Summary:

- Amazon has an impressive portfolio with growth in all aspects of its business, driving total net income.

- The company’s ads and AWS business have the ability to continue generating $10s of billion in net income that the company can use for returns.

- Overall, Amazon has earned another quarter of trust, making it worth holding on to for now.

Cristian Lourenço/iStock via Getty Images

Amazon (NASDAQ: NASDAQ:AMZN), the world’s largest bookstore, and now the largest in many other market segments recently announced its earnings. While we’ve wavered on Amazon before, most recently we were bullish, discussing the company’s impressive ads business. As we’ll see throughout this article, continued strong performance in key businesses makes Amazon a valuable investment opportunity, as the company’s earnings earn it another quarter of investment.

Amazon 3Q Results

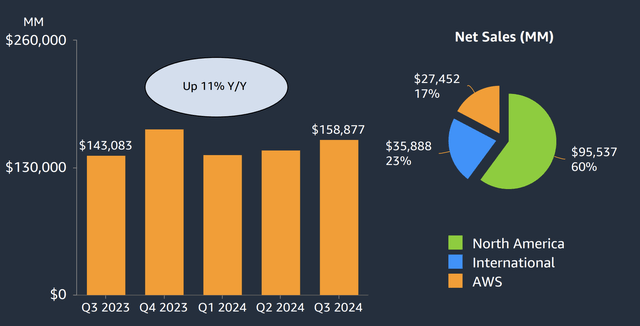

Amazon managed to achieve strong results with revenue up double-digits YoY.

The company earned almost $160 billion in revenue for the quarter as the company continues to focus primarily on its North American business. However, the company also managed to see strong performance from both AWS and its International businesses, as TTM revenue pushed past $600 billion.

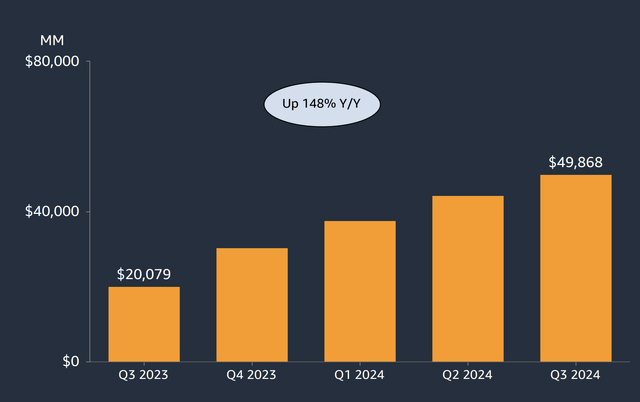

The company also saw much faster growth in its net income to almost $50 billion TTM. That still shows how the company trades at a lofty valuation, with a P/E of ~40x. Still, the company has managed to increase its net income by almost 150% YoY, supported by strong performance from its strongest business, AWS.

The company’s ability to convert a smaller growing revenue into additional net income growth highlights its financial strength. The growth here will make it easier for the company to reward shareholders.

Amazon Segment Results

The company has seen relatively strong performance across all of its segments.

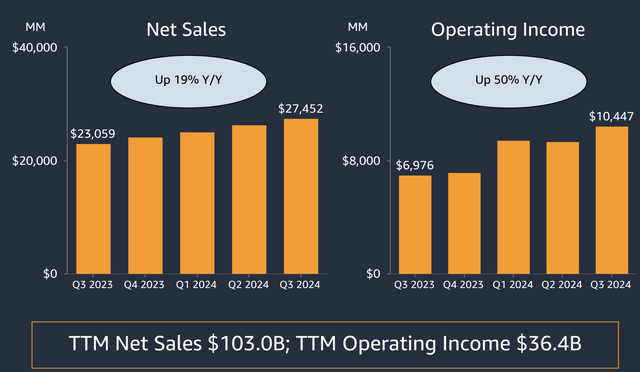

In AWS above, the company’s strongest segment, TTM sales crossed $100 billion as the company saw 19% YoY revenue growth. The company is the largest cloud provider, and as the industry continues to grow rapidly, the company continues to benefit as well. This business drove more than 75% of the company’s operating income at more than $36 billion.

That operating income grew by 50% YoY. The company’s other segments performed well too. In North America, the company saw 31% YoY operating income growth on the back of 9% YoY net sales growth. The company’s operating income margin here is still ~6%; however, that’s a strong improvement for the company.

Internationally, the company is still working to build up its business. The company had $140 billion in TTM revenue here with a 1.5% operating income margin. The company’s most recent quarter was its strongest ever here, and we expect the company its international business to continue maturing and growing.

Amazon Ads

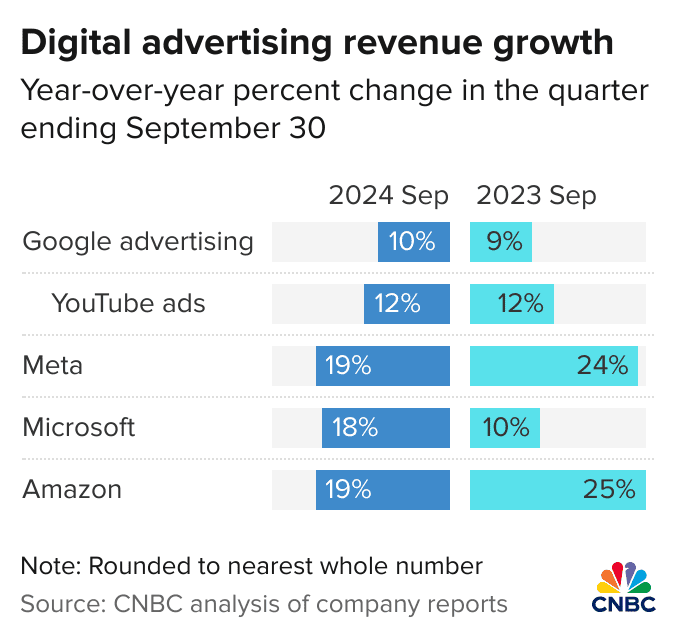

The company is rapidly growing its ads business with 19% YoY growth as the company has one of the largest growing ad businesses.

The accordion chart shows the advertising revenue growth for Google, Meta, Amazon and Microsoft in the quarter ending September 30 (calendar Q3) in 2024 and 2023.

The company’s annualized revenue here is crossing $60 billion, and Meta is the company’s only close competitor as the company continues to outperform both Google and Microsoft. The company’s status as a massive marketplace keeps it close to the final consumer for its ads business and enables it to drive valuable results.

More importantly, the business can generate very high profit margins as the costs for it are quite minimal. The growth of this business is essential for the company.

Amazon Multi-Trillion Dollar Justification

Amazon has continued to perform well in virtually all of its segments. While the company needs to quadruple its profits to generate double-digit shareholder returns with 150% YoY performance, we see it as having the ability to do that. Specifically, we see three catalysts:

1. AWS

The crown jewel in the company’s portfolio is AWS. AWS continues to see double-digit growth, with expanding revenue, and strong margins. The growth of artificial intelligence and the scale required will increase the demand for cloud providers even further. Amazon is a leader in the field, and we expect it to continue generating a growing $10s of billions in annual profit.

2. Ads

The company’s ads business uses the company’s incredibly strong pipeline and sales business. It’s one of the fastest growing major ads businesses in the online space, and it’s providing the company with many $10s of billions in annual revenue. Given its uses of existing assets, this is all high margin revenue. That will enable the company to continue growing high margin profit.

3. Improving Core Margins

Lastly is the company’s core business, which in North America saw more than 30% YoY growth in operating profit. The business has long turned minimal profit as cash has been reinvested, but we foresee the times as changing. We expect this business to become an increasingly important part of Amazon’s cash flow and future shareholder returns.

Thesis Risk

The largest risk to our thesis is that Amazon’s profits are primarily driven by AWS, and AWS is seeing substantial wealthy competition from Google and Microsoft. That could hurt margins and Amazon’s largest source of profits, hurting potential future shareholder returns and the company’s ability to justify its future valuation.

Conclusion

Amazon is an expensive investment, however, unlike some of the company’s peers, the company has the growth to justify its valuation. The company has two major growth catalysts from profits, both its ads business and the continued demand for AWS. Each of these businesses are major businesses in their own right.

On top of that, the company’s core business continues to perform incredibly well. That will enable the company’s profits to continue growing, which could help justify the company’s valuation. However, the company still has risks worth paying close attention to. Let us know your thoughts in the comments below.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated, and you only get one chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.