Summary:

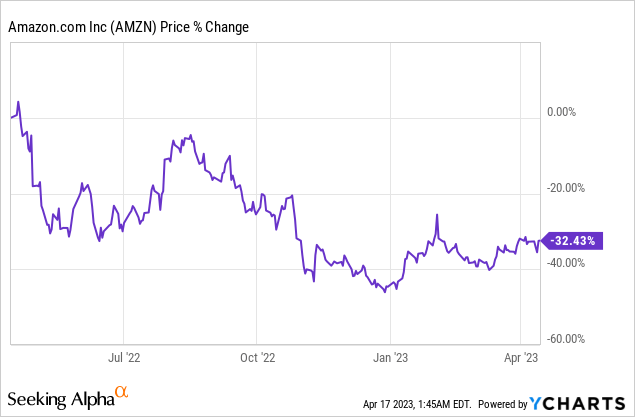

- Amazon’s share price is struggling due to macro challenges and slowing post-pandemic top line growth.

- The share price may get pushed into a new down-leg as the e-Commerce firm appears to be set for a weak earnings release.

- I discuss which two key metrics will likely be the most important ones for investors in Amazon’s Q1’23 earnings sheet.

HJBC

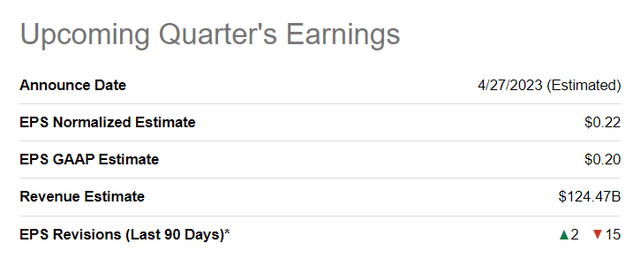

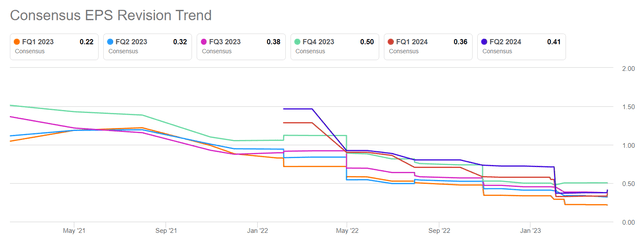

E-commerce company Amazon (NASDAQ:AMZN) is going to report earnings for its first fiscal quarter on April 27, 2023 and investors should be prepared, based on the current EPS estimate trend and a weak macro picture, to see a weak earnings sheet. Amazon has guided for single digit revenue growth for Q1’23 and estimates indicate that analysts don’t expect any major surprises in the company’s first-quarter. I believe investors should look at two key metrics especially that could show investors what direction Amazon’s business is taking. With Amazon’s free cash flow being negative and Amazon Web Services growth slowing by 50%, I see continual headwinds for the company’s valuation. Considering that the EPS trend heading into earnings is also negative — with down-side EPS corrections significantly outnumbering up-side revisions — investors should not buy Amazon before Q1’23 earnings, in my opinion!

Amazon: Get Ready For A Weak Earnings Report

Amazon is going to report earnings for its first-quarter in ten days and analysts expect the e-Commerce company to report a weak earnings sheet. The average consensus EPS estimate sits at $0.22 compared to a loss of $0.38 per-share last year. Amazon guided for 4-8% top line growth in Q1’23: Amazon’s revenues are expected to come in at the top of the range with $124.5B, implying 7% year over year growth.

Amazon’s EPS trend is very negative heading into Q1’23 and analysts have refreshed their estimates to incorporate a deteriorating macro picture as well as persistently high inflation rates. Amazon has seen 15 EPS down-side revisions for its Q1’23 EPS in the last 90 days compared to just 2 up-ward revisions. In other words, analysts widely expect continual headwinds in consumer spending (e-Commerce) to affect Amazon’s operating performance.

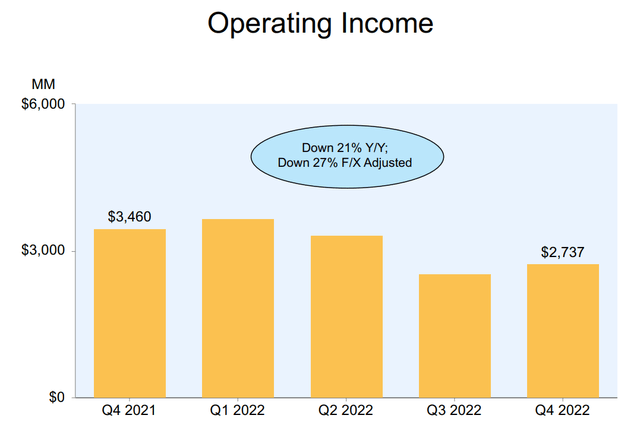

Don’t expect a change in Amazon’s operating income trend

In the last year, Amazon’s operating income trend has gotten worse due to a number of factors including a slowdown in the core e-Commerce business which cumulatively contributed an operating income loss of $10.6B in FY 2022 and there is no indication that Amazon could have turned around its e-Commerce segment in the last quarter as inflation continued to weigh on consumers. Additionally, USD strength weighed on Amazon’s operating results. For the first-quarter, I don’t expect much of a change in Amazon’s operating income trend as the macro picture remained challenged.

2 key metrics to watch out for

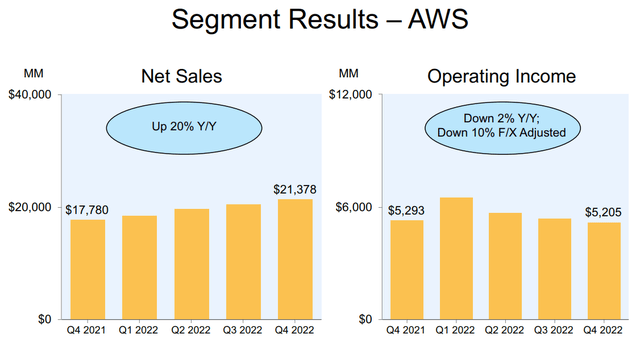

When it comes to Amazon’s upcoming earnings release, I believe investors should pay attention to 2 key metrics specifically. The first metric is Amazon Web Services’ top line growth and the second metric is Amazon’s free cash flow.

If there is a way for Amazon to surprise regarding Q1’23 earnings it would likely relate to Amazon Web Services which is Amazon’s growth engine. The company has seen a serious ramp in revenues in the last two years, with growth accelerating during the pandemic. But the segment’s top line growth has started to slow down in the second half of FY 2022 as companies have become more careful about spending money in a high-inflation world.

Amazon Web Services’ top line growth slowed to 20% in Q4’22, down from 40% in the year-earlier period. While 20% is still a great growth rate, the market should ready itself for a further slowdown in growth in Q1’23 as the macro picture did not improve and the financial crisis may have further added uncertainty to an already weakening economy. I am looking forward to seeing 18-20% revenue growth for AWS as corporations went to great lengths in Q1’23 to control costs and lay off tech workers (Source).

Turning to free cash flow.

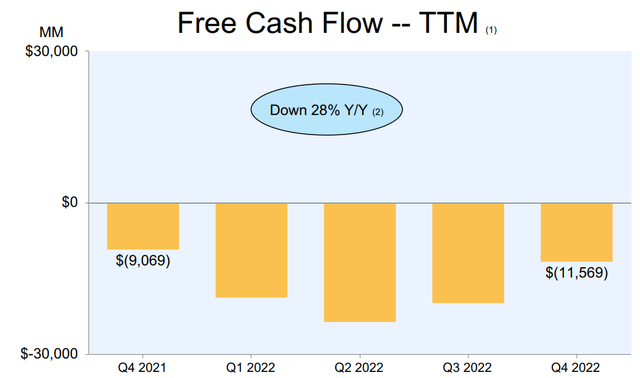

Since Amazon still suffers from a slowdown in the e-Commerce economy following a major pandemic boom, the e-Commerce is likely to report yet another quarter of negative free cash flow. Like its operating income trend, Amazon has taken a free cash flow hit in FY 2022 as the company has seen weakening operating cash flow growth and continues to invest aggressively in new products and services. The result has been a steep decline in free cash flow which declined 28% year over year in Q4’22. For Q1’23, I also expect deeply negative free cash flow as first-quarter FCF typically takes a hit after the holiday season. With that said, should Amazon surprise, against all odds, with strong free cash flow, shares of Amazon may revalue higher post-earnings.

Amazon’s valuation

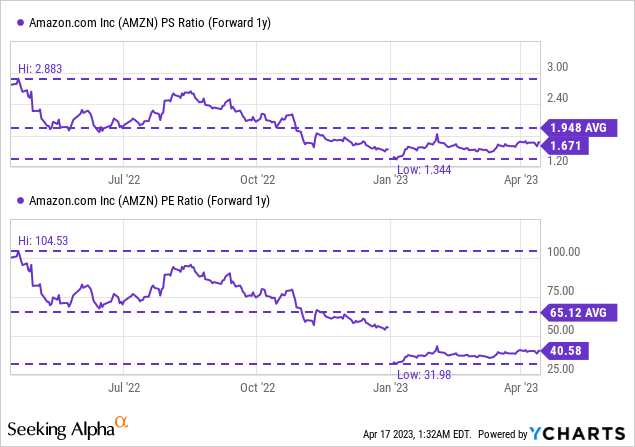

Shares of Amazon are not attractively valued when considering that Amazon is running a consumer spending-sensitive business. Amazon is expected to still grow earnings and revenues in FY 2023 and FY 2024, but growth may slow further, especially if we were to see the start of a major recession later this year. Amazon is currently valued at 1.67X (FY 2024) revenues and 40.6X (FY 2024) earnings. Given that Amazon is struggling in its e-Commerce business (negative operating income margins) and that Amazon Web Services may grow slower in the future as corporations cut back on costs, I believe paying a 40.6X earnings multiplier results in an unattractive risk/reward ratio.

Risks with Amazon

The biggest commercial risk for Amazon, and the biggest risk for the company’s valuation, is that Amazon Web Service’s top line growth is slowing further. The market has grown used to seeing negative free cash flows, but if growth slows in Amazon’s fastest-growing business unit, investors may be forced to apply valuation discounts to Amazon’s shares. Additionally, continually weak operating income margins in Amazon’s e-Commerce business are a concern and could derail Amazon’s bid to optimize free cash flow going forward.

Final thoughts

Amazon is set, in my opinion, to report a weak earnings sheet for its first-quarter considering that economic growth is slowing, inflation remained high, retail sales are under pressure and growth in Amazon Web Services is moderating as well. The slowdown in AWS growth is also the key reason for me to believe that Amazon has very little earnings surprise potential later this month when Q1’23 earnings are due. I believe investors want to see an optimization of free cash flow and operating income, but the current market environment — slowing economic growth paired with inflation — is unlikely to allow Amazon a lot of room for improvement. For those reasons, I believe that Amazon’s Q1’23 earnings are set to disappoint to the down-side and the market must expect a continual slowdown in Amazon Web Services as well!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.