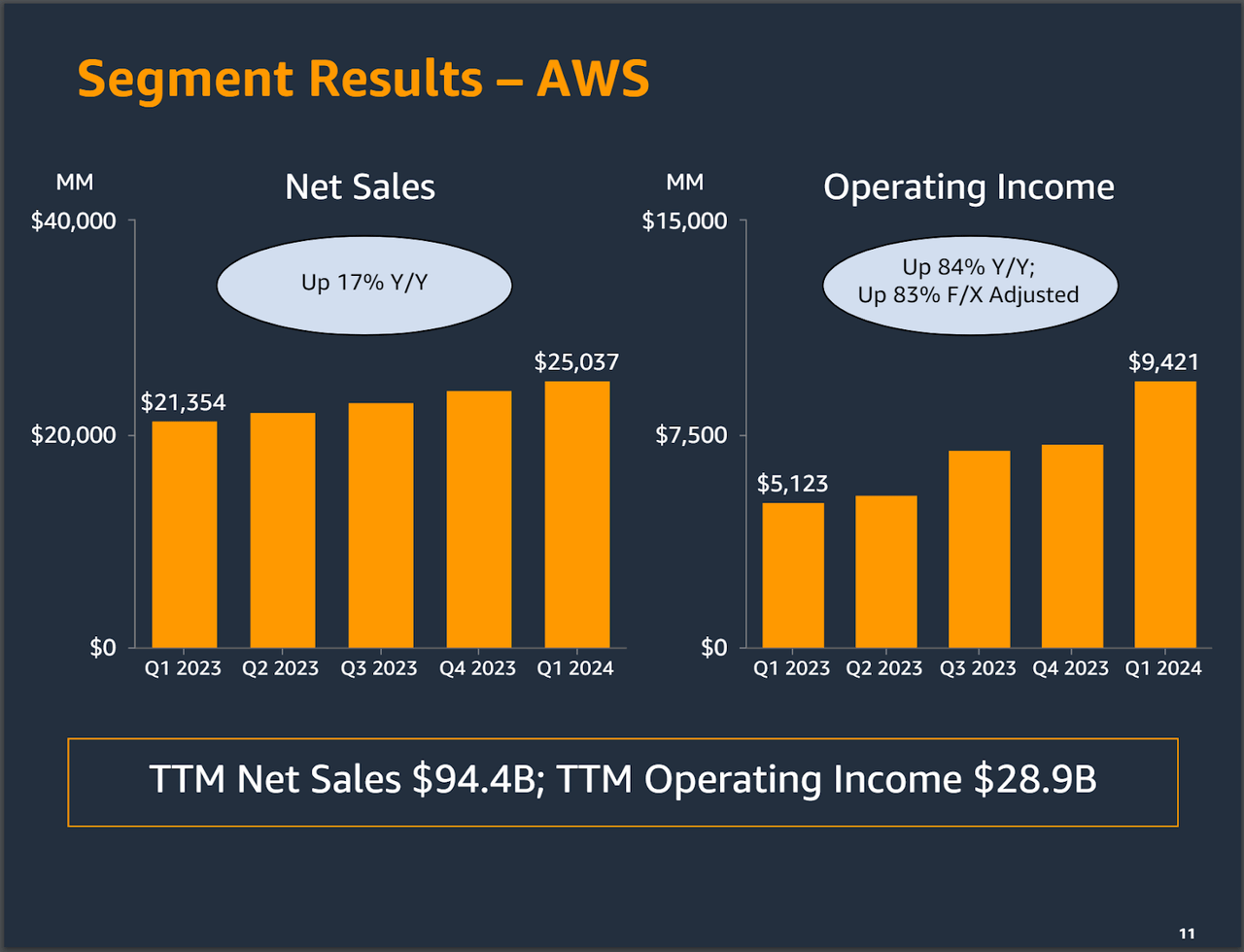

AWS Results, Q1 2024 (Amazon’s Q1 2024 Presentation)

AWS has been growing disproportionately, with Sales up 17% year-on-year as of Q1 2024, and Operating Income up 84% year-on-year. This growth is nothing short of exceptional, in my view, considering that AWS is still the global leader in Cloud services, with a market share of around 30% at the time of writing this article. Once again, I believe this shows how Amazon’s management is simultaneously managing to increase disproportionately profitability while keeping growing core categories to the company.

Where do we go from here? My target is for Amazon to be at least a Top 3 Tech company by market cap

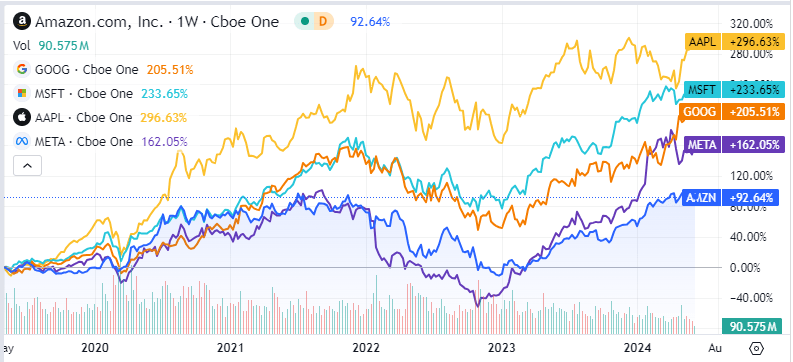

Amazon stock performance vs. peers (Seeking Alpha)

Amazon’s stock has lagged behind most of its Tech peers for the past 5 years. I believe the reason has a lot to do with the shift in US and global interest rate policies. A focus on profit, rather than revenue growth, is especially appreciated by markets during periods of higher interest rates. Lower interest rates tend to inflate the value of all assets, including unprofitable companies (or companies showing little profitability). In a higher interest rate environment, when investors have the option to pocket higher-than-inflation returns risk-free, only profitable companies thrive.

For the past years, while Amazon kept focusing on growing its categories at the expense of profitability, most Tech companies managed to disproportionately grow their Operating Income. As I have outlined in this article, I think times have changed. With Amazon entering “day 2”, I expect its stock to start over performing that of its direct peers for the foreseeable future.

In evaluating a stock, I prefer not to provide exact targets and timeframes. My investment style is based on fundamentals, deep knowledge of products and macro-trends. There are also plenty of good analyses available on Seeking Alpha that provide exact target figures for stocks.

I do, however, believe that a “day 2” Amazon will be able to surpass all other tech companies in terms of profitability – given its size and superior executional excellence. The pricing power is there, and Amazon’s management has only started to unlock it. I do not think the market has fully priced in Amazon’s capability to unlock profits and start rewarding shareholders, simply because historically the company has never focused on either of these two elements.

I think Amazon’s stock will catch up with its peers by growing into a top 3 Tech company in terms of market capitalization. I believe Amazon’s market cap will therefore be in the range of 3 Trillion, matching those of NVDA, Apple (AAPL), and Microsoft. At the bare minimum, I see a 30%-40% upside from current levels.

Further catalysts for Amazon include a shift in global interest rates – which has started with the European Central Bank and Bank of Canada pivoting – as well as the possibility that Amazon will start paying a dividend. META and Google rallied roughly 15% after announcing dividends in the past months.

Risks to my thesis

The main risk to my thesis is that Amazon might not manage to keep growing profitability exponentially as I expect. Amazon’s historical business, eCommerce, is just not as profitable in terms of margins as AWS or Amazon Advertising. While I do think Amazon’s move into Advertising is exactly what the company needed to increase the profitability of its eCommerce business, headwinds might manifest for eCommerce. And that is still the part of Amazon’s business that generates 80%+ of the company’s revenue. If a slowdown in eCommerce sales were to happen, Amazon’s stock would surely suffer.

Other risks include increased competition in the Cloud business and a slowdown in the overall Advertising industry – which is becoming more crucial to Amazon’s business by the day.

AWS is still by far the leader in the Cloud, but Microsoft’s Azure is closing ground, and it is now closer than ever to AWS. Advertising, on the other hand, is a cyclical industry, closely tied with the overall growth of global consumer demand. A slowdown in global Ad spend might affect Amazon’s Advertising unit as much as the business of well established players in the Advertising industry, such as Google or META.

Conclusion

In my opinion, Amazon’s last earnings clearly show how management has guided the company into “Day 2.” From what we have seen so far, Day 2 means an increased focus on profitability, cash flow, and efficient management of share dilution.

I believe this is a dream scenario for shareholders, who are now finally at the center of Amazon’s management interest-more so than during the era when the company focused almost exclusively on growing in size and outcompeting key category rivals.

I expect the market to start realizing just how profitable and shareholder-oriented Amazon has become in the next few quarters, as results and management’s actions prove that Day 2 is a win for investors. I see an upside of at least 30% in Amazon’s stock based on the company’s current market capitalization, and I rate the stock a BUY.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.