Summary:

- Amazon.com, Inc. announces another round of job cuts.

- Amazon needs to improve margins, especially for AWS.

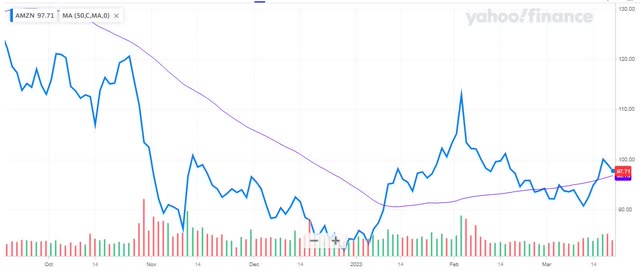

- Amazon shares are trading near the 50-day moving average.

HJBC

Being overweight can lead to health problems, so most people that put on too many pounds eventually end up making some big changes. In the corporate world, companies can find themselves in a similar situation when their expense bases become bloated. On Monday, tech and retail giant Amazon.com, Inc. (NASDAQ:AMZN) announced another set of job cuts, which hopefully will allow the company to get its operating line moving again.

Amazon’s number of employees had more than doubled thanks to the pandemic. Not only was the company hiring more workers for its warehouses thanks to an online shipping boom, but also as Amazon Web Services (“AWS”) saw its revenues continue to surge. However, as growth has finally started to slow down in recent quarters, the company failed to keep expense growth in check, leading to dramatic margin compression.

Last year, Amazon reported in its final results that its total operating income was more than cut in half. The bottom line looked even worse, swinging from a large net profit of more than $33 billion to a loss of a few billion. Looking at the bottom line can be a bit more tricky, however, because of the huge write-downs the company has taken on its investment in Rivian Automotive, Inc. (RIVN). The electric vehicle maker has seen its shares hit new lows almost monthly now as its results have fallen short of expectations in most quarters.

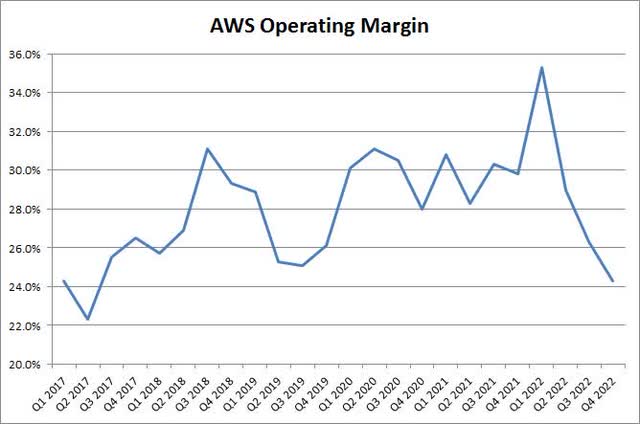

Sure, Amazon’s retail business did not do well in 2022, especially as the international side saw its revenues fall a little. However, AWS couldn’t totally offset the fall in operating income, despite its continued revenue rise. In fact, AWS reported a year-over-year decline in operating income dollars for Q4 2022, which is likely why it is a part of this round of job cuts. As the chart below shows, the Q4 2022 AWS operating margin figure of 24.3% was the first sub-25% result since the first half of 2017.

AWS Operating Margin (Amazon Earnings Reports)

Amazon doesn’t have to improve margins significantly to grow its operating income for the segment. Even holding your operating margin percentage steady will increase your operating income dollars as you continue to see revenue growth. Since the pandemic started, we’ve seen operating margins for AWS increase sequentially from Q4 to Q1 each year, so it will be interesting to see if that trend continues this time around.

Amazon shouldn’t have to worry too much more about Rivian write-downs with the price so low currently, so hopefully the bottom line will get back on track rather soon. In the summer of 2021, analysts were expecting almost $5 of earnings this year, but estimates now call for less than $1.50. As the table below shows, estimates have dropped in the past two quarters, but the declines have started to level off a bit. Future year numbers have even headed a little higher recently, and we might see some more green thanks to the latest job cuts news.

Amazon EPS Estimates (Seeking Alpha)

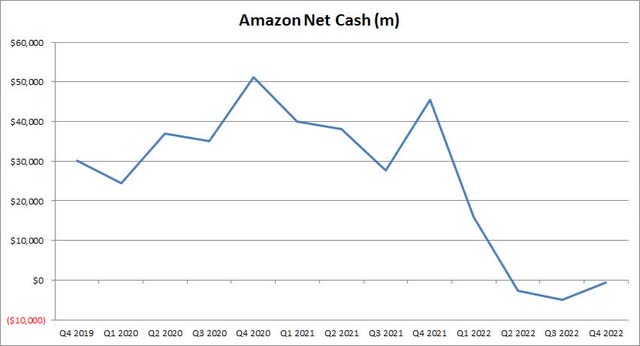

Analysts and investors will also be watching to see if Amazon curtails its capital expenditures at all this year. In 2018, the company spent $13.4 billion on property and equipment, but last year the number had skyrocketed to more than $63.6 billion. You do have to spend to grow in certain respects, but the company’s revenue growth was not up anywhere near the amount that capex grew in percentage terms.

I had mentioned the capital expenditure situation about a year ago because it was certainly having an impact on the company’s balance sheet. Amazon entered into a term loan agreement earlier this year that could provide up to $8 billion in additional liquidity. We have seen the company tap the debt markets in recent years, especially as its free cash flow turned negative during the latest investment cycle. As the chart below shows, net cash actually has gone negative in recent quarters, although the figure did improve sequentially in Q4 almost back to the flat line.

Amazon Net Cash (Company Filings)

Amazon isn’t in any financial trouble at the moment, but you don’t want to be in too much of a net debt scenario if you don’t have to, as that can certainly hurt your income statement prospects down the road. Increasing profits and holding capital expenditures steady can help in that regard, so free cash flow will be the most important item I’ll be watching in 2023. Amazon also finds itself in a position where any future high profile acquisitions may need to be more stock based than cash, and shareholders might not appreciate any dilution.

As for Amazon shares, they have rebounded nicely off their recent lows, although they are still well below where they were a year or two ago. The average price target on the street is $138, which implies more than 40% upside from Monday’s close. Analysts remain extremely positive on the name with almost all of the ratings either being a buy or strong buy. As a point of reference, the average target is down roughly $70 in a year. More importantly, however, the stock is just above its 50-day moving average seen in the chart below, which could be a level of support unless this trend line rolls over.

AMZN Last 6 Months (Yahoo! Finance)

At the moment, I’m hesitant to recommend diving into Amazon shares. There are a lot of economic worries out there right now, which could provide some sales headwinds, and AWS revenue growth is slowing in percentage terms. A Fed rate hike this week could be bad for the overall market, especially if it results in a stronger U.S. dollar that would hurt Amazon’s results again. For the name to become a solid buy, I’d like to see that these layoffs are impacting the overall cost basis in a positive way, and that the free cash flow situation is really starting to improve.

In the end, Amazon.com, Inc. is finally starting to make the moves it needs to get its bottom line moving in the right direction again. Regardless of what happened with the firm’s Rivian investment, Amazon’s operating income took a large hit last year. Even the crown jewel AWS saw a profitability hit late in 2022, while showing its lowest operating margin percentage in more than 5 years. This round of job cuts may not be the last, however, and it will be interesting to see if the Amazon.com, Inc. capex and cash flow situation can improve for more than just a single quarter.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.