Summary:

- I do not believe that Amazon’s P/E ratio is a helpful measure, as its earnings are artificially low.

- The true measure of Amazon’s valuation is its cash flow, specifically operating cash flow.

- Amazon’s high-margin businesses, particularly AWS, are driving future revenue growth and profitability.

hapabapa

Amazon.com, Inc. (NASDAQ:AMZN) has trailed the S&P 500 since its earnings release on 4/30. I believe investors are overlooking some key drivers of Amazon’s long-term performance and have left it trading below its historical averages. I want to keep this short and sweet since Amazon articles are a dime a dozen, but there are a few important points to be made about Amazon’s valuation, and I believe visualizing them in charts is highly instructive.

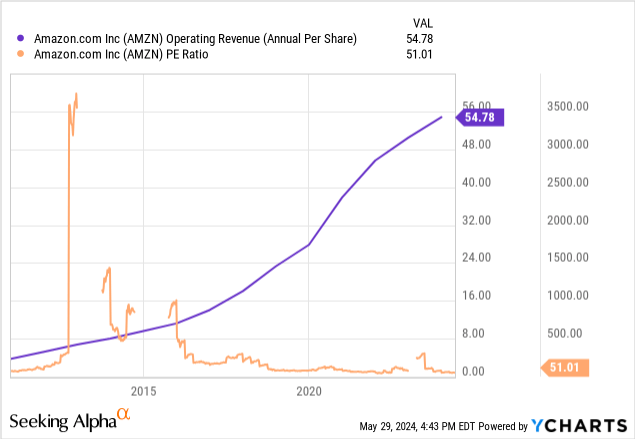

Firstly, the P/E ratio for Amazon does not provide a lot of information about the valuation, and I do not believe it should be used as a tool at this stage.

As shown by the steady revenue growth, Amazon is a fairly consistent grower. What do we learn from the P/E ratio, though? It hovers around the 70-200 range most of the time, sometimes in the thousands, and sometimes doesn’t exist at all. The consistent thing is that it does not accurately predict future stock performance. Earnings are a specific financial measure that does not suit a stock like Amazon that is constantly growing and reinvesting into itself. Until about 2016, Amazon had just about no earnings at all, even though it was a wonderful business to own.

Valuation

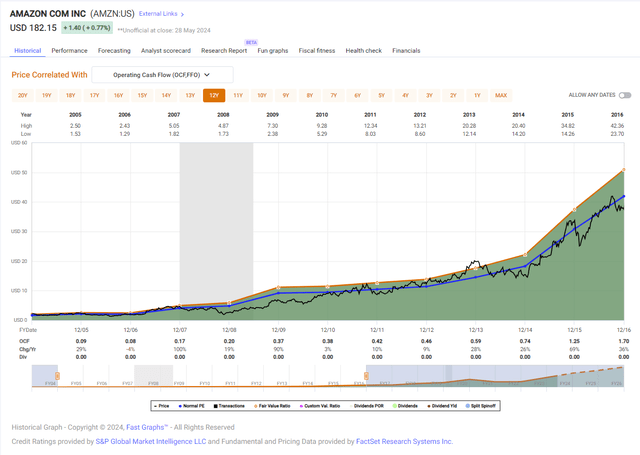

The true measure of Amazon’s valuation comes from its cash flow, specifically operating cash flow. This is how much money Amazon’s business is actually making. The correlation of operating cash flows to price holds very tightly over long periods of time. FAST Graphs show this well, first looking way back from 2004-2016 to establish the historical correlation:

The blue line is the average P/OCF multiple, 24.70 for that time period. And now we look at 2016-2026 (estimates):

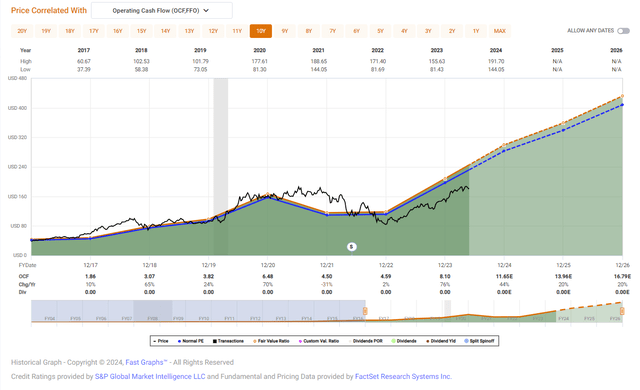

The correlation holds here, and the average P/OCF multiple is 24.33, very close to the prior period.

However, there are two things that stand out. First, Amazon is trading well below its historical P/OCF multiple, at currently a little over 19x on a blended basis. That implies a close to 30% upside based on returning to its historical valuation alone. And again, this has been a very tight correlation throughout Amazon’s history as a company.

More importantly, though, is the strong upward trajectory of estimated OCF. What is going on? Why is the projected growth so strong? To answer those questions, I want to show some charts aggregating data about Amazon’s revenues.

Revenue Quality

Shoutout to LasVegasInvestor for pounding the table on Amazon and especially its OCF correlation, and shoutout to Joseph Carlson for developing Qualtrim which made it easy to turn the raw data into the visuals I wanted to show.

All facts and figures are taken from Amazon’s most recent quarterly report, which you can find here on Seeking Alpha or here on Amazon’s site itself.

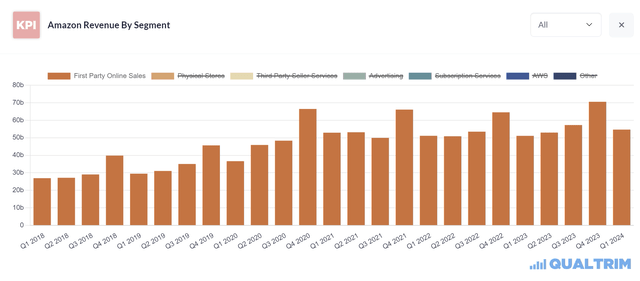

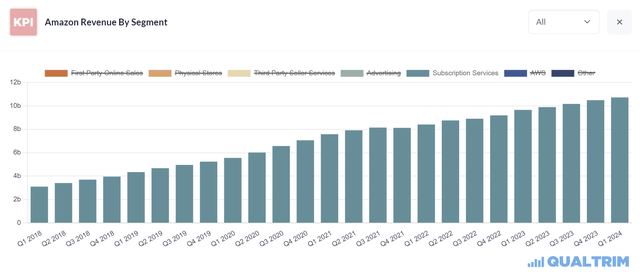

Amazon breaks down its revenue into several segments. The revenue mix is what we want to concern ourselves with. First, here is first-party online sales, the traditional Amazon retail business:

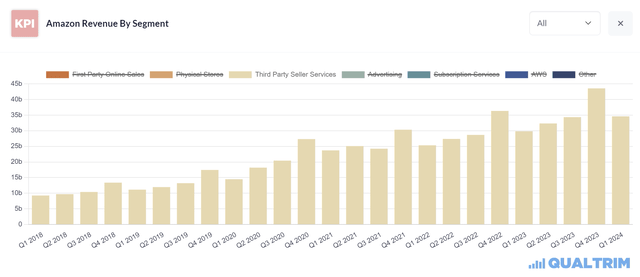

You can see here that these traditional sales have plateaued a bit in recent years, but this is one of Amazon’s lowest margin segments. Next is the third-party services business, a higher margin business where sellers use Amazon’s network and logistics to sell their own products:

The growth here has been more steady in recent years. There are two more relevant high-margin business segments that have also been growing. First is subscription services:

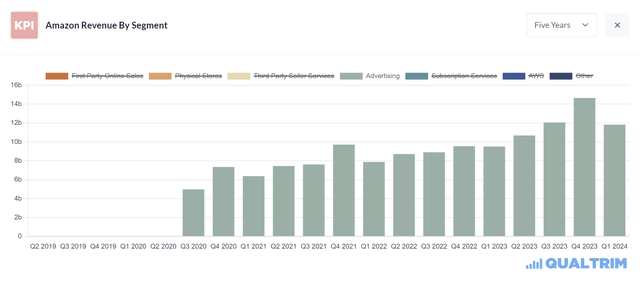

That is the kind of trajectory you want to see. Second is advertising, which was worth nothing in 2020 and now provides over $45 billion a year with steady growth, again at higher margins than the legacy retail business:

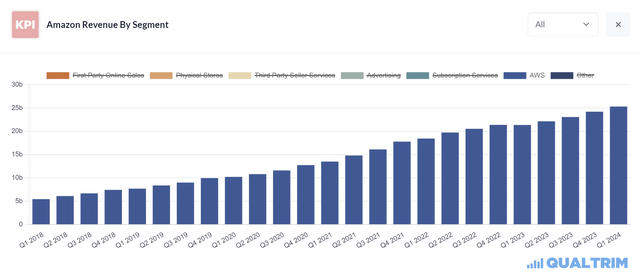

The real crown, jewel, though, is, of course, AWS:

AWS was only 18% of total revenue for the quarter, but 61% of the total operating income. This is the segment that matters the most, and where the real profits are.

AWS Growth

AWS is still the largest cloud provider in the world, so its growth in percentage terms may not look as impressive at this stage in its development. In recent quarters, growth had plateaued around 12-13%, which was not overly impressive. The encouraging news in Q1, however, was that revenue growth was up to 17.2% year over year, which is a large step up in the right direction. This is the metric to watch moving forward, but Amazon is now heading in the right direction and all signs point to this accelerated growth continuing.

With Alphabet Inc. (GOOG), (GOOGL) recently initiating a dividend in April and Meta Platforms, Inc. (META) initiating its own in February, hopes for Amazon in prior years have been that it would mature, increase profitability, and start returning capital to shareholders. With all the high-margin growth that it has been seeing, though, Amazon now has better uses for its capital, namely investing in future AWS growth.

CEO Andy Jassy had a lot to say about this in the recent conference call, where he notes that “we don’t spend the capital without very clear signals that we can monetize it.” The CFO continues later on with a nice summary (emphasis mine):

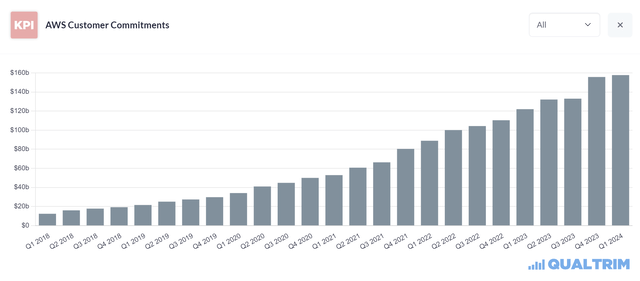

Right now, in Q1, we had $14 billion of CapEx. We expect that to be the low quarter for the year. As Andy said earlier, we are seeing strong demand signals from our customers and longer deals and larger commitments, many with generative AI components. So those signals are giving us confidence in our expansion of capital in this area. And as he also mentioned, we’ve done this for 18 years. We invest capital and resources upfront, we create capacity very carefully for our customers, and then we see the revenue, operating income, and free cash flow benefit for years to come after that, with strong returns on invested capital.

Analysts are anticipating huge expenditures in future quarters on AWS, and this was confirmed on the conference call. The money is coming in, and the demand is there for cloud computing space. Here is a chart of revenue that has not yet been booked, but committed from cloud customers:

We see growth accelerating here as well, and this is what is spurring Amazon to be back in capex growth mode, where most of their operating income will be refunneled back into the business to further grow their highest margin segment. The opportunity here is massive, and we should be grateful for the lack of buybacks and dividends. The more Amazon spends today the more it will make tomorrow.

Proper Price Target

I believe the market is not properly accounting for this growth in higher margin businesses. Already Amazon achieved a 10.78% operating margin this last quarter, smashing their previous high of 8.17% coming out of the pandemic.

I have already pointed out that Amazon is trading below its historical P/OCF multiple, which is without a doubt the best way to value the business. However, I would argue that as more of the revenue mix comes from higher quality sources and operating margin continues to climb higher, Amazon should be trading above its historical multiple, which was based on more traditional retail sales. Higher growth and higher margins will compound together to equal higher operating cash flow and should indicate a higher multiple on that cash flow.

As it stands, even at its historical multiple and using analyst estimates out to year-end 2026 we get a fair value of 428, or close to 40% annual returns from here. I certainly think that kind of upside is achievable, given what we have seen in past quarters and know about future capex demand.

Potential Risks

Of course, nothing is guaranteed, and any investment with a 40% return potential comes with risk. Luckily with a company the size and strength (AA credit rating) of Amazon, there is little existential risk. The downside of their scale is the potential for government intervention and the potential breaking up of their businesses for competitive reasons, but this seems unlikely and not in anyone’s best interest.

The more reasonable risk is that AI turns out to not be what we thought it could be, and no one makes money on it. Or, even more plausibly, it takes longer to achieve real profits using AI than currently projected, and the boom cools off.

There was an interesting comment in NVIDIA Corporation’s (NVDA) recent conference call where they noted that “For every $1 spent on NVIDIA AI infrastructure, cloud providers have an opportunity to earn $5 in GPU instant hosting revenue over four years.” In other words, there is an extremely quick payback time for an investment in cloud computing. Given that NVIDIA is continually sold out of their highest-performing chips, the demand for cloud computing and AI training is seemingly insatiable.

I am confident that AMZN would not be investing so much into their AWS platform if they were not extremely confident that it would result in high returns. Their customers are also confident in their own abilities to make money from their investments.

So while there is an AI risk here, Amazon is more of a pick-and-shovel style investment case and will ultimately be a beneficiary of any AI advancements that their infrastructure helps to produce.

I want to mention as well that in the short term, the market may not react well to the amount of capex that Amazon is investing in future revenue streams. Of course, I view these investments as positive, but if the market does not then the stock may move lower from here. I would see this as a gift and an opportunity to add more.

Conclusion

In short, I see Amazon as a home run here. The FAST Graph at the top of this article shows the thesis visually. You have a mature business making massive amounts of money and trading below its normal cash flow multiple. Add on top of this the opportunity to grow at a high rate and increase margins significantly, and you get all the ingredients of a successful investment.

The safety profile is wonderful while also featuring the potential upside of far riskier investments. I see no reason to chase unproven tech stocks while the cloud market leader remains on sale. The combination of safety, value, and growth makes Amazon an excellent portfolio cornerstone, and one of my largest personal holdings.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN, NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.