Summary:

- Next week, I intend to once again meaningfully up my position in Amazon, bringing it up to par with the S&P 500 index’s weighting.

- The company’s net sales and diluted EPS outpaced analysts’ expectations in the third quarter.

- Amazon enjoys an AA credit rating from S&P on a stable outlook.

- Shares could be trading at a 35% discount to fair value.

- Amazon has a viable path to put up 36% annual total returns through 2026.

An Amazon Prime van on its delivery route. Sundry Photography/iStock Editorial via Getty Images

Those who have followed my work over the years know that I’m a younger investor. I’ll be 28 in April, and it’s been quite a learning process in the seven plus years that I have been investing.

In my younger years, I used to very much buy into the diversification for the sake of diversification fallacy. This led me to start too many positions for the sake of what Peter Lynch has called “diworsification.” As a result, I purchased what I now view as lower conviction positions as a way to “hedge my bets.” This led my portfolio to swell to 100 positions at one point earlier this year.

In recent months, I’ve been busy closing out positions. I’m now down to 92 positions and would ideally like to get down to 40 or 50. There’s a lot of overlap in my portfolio and I think I can eventually reach the high end of that range, or at least come close.

As I’m selling out of positions, I’m looking to concentrate more heavily on my top picks. One of those names is Amazon (NASDAQ:AMZN). When I last covered the stock with a strong buy rating in September, I liked Amazon for its remarkable growth story. The explosion in free cash flow and impressive balance sheet were also pluses. Lastly, Amazon’s valuation was a steal.

Amazon’s third quarter results shared on October 31st only convinced me more of my strong buy rating. The company posted a double beat in the quarter. The long-term tailwinds also remain undeniable for Amazon. Shares are still trading substantially below fair value, which makes the strong buy case an easy one to make in my view.

Amazon Still Has A Lengthy Growth Runway

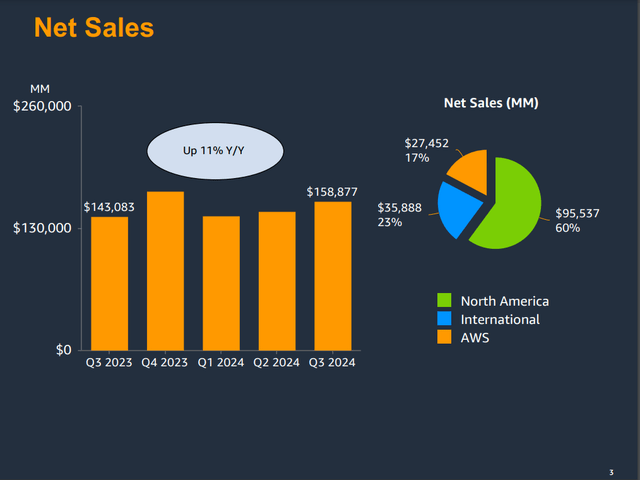

Amazon Q3 2024 Earnings Presentation

As I alluded to at the outset of this article, Amazon delivered for shareholders in the third quarter. The company’s net sales climbed by 11% over the year-ago period to $158.9 billion during the quarter. This beat Seeking Alpha’s analyst consensus for the quarter by $1.6 billion.

Amazon’s North America segment drove the largest portion of topline growth in the third quarter. The segment’s net sales grew by 8.7% year-over-year to $95.5 billion during the quarter. This was the result of increased unit sales, which was fueled by Amazon’s continued dedication to price, selection, and customer convenience. That translated into greater third-party seller sales, advertising sales, and subscription services for the segment.

The company’s AWS segment was again the second-biggest growth catalyst for the third quarter. AWS segment net sales vaulted 19.1% higher over the year-ago period to $27.5 billion in the quarter. CEO Andy Jassy pointed to more customers growing their footprint in the cloud in his opening remarks during Amazon’s Q3 2024 Earnings Call. This is backed up by the recent deals with the likes of Booking.com, Capital One, and T-Mobile. Higher customer usage again more than countered pricing changes driven by long-term customer contracts. That helped to produce the outsized topline growth for the AWS segment during the quarter.

Finally, the International segment made a solid contribution to Amazon’s topline growth for the third quarter. The segment’s net sales rose by 11.7% year-over-year to $35.9 billion in the quarter. Just as was the case for the North America segment, Amazon’s emphasis on price, selection, and convenience resulted in an uptick in unit sales during the quarter. That pushed the segment’s topline higher for the quarter.

Amazon’s diluted EPS soared 52.1% over the year-ago period to $1.43 in the third quarter. That trounced Seeking Alpha’s analyst consensus by a whopping $0.29 during the quarter. Amazon’s total operating expenses increased by just 7.3% year-over-year to $141.5 billion for the quarter. This careful cost management led to a 270-basis point expansion in the company’s net profit margin to 9.6% in the quarter. That is how Amazon’s diluted EPS growth rate far outpaced the net sales growth rate during the quarter.

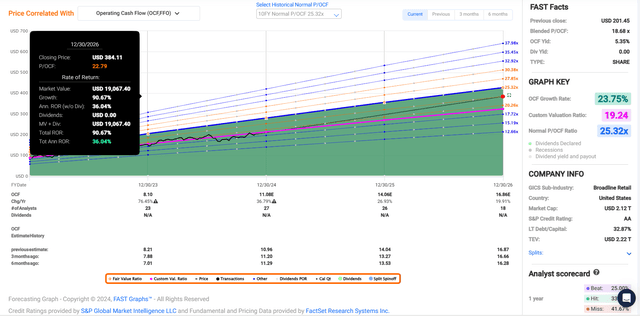

Amazon’s future also continues to be bright beyond this year. This is most prominently evidenced by the analyst outlook for the company’s operating cash flow per share. As I have indicated in previous articles, this is the most important metric for Amazon in my opinion. That’s because operating cash flow per share accounts for its capex-heavy business model, which can skew free cash flow in heavy capex cycles.

After expecting a 36.8% spike in operating cash flow per share to $11.08 for 2024, the FAST Graphs analyst consensus remains promising for 2025 and 2026, too. In 2025, another 26.9% surge in operating cash flow per share to $14.06 is being anticipated. For 2026, an additional 19.9% boost in operating cash flow per share to $16.86 is the current consensus.

Amazon’s leadership in thriving industries continues to be the driving force for these remarkable growth estimates. Market research firm, Forrester Research, anticipates that global retail e-commerce sales will rise from $4.4 trillion in 2023 to reach $6.8 trillion in 2028. The convenience of e-commerce is expected to take its total share of global retail sales from 20% to 24% in that time. It stands to reason that Amazon’s moves should keep attracting more customers. That includes the recent addition of unlimited grocery delivery from Whole Foods Market, Amazon Fresh, and local third-party grocery partners for an extra $9.99 a month for Prime members.

For AWS, most global IT spending remains on-premises. As companies continue to transition more to the cloud, Amazon is in a prime position to keep benefitting from this ongoing trend.

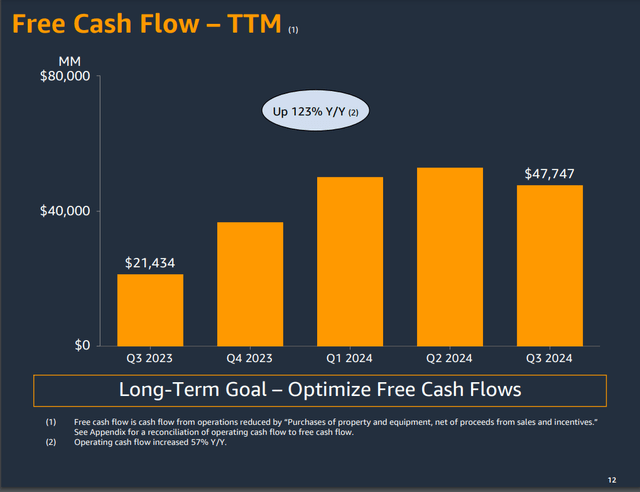

Amazon Is Becoming A Free Cash Flow Machine

Amazon Q3 2024 Earnings Presentation

Amazon is also becoming a lean, mean, free cash flow machine. In the past 12 months, operating cash flow has risen by 57.3% year-over-year to $112.7 billion. In that time, net capex has “only” increased by about half of that rate (+29.3%) to $65 billion. That has resulted in a more than doubling of TTM free cash flow to an astonishing $47.7 billion.

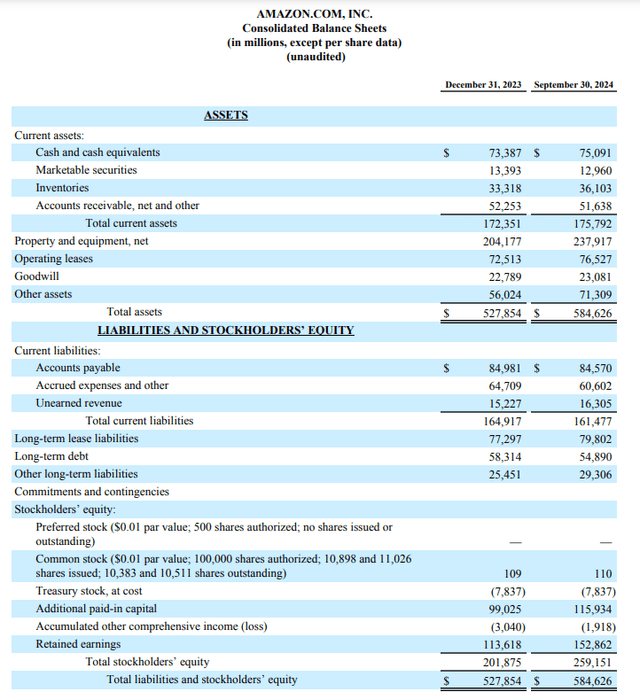

Amazon Q3 2024 Earnings Press Release

Thanks to its immense free cash flow, Amazon’s net cash and marketable securities position remained vigorous at $33.2 billion as of September 30th, 2024. Thus, the company has swung from a net interest expense of $421 million in the year-ago period to a net interest income of $1.6 billion so far in 2024. That is why Amazon possesses an AA credit rating from S&P on a stable outlook per The Dividend Kings’ Zen Research Terminal (unless otherwise sourced or hyperlinked, all details in the previous two subheads were according to Amazon’s Q3 2024 Earnings Press Release, Amazon’s Q3 2024 10-Q Filing, and Amazon’s Q3 2024 Earnings Presentation).

Fair Value Could Be Over $300 A Share

In less than three months, shares of Amazon have gained 18% as the S&P 500 index (SP500) has notched just 10% gains. The degree to which Amazon is undervalued isn’t quite as much as it was in September. However, there is still a ton of room from my perspective for the stock to rally much more.

Amazon’s forward P/OCF ratio is just 14.6, which is several standard deviations below the 10-year average P/OCF ratio of 25.3 per FAST Graphs. Keep in mind that Amazon’s 23.8% annual forward OCF per share growth consensus isn’t too far off of its 10-year average of 29.7%. The fact that its growth profile is still that strong as a $2 trillion company is mind-boggling. Yet, it makes sense with Amazon’s growth catalysts.

Is a reversion to the 10-year average P/OCF ratio probably a bit too optimistic? Sure. All things considered, though, I stand by my fair value estimate of one standard deviation below this multiple – – or 22.8.

The calendar year 2024 is going to be 92% complete after this week. That means another 8% of 2024 and 92% of 2025 are to come in the next 12 months. This guides my 12-month forward OCF per share input of $13.83.

Applying my fair value P/OCF ratio, I arrive at a fair value of $315 a share. From the current $206 share price (as of November 26th, 2024), this implies Amazon’s shares are 35% undervalued. If it grows as anticipated and returns to fair value, Amazon could generate 36% annual total returns by the end of 2026.

Risks To Consider

Amazon is certainly in the conversation of the best businesses on the planet. Even so, there are risks that should be monitored to make sure that the investment thesis is holding up.

As I outlined in my prior article, Amazon has treasure troves of customer data, of which most companies can only dream. That stash of data could be very valuable to bad actors, too. If any attempted cyber breaches are successful on a large enough scale, trust in the Amazon brand could be diminished. Massive legal settlements against the company could also materialize. These headwinds could be enough to meaningfully damage the investment thesis.

In a multi-trillion-dollar global e-commerce retail industry, there is plenty of competition that Amazon will have to win out against to keep thriving. These include Temu and Shein. If Amazon can’t execute properly, it could risk losing market share to these competitors. That could pose at least a slight setback to the company’s growth prospects.

Another risk to Amazon is the potential for legislation to be passed in key markets that could chip away at its competitive positioning. If this happened, the company may not be able to function as efficiently as it would otherwise. That could impact its fundamentals as well.

Summary: Marching Toward An Overweight Amazon Stake

The Dividend Kings’ Zen Research Terminal

Amazon is a booming business, with the catalysts needed to keep generating strong growth for shareholders. Free cash flow keeps improving, and the balance sheet is incredibly vigorous. For my money, the valuation here remains enough of a no-brainer to justify a continued strong buy rating.

That’s why Amazon comprises 3% of my portfolio and is my third-biggest holding. In the next week, I plan on adding another 25% or so to my position. This will put my weighting just ahead of the S&P 500’s 3.7% weighting in Amazon. I could easily envision this holding making up even 5% or 6% of my portfolio one day.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.