Summary:

- ‘Competitive moat’ refers to a business’s ability to maintain an economic advantage over competitors, and we think Amazon has the largest moat in Big Tech.

- Amazon’s core physical marketplace and logistics network, along with additional revenue streams, contribute to its near-impregnable financial results.

- While there are risks, like the extended multiple, Amazon’s strong business model and potential for double-digit long-term growth make it a compelling investment option.

- We rate AMZN a ‘Buy’.

georgeclerk

If you ask Google (GOOG) the definition of a ‘Competitive Moat‘, it quickly comes up with the following answer:

A competitive moat, also known as an economic moat, is a business’s ability to maintain a competitive advantage over its competitors. The term comes from the moats that surrounded medieval castles, which acted as a barrier to protect the castle from outside invaders.

While the concept was initially popularized by Warren Buffett, the term has seeped its way into all corners of investment analysis, especially when it comes to considering a company’s ‘durable’ advantage in the marketplace.

It makes sense – the bigger the moat, the longer you’re able to continue producing profit, and the more valuable your shares become.

Thus, in some ways, most companies in the S&P 500 have some sort of competitive moat, as they have become public and established a profitable track record over time.

In this article, we wanted to talk about Amazon (NASDAQ:AMZN) (NEOE:AMZN:CA), the apex predator in the business world when it comes to competitive moats. While many top Big Tech firms have considerable size, user switching costs, and price advantages, we think that Amazon has the largest competitive moat of them all.

Today, we’ll explore Amazon’s unique features that make it such a durable business, and explain why we think the company’s powerful moat makes the stock our number one big tech buy for those with a very long-term time horizon.

Sound good? Let’s dive in.

Amazon’s Advantages

In terms of difficulty, some businesses are harder to build and sustain than others. Building a lemonade stand is easier than building a full-service restaurant, and building a kayak rental shop is easier than building a cruise line.

Capital, complexity, and incremental cost simply make some business models more technically challenging to execute than others.

In our view, the two types of businesses that are hardest to build are marketplace businesses, and physical logistics networks.

Building a marketplace is incredibly hard because at the beginning, the value proposition for joining is incredibly weak. If there’s already competition in the space, then why even bother? The incumbent likely already has a flywheel going.

You see this in social media, with Meta (META) crowding out all meaningful competition aside from TikTok.

Building a physical logistics network is also incredibly difficult due to the challenges of moving things around in the physical world.

People steal things. Items go missing, or get broken. Millions of packages need to be carefully organized, shipped, and tracked, and storms and disasters can meaningfully disrupt business.

A logistics network is also akin to a physical marketplace, insofar as the utility of the network only increases once the network gets big enough to serve a large enough area. Looking to ship something from Anchorage to Miami? There are only a couple of service providers large enough to do this for you efficiently.

Building either of these business models to scale is an incredibly complex and intense effort, and Amazon has managed to combine them both into its core ecommerce product.

This, in our view, is Amazon’s competitive moat.

It’s true that other firms like Meta, Google, Microsoft (MSFT), NVIDIA (NVDA) and Apple (AAPL) have strong inputs to their competitive positions as well.

For example:

- Brand – Need to search something? Be sure to ‘Google’ it. Brand advantages matter because when they get strong enough, they can dictate customer behavior. Think of a strong brand like a marketing monopoly.

- Size – Larger size means that you can do things with larger economies of scale. Most companies in the world have gross margins somewhere between 10% and 50%, but typically only need some level of fixed costs to operate. Thus, the more you sell, the more profit you make on the bottom line. This profit can then be re-invested to keep competitors at bay, or innovate and stay ahead.

- Switching Costs – Some businesses have very high switching costs, where the benefits of switching are very nominal compared to the costs of leaving. For Meta, for example, there really aren’t any other social networks that have the size and reach that it does.

We like Amazon because it has all of these advantages and retains the core physical network and marketplace flywheel.

- Microsoft doesn’t have a marketplace, and the things it sells move around the world digitally.

- Google’s only true “networks” are YouTube and the Google Play Store, and it mostly refrains from building/moving things in the real world (although we’ll see about Waymo).

- Apple does manufacture devices, but it contracts that bit of the process out. Plus, the company continues to shift to a services-first model where products flow more and more through data centers.

- Meta’s strong network only exists in the digital realm.

- Finally, Nvidia’s technological advances represent a complex challenge, but likely aren’t more than a year or two ahead of competitors.

Viewed from this lens, Amazon simply has the most durable economic moat out of all of big tech. As far as we know, no other companies are even trying to replicate Amazon’s business model in any real way, which can’t be said for anyone else we just listed.

Thus, we see Amazon’s long-term profitability as the ‘safest’ bet out of almost any stock in the market at present.

Amazon’s Financials & Valuation

As we’ve laid out, Amazon’s physical marketplace & logistics network is the core, low margin business that powers the company, but it’s far from the only way Amazon monetizes this advantage.

Over the last few years, AMZN has been building businesses on top of this offering, which has amped up profitability considerably.

On the business side, the company’s advertising business has grown exponentially as marketers have begun to vie harder and harder to get in front of buyers that are actively looking to purchase. Additionally, the FBA business (Fulfillment, shipping, and customer service) also takes a huge cut of third-party sales on the platform but is still worth it to vendors due to the complexity & cost savings. Finally, the company’s homegrown IT stack for managing the business has grown into AWS, the public cloud product that keeps the company on the forefront of innovation in the tech sector.

On the customer side, Amazon Prime is one of the most successful consumer subscriptions of all time, and the company uses it as a retention mechanism that further enforces the advantages of the flywheel.

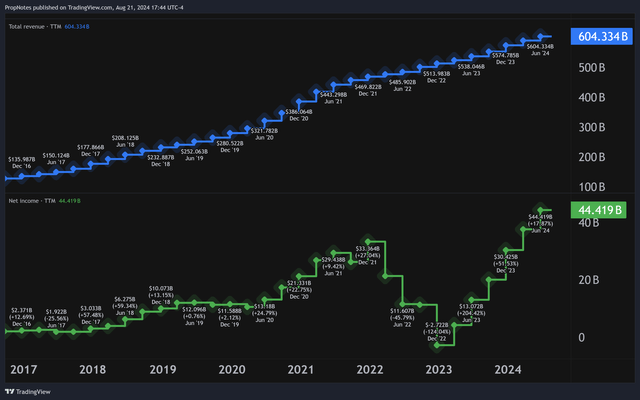

All of this has led to impressive financial results, with TTM revenues topping $600 billion and TTM net income of more than $44 billion – all-time highs on both metrics:

TradingView

While the margins aren’t incredible here at only 7% on the bottom line, we see AMZN’s business as a whole as being the most well-defended in the S&P 500. Again, nobody is trying to take out Amazon here. The last company that tried, Shopify (SHOP), recently jettisoned its fulfillment network to focus on its core product, which was much more profitable.

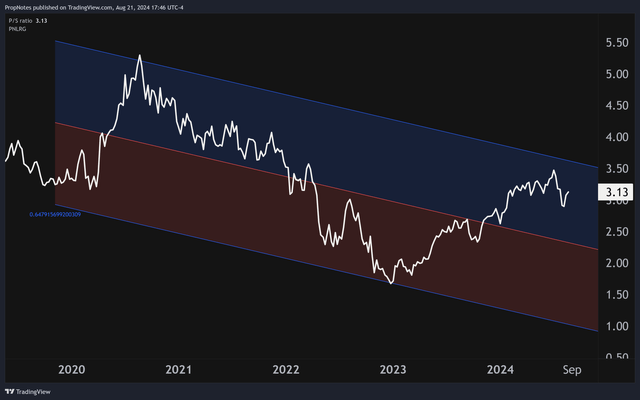

As far as the valuation goes, AMZN trades at a 3x sales valuation, which, for a retailer, is quite a premium:

TradingView

Additionally, the multiple is in the upper half of the regression channel above, which indicates that there likely isn’t too much room for further multiple expansion.

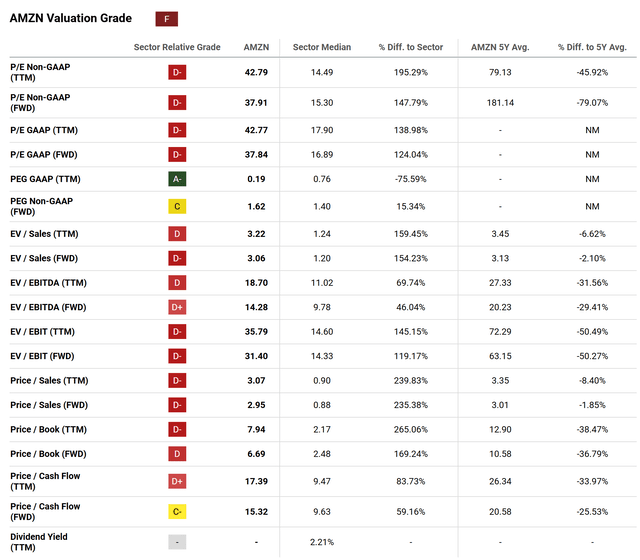

The same can be said for the bottom line. As you can see, Seeking Alpha rates AMZN as an ‘F’ from a valuation perspective, which seems a tad aggressive:

Seeking Alpha

Once you dig into the above numbers though, you can see that the company is actually reasonably priced vs. peers for its Growth, at 0.19x TTM and 1.62x FWD, and it’s the pure consumer multiple comparison that’s throwing things off. A chunk of Amazon’s business is powered by high margin AWS results, which commands a higher premium and would likely be more in line when compared with the tech sector.

The key here is what AMZN looks like going forward.

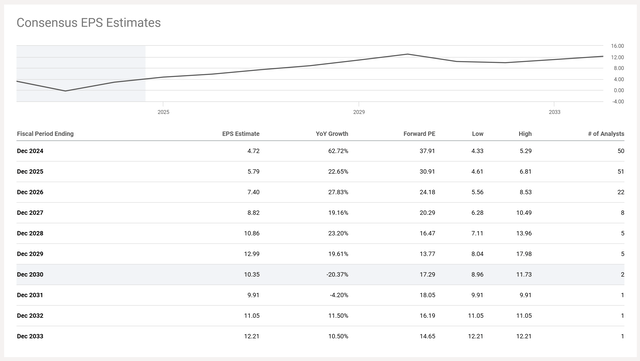

At the moment, analysts are projecting 2029 EPS at roughly $12 per share, which would put the stock at a ~15x multiple:

Seeking Alpha

Obviously, that is a LONG way off, but we do see the YoY growth continuing at this pace well into the future.

It’s tough to peg a Fair Value given historical volatility in some profitability multiples, but we think AMZN is one of the highest-confidence compounding opportunities around, with the ability to grow an investment’s value at 15%+ per year for the next decade – 15 years with a very small amount of variance.

We can’t say the same for any of the other large tech firms.

Risks

There are some risks here, but in total, much of the thesis is about how de-risked AMZN is as a result of the advantages we’ve discussed. Absent a breakup by the federal government, we don’t see the company facing a serious risk as a going concern anytime in the coming decade or two. Disrupting a digital product is one thing, but physically building out a network like Amazon – nobody wants to do this. It’s capital intensive and slow.

To us, the key risk to be aware of, right now, is what you’re paying for the entry multiple on the way in.

The stock is trading at roughly 40x FCF, which is a bit on the aggressive side. Poor entries can lead to years of robbed appreciation as the fundamentals catch up with the valuation, but we also think it’s entirely possible that AMZN retains a premium as long as it can keep juicing higher profits from its ecommerce and AWS businesses.

Summary

All in all, we think AMZN has one of the best, most durable business models in the world, and expect that the company will continually reward shareholders going forward well into the future.

It’s true that the multiple is a bit stretched at the moment, but if you’re looking to invest for the long haul, then we don’t see many better options than this robust company.

That’s why we’re rating it a ‘Buy’.

Stay safe out there!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.