Summary:

- Amazon’s stock price has risen by ~16% in two months, aligning with a Strong Buy rating on the stock.

- Labor issues persist, though Amazon’s relevant investments to assuage workers can temper them.

- AWS continues to be its highlight, which brings in much of the company’s income, and recent generative AI-related developments affirm its potential.

- With its price near all-time-highs and rise in the forward P/E in recent months, a price rise in the immediate future isn’t a given, however, even as it’s likely to do so over time.

4kodiak/iStock Unreleased via Getty Images

Since the last time I wrote about the e-commerce giant Amazon (NASDAQ:AMZN) (NEOE:AMZN:CA) two months ago, its price is up by ~16%. This is in line with a rating upgrade for the stock then to Strong Buy, after it had fallen to it’s now six-month low (see chart below). With no earnings updates since, it follows that the forward multiples have risen since, too.

So, can AMZN continue to rise? Here I argue that it can, and despite its continued labor challenges, with generative AI to the rescue. But it’s not clear whether these price gains will happen immediately.

Price Chart (Source: Seeking Alpha)

Labor challenges continue

Labor discontent, that began to surface in a significant way as high inflation led to a cost of living crisis, has yet to cool down. This has been witnessed across industries and in various parts of the world, including by Amazon itself.

Unionisation and strikes

For the company, it started in 2022, when workers at the JFK8 warehouse at Staten Island formed the Amazon Labor Union [ALU]. Then last year it saw the biggest ever industrial action starting with the UK’s Coventry warehouse, that saw workers across 30 countries joining in during the important Black Friday sale period. The company’s financials weren’t truly affected, and it also responded with increased investments in the UK to assuage the workers.

But that hasn’t stopped further unionisation. In the US, the labor union at its Staten Island warehouse subsequently teamed up with the biggest American one, the International Brotherhood of Teamsters. And more recently, delivery drivers at its facility in Queens, New York have joined in too.

Response and impact

Keeping up with its response to last year’s strikes, the company increased pay for front-line employees and promised investment of USD 660 million in the next year to its Delivery Service Partner program recently. Much like last year’s package, at 0.12% of the company’s operating expenses in 2023, the amount isn’t expected to impact its earnings.

In fact, Amazon’s e-commerce operating income from North America more than doubled in H1 2024. The international e-commerce operations also swung into profits, after reporting losses in H1 2023. With rising labor costs, though, it would be a good idea to look out for how the e-commerce numbers play out in the next quarters, as the segment’s contribution to operating income becomes more important. From contributing 15.8% to total operating income in H1 2023, e-commerce’s share was up to 37.4% in H1 2024.

Increasing generative AI focus

That said, the company’s cloud services division, Amazon Web Services [AWS], remains the big income generator, with a 62% contribution to the operating income in H1 2024. Not only has it not been insulated from strikes, but there’s also much potential for it.

AWS makes gains

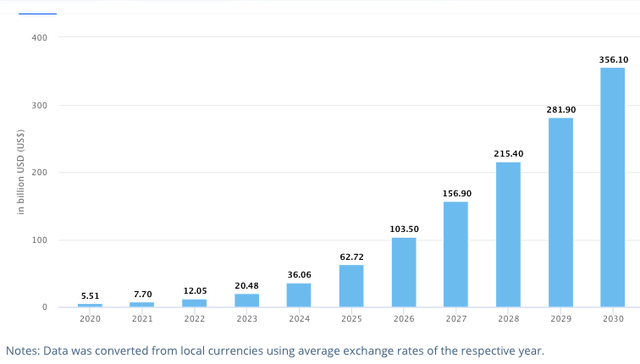

In recent months, it has made gains in the fast-growing generative AI segment, a market that’s expected to grow by over 17x by 2030 from its 2023 levels (see chart below). In the past couple of months, AWS has been chosen by multiple companies for their generative AI-based applications, including with the Spanish clean energy utility Iberdrola (OTCPK:IBDSF), Japan’s high-speed rail services provider Central Japan Railway Company, the UK’s telecom company BT Group (OTCPK:BTGOF) and the National Football League.

Generative AI, Market Size (Source: Statista)

Support to e-commerce

In fact, the company’s recent focus on generative AI could even enhance the performance of the e-commerce segment. The company recently launched a slew of tools to this extent.

The first of these was Amelia, which the company calls a “generative AI-based selling expert that is always available to immediately provide sellers with the answers, advice, and tools they need to succeed”. Other tools can help sellers generate content for product listings, support brand development and create product videos. Amazon’s shopping assistant for customers, Rufus, also continues to expand its reach with its recent launch in the UK.

Market multiples inch up

As positive as the AI related developments are, how fast they add to the company’s bottom line remains to be seen. In the meantime, though, with no earnings updates since I last checked, AMZN’s price rise has meant an inching up in market multiples.

In August, I had made two estimates. As per the first one, it was assumed that the diluted earnings per share [EPS] would double from the first half of 2024 (H1 2024) in H2 2024. With this assumption maintained, the forward price-to-earnings (P/E) ratio is now at 41.6x, compared with 36.5x in August.

The second estimate assumed that the EPS would grow by 137.1% year-on-year (YoY) in H2 2024, much like in H1 2024. This would result in an EPS of USD 6.9 in 2024. This results in a forward P/E of 27x, compared with 24.4x in August.

However, this second estimate is unlikely to play out. As per the company’s guidance, the operating income will range between USD 11.5-15 billion in Q3 2024. At the midpoint, this is an 18.3% YoY growth, down from the 140% YoY increase seen in H1 2024. Assuming that the slower growth guidance for Q3 2024 sustains into Q4 2024 as well and the ratio of net income-to-operating income remains at 79.8% (as seen in H1 2024), the forward P/E is essentially the same as for the first estimate above.

The key point being that no matter how the estimates are done, the forward P/E is at 40x plus levels. Still, these are attractive levels compared to the average of 180x for the past five years.

What next?

But with the stock still relatively close to the all-time-highs seen in July, in the short term, it’s hard to see another rapid uptick in stock price. This can change, if the company’s Q3 2024 results are better than expected and if it upgrades its guidance on recent developments. But we don’t know that yet.

In the meantime, its ongoing labor challenges could dilute sentiment for the stock, even while the progress for AWS can temper it. Based on this, I’m downgrading AMZN to Buy now, as the positive momentum can continue, but perhaps not in the immediate future.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in AMZN over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

—