Summary:

- Temu’s impact on Amazon.com, Inc. may be underestimated in the next several years as it will likely grow rapidly as it offers consumers lower prices. It may cut into Amazon’s growth.

- In the long run, Amazon will likely persevere given advantages in its fulfillment capabilities and broad service offerings as well as legal and regulatory options.

- Worst case scenario, Amazon can copycat Temu’s model for lower transaction value products, as I believe Temu does not have any substantial moat preventing copycatting.

- Therefore, any short-term dips in Amazon’s stock price, especially if Temu’s expansion dents Amazon’s financials noticeably, will be a great time to buy Amazon.

4kodiak/iStock Unreleased via Getty Images

The Wall Street Journal (WSJ) recently reported “Amazon’s new focus: Fending off rivals Temu and Shein.” How does Temu impact Amazon.com, Inc. (NASDAQ:AMZN) and how can Amazon respond? How will Amazon fare in its competition against Temu?

This article will attempt to address these considerations from an investor’s point of view. This article covers Temu rather than Shein, as Temu is more of an “everything store” akin to Amazon, while Shein is more focused on apparel.

This article is categorized into 5 parts:

Part 1: Ecommerce’s significance to Amazon.

Part 2: How PDD Holdings Inc. (PDD) (Temu’s owner) rose to dominance.

Part 3: Temu poses a significant challenge to Amazon.

Part 4: The roots of Temu and PDD’s success.

Part 5: Amazon vs Temu: who will win?

Part 1: Ecommerce’s significance to Amazon

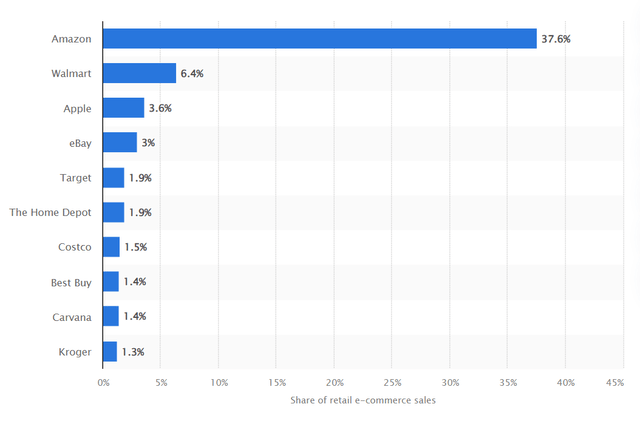

Despite Amazon’s efforts at diversification (in cloud services etc.), c.80% of its sales are still from e-commerce ). In 2023, it was far ahead of rivals in terms of e-commerce market share: one estimate puts Amazon at 37.6% and Walmart Inc. (WMT) at a distant 6.4%. Other competitors are mainly the online sales of brick-and-mortar retailers (such as Target, Home Depot, Costco, Best Buy, Kroger) rather than a dedicated online platform such as Amazon (with the exception of eBay Inc. (EBAY), which serves an entirely different segment).

ecommerce market share (Statista)

Given Amazon’s dominance in e-commerce, one may wonder how could Temu and Shein ever pose any significant competition? To answer this question, we must go back to the roots of Temu.

Part 2: How PDD (Temu’s owner) rose to dominance

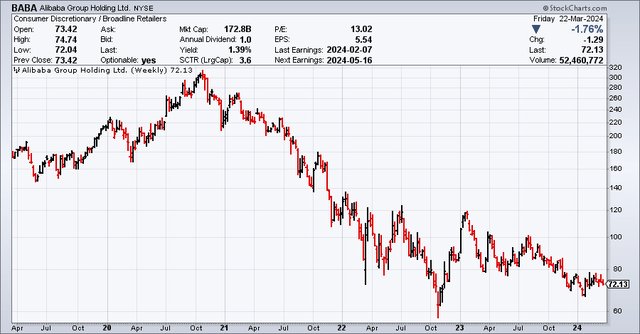

Temu is ultimately owned by Chinese company PDD Holdings. PDD has managed to dethrone Alibaba Group Holding Limited (BABA) in the China e-commerce market, an act that was previously thought impossible given Alibaba’s e-commerce platform was considered to have strong network externalities that would bind consumers and vendors to the platform through high switching costs. Alas, that was not to be.

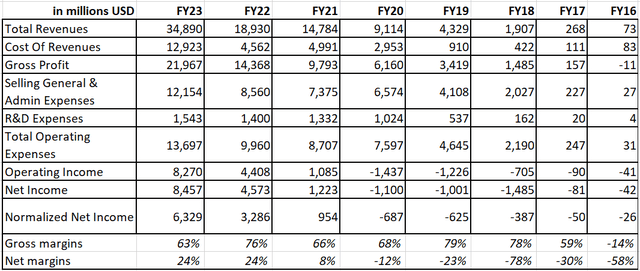

As shown below table, PDD’s e-commerce revenues grew from barely zero six years ago to $9 bn in FY21, and further on to $34.9 bn in latest 12 months, while Alibaba has treaded water.

|

E-commerce revenues comparison between PDD and Alibaba |

|||||

|

in USD bn |

TTM |

FY23 |

FY22 |

FY21 |

FY18 |

|

PDD |

34.9 |

18.9 |

14.8 |

9.1 |

0.3 |

|

Alibaba |

41.4 |

39.9 |

43.3 |

41.9 |

n/a |

Source: PDD financials from Seeking Alpha, Alibaba financials.

Note:

- Alibaba FYs end in March (i.e., FY23 above is the year ended March 31, 2023) while PDD FYs end in Dec (i.e., Alibaba’s FY23 corresponds to PDD’s FY22 (year ended December 31, 2022) above), so there is a slight mismatch, but should largely be comparable.

- Alibaba USD figures translated at a constant rate of 7.27 (which is the latest USD/CNY exchange rate).

- E-commerce revenues are the “customer management” portion of domestic China e-commerce revenues in Alibaba’s segment reporting. This metric is used as it does not exclude direct sales (which are reported on a gross basis and may distort trends) and reflects its take of the GMV on its platform, which is comparable to PDD.

- PDD’s revenues may include China and non-China segments (though the overwhelming majority of revenues will be from China), so the above comparison is more for illustrative purposes rather than an exact estimate.

This contributed to Alibaba’s stock price declining from a peak of $300/share (market cap: $720 bn) in October 2020 to the latest $72/share (market cap: $172.8 bn).

Of course, there were many other reasons (e.g., political and regulatory) for this decline in share price, and not all of it can be attributed to PDD, but it is evident that PDD had a large impact on Alibaba’s financials. Without competition from PDD, Alibaba would likely have seen much better financial results.

Alibaba stock price (StockCharts)

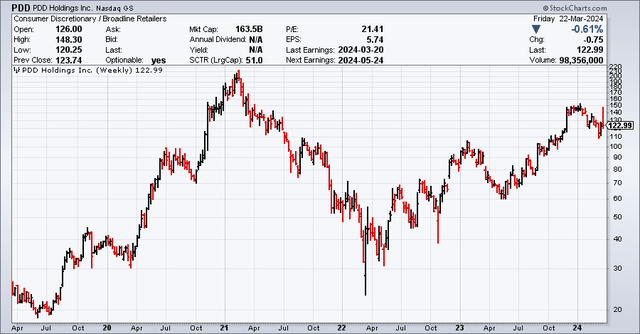

In the meantime, PDD has become richly rewarded by the market, with a market cap near that of Alibaba.

Even more remarkably, PDD’s David v. Goliath story was achieved with comparatively limited resources:

- PDD ploughed right into this segment with just $2 bn in funding before its IPO, as discussed in my previous article, challenging Alibaba which then had a market cap in the hundreds of billions of dollars.

- PDD operates a light asset model with almost no investment in fixed assets. Even today, with a market cap of $162 bn, PDD still has less than $1 bn of fixed assets. It’s as if David is really running circles around Goliath with, well, slingshots and rocks.

|

in millions USD |

Dec-23 |

Dec-22 |

Dec-21 |

Dec-20 |

Dec-19 |

Dec-18 |

Dec-17 |

Dec-16 |

|

Net Property, Plant & Equipment |

716.3 |

356.8 |

494.4 |

127.6 |

80.2 |

4.2 |

1.4 |

0.3 |

After dethroning Alibaba in the China ecommerce market, PDD exported its business model into the global market in the form of the Temu app. In the past year, financial media has regarded Temu more as a curiosity before the above-mentioned WSJ article a few days ago on Amazon viewing Temu as a significant competitor. The Mongol hordes are pouring out of the steppes, and while their numbers may be limited, they have already faced down one empire and are confident in their ability to expand globally.

Part 3: Temu poses significant challenge to Amazon

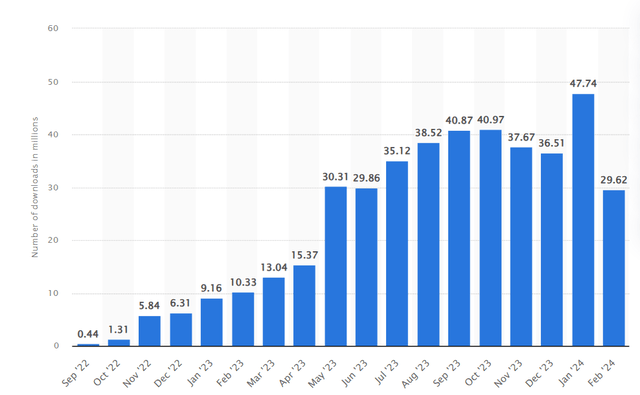

Temu launched in Sep-22 and since then has grown massively:

1. Downloads from barely nil in Sep-22 to 30-40 million per month since mid-2023.

Temu’s monthly downloads globally (in millions) ( (Statista))

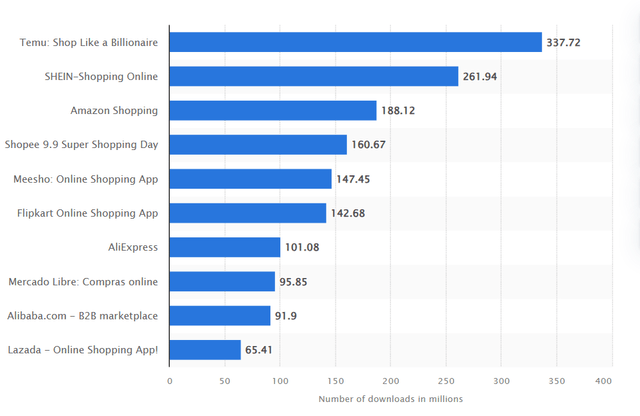

2. This led to Temu becoming the most downloaded shopping app in the world in 2023, with 337 million downloads, more than double that of Amazon Shopping.

Top shopping app downloads in 2023 ((Statista))

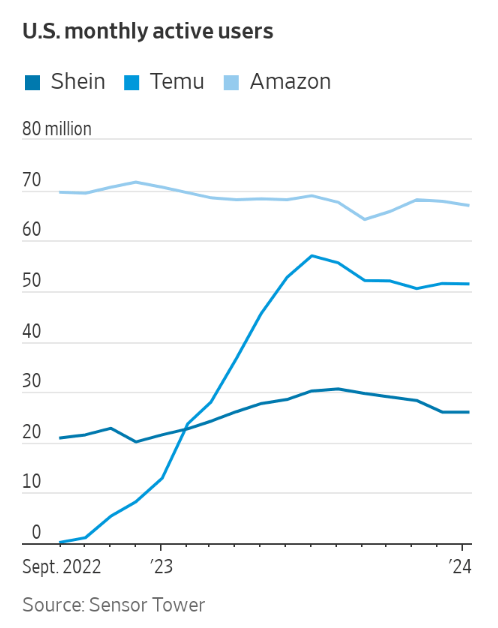

3. Massive amount of users: According to Sensor Tower data quoted in the WSJ), Temu has already achieved a U.S. monthly active user (MAU) of 50 million in January 2024 which is close to Amazon’s 67 million, while Amazon’s MAU has declined from 69.6 million to 67 million in the same period, though WSJ also quoted Amazon saying that overall it hasn’t seen a decline in usage but declined to provide details.

US MAU (Sensor Tower, WSJ)

4. Already impacting dollar stores: Per the same article above, Temu’s impact is already being felt in the marketplace:

“study of more than a half million Dollar General shoppers found that their spending at Temu rose to 10% of their total spending in December, up from 1% a year ago, according to market-research firm Earnest Analytics.”

5. There are some that state Temu is only a low-end competitor (as this Bloomberg article proclaims: “The Next Amazon Killer Is Really Just a Dollar Store Killer.” This would be underestimating Temu. In China, PDD did indeed start from low-end products but rapidly worked its way to higher-end products, as reported by the WSJ.

6. Temu is also able to appeal to international and American users, replicating its experience in the China market. According to an article from Bloomberg, the app’s engagement time is 18 minutes per day per user, which is higher than Amazon’s 10 minutes per day, which suggests stickiness with users and ample opportunity to increase sales.

7. Temu has a different mindset compared to Amazon’s American competitors. Amazon faces a whole new factor when facing Temu:

- American companies are more wary of choosing their field to compete in and often do not enter a field where there is a dominant incumbent. Amazon including other “Magnificent Seven” stocks did not face significant competition in their core markets (e.g., Google in search, or Facebook in social networking) after establishing a dominant position. Note how Apple gave up its car project as Tesla and other companies had established a strong leading position.

- Walmart launched its shopping app over a decade ago, yet in 2023 it has a 6% share of the U.S. e-commerce market, while Amazon has nearly 40%. Walmart has chosen to focus on areas it is strong in (e.g., surpassing Amazon in online grocery sales). Other than Walmart, the other players (eBay and other retailers) are very small in ecommerce compared to Amazon. By contrast, Temu’s aggressive approach to customer acquisition and growth is not really seen in these companies.

Part 4: The roots of Temu and PDD’s success

PDD and Temu have been able to achieve tremendous growth by the following strategies. By understanding Temu’s strategy and strengths, we may get a clue as to how its competition with Amazon might unfold.

1. Disrupting e-commerce platform business model to lower prices

On e-commerce platforms such as Alibaba, merchants set whatever prices they want and then figure out how to attract consumers. Often high ad spend is needed and this goes into the final list price for consumers.

PDD cuts through this and directly deals with vendors to secure a very low list price for customers. For a certain product, vendors would first send their quote and samples to PDD, and PDD would select the vendors and offer them a fixed margin. Since vendors don’t have to spend as much on advertising, prices can be much lower. Note that PDD does not actually procure from the vendor: if the sale is closed, then the vendor is compensated and if not, the products are returned to the vendor at no risk to PDD/Temu.

PDD’s bet was that at least some consumers would care about lower prices far more than their loyalty to any platform and they were right.

2. Disrupting customer acquisition model: Direct cash reward to acquire customers

This is done by directly appealing to the consumer without worrying about advertising and click-through rates and conversion – PDD initially rapidly won millions of users in China as people would get cash (c.$15/user) for recommending the app to enough of their friends to download. Retirees across the country would rush around getting their kids and grandkids to sign up to get the $15. Giving out freebies (e.g., free fruit by opening the app each day for a month, effectively costing the app maybe $1/month per active user, which is still done on many major Chinese apps) to attract users, is a time-tested user acquisition/retention gimmick in the China internet market. Temu appears to be doing the same thing internationally with trinket cash reward games, which are a direct (and perhaps cheaper) way to acquire and maintain customers.

3. Leveraging existing partners in the ecosystem to grow quickly

PDD leveraged existing logistics vendors without making many investments itself. This enabled it to operate using a light asset model.

PDD also leveraged rivalries within the Chinese internet market – it allied with Tencent Holdings Limited (OTCPK:TCEHY) (which dominated the social network field but never succeeded in breaking into the e-commerce market dominated by Alibaba). PDD would find it easier to promote on the Tencent platforms (such as WeChat) while Tencent received an equity stake in PDD.

The above gives PDD significant capabilities and intent:

- PDD’s past experience and success give it confidence to pursue strong growth at the expense of short-term losses

- Cash to spend ($30 bn in cash reserves): Temu was one of the largest advertisers on U.S. platforms, spending an estimated $2 bn on Meta Platforms, Inc. (META) alone in 2023.

Part 5: Amazon vs Temu: how will the battle unfold?

In the short run, Temu will likely continue to see strong GMV growth:

- Temu’s GMV is not officially reported by PDD, but there are market estimates and news reports. Temu’s GMV is estimated to have grown strongly with its user base, achieving quarterly GMV of $5bn in Q3-2023 (in English and in local language). Temu’s 2024 GMV is forecast to potentially be $30-40 bn.

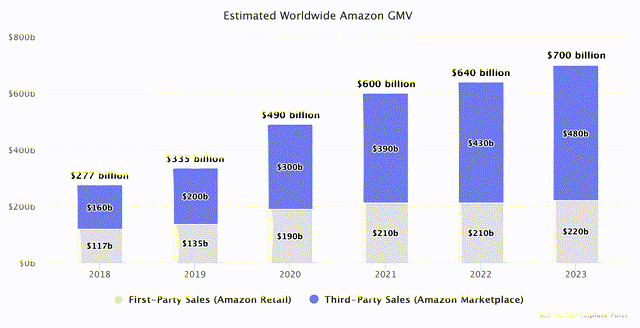

- If Temu maintains this growth for a few more years, it could reach $100-200 bn of GMV and may even take significant market share from AMZN (which is estimated to have a GMV of $700bn in 2023, though growing at only 10% compared to 2022 due to its bigger size).

Estimated Worldwide Amazon GMV ((marketpulse estimates))

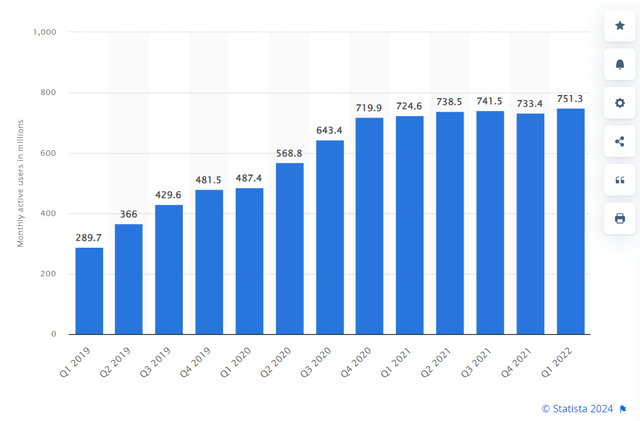

- Past experience suggest Temu’s GMV should still see strong growth a year or two after reaching a peak in its user base, similar to PDD’s battle with Alibaba in the Chinese market as GMV and/or revenues per user increase:

- After PDD built up its user base to 700 million MAU by Q4-2020, flatlining thereafter), its sales rapidly increased afterward anyways, doubling from the FY21 figure (assuming FY21 reflects the full year sales based on 700 million users).

PDD MAU during growth years (Statista) PDD financials (income statement) (Seeking Alpha) (Seeking Alpha)

- However, this should be tempered by a recent report that Temu wants to reduce its reliance on U.S. sales and reduce U.S. sales to 30% of its GMV (down from the current 60%) amid growing heat from U.S. politicians towards Chinese companies, which may reduce Temu’s growth rate.

In the long run, Amazon still has significant capabilities to fight back, both from economic and legal/regulatory perspectives.

Economics:

1. Amazon’s fulfillment capabilities may negate Temu’s list price advantage

Amazon has significant end-to-end delivery capabilities on its own, with $48.4 billion invested in 2023 (over $10bn dollars of capex annually since 2015, much of which was spent to build out its fulfillment capacities,) while Temu is heavily reliant on the goodwill of others every step of the way. Temu is almost entirely reliant on third-party logistics and perhaps most important of all, friendly market access, while Amazon does not rely on any of these.

The cost to fulfill an order in the U.S. is very high for Temu compared to PDD in China. It could cost less than a dollar (indeed the revenue per delivery for freight companies in China is often much less than $1/order) to cover the entire freight delivery chain in China (from pick-up of goods to on-door delivery), so freight costs are an afterthought, while the cost for Temu to fulfill an order in the U.S. is estimated to be $14/order at an average transaction amount of $25/order before shipping, which Temu is currently heavily subsidizing. In fact, some estimate Temu is losing as much as $30/order.

While Amazon also incurs fulfillment costs, it already has tens of, if not hundreds of billions of dollars invested in fulfillment that is a sunk cost, and the cash costs of operating these centers are much lower than the “market rate” for fulfillment that Temu would likely have to pay. This may negate Temu’s cost advantage, especially if potential tariffs are also considered (see below section on legal and regulatory).

2. Amazon’s sprawling empire allows it to bundle services

Amazon provides a suite of services such as books and videos, which gives it an opportunity to cross-subsidize its services, i.e., Amazon can subsidize its e-commerce as well as enhance customer loyalty through video, books, etc., while Temu does not offer these services.

3. Temu may be distracted by PDD’s looming problems at home

PDD’s stock price surged on March 20, 2024, when it announced strong Q4 results and then fell just as rapidly. As I previously discussed, PDD is likely to face a revigorated Alibaba in the Chinese market, and this may slow its willingness to splurge on Temu’s market expansion. To slightly stretch the historical parable of the Mongol hordes, when they were closing in on the gates of Vienna, they purportedly retreated due to more pressing concerns back home.

4. Temu’s model is copyable

Worst comes to worst, it is perfectly possible that Amazon copies Temu’s model and selects vendors based on low-cost offerings and offers these to consumers that are more budget-conscious. As I previously argued, PDD/Temu’s operations lack any significant moat and its competitors can match it eye-for-eye – the only thing lacking is the will.

Legal and regulatory:

1. The American market has much higher standards for product liability, with huge damages awarded for cases such as McDonald’s coffee spills. There are virtually no damages of such amounts awarded in China, so Temu may have underestimated the potential exposure from selling low-priced goods to the U.S. To be clear, while there are internet posts about the uneven quality of Temu products, there have been no reported litigation yet, but the potential for litigation exists, even if there are only a few product complaints that rise to that level.

2. Temu is helped by a trade loophole that exempts it from U.S. tariffs for goods under $800. If this loophole is closed (as it was never intended for the use that Temu is putting it to) it could even the playing field a bit for Amazon.

3. Legislation to potentially ban foreign adversary-controlled apps: The House overwhelmingly passed ” the Protecting Americans from Foreign Adversary Controlled Applications Act” (referred to below as the “TikTok Bill” for simplicity) on March 13, 2024 (352 votes for and 65 votes against) and now it will move to the Senate. President Biden has already stated he would sign the legislation if it passes Congress.

The TikTok Bill would create a process for the President to designate certain social media applications under the control of foreign adversaries, like China, Russia, Iran, and North Korea, as national security threats. Once an app is deemed a risk, it would be banned from online app stores and web-hosting services unless it severed ties with entities under the control of the foreign adversary within 180 days of the designation. You may view the bill in its entirety here, if you like.

Though the TikTok bill has primarily been mentioned in the context of TikTok, it could potentially spread to Temu as well. Note how House Speaker Mike Johnson posted on X after the TikTok bill passed the House:

“Apps like TikTok… engage in malign activities, such as harvesting the location, purchasing habits, contacts, and sensitive data of Americans.”

This appears to already imply: (i) the legislation may target apps beyond TikTok; and (ii) purchasing habits, contacts, location, and sensitive data of Americans are important consideration factors (which are all relevant to Temu) in addition to the content TikTok pushes.

While it is still quite uncertain if the legislation will pass into law and, even if it does, whether it will be used against TikTok or even Temu, this is a potential way that Amazon could nip Temu in the bud. It may also already have caused Temu to think twice before expanding more aggressively into the U.S.

Conclusion:

In the short run (i.e., next several years), Temu will likely grow rapidly as it indeed gives lower prices to consumers. It may cut into Amazon’s growth rate or even Amazon’s existing market. I believe markets are likely underestimating Temu’s impact, given few Internet giants in the U.S. have been toppled as quickly as PDD did to Alibaba. The lack of historical precedent makes it seem inconceivable that Amazon could be seriously challenged by a fun little app that sells trinkets for a few dollars and hands out cash rewards of dimes and nickels.

However, in the long run, Amazon.com, Inc. will likely persevere against Temu given advantages from its self-operated fulfillment capabilities (as freight and shipping costs per order are quite high in the U.S. compared to Temu’s parent PDD’s home market in China) and broad service offerings to customers, as well as having a few legal and regulatory cards up its sleeve that it can play. Worst case scenario, Amazon can also copy Temu’s model for some of the low transaction value products. I believe that Temu/PDD’s model does not have any substantial moat that prevents copycatting.

Therefore, any short-term dips in Amazon’s stock price, especially if Temu’s expansion dents Amazon’s financials for a few quarters, will be a great time to load up on Amazon.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.