Summary:

- Reaffirming ‘Strong Buy’ for Amazon stock due to impressive growth and strategic positioning in e-commerce and cloud computing sectors.

- AWS’s dominance in the cloud sector is highlighted by several significant contract wins in the recent weeks.

- Impressive fiscal Q2 performance highlights successful cost management and operational efficiency.

- Current valuation remains highly attractive, presenting a compelling investment opportunity despite recent stock price stagnation.

4kodiak/iStock Unreleased via Getty Images

Introduction

I had a ‘Strong Buy’ thesis on Amazon (NASDAQ:AMZN) stock back in May. Since then, the stock has gained around 0.5%, while the S&P 500 has gained 7%.

However, Amazon continues to show growth and strategic foresight, and that strengthens Amazon’s standing as an undisputed leader of the e-commerce and the cloud industries. Amazon’s recent Q2 numbers and strategic investments continue to show us the strength of the company and the possibility for more robust growth for the foreseeable future. AWS recently secured numerous new contracts with the largest customers across the world, which is a further demonstration of Amazon’s robust reputation as the leading cloud provider. And there is still strong upside potential, and therefore I am reiterating my ‘Strong buy’ recommendation for AMZN.

Fundamental analysis

Total revenue increased by 10% year-over-year in 2Q24 to $148.0 billion, benefited by a strong business mix. Amazon’s bottom-line figure somewhat went in sync with higher revenues. Non-GAAP EPS jumped an impressive 95% YoY to $1.26 per diluted share against consensus estimates, enough to highlight Amazon’s strong cost management and operational efficiencies.

SA

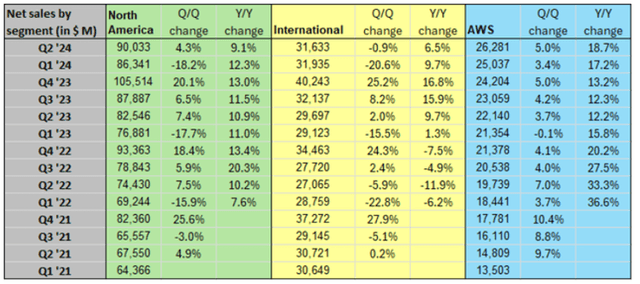

Driving the top-line results was Amazon’s North American retail segment, which saw its YoY revenue increase by 9.1% to $90.0 billion, with an operating profit of $5.07 billion. Encouragingly, the International retail segment reported a revenue increase of 6.5% to $31.6 billion and became profitable for just the second time ever as the company continued to make operational improvements.

AMZN’s Q2 2024 presentation

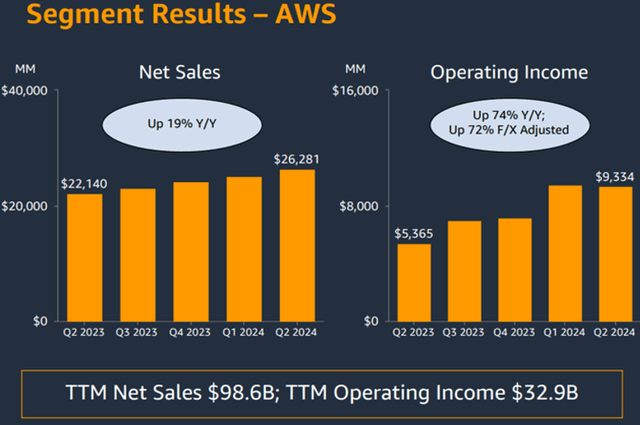

Another factor is Amazon Web Services (AWS). AWS contributed $26.3 billion to Amazon’s consolidated revenue in Q2, a YoY growth of 19%. Amazon reported $9.3 billion in operating profit from AWS for the quarter, an increase of 74% from last year. Its operating margin was 35.5%, an impressive level. AWS is sustaining its exceptional current growth from continued global investment in cloud computing and AI services. The company is also investing huge amounts in cloud and AI infrastructure to remain ahead of competitors. The company recently announced it will expand its data centers in the UK with a multi-billion GBP investment.

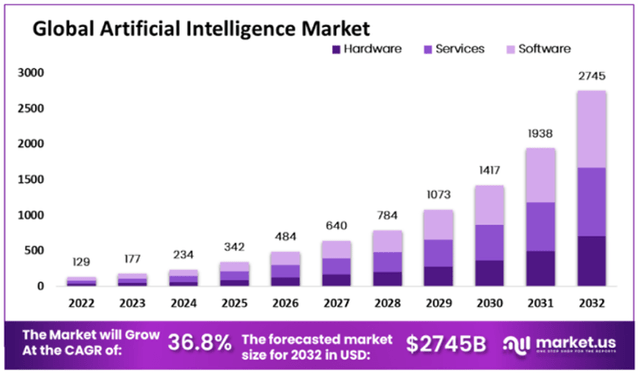

Aside from investing in the AI infrastructure, Amazon is also using its huge cloud infrastructure to offer advanced AI services. AWS launched new features in Amazon Bedrock (a suite of foundation models) helping customers to build complex generative AI applications. This explicit focus on AI by Amazon is allowing it to leverage the fast-growing demands for AI applications. The demand is significant as the entire market of global AI is forecasted to deliver a 37% CAGR by 2032 as shown in the screenshot below. AI software will be the largest segment of the AI industry.

market.us

The company has also been helped by partnerships, such as with big technology companies Oracle (ORCL) and Nvidia (NVDA), which ensures that AWS can offer customers a wider range of hardware options for AI and cloud computing. AWS’s CEO, Matt Garman, is extremely optimistic about the company’s prospects in cloud and AI.

AWS’s image as a technological avant-garde provider of AI-based and cloud services is reinforced by the fact that it has just been chosen to supply the Central Japan Railway with its new solutions in track maintenance. In case you have forgotten, that is one of the world’s most advanced and busiest railway systems, riding on bullet trains that service more than 170 million passengers via the Tokaido Shinkansen system per year. Recent notable new AWS clients include Gold Fields and GE HealthCare.

Amazon certainly is not sand-bagging AWS – it uses one lever to pull another – and drives innovation and efficiencies in its legacy e-commerce business too. Faster delivery times and lower cost for customers, thanks to optimized fulfillment in the US. More sales from third-party merchants is turbocharging Amazon’s retail efficiency, and its recent $2.1 billion investment plan for its Delivery Service Partner program is aimed at boosting driver pay and safety.

All these bolster my bullish outlook on Amazon. It’s clear that we have a good revenue mix along with strong growth not only in the mature segments, but also in younger business lines in the near future. This is a clear indication that Amazon is quite resilient and flexible. Moreover, I refer to Amazon’s investments in AI and cloud infrastructure and how the company is likely to be in a good position to benefit from all the emerging opportunities in those high-growth areas. So, you can understand why I am not astonished that the stock has received first place in a recent top-15 ‘Vintage Value’ names list for 2025 by Morgan Stanley.

Valuation analysis

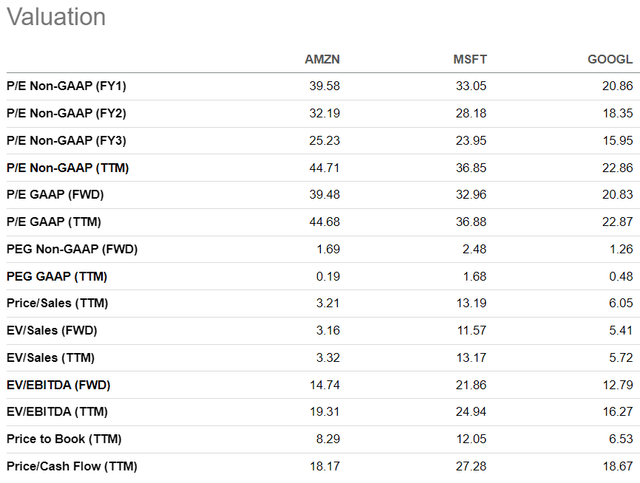

Amazon’s unparalleled leadership in both e-commerce and cloud computing makes it challenging to conduct traditional peer ratio analysis. Truth be told, there isn’t a single company that boasts rock-solid leadership in two big and rising industries. I can obviously compare the multiples of Amazon with its closest challengers in the cloud business – Microsoft (MSFT) and Google (GOOG) (GOOGL).

SA

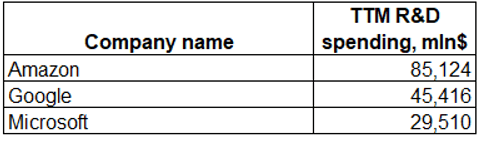

Overall, Amazon appears somewhat underpriced relative to its peers, considering Price/Sales and Price/Book. Amazon’s TTM Price/Sales is 3.21, compared to Microsoft’s 13.19, and Google’s 6.05. Similarly, Amazon’s Price/Book ratio of 8.29 appears less than Microsoft’s 12.05. Amazon’s TTM Price to Cash Flow ratio, 18.17, appears near to Google’s 18.67, and far less than Microsoft’s 27.28. Given that Amazon’s P/E ratios are higher than its competitors – a TTM P/E of 44.71, as opposed to Microsoft’s 36.85, and Google’s 22.86 – this isn’t necessarily encouraging at first glance. Amazon is famously a leader in R&D investment, however, and its bottom line is affected by these investments. On a TTM basis, Amazon’s R&D investment is close to double that of Google and approximately triple that of Microsoft – further making P/E comparisons somewhat misleading.

Compiled by the author

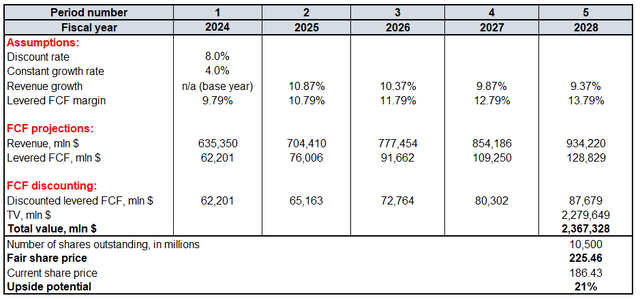

Doing the DCF will help to calculate Amazon’s price target and upside potential. Amazon’s cost of equity is 8%. For 2024-2025 revenue, I am using analysts’ consensus. For 2026-2028, I expect some growth deceleration as the year-on-year growth becomes a bigger comparative. As an enduring AI stock, I think that AMZN can justify a 4% constant growth rate when I calculate terminal value (TV). I will use a 9.79% TTM free cash flow (FCF) margin for the base year. Historically, strong profitability means that Amazon can easily convert an approximate 10% CAGR in revenue to at least 100bps of FCF expansion. According to Seeking Alpha, there are 10.5 billion Amazon shares outstanding.

Calculated by the author

I get a fair share price of $225. This implies an upside of 21% on the current share price. The updated $225 target is slightly above my previous AMZN target of $223.

Mitigating factors

With an effective market monopoly in e-commerce and a vast market share in the cloud industry, AMZN not only has a strong strategic position, but it also carries sizeable antitrust risks. Amazon and Flipkart are being investigated for alleged price collusion by the Indian antitrust; and earlier this year, the U.K. Competition Market Authority (CMA) kicked off its inquiry into AMZN’s collaboration with Anthropic to investigate whether the pair might have ‘worsened competition’ for U.K. customers. Such scrutiny could result in greater legal and consulting expenses for AMZN, which are unlikely to be budgeted for.

crn.com

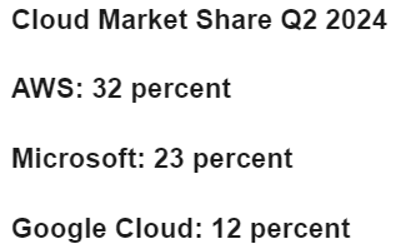

AWS is number one in the world in terms of market share in the cloud computing business, but the competition is also very fierce. Besides, competitors are larger in the sense of market cap – Microsoft ($3.2 trillion) and Google ($1.94 trillion). In Q2 revenue growth, both Azure and Google cloud are also faster growing than AWS. Also, competitors have financial resources to invest and have the ability to make other expenses, such as paying the brightest engineers. So, if one looks simply at competitors’ resources, that makes both of them a danger to Amazon’s dominant position in the cloud. But the risk is remote because the difference between AWS and Azure in terms of the market share, the gap is still considerable.

Conclusion

So as for AMZN, there are no reasons to be less bullish. The company still has strong growth momentum and, fueled by capable and visionary management, tremendously increased its potential in cloud and AI. The company continues to innovate and improve its legacy e-commerce business, seeking efficient strategies to enhance its performance. I find the valuation for AMZN stock is quite attractive, and I’m upgrading my target price to $225.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.