Summary:

- Amazon stock sold off over 12% post-earnings. I believe the reaction is unwarranted due to their stronger financial health and growth prospects.

- Despite a slight margin drop, Amazon’s profitability remains high, with strong margins and impressive financial metrics. These margins will likely improve again.

- The market’s misinterpretation of Q2 earnings overlooks the strong performance of AWS and overall positive outlook for Amazon, making it a strong buy.

FinkAvenue

Investment Thesis

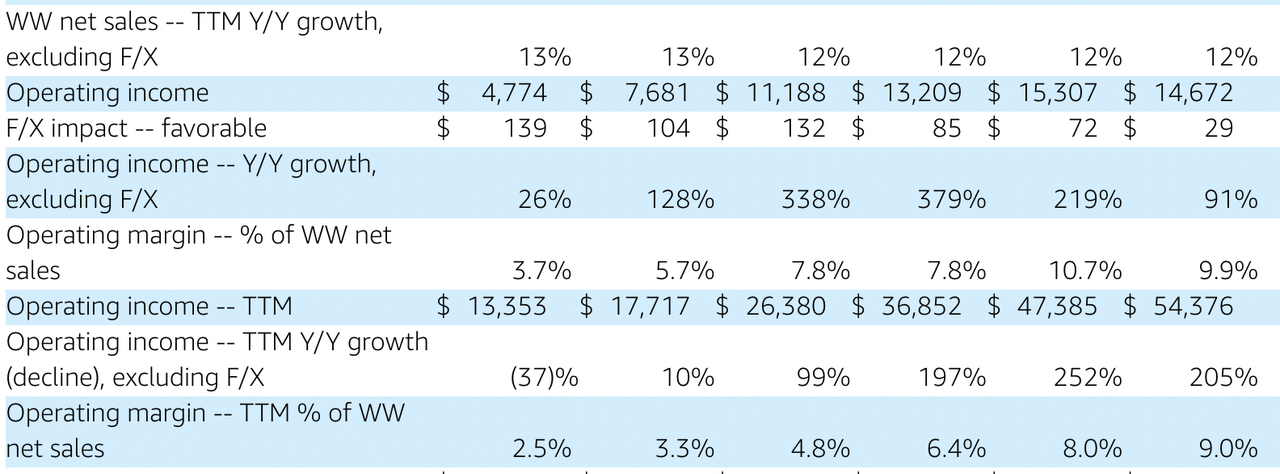

Since I last covered Amazon (NASDAQ:AMZN) in July (pre-earnings), the stock has sold off in part due to the market’s reaction to earnings. I believe this reaction is unwarranted. While operating margins dropped slightly, the market appears to be overlooking the substantial improvements the company has achieved, especially compared to the previous year. Amazon (because of their cyclicality due to seasonal retail trends) will often see margins move up and down on a sequential basis. What matters is YoY improvement.

Amazon Operating Results (Amazon)

On the whole, Amazon’s gross profit margin is holding strong, with TTM standing at 48.04%, which is 30.26% higher than the sector median and also 12.80% above the 5-year average of 42.59%.

The market has sold off the stock like they reported a serious setback. Yet, Amazon’s overall financial health remains strong, with substantial cash flow and seriously impressive margins. The company’s profitability grades are high across multiple metrics, such as a strong TTM EBITDA margin of 17.22% (51.33% higher than the sector median) and a TTM net income margin of 7.35% (54.97% higher than the sector median).

The market’s misinterpretation of the results seems to stem from a myopic focus on the guidance and a slight margin drop. I believe this neglects the broader picture of Amazon’s financial health and growth prospects. The trailing twelve-month PEG ratio of Amazon is currently at 0.18, significantly lower than the sector median of 0.61, showing that the market has doubted the company’s ability to grow earnings quickly over the last 12 months. I believe this may be the case for the next 12 months.

Despite the market’s reaction to the company’s Q2 earnings report, I remain unconcerned. I think Amazon shares remain a strong buy.

Why I’m Doing Follow-Up Coverage

Usually, I don’t cover the same stock within such a short timeframe. However, I think the market’s visceral reaction to Amazon’s latest quarter is a complete overreaction.

Despite a slight dip in operating margins, I think the company’s overall profitability remains strong, with AWS posting a 19% revenue growth and exceeding Wall Street’s expectations. The sell-off, which saw Amazon shares drop by roughly 9% (now down roughly 12% from the close right before earnings), appears to be an over reaction to guidance shortfalls rather than a reflection of the company’s underlying strength.

The purpose of this article is to dive deeper into Amazon’s business potential, and show how the e-commerce company’s strong fundamentals remain and highlight the progress the market seems to have overlooked.

Earnings Recap

I believe Amazon’s Q2 report was really overall positive. The Washington state-based company reported earnings per share at $1.26/share, beating expectations by $0.24, while revenue came in at $147.98 billion, slightly missing the consensus estimate by $780.22 million. While I could see how this miss could appear concerning on the surface, it’s important to note that this is still 10.12% year-on-year growth. Even with a slight miss, the company showcased several strong points that were largely overshadowed by the market’s focus on a guidance shortfall.

For example, Andy Jassy, CEO, stated during the call:

Operating income was $14.7 billion, up 91% year-over-year, and trailing 12-month free cash flow adjusted for equipment finance leases was $51.4 billion, up 664% or $44.7 billion year-over-year -Q2 Earnings Call.

91%?? I find it hard to believe how a company that is doing over $500 billion in annual revenue disappoints the market when operating income is up 91% YoY.

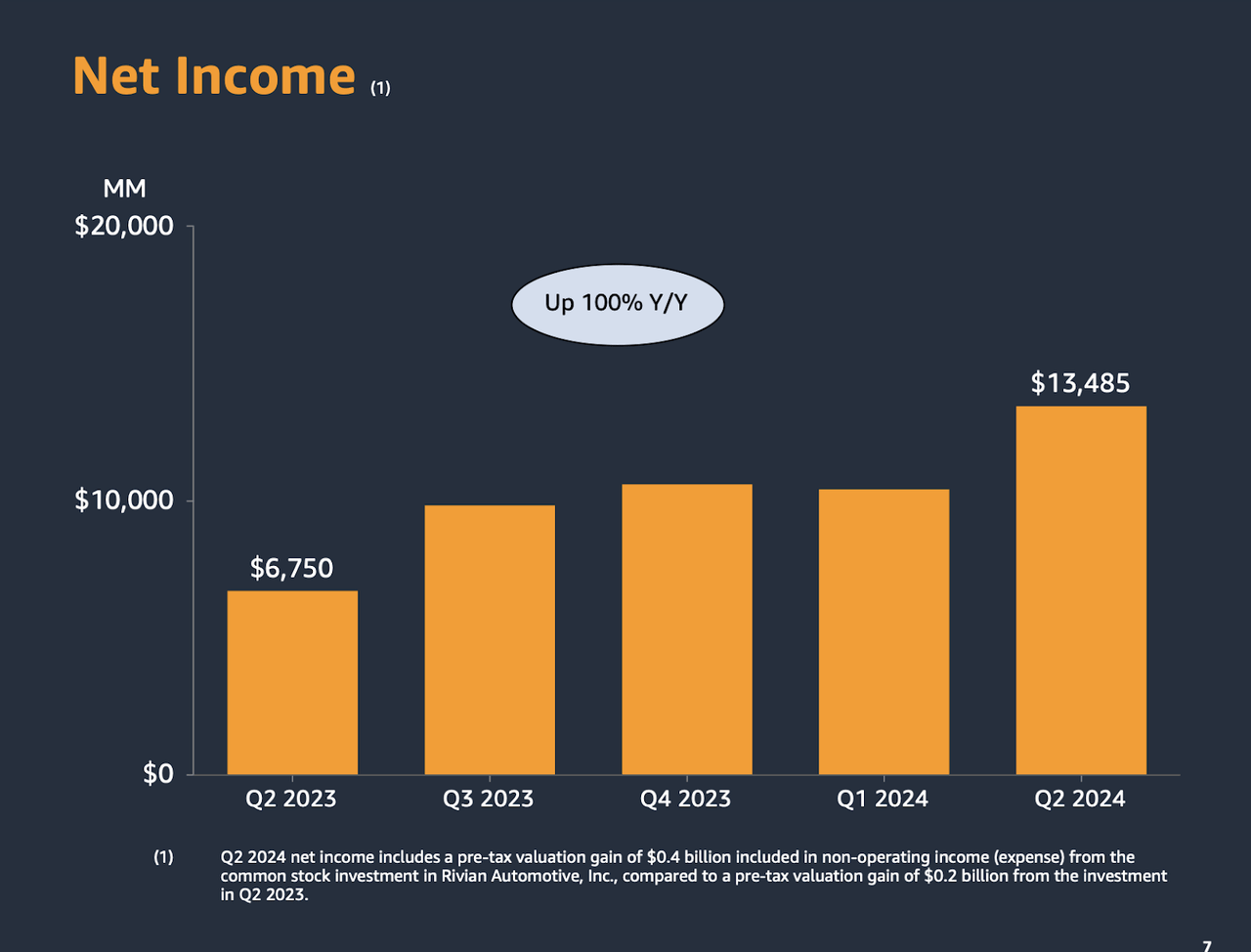

Apart from operating income, Amazon’s net income results were equally promising. Their e-commerce division is using AI to optimize and eliminate the need for human labor.

Amazon Net Income (Amazon)

Net income is growing exponentially, increasing a whopping $6.7 billion to $13.485 billion, up 100% year over year.

Looking specifically at AWS, performance here was a key highlight of the earnings report. AWS reported a 19% revenue growth, reaching $26.3 billion, which surpassed Wall Street’s expectation of 17.6% growth.

I believe this re-acceleration in AWS after facing headwinds last year is a critical factor in Amazon’s overall profitability, since this business line’s high margins have historically powered the company to invest in growth. Now, it helps profits compound and reach new records.

In fact, some analysts project AWS to even grow their margin further for the rest of 2024, with expectations of achieving 35.5% margins by the year’s end, up from 34.1%.

During the earnings call, Jassy touched on AWS:

During the past 18 months, AWS has launched more than twice as many machine learning and generative AI features into general availability than all the other major cloud providers combined. This team is cooking, but we’re not close to being done adding capabilities for our customer’s usage base -Q2 earnings report.

This is incredible. Some analysts have expressed concerns that Amazon is flailing behind in the AI race because they have not released a flagship model like Meta (META) or Google (GOOGL). This is the wrong opinion, I believe.

Amazon is focused on making AI models that optimize their e-commerce and ads internally, while providing some of the best infrastructure out there to host other’s AI models. Much like how some analysts believe Nvidia (NVDA) and Advanced Micro Devices (AMD) are selling GPUs like pickaxes to mine gold, AWS is selling a powerful platform for others to develop strong AI tools.

Jassy then went on to say:

For perspective, we’ve added over $2 billion in advertising revenue year-over-year and generated more than $50 billion in revenue in the trailing 12 months. Sponsored ads drive the majority of our advertising revenue today and we see further opportunity there -Q2 Call.

While the market sold off after earnings, I think Amazon’s guidance for the next quarter was conservative. The company’s total revenue guide for Q3 is set at $156.25 billion (at the midpoint of the range), and is less than the expected $158.33 billion. Amazon’s operating income for Q3 is expected to fall between $11.5 billion and $15 billion, compared to the $11.2 billion in Q3 2023. Profits on the low end will beat last year’s operating income. And I think this will end up being conservative guidance in hindsight. I really think the company is set up well from here.

Valuation

Amazon’s non-GAAP forward price-to-earnings (P/E) ratio stands at 34.30, which is higher than the sector median of 14.83. It’s definitely higher than the sector median (by 131.25% to be specific), but that doesn’t mean it’s unjustified. As per the point of this whole write-up, I think the company has a lot of opportunity to grow its net income that the median company in the sector does not.

I believe this P/E is well justified by Amazon’s robust growth rates and strong profitability. Amazon’s EBITDA growth (YoY) is 61.87%, vastly outperforming the sector median of just 0.69%. With this, the e-commerce giant’s forward EBITDA growth rate is set to be 28.40%, 675.33% higher than the sector median. On the revenue front, the company’s forward revenue growth is set at 11.15%, which is 209.05% higher than the sector median. I really think we have something special here in terms of growth.

As I mentioned above, after this earnings report, the stock has fallen roughly 12% due to concerns over margins. Yet, Amazon continues to rise to the challenge here (as I mentioned above) and overall returns on capital. Amazon’s TTM return on common equity is 21.93%, once again significantly higher than the sector median of 11.64%. They are amazing at being efficient capital allocators. I think this will allow them to continue to generate strong returns.

With this market sell-off, Amazon’s trailing twelve-month PEG ratio of 0.18 is significantly lower than the sector median of 0.61. The market here is indicating that they underestimated the company over the trailing 12 months relative to their growth potential (which I laid out above). In the past, Amazon’s PEG ended up being below the sector median. Therefore, investors should not underestimate Amazon’s ability to ramp up profits in the future. In my last piece in July, I argued that Amazon should have a PEG ratio that is 50% above the sector median. My belief remains the same. With an adjustment in the stock since then to account for earnings, if we saw the non-GAAP forward PEG ratio increase from the current value of 1.46 to 2.07 (2.07 being a 50% premium over the sector median of 1.38), this would create upside potential of roughly 41.78% for shares.

Risks

Similar to my previous coverage of Amazon, I think a slower economy is the single big risk to the company’s stock price. Last Friday, the jobs report in many ways spooked the market (and likely amplified the company’s selloff post earnings). The labor department’s report showed that the unemployment rate rose to 4.3% in July, with non-farm payroll employment increasing by only 114,000, well below the average monthly gain of 215,000 over the past year.

Economic downturns can lead to reduced consumer spending, directly impacting Amazon’s retail segment, which remains a core part of their business. I admit this is a real risk here. I’m banking on automation to save the day.

Amazon has proactively addressed some of these risks through automation and efficiency improvements. The company has already successfully integrated advanced automation technologies to streamline operations and reduce labor costs. For example, Amazon has eliminated approximately 100,000 positions while still managing to grow revenue (meaning margins went up). I wrote more extensively about this in April when I initially covered Amazon. They appear to be executing on this flawlessly. I remain optimistic.

Bottom Line

Amazon’s Q2 earnings report, despite what, I think, is the market misinterpreting it, demonstrated an overall strong outlook for the company. The slight decline in operating margins was overshadowed by significant improvements from last year and exceptional performance from Amazon Web Services, which reported promising revenue growth and is predicted to continue to drive profitability.

Valuation wise, I think Amazon’s undervalued forward non-GAAP PEG ratio presents a great opportunity for investors to capitalize on the upside potential, especially after this selloff. With various growth metrics for the ecommerce giant still running well above the sector median, I feel good that we will see their PEG ratio rise as the market regains confidence on Amazon. The company is weathering the coming economic storm, but I remain optimistic. I still believe Amazon is a strong buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN, GOOGL, META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Noah Cox (account author) is the managing partner of Noah’s Arc Capital Management. His views in this article are not necessarily reflective of the firms. Nothing contained in this note is intended as investment advice. It is solely for informational purposes. Invest at your own risk.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.