Summary:

- Amazon seems to be struggling in the last few quarters – especially as growth rates for AWS slow down.

- Over the long run, Amazon has not only growth potential in ecommerce and its cloud business, but also in healthcare or its “Project Kuiper”.

- However, in the next few quarters, the overvalued stock and looming recession might have a negative effect on the stock price.

- In my opinion, Amazon might decline to $65 or even to $45 in the coming quarters as the stock is still overvalued.

FinkAvenue

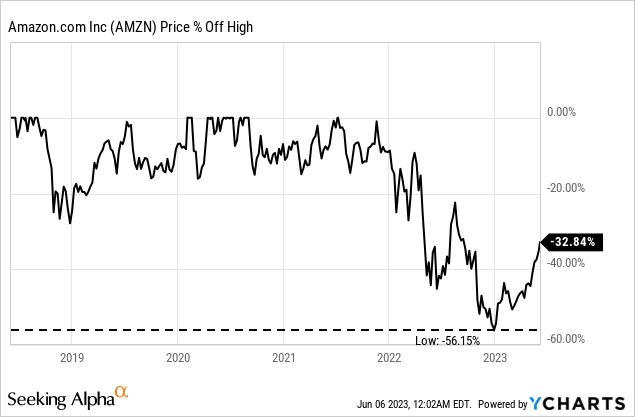

In my opinion, Amazon.com, Inc. (NASDAQ:AMZN) seems like a trap for investors. On the one side, the stock already declined 56% since its previous all-time high and a correction of more than 50% is certainly a steep decline and is in many cases creating a bargain. And although Amazon’s stock price increased again, it is still trading 33% below its previous all-time high.

While we do not have to expect Amazon to decline as steep as during the Dotcom bubble again, when Amazon lost about 95% of its previous value, the combination of still high valuation multiples, AWS growth slowing down and the economy heading towards difficult times is enough to be extremely cautious about Amazon as the stock is in my opinion still far away from being fairly valued.

Solid First Quarter Results

We start by looking at the last quarterly results and for starters, Amazon beat earnings per share estimates by $0.11 and revenue estimates by $2.85 billion. Additionally, total sales increased from $116,444 million in Q1/22 to $127,358 million in Q1/23 – resulting in 9.4% year-over-year growth, which is in line with the growth rates in the last few quarters. Operating income also increased from $3,669 million in the same quarter last year to $4,774 million this quarter – resulting in 30.1% year-over-year growth. This was actually the first quarter since June 2021 in which Amazon could report growth for its operating income. However, trailing twelve months operating income is still less than half of what Amazon could report in 2021.

And instead of a diluted loss per share of $0.38 in Q1/22, the company could now report a diluted net income per share of $0.31 and Amazon is profitable again (on a quarterly as well as TTM basis). However, Amazon still had to report a negative free cash flow $3,319 million for the quarter (and this is in my opinion the more important metric). I already explained in a previous article that I find it deeply irritating that Amazon is not able to be profitable after 30 years (although I understand the necessity of investing in the future).

Retail Improving but Recession Ahead

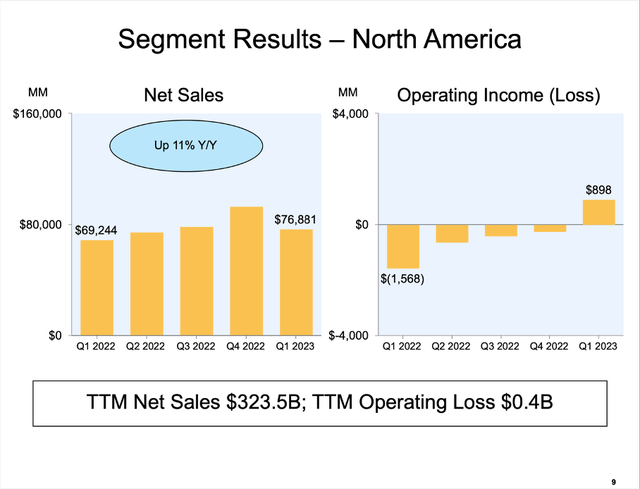

When looking at the two major retail segments – North America and International – we see the picture improving. Net sales for the North America segment increased from $69,244 million in the same quarter last year to $76,881 million this quarter resulting in 11.0% year-over-year growth. And the segment was profitable again ($898 million in operating income) after not being profitable for several quarters in a row.

Amazon Q1/23 Earnings Presentation

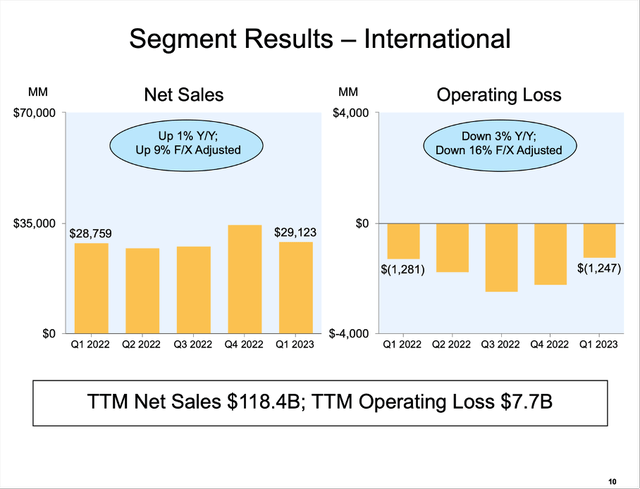

And when looking at the International segment, sales could increase only slightly from $28,759 million to $29,123 million, however, FX-adjusted, sales would have increased 9% year-over-year. While the segment could report solid top line growth, it was once again not profitable.

Amazon Q1/23 Earnings Presentation

And when looking at the results in even more detail, we can see that online store sales struggled and could grow only 3% year-over-year (FX adjusted), but especially subscription services (17% YoY growth), third-party seller services (20% growth) and advertising services (23% YoY growth) could report strong growth rates. And especially growth of advertising services is impressive when considering that peers – like Meta Platforms (META) – struggled and could grow revenue only in the low-to-mid single digits. However, Amazon should be cautious not to sacrifice its customer experience – which is key for Amazon – for growth in advertisement revenue. And with a growing number of ads, the customer experience might get worse.

While the first quarter results were solid, we should not ignore the signs for a potential recession. And Amazon is also seeing these signs – for example a shift in customer spending towards lower-price items. During the last earnings call, CFO Brian Olsavsky made the following statement:

We saw moderated spending on discretionary categories as well as shifts to lower-priced items and healthy demand in everyday essentials, such as consumables and beauty. Third-party sellers, including businesses who elect to utilize Fulfillment by Amazon for their storage and shipping services are a key contributor to the selection offered to customers.

However, the economy heading towards a recession and the labor market slowly turning has also a positive effect for Amazon. As the CFO pointed out during the earnings call, labor availability is stabilizing again (as Amazon had troubles to find workers in the last few quarters).

Although the unemployment rate is still extremely low (3.7% in May 2023), we see the labor market slowly shifting. In the two years following the pandemic, people quitting was the highest it has been in the last 20 years (I don’t have older data) and layoffs were close to zero. But in the last few months we saw a reversion to the mean again with layoffs increasing and people quitting slowly drifting lower again.

And Amazon itself is also laying off people. In 2023, we are talking about 27,000 layoffs. Amazon already laid off 18,000 employees earlier this year and now Amazon will eliminate additional 9,000 roles – especially impacting AWS, Twitch, advertising, and human resources.

AWS Struggling?

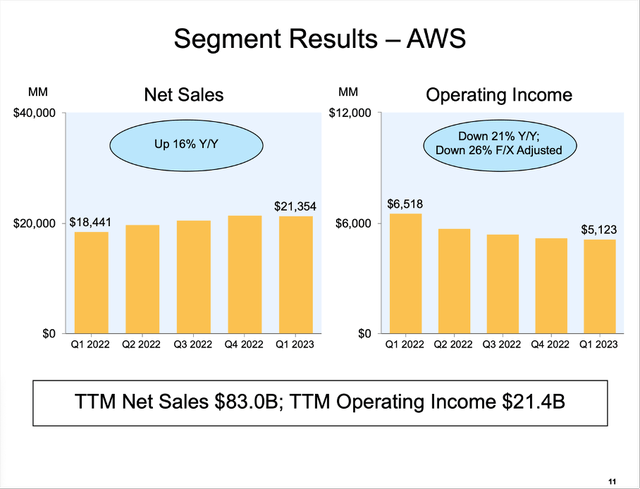

AWS is still the most important segment for Amazon as it is driving almost all operating income for the company although operating income declined from $6,518 million in the same quarter last year to $5,123 million this quarter. Net sales however still increased from $18,441 million to $21,354 million.

Amazon Q1/23 Earnings Presentation

And Amazon is also seeing a strong trend by its AWS customers towards saving costs resulting in lower growth rates for its AWS business. Growth slowed down in the first quarter and for April, revenue growth rates are about 500 basis points lower than in the first quarter. Amazon is pointing towards businesses of all sizes trying to save costs, which has a negative effect on their cloud spending. The mediocre outlook for the cloud business was often quoted as reason why a 12% jump following earnings turned into a stock price declined during the earnings call.

But long term, Amazon’s cloud business should have high growth potential. Brian Nowak of Morgan Stanley for example believes that Amazon Web Services has a total addressable market of $2.5 trillion, which is still largely untapped. During the last earnings call, Andy Jassy pointed out that more than 90% of global IT spending is still on-premises but he is believing that the equation is going to flip, and more and more businesses are going to move to the cloud. Another study is seeing the public cloud total addressable market around $2 trillion in a base scenario with bullish scenarios up to $10 trillion.

And this is backed up by several different studies (see here and here) and forecasts that also expect high growth rates for the cloud business in the years to come.

Additionally, product innovation and delivery in case of Amazon is rapid and compelling. And Andy Jassy also pointed out that people don’t really get what impact AI will have on the cloud business:

And in my opinion, few folks appreciate how much new cloud business will happen over the next several years from the pending deluge of machine learning that’s coming.

About a month ago it was also reported by Forbes that Amazon has ambitious plans to build a new team dedicated to developing artificial intelligence tools (including tools to design and create photos and videos for merchants on the Amazon platform).

And although the cloud business is struggling a bit, the long-term potential for cloud and AWS still seems very promising – not only because of the move towards AI.

Future Growth

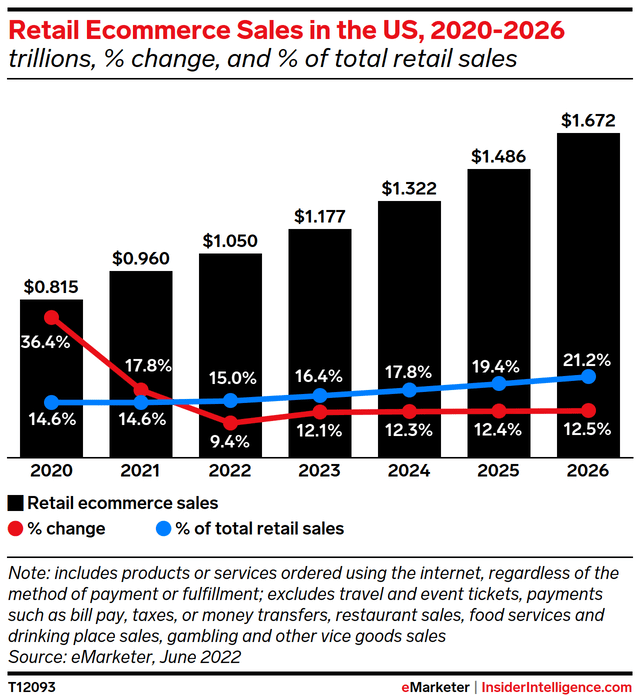

But not only cloud will contribute to growth. Ecommerce will also continue to grow in the high-single or even double digits, and we can assume that Amazon will be able to profit from that growth. Ecommerce sales in the United States are expected to grow about 12% annually for the years to come.

And aside from already existing business segments, CEO Andy Jassy outlined during the last earnings call once again that Amazon has huge plans for the future and will continue to expand into new businesses:

These are investments both in our larger business as mentioned earlier as well as in areas like international expansion in our stores business, large retail market segments in which we’re still nascent like grocery and business-to-business, allowing consumers to use Prime off of Amazon in our Buy with Prime program, entertainment, devices, health care and our Low Earth Orbit satellite for the hundreds of millions of households, companies and government entities that have limited to no connectivity.

It’s hard to predict that all of these will be successful but only one or two working would change our business over the long term. We have a lot of work in front of us, but I like the direction we’re headed and strongly believe our best days are in front of us.

And two of the projects Amazon will especially focus on in 2023 – also outlined by Andy Jassy in his annual letter to shareholders – are healthcare and its “Project Kuiper”.

For example, Amazon’s push into healthcare seems to be one of the more promising plans for the coming years. And on February 22, 2023, the acquisition of One Medical was completed. One Medical is a primary care organization offering both 24/7 virtual care services and in-office visits across the U.S. for preventive and everyday health, chronic care management or mental health service. This is following previous deals like the acquisition of PillPack in 2018.

Another future growth project might be “Project Kuiper” – this is a project to bring fast, affordable broadband to unserved and underserved communities by 3,236 satellites in low Earth orbit. Amazon’s plan is to start offering commercial services next year and management is often comparing the project to AWS as the company is hoping for similar profits (after huge up-front investments).

Still Overvalued

Aside from a potential recession that will have a negative impact on Amazon’s business in the short-to-mid term, another “problem” remains: the valuation. Despite the above-mentioned decline, the stock is still trading for extremely high valuation multiples, and it seems not like a good investment. And especially high valuation multiples combined with a looming recession and lower revenue growth rates (or even declines) is often the recipe for short-to-medium term investment disasters. These are usually the stocks that get punished hard.

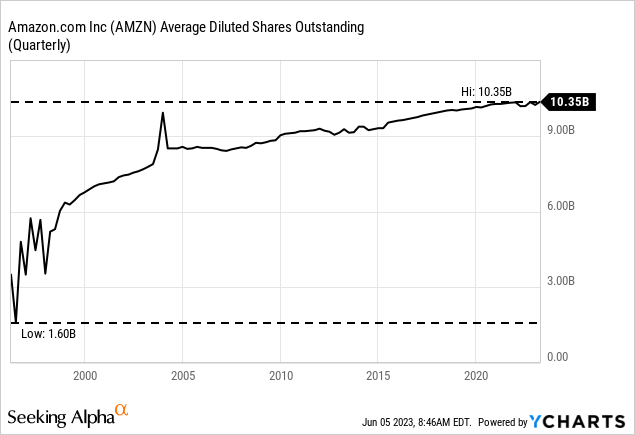

A first minor problem is Amazon constantly increasing the number of outstanding shares. And while share growth clearly slowed down, Amazon still increased the number of outstanding shares from 9.12 billion 10 years ago to 10.35 billion right now – an increase of 13.5%.

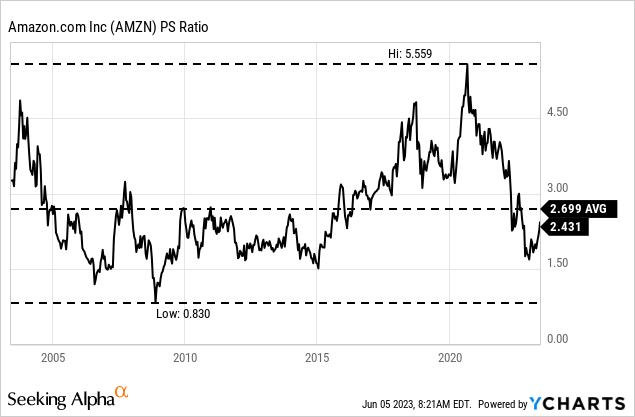

We can start by looking at the price-sales ratio and when excluding the Dotcom years (when Amazon stock was peaking at a P/S ratio of 43) the P/S ratio was between 0.8 and 5.6 in the last twenty years. Right now, Amazon is trading for 2.43 times sales which is below the average of the last two decades and actually one of the lower P/S ratios in the last few years.

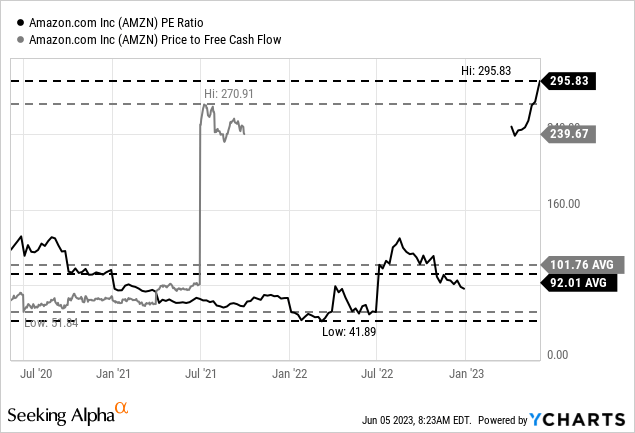

However, when looking at price-earnings ratio or price-free-cash-flow ratio the picture is different. For starters, with free cash flow being negative for several quarters in a row now, it is not possible to calculate a P/FCF ratio. And after a few quarters in which it also wasn’t possible to calculate a P/E ratio, Amazon is now trading for almost 300 times earnings.

It is certainly easy to make up earnings per share estimates for the future and calculate a forward P/E ratio that is much more reasonable than TTM numbers. In case of Amazon, the forward P/E ratio right now is “only” 80. But I also agree that P/E ratios are only a snapshot of a certain point in time and can be extremely misleading (in both directions).

Therefore, a discount cash flow calculation is usually a better way to determine an intrinsic value. And let’s make similar assumptions again as in my last article. We take a free cash flow of $26.96 billion as basis (the highest amount Amazon could report so far) as well as 10,347 million outstanding shares. As growth rate in 10 years from now (till perpetuity) we use 6% again – as always for our wide economic moat companies. When calculating with these assumptions (and a 10% discount rate), Amazon must grow between 15% and 16% in the next ten years to be fairly valued at this point. And while these growth rates could be achievable for Amazon, we should not take them for granted – especially as Amazon first must demonstrate its ability to generate $27 billion in free cash flow again.

Conclusion

When looking at the chart, it seems like Amazon broke its downtrend already and could be on its way towards higher stock prices again.

However, I don’t see Amazon in an uptrend yet – at least not before it can break above $145. And in my opinion, there is still huge downside risk, and the current upward wave seems like a bull trap as it is only a correction of the previous down wave. I would still hold out for Amazon either reaching the range between $65 and $72 or – in a more extreme case – the support level around $45. I know these price targets might seem absurd to many Amazon bulls, but the combination of growth slowing down due to a potentially severe recession and a stock price built on high growth expectations could easily lead us there.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.