Summary:

- I added Amazon stock aggressively late last year and earlier this year, as I anticipated its bottom. Therefore, I’m not surprised AMZN has outperformed the S&P 500 significantly.

- I highlight why investors need to be forward-looking and not wait for the coast to be clear. Amazon’s Q2 earnings release indicated an ongoing recovery, justifying my optimism.

- However, if you wait till its results offer more clarity, you have missed out on the most attractive risk/reward buying opportunities over the past year.

- Analysts’ estimates suggest that Amazon’s forward earnings growth could recover significantly over the next three years. However, I highlight why the market has not priced it in.

- I make the case for buyers to join me in adding more AMZN before it re-tests its all-time highs. Don’t wait till the AMZN northbound train departs.

FinkAvenue

Amazon’s (NASDAQ:AMZN) naysayers have been put to the sword, as the leading e-commerce and cloud computing company reported a solid second-quarter or FQ2 earnings release.

However, if you wait until you see a “confirmed” growth inflection point in Amazon’s recent operating performances before returning, you have missed the most attractive risk/reward upside in late 2022 or earlier this year. Together with members of my service, I started to buy more AMZN in September 2022 and added more aggressively in December when AMZN bottomed out.

When I added more AMZN in December at $85, I highlighted that AMZN was then a “significantly undervalued stock.” As it continued to hover at its lows in early January (when I added again at $85), I stressed that “if the market bottoms, AMZN will be straight out of the gates leading consumer discretionary.”

As such, I have not been surprised by the remarkable recovery posted by AMZN, as it significantly outperformed the S&P 500 (SP500) since its early January lows. Accordingly, AMZN surged nearly 80% from its early January lows through last week’s highs. Therefore, investors are reminded that the market is always forward-looking. Market operators wouldn’t wait for such clarity before returning, as they correctly anticipated its bottom “well ahead of time (Q2 earnings).”

I highlighted last year that AMZN is a free cash flow or FCF growth story. Given its relatively low FCF margins, the company is susceptible to FCF swings as it invests in its significant e-commerce and cloud computing infrastructure. Moreover, the pandemic-driven gains surprised the company, as it overexpanded. Bedeviled by the unfavorable macroeconomic and high-inflationary conditions in 2022, Amazon’s FCF swung to losses in FY2021-22.

However, Amazon’s robust Q2 release demonstrated that the negative FCF margins we experienced are likely a thing of the past, as the company could improve its operating leverage significantly moving ahead.

According to the most updated analysts’ estimates, Amazon is expected to post an EBIT CAGR of 55.2% from FY22-26 as Amazon’s operating income recovers from the worst battering in recent memory. CEO Andy Jassy and his team’s optimism about leveraging further on its AWS cloud computing scale in benefiting from the generative AI momentum isn’t misplaced. Jassy highlighted that AI monetization remains nascent. Therefore, I believe analysts’ estimates would not likely have reflected a near-term growth inflection from generative AI monetization.

Furthermore, its Q2 results corroborated that Amazon’s consumer businesses are on an upward recovery, with its retail media advertising segment also performing well. As such, I believe it’s important to assess AMZN as a big tech growth recovery story, supported by Seeking Alpha’s Quant growth grade of “A.”

With that in mind, AMZN’s FY26 EBITDA of 9.2x suggests that investors have not priced in its medium-term growth recovery. Relative to its 10Y average of 21.3x, investors remain reticent about AMZN’s recovery, offering substantial opportunities for investors to add further.

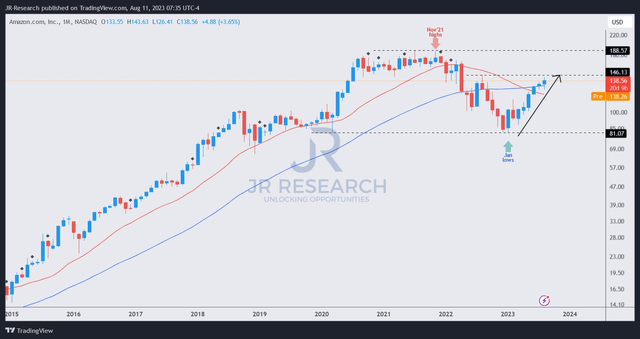

Moreover, I gleaned AMZN’s long-term uptrend bias has nearly recovered, which could attract more momentum investors back to it, supporting its forward recovery to take out a new high.

AMZN price chart (monthly) (TradingView)

As seen above, AMZN is on the verge of reclaiming its critical 50-month moving average or MA (blue line). While there’s a near-term resistance zone at the $146 level, the positive breakout sentiment after AMZN’s Q2 earnings suggest it should be breached moving forward.

As such, I expect AMZN to regain its long-term uptrend bias decisively after breaking out of the $146 zone before re-testing its November 2021 highs.

With that in mind, AMZN’s rally is still in the earlier stages compared to the stock of its big tech peers, such as Microsoft (MSFT) and Apple (AAPL), as they have already re-tested their all-time highs.

Therefore, investors still on the sidelines should consider leveraging AMZN’s recovery to add more exposure.

Rating: Maintain Buy. Please note that a Buy rating is equivalent to a Bullish or Market Outperform rating.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN, MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!