Summary:

- Amazon faces significant macro and political risks that can affect its performance in the not-so-distant future.

- Considering the rising challenges and a changing macro environment, we believe that it’s hard to justify Amazon’s current valuation.

- That is why Amazon is a SELL for us right now.

David Ryder

The robust growth of Amazon’s (NASDAQ:AMZN) stock could be coming to an end in the not-so-distant future. While the share price got a boost thanks to the company’s good performance in Q3, the political risks are increasing, and Amazon’s stock itself is overvalued in our opinion. That is why we believe that Amazon is not worth investing in right now and its stock is a SELL at this price.

Significant Risk Ahead

There’s no denying that Amazon had a good performance in Q3. During the quarter, its revenues were up 11% Y/Y to $158.88 billion and above the expectations by $1.6 billion. However, Amazon also faces significant risks that could affect its business model in the upcoming quarters.

While inflation is retreating and the Federal Reserve started to cut interest rates, some macro risks persist. Considering the scale of Amazon, it’s likely that its business will continue to be exposed to macro developments that can impact its performance in the future.

One such development is the potential implementation of greater tariffs on foreign goods which President-elect Donald Trump promised to do when he was campaigning for the highest office in the United States a few months ago. To tackle the issue of the ever-rising debt levels in the United States, Donald Trump’s proposal, if implemented, could have a direct negative impact on Amazon’s performance as it would escalate the trade war risks.

Some reports suggest that Amazon’s China-based merchants account for nearly half of the third-party gross merchandise volume and almost half of Amazon’s 10,000 sellers are based in China. Amazon itself hinted at this when it stated the following in its latest annual report:

In addition, because China-based sellers account for significant portions of our third-party seller services and advertising revenues, and China-based suppliers provide significant portions of our components and finished goods, regulatory and trade restrictions, data protection and cybersecurity laws, economic factors, geopolitical events, security issues, or other factors negatively impacting China-based sellers and suppliers could adversely affect our operating results.

The potential implementation of a 10% import tariff across the board and at least a 60% levy on Chinese goods imported to the United States could spell trouble for Amazon considering its reliance on China-based third-party merchants.

Considering such a risk, it’s hard to justify Amazon trading at over 40 times its forward earnings, which is above the sector’s median. Going forward, we don’t see much upside ahead and believe that macro risks won’t go away anytime soon.

Risk to Our Bearish Thesis

Some developments could still undermine our bearish thesis. The U.S. composite PMI of 54.4 was above the expectations of 54.3 in September, and the business activity in October seems to be growing at a solid pace.

In addition, Amazon’s cloud business is also performing better than expected and could offset the underperformance of some of the company’s other segments. In Q3, AWS saw its sales grow by 19% to $27.5 billion. What is more important is that by generating $10.45 billion in operating income in Q3, AWS now accounts for 60% of Amazon’s total profits.

This is certainly an important development. As the generative AI market is expected to continue to grow at over 40% in the next few years and more businesses start to use cloud services to run generative AI models, Amazon’s cloud business is expected to show an impressive performance and offset the potential downside of the company’s other businesses. Amazon’s management itself said that they’re experiencing a lot of demand for its cloud services. This means that Amazon still has a chance of growing its sales by around 10% in the next few years.

The Intrinsic Value of Amazon

There are more than enough risks to our bearish thesis, but we believe that it’s still hard to justify Amazon’s current valuation. We believe that at the current price, Amazon’s stock is overvalued, and below we present our valuation model.

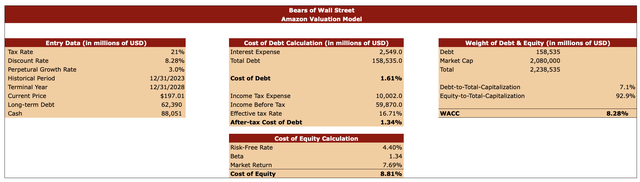

The tax rate in our valuation model is 21%, which is currently the corporate rate in the United States. This is slightly above Amazon’s current efficient tax rate. But since we’re forecasting Amazon’s performance for the next five years in our valuation model, it makes sense to use a 21% rate for the base scenario.

We create this model when Amazon is trading at $197.01 per share, and the data for its cash reserves and long-term debt are taken from its latest earnings report. The perpetual growth rate in our model is 3%, which is the rate that we constantly use since it’s close to the historical GDP growth rate.

The discount rate in our model is 8.28%. We found it by figuring out Amazon’s after-tax cost of debt along with the cost of equity. To calculate the cost of debt we used primarily Amazon’s TTM data. To calculate the cost of equity we used the risk-free rate of 4.4%, beta of 1.34, and the market return rate of 7.69%.

Amazon’s valuation model (Bears of Wall Street)

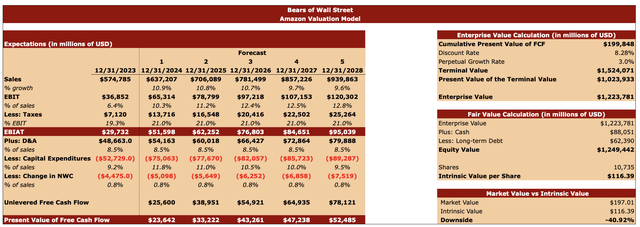

With the entry data submitted, we then move on to our forecast table. For the following years, we expect Amazon to grow its sales by around 10% Y/Y, which is similar to the current consensus. The EBIT is also expected to gradually increase due to the potential improvement of the company’s efficiency caused by the ongoing generative AI revolution, which could improve its overall margins. The CapEx in FY24 is expected to be around $75 billion. This is in-line with the management’s expectations.

By completing the forecast table with our assumptions, we were able to do additional calculations presented on the right side of the picture below and found out that Amazon’s enterprise value is $1.22 trillion. We then added the cash reserves, subtracted long-term debt, and found out Amazon’s equity value, which in our case is $1.25 trillion. We then divided the equity value by the number of Amazon’s shares and found out that the company’s intrinsic value is $116.39 per share. With a downside of around 40%, we believe that the company is not a good investment right now even if we include different growth opportunities.

Amazon’s valuation model (Bears of Wall Street)

Final Thoughts

We believe that the 10% sales growth rate that the analysts expect in the following years is not enough to justify the current valuation. If we add the rising number of risks into the equation, which could materialize over time, then the downside could be even more significant than in our model. That is why Amazon currently is a SELL for us.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.