Summary:

- Amazon stock has recovered well and outperformed the S&P 500 recently.

- Amazon has regained the initiative across its key business segments: retail, AWS, and advertising.

- Amazon Prime has demonstrated its moaty advantages, bolstering Amazon’s opportunities across its ecosystem.

- Amazon’s ability to recalibrate its operating margins and drive operating leverage growth further demonstrates its incredible execution.

- I explain why AMZN, while no longer undervalued, remains a solid buying opportunity. Read on to find out more.

FinkAvenue

Amazon: Recovered Well And Outperformed

Amazon.com, Inc. (NASDAQ:AMZN) investors who bought the stock’s August dips have performed remarkably well, outperforming the S&P 500 (SPX) (SPY). In my previous bullish AMZN article, I urged investors to ignore the market’s undue pessimism as profit-taking hit the stock. I enunciated why the company’s deeper forays into advertising and the resilience of AWS should bolster its recovery trajectory. Hence, I’m not surprised by AMZN’s robust outperformance, as investors re-rated its bullish thesis.

Given the stock’s impressive recovery, it’s no longer assessed to be undervalued, although it doesn’t necessarily translate to a more cautious rating yet. As we enter the third-quarter earnings season, the market has likely already baked in pessimism in Amazon’s forward outlook, as AMZN remains well below its July 2024 highs ($200 level).

Amazon: Headed Into Q4 Confidently

Despite that, the company has made noteworthy progress in digital advertising and Gen AI, seeking to regain the initiative against its leading peers. Furthermore, the economy has remained incredibly robust, notwithstanding weaknesses assessed in lower-income consumers. Coupled with potentially faster growth in online sales (versus its offline peers), Amazon’s retail business is well-poised to benefit, bolstered by Amazon Prime’s moaty subscription business.

Accordingly, Amazon recently recorded more than $1.8B in upfront advertising spending commitments, surpassing its internal targets. Therefore, it has demonstrated increased traction in its ad business, particularly as it seeks to capitalize on the secular growth of the CTV segment. Apple TV+’s (AAPL) recent tie-up with Amazon Prime Video corroborates its broadened exposure with audiences, affirming its status as a “first-stop entertainment destination.” Therefore, I assess potentially significant opportunities for Prime Video to monetize its prospects in CTV advertising, bolstering its momentum in its core retail media profile.

In addition, Amazon Web Services has gained more confidence in its competitiveness in the AI race, given its massive scale and deployment availabilities. It is assessed to have more robust custom chip capabilities, bolstering its ability to offer customers diverse training and inference solutions with its chips. Therefore, AWS has astutely capitalized on its scale advantages, potentially helping broaden the enterprise adoption more rapidly than its leading cloud peers. Wall Street has also become more cautious about Microsoft Corporation’s (MSFT) thesis, given its more focused partnership and concentration with OpenAI’s business model. In addition, it’s also assessed to have less robust custom chips solutions compared to Alphabet Inc. (GOOGL) (GOOG) and AWS.

Notwithstanding Amazon’s optimism about its AI capabilities, there are justified concerns about whether increased CapEx investments could lead to a supply overhang. Enterprise adoption has likely not convinced the market that software companies have effectively monetized their AI growth prospects. However, NVIDIA Corporation’s (NVDA) commentary about selling out its Blackwell chips over the next twelve months has likely assured investors about the sustainability of the AI upcycle. As a result, I assess that it should lower the execution risks for Amazon’s core operating income driver.

Amazon came out with “guns blazing,” emphasizing that it delivered record-breaking sales at its Prime Big Deal Days 2024 event. Hence, it should give more assurance to investors who are concerned about the strength of the holiday season sales. It has also justified Amazon’s decision to up the ante for its holiday hiring, anticipating a solid performance. Management underscored the appeal of its Prime membership, lifting engagement and as members collectively saved over $1B in deals globally. Hence, investors shouldn’t understate the synergies afforded by Prime across Amazon’s retail and advertising ecosystem.

In addition, Amazon CEO Andy Jassy has also lifted investor sentiments as he seeks to continue his targeted cost-cutting approach while taking a bold move to reinstate Amazon’s unique office culture with its five-day return-to-office mandate. Coupled with the shift in its retail strategy as Amazon closed some of its high-tech Amazon Go stores, Jassy has demonstrated his resolve to recalibrate its operating margins.

In addition, the geopolitical headwinds that recently affected Temu of PDD Holdings Inc. (PDD) and Shein as the US government seeks to crack down on importing cheap Chinese goods should benefit AMZN’s retail business. Hence, I assess that AMZN seems to have headed into its pivotal Q4 with a more constructive outlook across its key business segments, justifying the market’s recent optimism as its stock outperformed.

AMZN Stock: Improved Margins Justify A Re-Rating

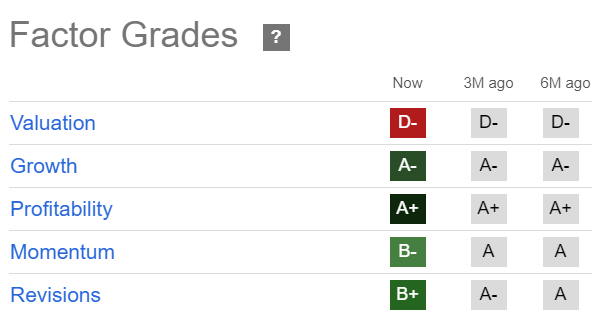

AMZN Quant Grades (Seeking Alpha)

AMZN’s “B-” momentum grade suggests investor optimism has weakened over the past six months, accentuated by its decline toward its August lows. However, its recent outperformance suggests investors have returned aggressively to bolster its dip-buying opportunities, lifting its recovery.

The stock is still priced for growth (“A-” growth grade), highlighting the impetus for Jassy and his team to intensify its competitive advantages in AWS and advertising.

AMZN’s forward adjusted PEG ratio of 1.87 suggests it’s valued at a 23% premium over its consumer discretionary (XLY) sector median. However, it still aligns with the tech sector median (XLK) of 1.93, suggesting it might not be overvalued. AWS is assessed to account for more than 40% of its valuation within an SOTP framework. Hence, potentially more robust growth in its AWS business could bolster a re-rating opportunity.

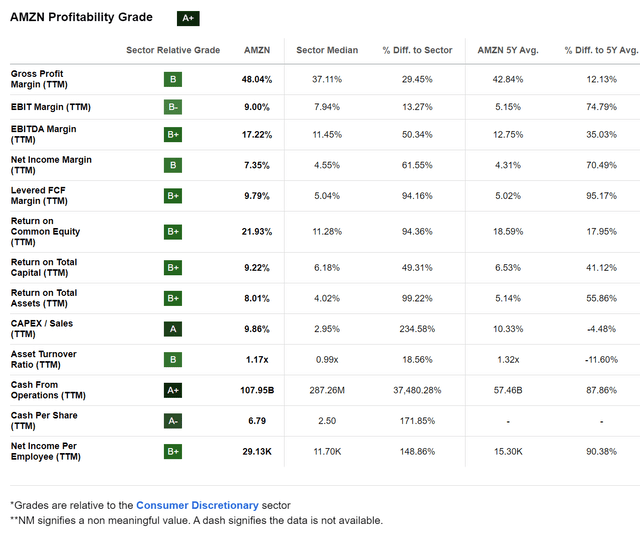

AMZN profitability grade (Seeking Alpha)

Despite that, it’s also crucial for investors to assess the variability in AMZN’s operating and free cash flow margins (trailing twelve-month basis). As seen above, AMZN’s FCF and operating margins are well above its sector median and over its 5Y average. However, the cyclicality of the retail business and its continued CapEx outlays in AWS could hamper a more robust growth trajectory.

However, AMZN’s FCF margins seem to be getting increasingly close to the tech sector’s median, justifying its recent valuation re-rating. Coupled with Jassy’s focus on cutting costs and driving operating leverage growth, it should help to stabilize Amazon’s profitability growth trajectory, bolstering its buying sentiments.

Rating: Maintain Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN, MSFT, NVDA, GOOGL, PDD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!