Summary:

- Insider activities on Amazon.com, Inc. stock are dominated by sellers.

- To me, these selling activities reflect the fundamental challenges Amazon stock faces in the near future.

- The key challenges include pressure on its operating margins, competition in key growth areas, and valuation risks.

- I expect its stock price to continue being rangebound in the near term due to these challenges.

Vladimir Zakharov

AMZN: check the insider activities before you buy

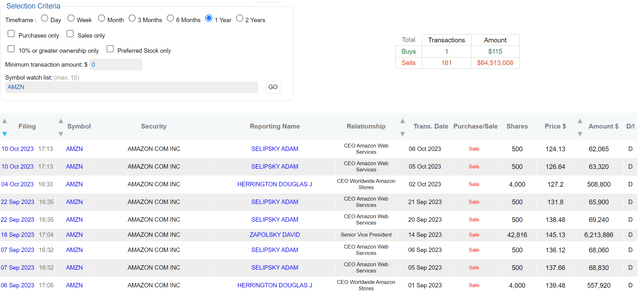

The chart below shows the insider activities on Amazon.com, Inc. (NASDAQ:AMZN) stock in the past 1 year. As you can clearly see, the insider activities are completely dominated by sellers. To wit, there were a total of 162 insider transactions, and 161 of them were selling activities. The only 1 buying activity could as well be a reporting glitch, as the transaction amount is $115. Even in the recent two months of September and October 2023, several Amazon executives made multiple sales in a price range between $124 to $140.

Usually, the signal from insider selling is not as conclusive as insider buying. As detailed in my earlier article:

When it comes to insider activities, usually I pay more attention to buying activities than selling activities. The reason is that selling activities can be triggered by a range of factors irrelevant to business fundamentals (such as divorce or buying a new house). In contrast, insider buying activities usually have only one explanation – the insiders think the stock is undervalued.

However, in the case of AMZN here, such a one-sided picture of insider activities still begs the question: why? This question leads exactly to the thesis of this article. in the remainder of this article, I will explain why I do not view insider selling activities as triggered by extrinsic factors. I do see that the stock faces both technical, valuation and fundamental challenges under current conditions.

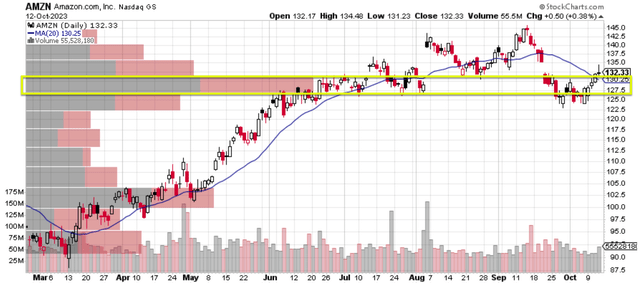

I will start with a brief technical analysis of its recent trading activities. These trading activities, when viewed in combination with the latest insiders’ transactions mentioned above, provide insights into the near-term price movements of the stock in my view. The next figure below shows AMZN’s trading activities in the open market in the past 3~4 months. As you can see, the prices have been moving sideways, mostly in the price range from $125 to $145. Furthermore, as highlighted by the yellow box, the large trading volume by far occurred in a price range around $127~$130, coinciding with many of the insider selling activities above. Thus, from a technical point of view, I anticipate the stock price to continue being range-bound in this window.

And next, I will examine risks to its business fundamentals and operations.

Operation and growth challenges

AMZN has been facing pressures on its operating margins lately. Unfortunately, I see the pressure to persist in the near future given the macroeconomic parameters.

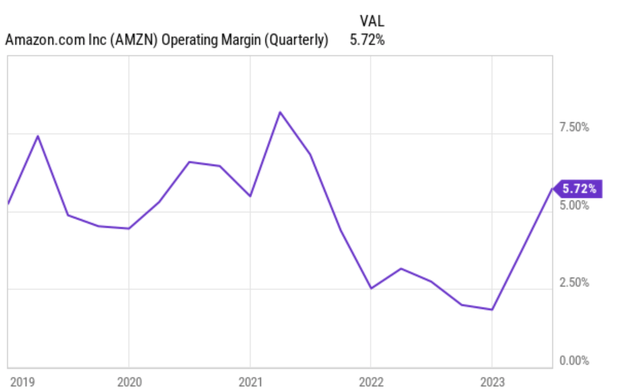

The chart below shows AMZN’s operating margin in recent quarters. As seen, Amazon’s operating margin (“OP”) has been declining sharply in 2022~2023 from a peak level of ~7.6% to a bottom of only ~2%. The key drivers for such margin pressure include fulfillment cost and labor costs in my mind. The margin has shown an improvement to 5.72% during the past quarter. It is still substantially below the average of its pre-pandemic level. And more importantly, I think the reversal in its OP seen in the past quarter is unlikely to last considering both overall inflation and energy costs persist at an elevated level.

Expanding our horizon a bit, I see competition intensification in AMZN’s key growth areas and AMZN is likely lagging. Its Amazon Web Services (“AWS”) is, of course, the elephant in the room here. In response to the use of generative artificial intelligence (“GAI”), AMZN announced its Bedrock service earlier this year.

However, I see a number of challenges that could prevent Amazon’s Bedrock from gaining market share. First, Bedrock is still in its early stages of development. In CEO Andy Jassy’s words, “the really good ones (i.e., GAI models) take billions of dollars to train and many years.” The large CAPEX requirements, especially combined with the margin pressure in its other segments, could make Bedrock’s future even more uncertain in the face of more established GAI services such as ChatGPT and Bard.

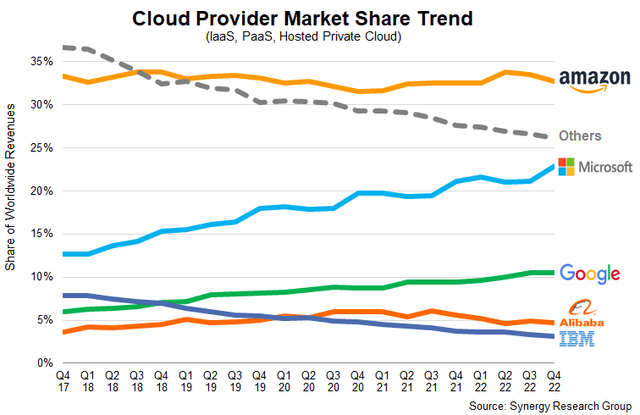

Second, the cloud computing market is already very competitive, and other competitors have been gaining on AMZN as you can see from the following chart. It is true that AWS still maintains the top market share. However, its market share has been stagnating at around 33% in recent years, while Microsoft (MSFT) and Google (GOOG) have been steadily gaining market share. I think AMZN’s lag on the GAI front would make it harder for AMZN to maintain its current market share.

Other Risks and Final Thoughts

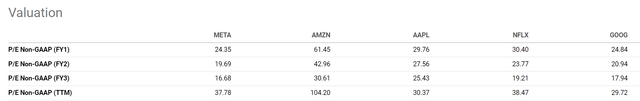

Besides the challenges analyzed above, there are a few other risks, both in the downside and upside directions, which are worth mentioning. First, AMZN stock also faces substantial valuation risk in my view. The valuation multiples are simply too high for me. Its FY1 price-to-earnings (P/E) ratio is currently at 61.5x, which is more than double that of other mega-tech firms, whose FY1 P/E is in a range of 24x to 30x. Even in the case that the higher growth assumption embedded in its multiples actually materializes, its FY3 P/E would still be much higher than the FAANG group by a good margin.

Then investors need to be aware that AMZN relies on financial leases to a larger degree than other large tech firms. A detailed analysis of how the lease financing can impact its cash flow and valuation multiples is in my earlier article. My overall conclusion is twofold: A) its lease obligations are significant reoccurring expenses; and B) such obligations make its cash less than on the surface (and valuation multiples higher than on the surface).

On the upside, management is working on strategies to control costs. These cost-saving initiatives could help the core e-commerce business by lowering fulfillment and labor expenses. But as mentioned earlier, the jury is still out in my view on how effective these initiatives can be against the macroeconomic headwinds. At the same time, AMZN is still the strongest brand name in e-commerce and masters strong pricing power in my view. As two reflections, its recent Prime Day is again another success with healthy revenue growth, and its price on the prime services (a sizable hike of 17% to $139 per annum) did not seem to meet too much resistance.

All told, I see a tug-of-war between the positives and negatives in the near term. And because of this tug-of-war, my thesis is that Amazon stock prices are likely to continue their side-ways movements with no clear upside bias. I further see the recent insider activities as a reflection of this consolidation period ahead.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Join Envision Early Retirement to navigate such a turbulent market.

- Receive our best ideas, actionable and unambiguous, across multiple assets.

- Access our real-money portfolios, trade alerts, and transparent performance reporting.

- Use our proprietary allocation strategies to isolate and control risks.

We have helped our members beat S&P 500 with LOWER drawdowns despite the extreme volatilities in both the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too. You do not need to pay for the costly lessons from the market itself.