Summary:

- Amazon shares purchased in December 2022 at a discounted price have since risen by over 75%.

- The company has shown exceptional innovation in product and service offerings, with advancements in drone deliveries, robotics, and smart home devices.

- Risks include the stock valuation and concerns about a slowdown in revenue growth rates, limiting an allocation in my portfolio to 7.5-10%.

- My analyst rating for the company is Buy, primarily driven by a potential margin expansion and excellent fundamentals.

georgeclerk

I bought Amazon (NASDAQ:AMZN) shares in early 2023 when the stock was trading 40-50% below its all-time high. While the price has risen over 75% since its December 2022 low, I don’t think it is too late to purchase a stake, considering the exceptional innovation in product and service offerings and strong financials. There are risks, primarily the valuation and revenue growth rate concerns, which deter me from allocating higher than 7.5-10% in my portfolio.

Operations Analysis

The company has made significant strides in 2023, introducing the MK30 delivery drone, which should reduce noise and is smaller and lighter than the current MK27 model. Drone deliveries are expanding in the U.S. and overseas, with planned drone operations in Italy and the UK by late 2024. Amazon Pharmacy has also announced the delivery of medications to people’s homes in less than 60 minutes in College Station, Texas, using drones. Customers will have 500+ medications available to them.

The company is also using robotics to aid employees in delivery. New innovations such as Sequoia will identify and store inventory at Amazon sites up to 75% faster. The firm is also implementing Automated Vehicle Inspection, or AVI, which is going to help maintain delivery fleets and reduce manual labor time. AVI will be utilized in the U.S., the UK, Canada and Germany initially.

These AI and robotics implementations are critical examples of how I think Amazon is making crucial strides in technological innovation, which is going to drive both revenues based on customer satisfaction and retention (faster delivery times, more access to wider products) but also increase margins significantly over time. The natural progress of this will undoubtedly be less headcount at Amazon and an increase in automated processes—this is something we are going to see across the international economy, and stocks will continue to grow, in my opinion, as the labor market inevitably changes.

Amazon has also launched the Echo Hub, with the ability to control more than 140,000 smart home devices, and many updates to its exiting smart home products, including generative AI in Alexa. The organization is also upgrading its home security product set. The Ring Stick Up Cam Pro refines alert processes using 3D motion detection and radar, for example.

AWS

Amazon Web Services is experiencing significant growth in abilities, with a heavy focus on generative AI. Amazon Q is an AI chatbot designed for work environments with synthesis to AWS operations. New AWS chips, AWS Graviton4 and AWS Trainium2, will enhance Amazon’s generative AI, and the company has improved machine learning with SageMaker Large Model Inference DLC, SageMaker HyperPod, and Automated Notebooks.

The company has also launched S3 Express One Zone for high-performance storage and updated existing Aurora, Redshift, and other database offerings. It has also announced AWS Resilience Competency, an offering to help improve cloud workload resilience. Amazon is also beginning to operate in quantum computing for enhanced backup and recovery services.

Financials

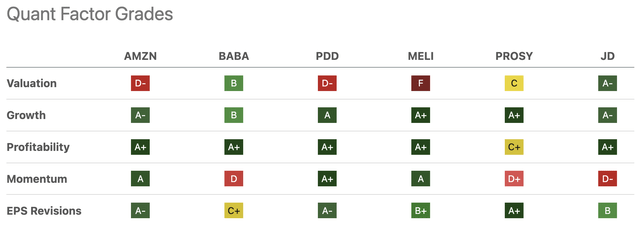

Amazon’s Quant Factor Grades versus its major peers give us a clear understanding of how the company is firing on all major cylinders except valuation. Even then, the company seemingly deserves a high valuation and is not directly responsible for excessive investor sentiment.

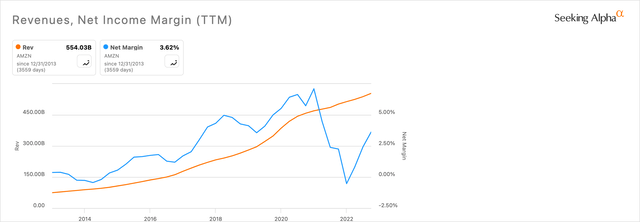

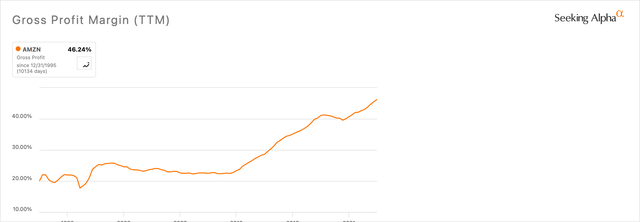

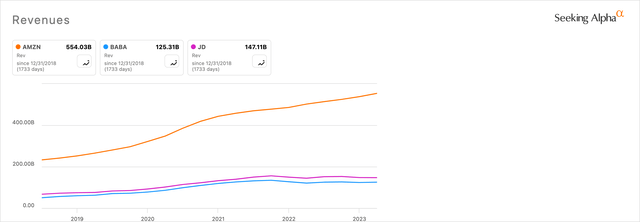

By delving deeper into the specifics, using Seeking Alpha’s charting system, I can piece together a 10-year profile for Amazon’s revenues and margins to ascertain its historical financial performance in more detail.

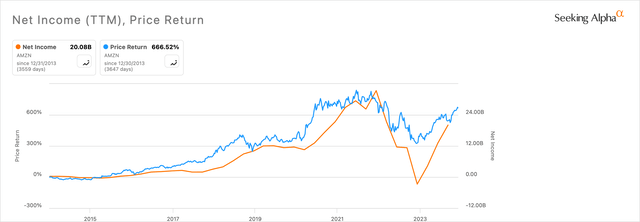

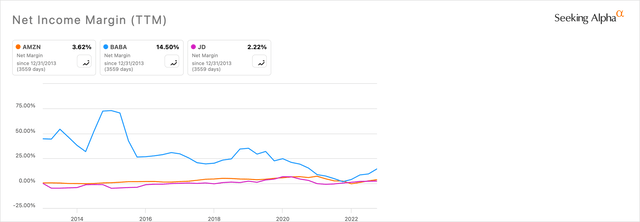

Indeed, from this chart, we can see a significant drop in net income from $33.36 billion in December 2021 to -$2.72 billion in December 2022. While the net income has now risen back up to $20.08 billion in September 2023, this drop is the core reason for the recent stock price decline.

One of the primary reasons for the net income loss during the period of decline was Amazon’s investment in Rivian Automotive (RIVN), a startup focusing on EVs. Amazon’s $700 million investment in the company in 2019 has fallen over 80% since it went public in November 2021. A rise in technology and payroll costs also impacted net income for the period. The cost of technology and content was 11.9% of revenue in 2021, rising to 14.2% in 2022. Marketing costs also rose from 6.9% of revenue in 2021 to 8.2% of revenue in 2022.

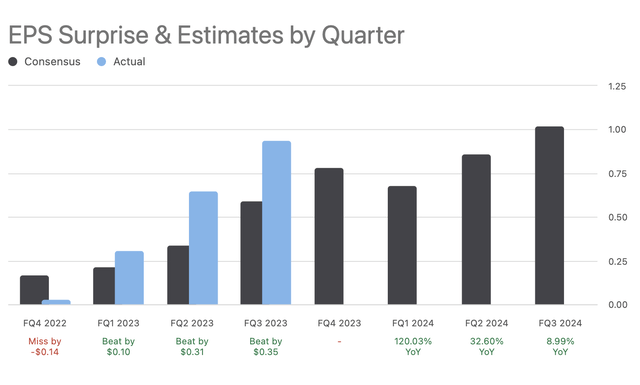

While these past significant operational and financial results were the leading cause of the decline, recent earnings results have reported the company to be back on track. Net income was $4.29 billion in March 2023, $13.07 billion in June 2023, and $20.08 billion in September 2023, revealing strong earnings growth in response to the recent challenges. This has been driven by growth in AWS, which has seen sales growing 12% year-over-year to $23.1 billion, as well as improvements in efficiency related to streamlining operations. The company announced in 2023 that it would cut more than 18,000 jobs, approximately 6% of Amazon’s corporate staff. Growth in advertising sales and good retail performance have also contributed. We can see the outsized effects of Amazon’s operational successes from the following chart; the company has beaten consensus estimates significantly for the last three earnings reports.

Valuation Concerns

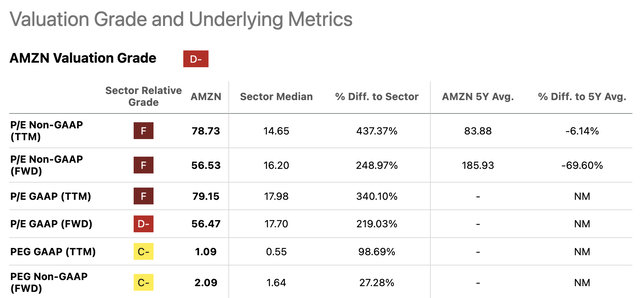

Even with such good momentum following a difficult 2022, the firm has two major risks from an investment standpoint, in my opinion. The first is its stock valuation.

This is especially true when analyzing the company in relation to its peers. When looking at Amazon versus JD.com (JD) and Alibaba (BABA), two major marketplace competitors from China, Amazon seems significantly overvalued relatively. While it arguably deserves to be so when considering the massive revenue advantage it has, Alibaba’s net income is much stronger than both Amazon and JD.

Author, Using Seeking Alpha Author, Using Seeking Alpha

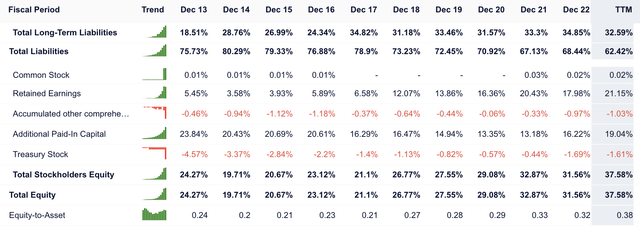

Yet, to contribute to Amazon’s favor, I think it’s worth understanding that the company has long-term increasing equity and decreasing total liabilities, further supporting it as a strong investment valued highly based on reasonable investor sentiment.

Growth Risks

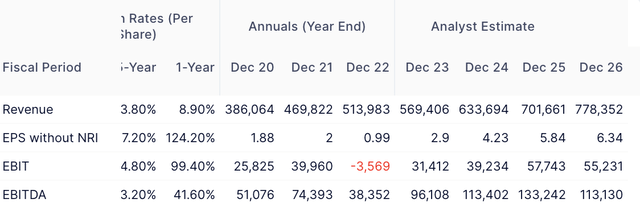

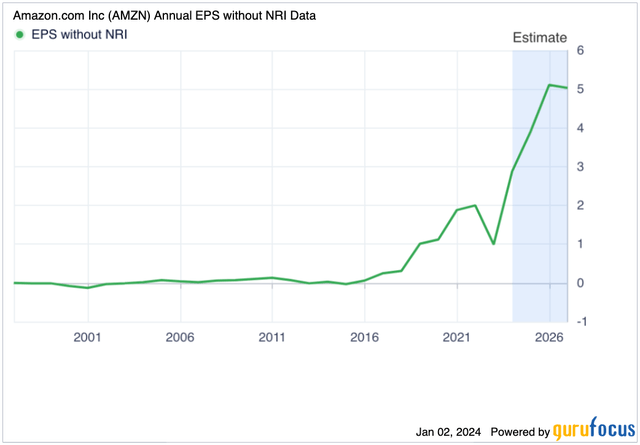

The second major risk I attribute to Amazon shares right now is its long-term growth, specifically in relation to revenue growth. Consensus earnings estimates for 2024 are strong, but I’d like to look closely at the revenue projections and also understand some of the operational hazards that could inhibit revenue growth rates.

These estimates represent continued revenue growth but a slowdown in the revenue growth rates. While this might present concern, the shift appears to be toward EPS growth, which is what keeps the company looking strong in 2024 and beyond. I think this will be further optimized through the use of AI, directly related to innovations pioneered by AWS and implemented across its segments. It is my opinion that Amazon could be among the companies with the highest margin increase as a result of AI as it integrates drone technologies, warehouse management robotics, and other lower-cost alternatives to human labor.

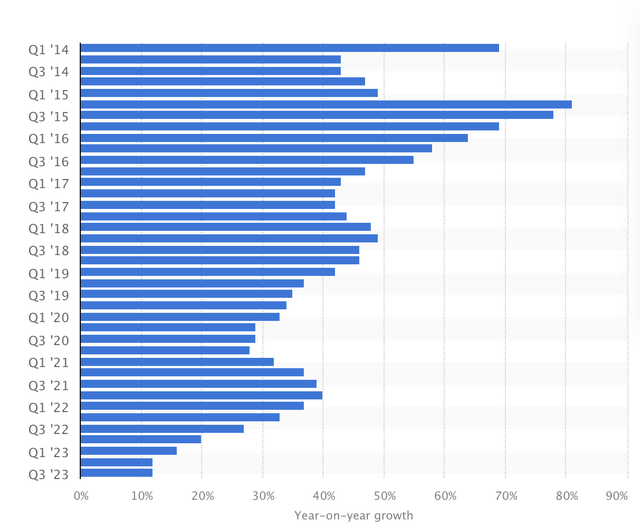

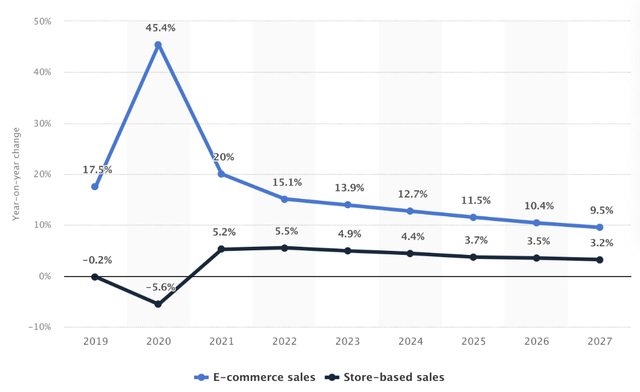

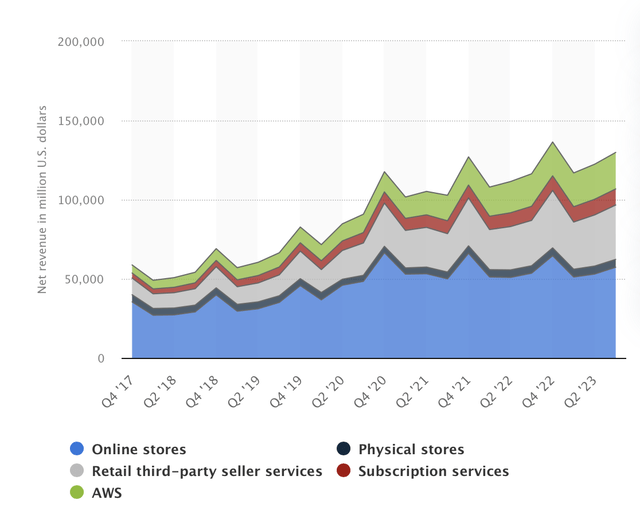

I have looked at specific revenue growth risks from the dominant segments. The first graph presents the AWS revenue growth rate long-term decline. The second graph shows a similar decline in retail segments. The third graph shows each revenue segment contributing to the total of Amazon’s net revenues.

AWS Revenue Growth Chart (Statista) Amazon Retail Revenue Growth Chart (Statista) Amazon Net Revenues by Segment (Statista)

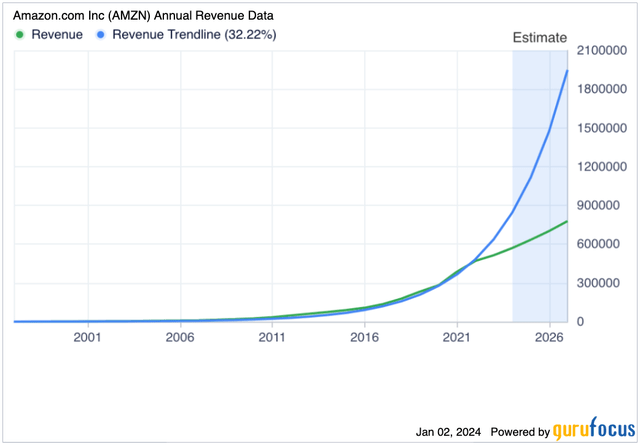

This data shows a considerable concern on investors’ hands, which is the evident revenue growth plateau Amazon is currently experiencing and has been for some time.

To counter this, the company’s net income has been going up significantly since 2016, and it is my opinion that the organization is incredibly well-equipped to maximize organizational efficiencies in contributing to a long-term high margin through a largely automated company with very large earnings coming as a result. I think the company’s cost of goods sold is going to go down as more automated processes are used (refer to my operational analysis above), significantly increasing the company’s gross margins further over time.

Conclusion

I think Amazon is an exceptional company. Given its size and market saturation, it is obvious that it would inevitably encounter some revenue growth issues. Yet, I find it interesting that the company still has strong earnings growth potential and long-term operational advantages, largely attributed to AWS and its implementation in other segments of the business. I think the increase in Amazon’s efficiency and margins will be its strongest suit moving forward.

The risks are significant, including a less-than-ideal valuation and a chance that automated operations may be more costly than initially intended due to technological challenges and regulatory hurdles, but my investor sentiment is very strong for the company on the whole, with an analyst rating of Buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.